Global Permanent Magnets Market By Material, Neodymium Iron Boron, By Application, and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032.

- Published date: Nov 2021

- Report ID: 21418

- Number of Pages: 382

- Format:

- keyboard_arrow_up

Permanent Magnets Market Overview:

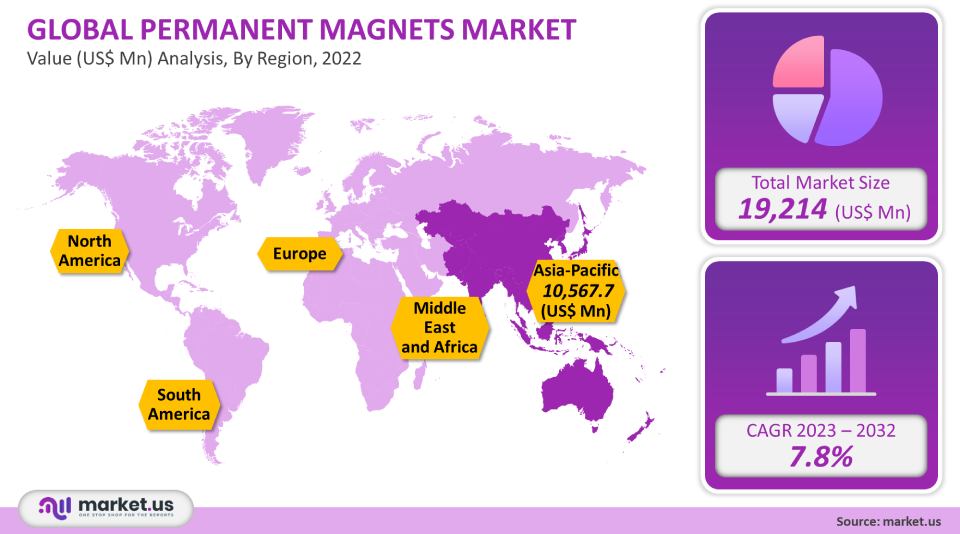

The Permanent Magnets Market size is expected to be worth around USD 43.86 billion by 2032 from USD 19.2 billion in 2022, growing at a CAGR of 7.8% during the forecast period 2022 to 2032.

The industry trends are expected to grow due to the increased use of renewable energy sources like solar and wind. Wind turbine generators currently use permanent magnets to increase their efficiency. Due to their reliability and low maintenance costs, rare earth magnetic property such as Neodymium Ferrite Boron NdFeB is preferred in wind turbines.

Global Permanent Magnets Market Analysis

Material Analysis

In 2021, the market’s largest segment was the ferrite materials segment. This group accounted for more than 80.6% volumetrically. Ferrite magnets are used primarily in motor applications. They are also used in loudspeakers, separation equipment, relays and switches, Magnet Resonance Imaging (MRI), and lifting and holding applications.

According to the forecast, Neodymium Iron Boron will be the second-largest segment in revenue and volume.

NdFeB magnets have seen a significant increase in their application over the past five years. NdFeB magnets are not only being used for traditional purposes but they are also being used in electric and hybrid cars, air conditioner compressors & fans, wind power generators, as well as storage systems. Alnico is an alloy made of nickel, aluminum, and cobalt.

Alnico was the first known permanent magnet. This alloy was discovered before rare earth magnets such as NdFeB. Magnet Applications Inc. reports that the alnico magnetic magnet exhibits a 7 MGOe average Energy Density (BHmax), which is much higher than ferrite but significantly lower than Neodymium-Iron-Boron(NdFeB).

Application Analysis

Electronics emerged as one of the top application segments for 2021. This product is used in electronics, including recorders, air conditioners & fans, and recorders. According to estimates, permanent magnet market growth will be supported by increased production of the product mentioned above categories.

The automotive sector is expected to see steady growth in revenue over the forecast period.Arnold Magnetic Technologies says that a car typically contains around 100 permanent magnets. While most car manufacturers prefer ferrite, consumers are now looking for lightweight cars. This has created a need for small-sized and high-performance magnet products. This is why the segment will see positive growth in the future, as vehicle energy cost efficiency improvements are expected to boost its growth. The third-largest volume share was held by the industrial application segment in 2021.

The permanent magnet market vendors see a great opportunity in the oil & gas industry’s need to increase energy-intensive technological processes such as electronic submersible pump driving and decrease power consumption.

Permanent magnet motors (PMM), as compared to asynchronous electric motors that are used for driving electrical submarine pumps, offer a variety of advantages that make them attractive economically for the oil & gas industry. Medical will be the fastest-growing market segment over the forecast timeline. The increasing demand for medical products is primarily due to their increased use in devices like MRI, body scanners, heart pacemakers, and body scanners.

Key Market Segments

By Material

- Ferrite

- Aluminum Nickel Cobalt (Alnico)

- Neodymium Iron Boron (NdFeB)

- Samarium Cobalt (SmCo)

By Application

- Consumer goods & electronics

- Industrial

- Energy

- Automotive

- Aerospace & Defense

- Medical

- Other applications

Market Dynamics

Rare earth magnets are widely used in high-end applications, such as robotics and electric vehicles; it is expected that the U.S. demand will grow faster than its ferrite counterpart during the forecast period. The adoption of plug-in electric cars has seen a substantial increase in the United States, driven primarily by the high-end products offered by major players like Tesla, Chevy, Ford, and Audi.

The US imported around 4 million pounds of parts from China due to fewer permanent magnet producers country. Most of the parts were electric motors. China’s threat to endanger its supply of rare and related products to the U.S. is likely to be a significant problem. In response, the U.S. government has taken various measures, including funding mining projects by the Defense Production Act.

These initiatives will likely increase raw earth material supply for domestic industries in the U.S.

The COVID-19 pandemic directly affected the country’s operations in key manufacturing and industrial sectors. The manufacturing sector slowly returned to productionduring the fourth quarter of FY 2020, which led to a recovery. Due to the huge fiscal packages provided by the U.S. government, industrial production has been supported. The domestic market for permanent magnets saw steady growth in 2021.Regional Analysis

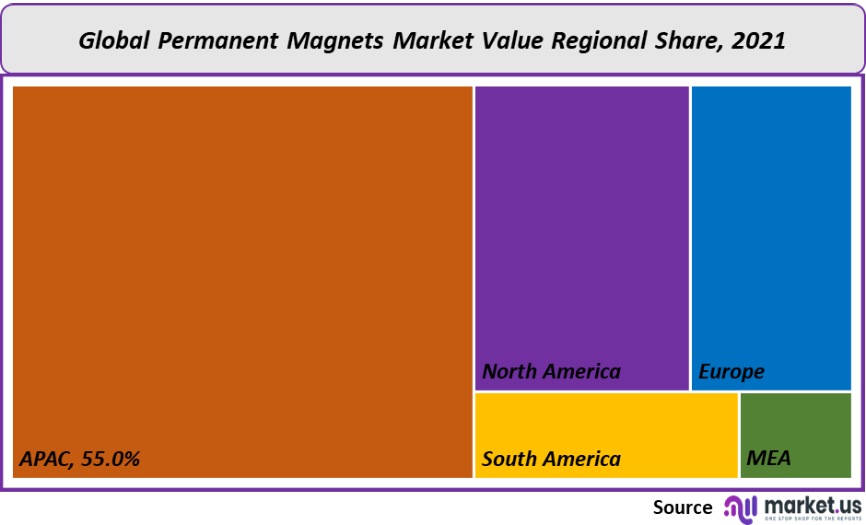

The Asia Pacific held the largest revenue share of 55% in 2021. It is known as a global manufacturing hub. Electronic and automotive production are key components of the region’s manufacturing activities. South Korea, Japan, and China have been hot spots for computer hardware manufacturing, including hard disks, chips, and microprocessors. This has resulted in a rise in demand for permanent magnets that are extensively used by the consumer electronics industry and hardware makers.

North America held a significant revenue share in 2021. The North American market supply was greatly affected by the COVID-19 pandemic.

According to the International Monetary Fund, in 2020, North America’s GDP fell by at most 7%. This shows the decline in manufacturing output from end-use sectors such as automotive, transportation, electronics, aerospace, and defense. The revenue growth key factor of the Middle East and Africa declined by nearly 8.12% in 2021. As deflation continues to rise in the region’s key countries, especially the Gulf countries, they begin to feel the pinch.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- The Middle East and Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

The global market is fragmented and is characterized as a regional market. Many small, medium, and large-scale manufacturing companies are found near due to the large-scale rare earth-metal deposits in China. Most manufacturers focus on creating or innovating high-performance products to meet the needs of high-end performance industries such as aerospace, defense, and automation.

Маrkеt Кеу Рlауеrѕ:

- Adams Magnetic Products Co.

- Thomas & Skinner Inc.

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Eclipse Magnetics Ltd.

- Hitachi Metals, ltd

- Electron Energy Corp.

- Goudsmit Magnetics Group

- Hangzhou Permanent Magnet Group

- Other Key Players

For the Permanent Magnets Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Permanent Magnets market size in 2021?A: The Permanent Magnets market size is US$ 19,214 million for 2021.

Q: What is the CAGR for the Permanent Magnets market?A: The Permanent Magnets market is expected to grow at a CAGR of 7.8% during 2023-2032.

Q: What are the segments covered in the Permanent Magnets market report?A: Market.US has segmented the Global Permanent Magnets Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material, market has been segmented into ferrite, aluminum nickel cobalt (Alnico), neodymium iron boron (Ndfeb), samarium cobalt (Smco). By Application, the market has been further divided into automotive, industrial, consumer goods & electronics, energy, aerospace & defense, medical, and other applications.

Q: Who are the key players in the Permanent Magnets market?A: Adams Magnetic Products Co., Thomas & Skinner Inc., Arnold Magnetic Technologies, Daido Steel Co., Ltd., Eclipse Magnetics Ltd., Electron Energy Corp., Goudsmit Magnetics Group, Hangzhou Permanent Magnet Group, and Other Key Players, are the key vendors in the Permanent Magnets market.

Q: Which region is more attractive for vendors in the Permanent Magnets market?A: APAC accounted for the highest revenue share of 55% among the other regions. Therefore, the Permanent Magnets market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Permanent Magnets?A: Key markets for Permanent Magnets are US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Q: Which segment has the largest share in the Permanent Magnets market?A: In the Permanent Magnets market, vendors should focus on grabbing business opportunities from the ferrite materials segment as it accounted for the largest market share in the base year.

![Permanent Magnets Market Permanent Magnets Market]()

- Adams Magnetic Products Co.

- Thomas & Skinner Inc.

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Eclipse Magnetics Ltd.

- Hitachi Metals, ltd

- Electron Energy Corp.

- Goudsmit Magnetics Group

- Hangzhou Permanent Magnet Group

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |