Global Pharmaceutical Glass Packaging Market By Drug Type (Generic, Biologic, and Branded), By Product (Vials, Ampoules, Cartridges & Syringes, and Bottles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 17977

- Number of Pages: 263

- Format:

- keyboard_arrow_up

Pharmaceutical Glass Packaging Market Overview:

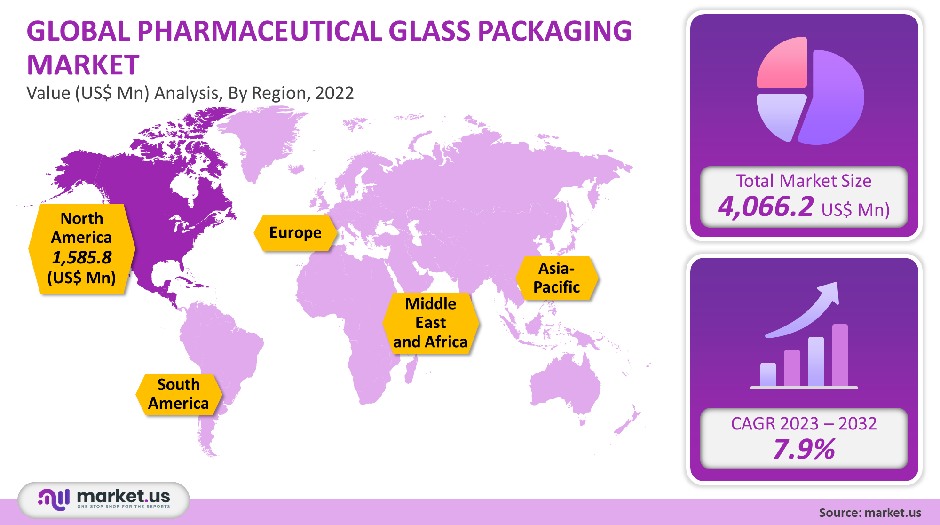

The global market for Pharmaceutical Glass Packaging was valued at USD 4,066.2 million in 2021. This market is expected to expand at a CAGR of 7.9% between 2023-2032.

Glass packaging is the most popular packaging material in the pharmaceutical sector. This is because it limits the alkalinity as well as hydrolytic resistance of glass containers. Furthermore, both the medical device and pharmaceutical industries are very regulated and stress safety and sustainability.

Since the importance of biotech drugs and cost sensitivity within the healthcare industry has grown, regulations regarding drug delivery products have been established. Numerous pharmaceutical glass producers are keen to improve the shelf life of their products and invest in vials.

Global Pharmaceutical Glass Packaging Market Analysis

Drug Type Analysis

Generic drugs dominated the market, accounting for 73% of global revenue in 2021. The increasing number of chronic diseases, an aging population, and the decline in drug patents have all contributed to the growth of the global generic drug market. Generic drugs are expected to be more popular due to the increased healthcare spending and lower drug prices. Because of its exceptional barrier property and regulatory ease, the increased use of generics will likely drive up demand for pharmaceutical glass packaging.

North America’s generic segment will see higher growth than its branded counterpart, in terms of both volume and revenue. However, patent expirations will further limit the growth potential for the branded section. Due to decreased sales volume of branded drugs the primary glass packaging will see a slowdown in growth.

A major reason for the rise in biological drug types is the ability of biologic drugs, particularly certain forms of cancer, to treat major chronic conditions. Glass delamination, chipping and surface degradation can reduce primary glass packaging for biologic medicines. Biologics will be of great benefit to the pharmaceutical industry as they address underserved therapeutic areas. Biosimilar competition has been low for biologics, which has resulted in a moderate growth of this segment. This has slowed the growth of the market.

The U.S. has a number of large pharmaceutical companies and is expected to remain a major region for many business activities in the area of pharmaceutical glass packaging. It is expected that the increased competition and customer consolidation in the country will lead to a significant rise in generic drug sales. This will impact market dynamics rapidly. This change is expected to limit sales of branded products in America, due to the expiration of patents on many drugs.

Product Analysis

The bottles segment held a high revenue share in 2021. Vials will see the fastest revenue-based growth after ampoules, from 2023-2032. This is due to their superior analytical performance and high sustainability. Type 1 borosilicate is used in the manufacture of vials, which gives the glass vials the desired chemical resistance. There are two types of glass bottles that are used in pharmaceutical packaging: large and small.

The use of large size glass bottles is to package reagents, as well as transfusion and injection bottles. The packaging of syrup bottles, oral liquids, and other liquids is done in small glass bottles. The market for small-sized bottles will see growth due to many new opportunities.

Ampoules held a significant market share in 2021 due to their superior performance and suitability. Glass ampoules are expected to see the greatest growth, both in volume and revenue, over the next five years. They are capable of filtering specific wavelengths, microbiological control and chemical resistance. Numerous ampoules conform to the DIN ISO EN9187-1/2 standard in sealed and funnel-type designs as well as straight-stem.

Key Market Segments

By Drug Type

- Generic

- Biologic

- Branded

By Product

- Vials

- Ampoules

- Cartridges & Syringes

- Bottles

Market Dynamics

Market growth is expected to be driven by the widespread use of generic injectable medicines and high demand from the pharmaceutical sector. Glass prevents harmful atmospheric gases like carbon dioxide, and oxygen from entering the primary containers, reducing the risk of contamination.

Glass packaging decreases the drug’s susceptibility for degradation, such as hydrolysis/oxidation. Glass packaging is also effective in preventing volatile ingredients from fleeing, which increases drug stability. All of these factors are expected to increase product demand in near future.

There was a slowdown in global pharma industry growth due to low to moderate demand in emerging markets. This was particularly evident in the U.S., the country with the largest and most important global pharmaceuticals market. This market had a major impact on the sales of injection drugs. The market will be revived due to the rising importance of generic drugs and better access to healthcare services.

To meet the demands of the pharmaceutical industry’s changing needs, glass packaging companies have been working to improve their production capabilities. Gerresheimer AG developed a Luer Lock Syringe, which is free of metals, that measures 1 ml long and weighs in at RTF. This new technology allows the cone to be shaped using a pin made of special ceramic material.

In addition to the COVID-19 epidemic, the pharmaceutical sector has been experiencing a steady increase in the demand for drugs and healthcare services. The market growth has been positive due to the increase in demand for drugs. In the event of approval for COVID-19 vaccinations that have been developed by different organizations and companies from different countries, the market is expected to reach a new peak.

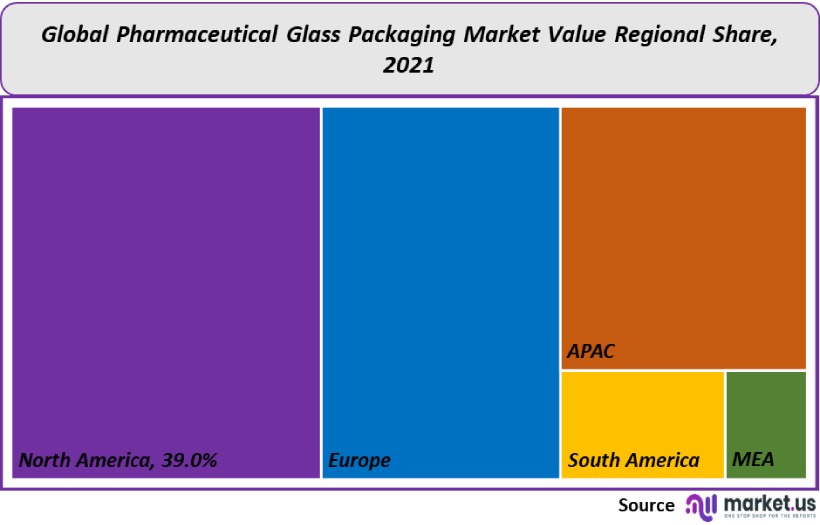

Regional Analysis

North America held a dominant position in the market and was responsible for 39% of global revenue in 2021. Over the next few years, developing markets will experience a boom in spending on pharmaceuticals. The U.S. is expected to remain the largest market and driver for the expansion of the regional pharmaceutical sector with innovative products leading the way. This will be helped by the steady rise in generics sales and volume in the region.

Because of the rapid expansion in the consumer base and the increase in spending, emerging markets should see higher growth rates than developed ones. Rising income levels and increased awareness of healthcare will all contribute to the Asia Pacific’s growth. Because of this increased awareness, governments across the Asia Pacific region are increasing their private and public health coverage. The increased demand for pharmaceutical products will fuel growth in the region due to the government’s efforts in developing countries to promote generic drugs that are cheaper and lower healthcare costs.

The Asia Pacific is expected to be the fastest-growing regional market in terms both of revenue and volume during the forecast period. Many small and medium-sized production units are located in the region, which is responsible for this growth. It also has relaxed regulatory policies that support manufacturers and attracts foreign investment.

It is common for companies such as Schott AG or Corning to partner with small-scale production units within the region. This allows them to grow their regional presence and gain a larger share of the market. The European region was responsible for a considerate revenue share in 2021. The European economy’s key asset is its research-based pharmaceutical sector.

The rise in medical research and development is driving the growth of the pharmaceutical glass packaging sector. It is expected that the national regulation that lowers profits and prices, and results in market fragmentation, will be a significant factor that distinguishes the strengths and weaknesses of the European research-based sector from its American counterparts within the pharmaceutical sector.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

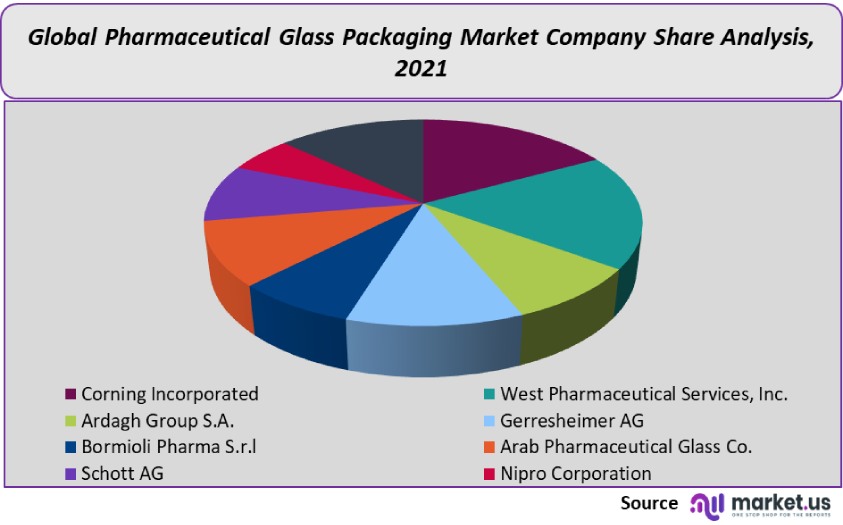

Market Share & Key Players Analysis:

Many of the leading pharmaceutical glass manufacturers are located in the North American and European developed regions. This results in a well-developed supply chain and production system. Due to their low labor costs, as well as the potential growth opportunities, manufacturers are shifting to countries like Brazil, India, or China. These countries are expected to see a rise in demand for pharmaceutical packaging during the forecast period.

SGD S.A. is one of the emerging players in global markets. This is due to ongoing investments in the expansion and production of glass pharmaceutical packaging. SGD S.A. upgraded its plants in China, Spain, and Spain with high-tech equipment to increase their production.

Маrkеt Кеу Рlауеrѕ:

- Corning Incorporated

- West Pharmaceutical Services, Inc.

- Ardagh Group S.A.

- Gerresheimer AG

- Bormioli Pharma S.r.l

- Arab Pharmaceutical Glass Co.

- Schott AG

- Nipro Corporation

- Other Key Players

For the Pharmaceutical Glass Packaging Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Pharmaceutical Glass Packaging Market in 2021?The Pharmaceutical Glass Packaging Market size is US$ 4,066.2 million in 2021.

What is the projected CAGR at which the Pharmaceutical Glass Packaging Market is expected to grow at?The Pharmaceutical Glass Packaging Market is expected to grow at a CAGR of 7.9% (2023-2032).

List the segments encompassed in this report on the Pharmaceutical Glass Packaging Market?Market.US has segmented the Pharmaceutical Glass Packaging Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Drug Type, the market has been further divided into Generic, Biologic, and Branded. By Product, the market has been further divided into Vials, Ampoules, Cartridges & Syringes, and Bottles.

List the key industry players of the Pharmaceutical Glass Packaging Market?Corning Incorporated, West Pharmaceutical Services, Inc., Ardagh Group S.A., Gerresheimer AG, Bormioli Pharma S.r.l, Arab Pharmaceutical Glass Co., Schott AG, Nipro Corporation, and Other Key Players are engaged in the Pharmaceutical Glass Packaging market

Which region is more appealing for vendors employed in the Pharmaceutical Glass Packaging Market?North America is expected to account for the highest revenue share of 39%. Therefore, the Pharmaceutical Glass Packaging industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Pharmaceutical Glass Packaging?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Pharmaceutical Glass Packaging Market.

Which segment accounts for the greatest market share in the Pharmaceutical Glass Packaging industry?With respect to the Pharmaceutical Glass Packaging industry, vendors can expect to leverage greater prospective business opportunities through the Generic drugs segment, as this area of interest accounts for the largest market share.

![Pharmaceutical Glass Packaging Market Pharmaceutical Glass Packaging Market]() Pharmaceutical Glass Packaging MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample

Pharmaceutical Glass Packaging MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample - Corning Incorporated

- West Pharmaceutical Services, Inc. Company Profile

- Ardagh Group S.A.

- Gerresheimer AG Company Profile

- Bormioli Pharma S.r.l

- Arab Pharmaceutical Glass Co.

- Schott AG Company Profile

- Nipro Corporation Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |