Global Online Video Platform Market By Type (Video Processing, Video Management, and Other Types), By Streaming Type (Live Streaming Type and Video on Demand), By End-User (Media & Entertainment, BFSI, Retail, Education, IT & Telecom and Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2022

- Report ID: 12088

- Number of Pages: 394

- Format:

- keyboard_arrow_up

Online Video Platform Market Overview:

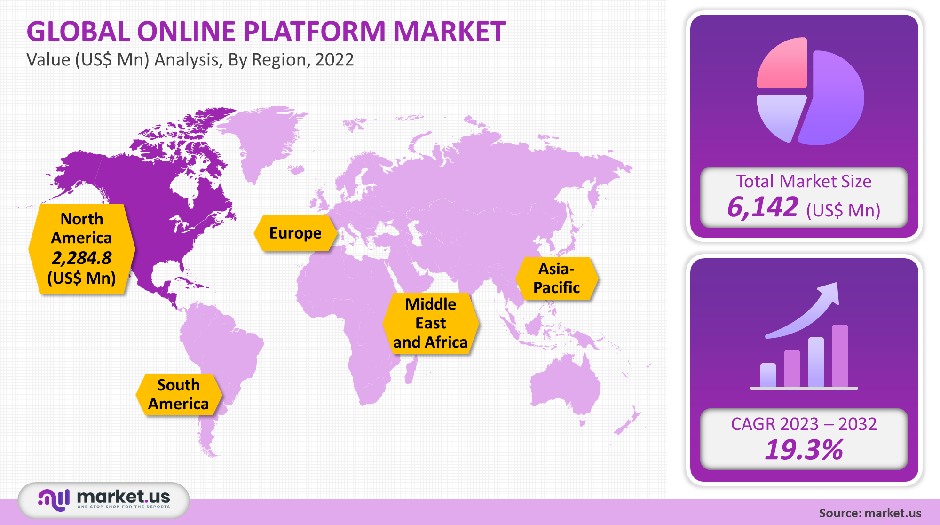

Global Online Video Platform’s market value was USD 6,142 million in 2021. The market is expected to grow at a compound annual increase rate (CAGR) of 19.3% between 2022-2032.

A fee-based platform that allows content creators and publishers to transcode and store, publish, track and monetize online videos on their channels is called an online video platform.

Additionally, the platform allows users to stream live videos simultaneously and record the broadcasting. They can also host videos as they are needed. As the devices can be used to stream live or preloaded video content, the Online Video Platform is seeing significant adoption from tablets and smartphones.

Global Online Video Platform Market Scope:

Type Analysis

The largest revenue share, 40%, was held by the video processing sector in 2021. Video processing platforms allow for efficient IP conversion and high-density transcoding. They also offer adaptive bitrate packaging and encryption. You can stream into a modular and visual solution.

These solutions allow broadcasters to offer online video solutions at a low cost, on both the live streaming platform and the video-on-demand platform. Many video processing platforms available on the market can deliver customized video experiences based on website behavior, geolocation, and demographics.

In terms of revenue, the video management market accounted for the second-largest share of online video platform markets in 2020. Optimized search functionality allows for easy video indexing, while also handling large video files. This is why video management platforms are gaining popularity. The segment of video analytics will see the greatest CAGR in the coming year.

The steady advancements in video reporting structures that allow for video consumption patterns, geographic reach, and campaign engagement as well as a comprehensive view of ROI can all be attributed to the continued growth of video analytics platforms.

Steaming Type Analysis

Video-on-Demand accounted highest revenue share in 2021. The cloud allows users to access videos instantly from anywhere. A key factor in the rise of video-on-demand is the ability to optimize revenue by serving more relevant ads according to user interests. Publishers are using users’ keyword searches to stream dynamic ads.

As more live streaming events are available with personalized chat room features, it is becoming more popular. As an example, Disney + Hotstar, which is hosting the 13th season of the Twenty20 Cricket (T20) league, has allowed spectators to create a virtual community and stream matches using interactive emoji streams.

Additionally, this segment is growing because of the increase in users of live video gaming streaming platforms such as Asubu, HitBox, Beam, and Beam. Vendors of gaming platforms are using this trend for increased revenue sources like ad streaming, paid subscriptions, badge sales, and other forms of advertising.

End-User Analysis

2021 saw the media and entertainment sector hold a significant market share. Over the forecast period, this segment is expected not to lose its dominant position. The growth in this segment can be attributed to a rise in internet connectivity and investment in OTT infrastructure around the globe. A significant role is also expected to be played by the increased investments in live streaming sports events.

Education was the second-largest revenue-generating segment in 2020. This segment is also expected to experience the highest CAGR in the forecast period. The introduction of advanced analytics dashboards for E-learning platforms makes it much easier to keep track and communicate with learners. In the coming years, E-learning platforms will benefit from the increased availability of advanced analytics features.

Key Market Segments:

By Type

- Video Processing

- Video Management

- Video Distribution

- Video Analytics

- Other Types

By Streaming Type

- Live Streaming Type

- Video on Demand

By End-User

- Media & Entertainment

- BFSI

- Retail

- Education

- IT and Telecom

- Other End-Users

Market Dynamics:

The growing popularity of online videos has led to significant growth in this market over the past few decades. With viewership surpassing traditional TV channels like satellite or cable, it is now a more popular option than ever.

This is positive for the market of online video platforms in developed areas, including North America as well as Europe. AT&T-owned DirecTV, an American satellite pay-TV provider, lost 1.2 million PayTV customers in 2018. This was largely due to the increasing competition from Over the Top and Video Demand players. DirecTV Now, AT&T’s online version, attracted 436,000 new subscribers the year before. This is due to shifting preferences towards online video content.

The increased penetration and ease of internet access across developing regions have led to the mass adoption of online video platforms.

Access to high-quality online content is now possible thanks to 4G networks’ high penetration. In the next few decades, 5G networks will be introduced worldwide. This will increase the amount of video content that can be accessed on the internet. The network’s fast internet browsing speed, which is nearly 13 times faster than the average connection, will be key to increasing video content consumption online.

To increase their customer base via digital platforms, more brands are turning to live video shopping events. Samsung Sweden held a live event in Sept 2020 to provide information about its new foldable smartphone, the Galaxy Z Fold2.

Similar launch events in the past have earned the company more than USD 60 million worldwide. Bambuser managed the entire online video campaign, which was based out of Stockholm. Alphabet Inc. and Endavo Media also offer similar solutions.; Frame.io Inc. JW player Facebook MediaMelon Inc.

Media reports estimate that around 1/4 of the global population has been kept in their homes because of the COVID-19 Pandemic and the associated social distancing norms imposed by local governments. This has greatly limited the entertainment options for people.

This has seen a substantial increase in the global viewership of online video sites like Netflix, Amazon Prime Video, and YouTube and a rise in the overall consumption rate of online videos. Netflix recorded an increase of more than 50% in the first-time downloads of its mobile app in Italy in March 2020 and more than 30% in Spain in March 2020.

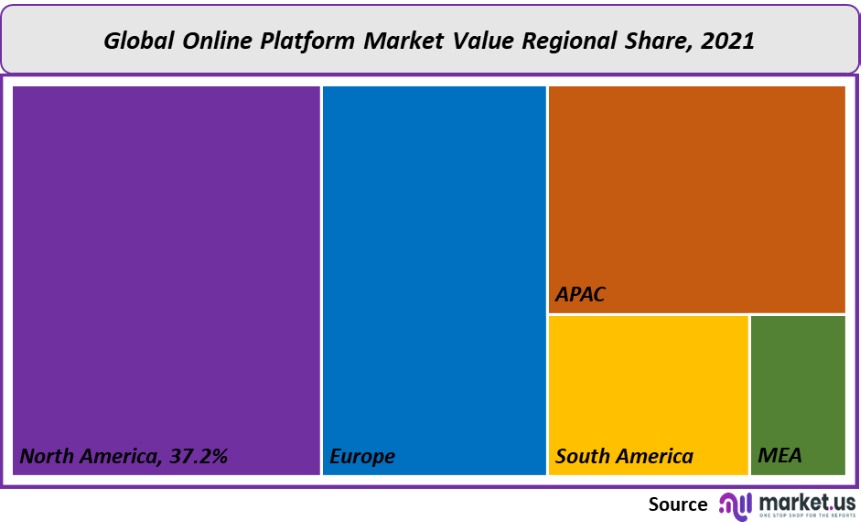

Regional Analysis

North America held the largest revenue share at 37.2% in 2020. The promise of growth in the region will continue in the near future, thanks to the introduction of advanced 5G network tech that makes online video platforms faster and more agile. An increasing number of U.S. corporations are also using online video platforms as a means to increase their brand recognition and promote their products.

The European region was second in market share for 2019 and will continue to see steady growth thanks to the widespread availability of high-speed broadband in the region. The Asia Pacific is expected to experience the highest growth rate over the forecast period. As the penetration of the internet increases across the region, video-on-demand and live streaming video are expected to be major drivers for the region’s market.

YouTube is rapidly becoming a popular online video platform for user-generated content. The Asia Pacific will be the largest beneficiary of the trend, as it has the greatest population worldwide. Additionally, increasing internet penetration in the region is driving online video user numbers. Live video streaming services on social media platforms like Facebook, LinkedIn, and Twitter are also increasing the number of users using online video platforms.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

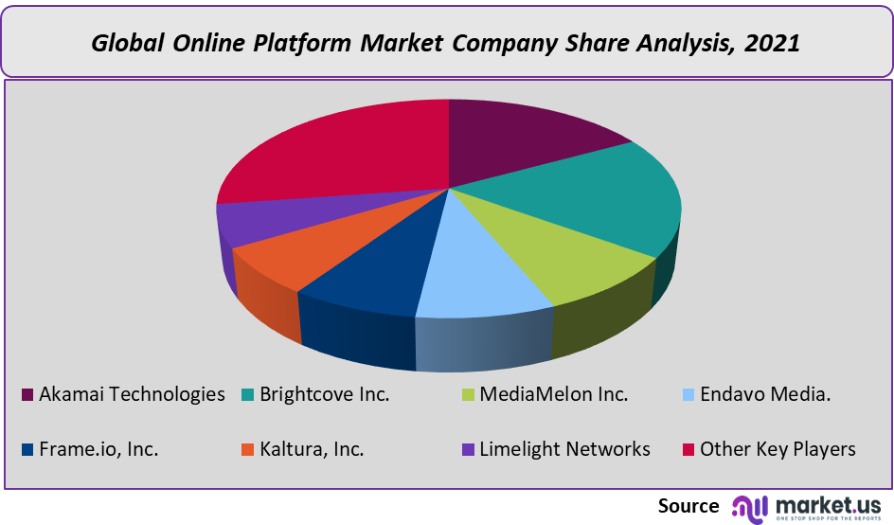

Akamai Technologies Inc, Alphabet, YouTube; Brightcove Inc, Comcast Cable Communications Management, LLC, Endavo Media, Kaltura, Inc, Longtail Ad Solutions, Inc, and MediaMelon Inc are the top players who dominated 2021’s market. Vendors want to expand their customer base and gain a competitive advantage in the market.

Vendors have been focusing their efforts on partnerships, acquisitions, mergers, collaborations, and mergers. Akamai, a U.S. content delivery network company, announced in April 2020 that it had entered into a partnership agreement with Verimatrix.

Verimatrix is a U.S.-based cybersecurity company. The partnership is designed to provide a secure watermarking capability. Watermarking provides session-based source identification and tracking that allow broadcasters to locate pirated content in real-time.

The solution could be used by broadcasting companies to prevent unauthorized redistribution of content, including the restreaming of live sporting events by unauthorized broadcasters. Some of the most prominent players in the international Online Video Platform market include:

Маrkеt Кеу Рlауеrѕ:

- Akamai Technologies

- Brightcove Inc.

- Comcast Cable Communications Management, LLC

- Endavo Media.

- Frame.io, Inc.

- Kaltura, Inc.

- Limelight Networks

- Longtail Ad Solutions, Inc. (JW PLAYER)

- MediaMelon Inc.

- Ooyala Inc. (Telstra

- Panopto

- Other Key Players

For the Online Video Platforms Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Online Video Platform Market size in 2021?A: The Online Video Platform Market size is US$ 6,142 million for 2021.

Q: What is the CAGR for the Online Video Platform market?A: The Online Video Platform Market is expected to grow at a CAGR of 19.3% during 2023-2032.

Q: What are the segments covered in the Online Video Platform Market report?A: Market.US has segmented the Global Online Video Platform Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Video Processing, Video Management, Video Distribution, Video Analytics, Other Types. By Streaming Type, market has been further divided into Live Streaming Type, Video on Demand.

Q: Who are the key players in the Online Video Platform market?A: Akamai Technologies, Brightcove Inc., Comcast Cable Communications Management, LLC, Endavo Media., Frame.io, Inc., Kaltura, Inc., Limelight Networks, Longtail Ad Solutions, Inc. (JW PLAYER), MediaMelon Inc., Ooyala Inc. (Telstra, Panopto, are the key vendors in the Online Video Platform market

Q: Which region is more attractive for vendors in the Online Video Platform market?A: North America accounted for the highest growth rate of 37.2% among the other regions. Therefore, the Online Video Platform Market in Europe is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Online Video Platform?A: Key markets for Online Video Platform are the US, Canada and Mexico.

Q: Which segment has the largest share in the Online Video Platform market?A: In the Online Video Platform market, vendors should focus on grabbing business opportunities from the Streaming Type segment as it accounted for the largest market share in the base year.

![Online Video Platform Market Online Video Platform Market]() Online Video Platform MarketPublished date: May 2022add_shopping_cartBuy Now get_appDownload Sample

Online Video Platform MarketPublished date: May 2022add_shopping_cartBuy Now get_appDownload Sample - Akamai Technologies

- Brightcove Inc.

- Comcast Cable Communications Management, LLC

- Endavo Media.

- Frame.io, Inc.

- Kaltura, Inc.

- Limelight Networks

- Longtail Ad Solutions, Inc. (JW PLAYER)

- MediaMelon Inc.

- Ooyala Inc. (Telstra

- Panopto

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |