Global Pet Food Ingredients Market By Pet (Dog, Cat, Fish, and Others), By Ingredients (Specialty Proteins, Amino Acids, Mold Inhibitors, Gut Health Ingredients, Phosphates, Vitamins, Acidifiers, Carotenoids, Enzymes, Mycotoxin Detoxifiers, Flavors & Sweeteners, Antimicrobials & Antibiotics, Minerals, and Antioxidants), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 26017

- Number of Pages: 200

- Format:

- keyboard_arrow_up

Pet Food Ingredient Market Overview:

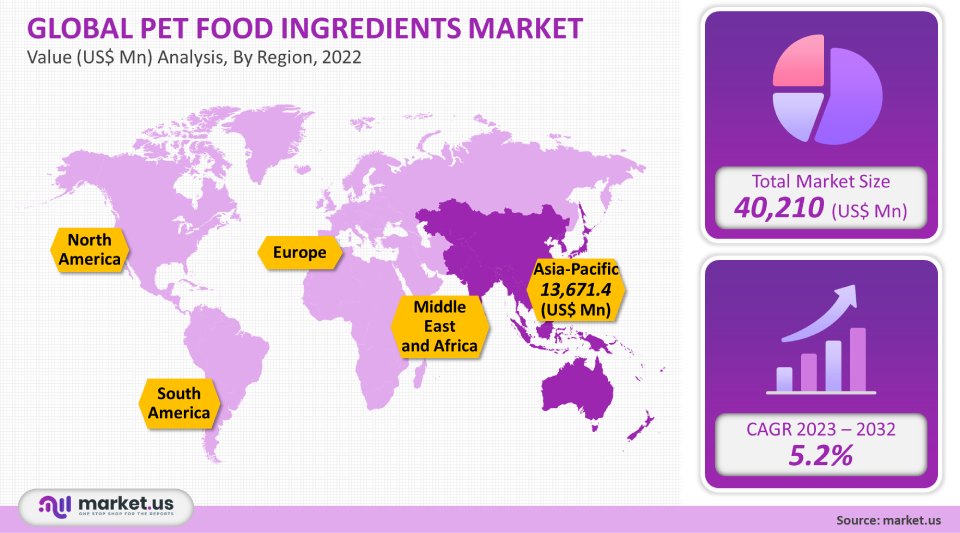

The global pet food ingredient market is estimated to reach USD 40,210 million in 2021 and will grow at a CAGR of 5.2% over the forecast period.

Global Pet Food Ingredients Market:

Pet Analysis

The global pet food ingredients market can be divided into three segments based on pets: fish, dogs, and cats. The market’s largest segment was the dog market, with a 33.9% market share in 2021.

This is due to an increase in the adoption of dogs into emerging economies, psychological and therapeutic benefits, and increased research and development of first-class drugs.

Ingredients Analysis

The segment of pet food ingredients was the most popular in 2021. The segment is made up of methionine (threonine), lysine, and cysteine. However, lysine appears to be the most dominant.

Lysine is a building block for protein. Supplementation or diet are the best options for this amino acid as it is not produced in sufficient quantities by the animal’s body. Lysine, which has the same biological value as soybean, is an economically viable ingredient to be added to companion animals’ diets.

The market for phosphates is another important segment that is expected to grow at an impressive rate. Monocalcium, dicalcium, and phospholipids are some of the most popular phosphates used in animal nutrition. These phosphates improve the health and well-being of companion animals by providing vital nutrients.

Gut health ingredients are further classified as beta-glucan, Fructooligosaccharides (FOS), Mannan-oligosaccharide (MOS), prebiotics, and probiotics. This product enjoys wide acceptance because it stimulates antimicrobial activity and anti-tumor activities by binding to receptors on macrophages and white blood cells.

Due to the growing focus on pet food palatability, Palatants are also experiencing steady growth in demand. Animals make their decisions about palatability based on three sensory attributes: texture, macronutrient profile, and aroma. Due to their hypersensitive noses, dogs are particularly sensitive to smells.

There is a growing concern over antibiotic use in agricultural applications. This has pushed the development of antioxidants, acidifiers, enzymes, and other compounds. Formic acid and fumaric acids are all common feed acidifiers. Fumaric Acid is a cost-effective and affordable energy source, similar to glucose. It is used as the primary driver for the product.

The market also includes specialty protein, minerals mycotoxin detoxifiers carotenoids flavors & sweetness, mold inhibitors vitamins, antimicrobial & antioxidants, and other important product segments.

Key Market Segments:

Pet

- Dog

- Cat

- Fish

- Others (rabbits, birds, and horses)

Ingredients

- Specialty Proteins

- Amino Acids

- Mold Inhibitors

- Gut Health Ingredients

- Phosphates

- Vitamins

- Acidifiers

- Carotenoids

- Enzymes

- Mycotoxin Detoxifiers

- Flavors & Sweeteners

- Antimicrobials & Antibiotics

- Minerals

- Antioxidants

Market Dynamics:

The primary drivers for the growth of pet food ingredients markets were the rising awareness about the nutritional value of minerals, dietary fiber, carotenoids, omega-3 fatty acids, and dietary fiber in pet nutrition.

Many pet food companies offer many options and a variety of products to suit different purposes. Customers can choose from a variety of factors including breeds, life stages, and price points as well as ingredient preferences. This is expected to drive pet food market growth.

Additionally, the global increase in households with companion animals has been signed between 2006 and 2016. In the United States, it has been noted that the growth of the number of households in the last ten years was less than the growth of the number of households with companion animal households.

Market drivers include increasing pet adoption and a greater focus on health and productivity. Due to their low cost, many ingredients used in companion animal food preparation are synthetic.

According to the Pet Food Industry, almost 95% of pet owners view their companion animals as part of their family. They, therefore, place importance on the quality and safety of the food they eat. The preference of pet owners for a premium or super-premium ingredients is a key driver for this market’s premium and premium products.The rising concern over the dangers of certain synthetic chemicals has led to a steady decrease in antibiotic use. Policymakers now focus on organic and natural products, which will allow for the fastest growth rate of natural products over the next years.

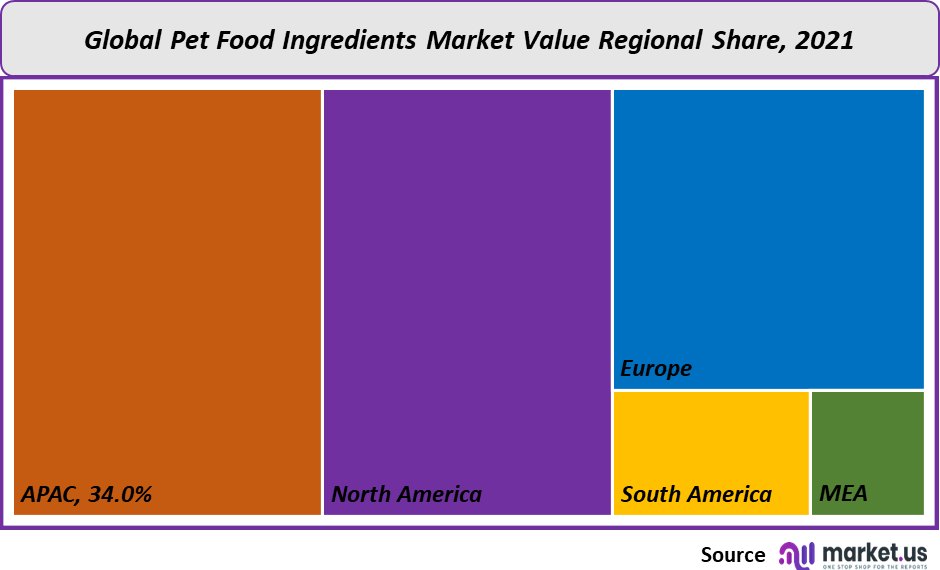

Regional Analysis:

The Asia Pacific, which had a market share greater than 34% in revenue, emerged as the largest regional market in 2021. The main drivers of consumer spending for companion animal care are the increasing population, rising disposable income, growing humanization trends in the region, and an increase in disposable income. Due to growing consumer preference for natural products and a shift in the market, premium products are being replaced by mass-market products.

North America, which included the U.S. and Canada, was the largest region in 2021. Mexico came in third. Because of the existence of a well-developed pet food sector and high ownership percentages of dogs, cats, and horses, the U.S. emerged as the largest market in North America. The country is ranked among the top five countries for the number of pets, cats, and dogs it has.

The U.S. and China have an enviable demand-supply balance in the pet food and animal feed industries. Companies in these markets are likely to see positive developments. China’s ingredient manufacturers have experienced faster consolidation than other countries in terms of acquisitions or integrations.

Nearly 27% of 2021’s market share was held by Europe. A number of factors are driving the pet food industry, including the presence of developed economies and a high-level pet ownership rate, as well as consumers’ willingness to pay more for pet care. According to the European Pet Food Industry Federation(FEDIAF), over 80 million households own at least one pet in Europe. Due to cat ownership, cat food dominates the regional market.Nearly 84.9 and 49.8 million of the total European pet population were dogs and ornamental birds. Europe has a large number of pet food manufacturers and 200 production facilities, making it a competitive market for pet ingredient companies.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

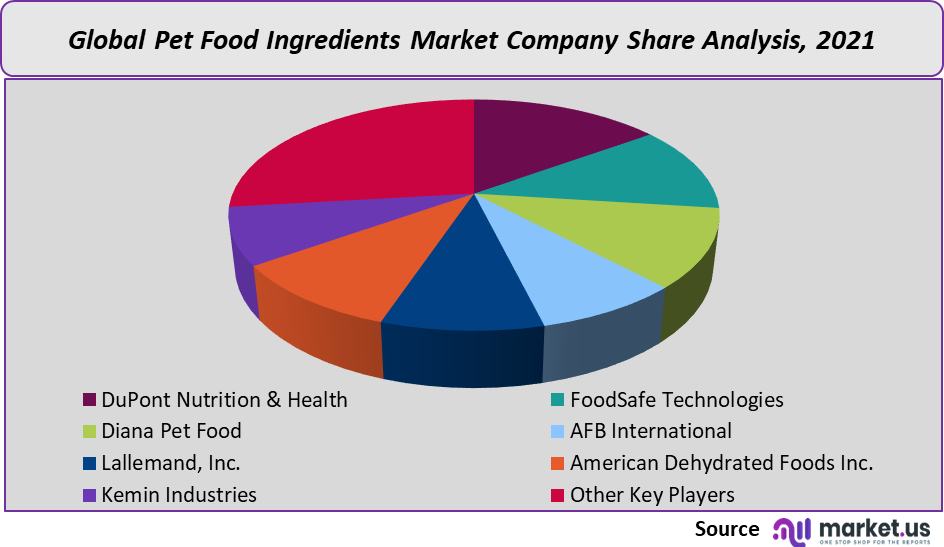

Market Share Analysis:

The pet food ingredients market remains fragmented. To increase their market share in the global marketplace, major manufacturers have launched a number of strategic initiatives including acquisitions.

Contrary to many commodity value chains, livestock value chains include a majority, which makes them easily identifiable and distinguishable transactions.Pet food ingredients manufacturers are now looking for technological breakthroughs to reduce their energy consumption and sourcing ingredients. The producers will face both a significant challenge and an opportunity because of the growing demand for pet food ingredients.

Producing contracts with pet food manufacturers and producers of ingredients is expected to be beneficial for the ingredient producers, as it creates opportunities to increase the profit margin.

Market players are now focusing on Asia Pacific countries, where the pet foods industry is expected to grow at an impressive rate. This is a significant driver for the product marketplace. The region’s lower pet ownership rate is driving global players to expand their operations there.

Key Market Players:

- DuPont Nutrition & Health

- FoodSafe Technologies

- Diana Pet Food

- AFB International

- Lallemand Inc.

- American Dehydrated Foods Inc.

- Kemin Industries

- Other Key Players

For the Global Pet Food Ingredient Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Pet Food Ingredients market in 2021?The Pet Food Ingredients market size is estimated to be US$ 40,210 million in 2021.

Q: What is the projected CAGR at which the Pet Food Ingredients market is expected to grow at?The Pet Food Ingredients market is expected to grow at a CAGR of 5.2% (2023-2032).

Q: List the segments encompassed in this report on the Pet Food Ingredients market?Market.US has segmented the Pet Food Ingredients market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Pet, market has been segmented into Dog, Cat, Fish, and Others. By Ingredients, the market has been further divided into Specialty Proteins, Amino Acids, Mold Inhibitors, Gut Health Ingredients, Phosphates, Vitamins, Acidifiers, Carotenoids, Enzymes, Mycotoxin Detoxifiers, Flavors & Sweeteners, Antimicrobials & Antibiotics, Minerals, and Antioxidants.

Q: List the key industry players of the Pet Food Ingredients market?DuPont Nutrition & Health, FoodSafe Technologies, Diana Pet Food, AFB International, Lallemand Inc., American Dehydrated Foods Inc., Kemin Industries, and Other Key Players engaged in the Pet Food Ingredients market.

Q: Which region is more appealing for vendors employed in the Pet Food Ingredients market?Asia Pacific is expected to account for the highest revenue share of 34%. Therefore, the Pet Food Ingredients Technology industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Pet Food Ingredients?U.S., Canada, Mexico, Germany, U.K., France, Russia, China, and Japan are key areas of operation for Pet Food Ingredients Market.

Q: Which segment accounts for the greatest market share in the Pet Food Ingredients industry?With respect to the Pet Food Ingredients industry, vendors can expect to leverage greater prospective business opportunities through the dog segment, as this area of interest accounts for the largest market share.

![Pet Food Ingredients Market Pet Food Ingredients Market]()

- DuPont Nutrition & Health

- FoodSafe Technologies

- Diana Pet Food

- AFB International

- Lallemand Inc.

- American Dehydrated Foods Inc.

- Kemin Industries

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |