Global Oil Spill Management Market by Technology (Pre-oil spill and Post-oil spill), By Application (Pre-oil spill and Post-oil spill), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 29006

- Number of Pages: 362

- Format:

- keyboard_arrow_up

Oil Spill Management Market Overview:

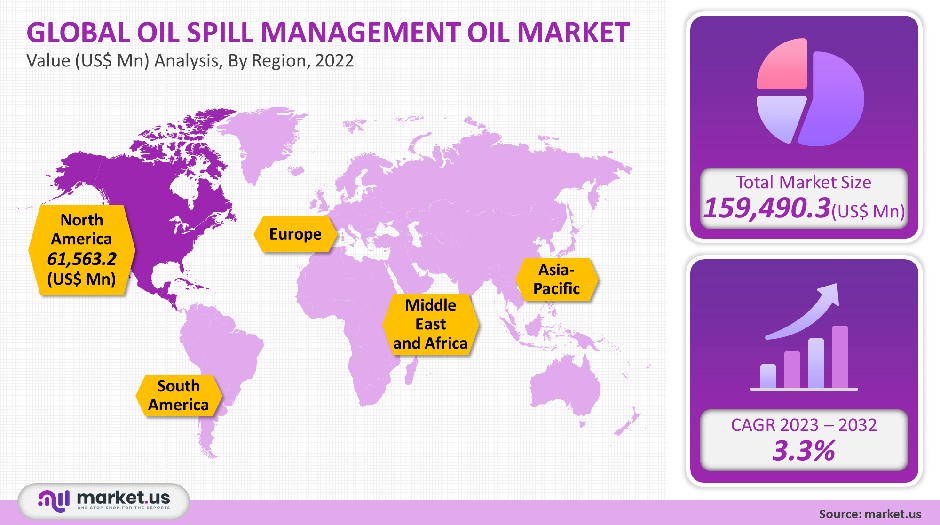

In 2021, the global oil spillage management market was valued at USD 159,490.3 million. The market is expected to grow at a CAGR of 3.3% from 2023 to 2032.

The global oil spill management market is expected to grow over the coming years due to rising safety concerns and increasing incidents of oil spillage globally. Oil & Gas transportation has seen a significant rise in both onshore drilling and offshore drilling.

Global oil spillage management will benefit from increased oil transportation via pipelines and tankers, as well as strict government safety advice. Industry leaders are investing large amounts in Research & Development. This will create huge opportunities for industry expansion and help to ensure that the industry thrives over the estimated period.

Global Oil Spill Management Market

Technology Analysis

The two main oil spillage management technologies on the market are pre-oil and post-oil. Pre-oil spillage management technology can be further divided into double-hulling, pipeline leakage detection, and blowout preventers.

The pre-oil spillage management technique that has been most popular in recent years is double-hulling. It accounted for 69% of the total market share in 2021.

Marine trade accounts for a large portion of oil and gas product transport. Market growth is expected to be boosted by the increasing demand for petroleum products and crude oil, from the Asia Pacific region, and Europe’s energy industry over the forecasted period.

International organizations and governments have been urging standardization in tanker design due to rising environmental concerns about hull-breach incidents causing harmful effects on the environment. It has also helped improve tanker protection against natural disasters and collisions. These factors will likely boost double-hull technology’s growth over the coming years.

The largest post-oil spillage management technique was mechanical containment and recovery, accounting for 61% of all market shares in 2021. This method uses sorbents and skimmers to clean up oil spillages. These are the best practices for large-scale oil spillages in deep-sea and near-shore areas.

Application Analysis

In 2021, the largest pre-oil spillage management application was offshore. It accounted for 71% of all total market. Over the next nine years, the demand for oil-spill management technology will rise due to the increasing need in remote and harsh locations as well as deepwater. In the near future, offshore E&P activity will be driven by projects in the South China Sea and Persian Gulf region as well as the renewal of old wells.

Increased regulations, taxes, and penalties related to oil spill containment are causing upstream and downstream oil & gas companies pressure to install safety equipment to ensure uninterrupted operations.

This equipment includes pipeline leak detection systems, blowout prevention (BOP), as well as other systems. The forecast period will see significant growth in pre-oil technology requirements, especially in the U.S.A, Qatar, and Saudi Arabia.

For their economic growth, remote areas, such as arctic and coastal regions, are heavily dependent on the marine environment. These coastal areas have suffered long-term damage from oil spillages, which has caused a significant decline in the seagrasses and feeding grounds of marine species.

Rising deepwater explorations and increasing energy demand will likely boost offshore prospects for arctic regions like Alaska, Russian Federation, and Norway.

In 2021, 68% of the market was accounted for by offshore post-oil spillage management. The large market penetration in recent years is due to numerous incidents, including good blowouts and pipeline failures, particularly in the U.S., and Canada.

Key Market Segments

By Technology

- Pre-oil spill

- Double-hull

- Pipeline leak detection

- Blow-out preventers

- Others

- Post-oil spill

- Mechanical

- Chemical

- Biological

- Others

By Application

- Pre-oil spill

- Onshore

- Offshore

- Post-oil spill

- Onshore

- Offshore

Market Dynamics

There have been many global initiatives taken by safety agencies and governments, such as the Occupational Safety and Health Administration.

These efforts aim to prevent and control oil leakages and oil spillages at the source and during transportation. The installation of leak detection sensors in pipelines and double hulling transportation carriers are two of the most important requirements.

The key factors that will drive the implementation of pre-oil spillage management techniques in the future are expected to be growing concerns and strict safety norms to prevent occupational hazards on-site and at transport points in petroleum facilities.

The Gulf of Alaska, North America’s largest oil spillage location, is located in the Gulf of Mexico and the North Sea in Europe. Over the next nine years, the market will be driven by rising oil spillage incidents both onshore and offshore. Russia, Canada, Indonesia, and Australia are the major onshore countries.

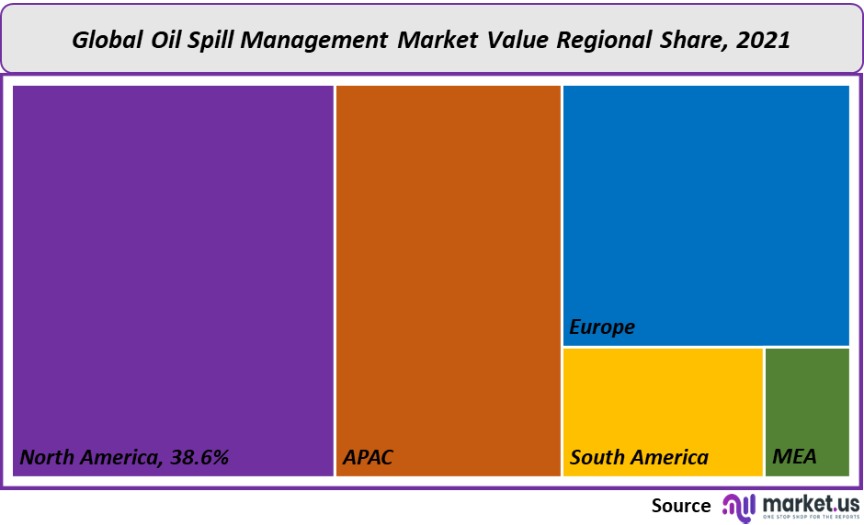

Regional Analysis

North America was the biggest pre-oil spillage management market in 2021. Due to rising oil & natural gas E&P activity, the region will gain market share. Oil spillages in the region, such as Marathon Oil, Exxon Valdez, and Deepwater Horizon, have led to the creation of a strict regulatory framework for both onshore and offshore oil & gas production activities.

The Asia Pacific pre-oil spillage management market was valued at USD 19936.2 million in 2021. The majority of oil and natural gas exploration and production in the region is currently centered in India and China. Encouragement of government regulations, such as tax benefits and financial aid to discover hydrocarbon reserves, is expected to drive industry growth in these countries over nine years.

Among the most notable oil spillage incidents of recent years are the Xingang Port in China (2010), ExxonMobil’s spillage in Nigeria (2010), and the Lac-Megantic derailment (2013) in Canada. The major reason for the development of post-oil-spill management techniques in recent years has been strict environmental regulations and large-scale spillage.

Key Regions and Countries covered in the rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

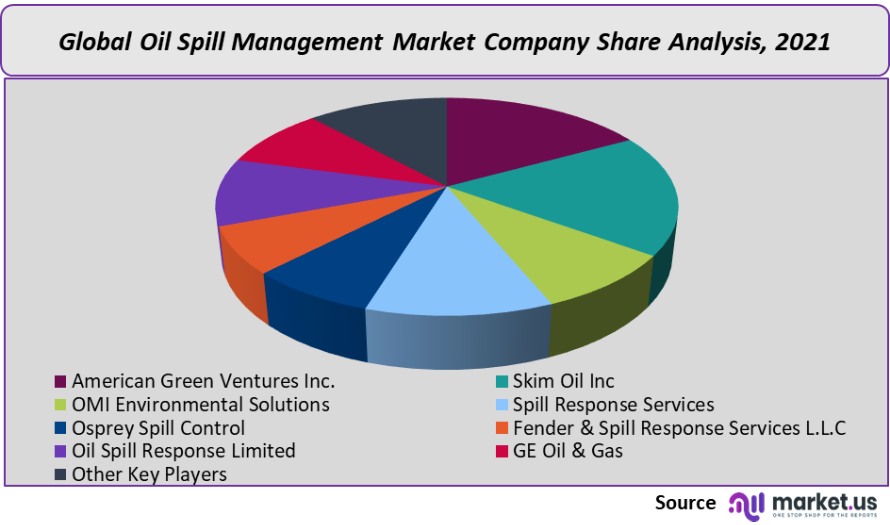

Market Share Analysis

Oil spill management is fragmented. Major companies are competing for market leadership. Recent M&A activity has seen the market witness strategic alliances and acquisitions.

American Green Ventures Inc. and Skim Oil Inc. are major players in the global oil spillage management industry. OMI Environmental Solutions, Spill Response Services. Osprey Spill Control. Fender. Oil Spill Response Limited.

Key Market Players:

- American Green Ventures Inc.

- Skim Oil Inc

- OMI Environmental Solutions

- Spill Response Services

- Osprey Spill Control

- Fender & Spill Response Services L.L.C

- Oil Spill Response Limited

- GE Oil & Gas

- Other Key Players

For the Oil Spill Management Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Oil Spill Management Market size in 2021?A: The Oil Spill Management Market size is USD 159,490.3 million for 2021.

Q: What is the CAGR for the Oil Spill Management Market?A: The Oil Spill Management Market is expected to grow at a CAGR of 3.3% during 2023-2032.

Q: What are the segments covered in the Oil Spill Management Market report?A: Market.US has segmented the Global Oil Spill Management Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Technology; Pre-oil spill (Onshore, Offshore), Post-oil spill (Onshore, Offshore). By application Pre-oil spill (Onshore, Offshore), Post-oil spill (Onshore, Offshore).

Q: Who are the key players in the Oil Spill Management Market?A: American Green Ventures Inc., Skim Oil Inc, OMI Environmental Solutions, Spill Response Services, Osprey Spill Control, Fender & Spill Response Services L.L.C, Oil Spill Response Limited, GE Oil & Gas, Other Key Players are the key vendors in the Oil Spill Management market

Q: Which region is more attractive for vendors in the Oil Spill Management Market?A: North America is accounted for highest growth among the other regions. Therefore, the Oil Spill Management Market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Oil Spill Management Market?A: Key markets for Oil Spill Management are the US, China and Canada.

Q: Which segment has the largest share in the Oil Spill Management Market?A: In the Oil Spill Management Market, vendors should focus on grabbing business opportunities from the pre-oil spill segment as it accounted for the largest market share in the base year.

![Oil Spill Management Market Oil Spill Management Market]()

- Pre-oil spill

- American Green Ventures Inc.

- Skim Oil Inc

- OMI Environmental Solutions

- Spill Response Services

- Osprey Spill Control

- Fender & Spill Response Services L.L.C

- Oil Spill Response Limited

- GE Oil & Gas

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |