Global Phosphate Fertilizer Market By Product (Triple Superphosphate (TSP), Mono-ammonium Phosphate (MAP), and Other Products), By Application (Fruits & Vegetables, Oilseeds & Pulses, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 15067

- Number of Pages: 271

- Format:

- keyboard_arrow_up

Phosphate Fertilizers Market Overview

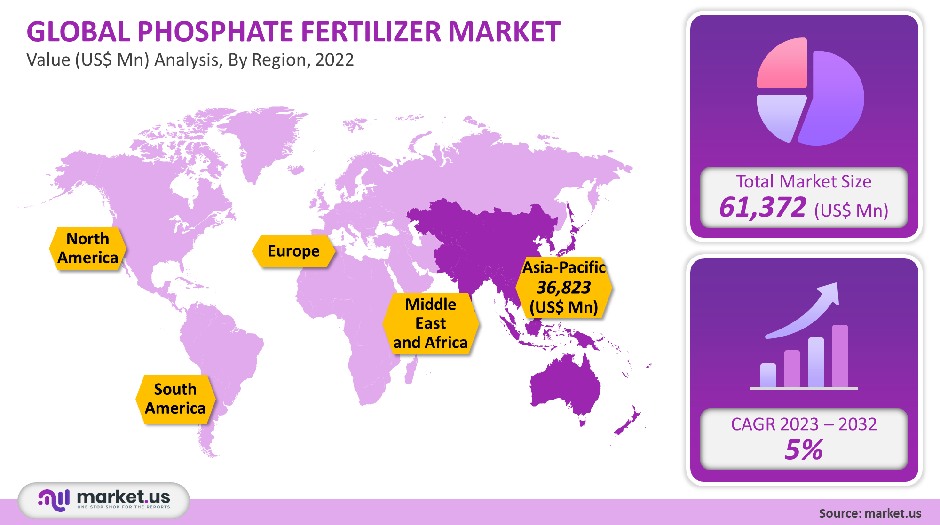

The market for Phosphate fertilizers was worth USD 61.37 Billion in 2021. It is expected that it will grow at a CAGR, of 5% between 2023-2032.

This can be explained by the growing demand from farmers for fertilizers that contain essential nutrients, such as potassium and nitrogen. The main areas of application are fruits, cereals, vegetables, and pulses. Phosphorous fertilizers can be used in different grains to encourage root growth, enhance crop quality, and increase stalk strength.

Global Phosphate Fertilizer Market Analysis

Product Analysis

Mono-ammonium phosphate accounted for around 33% of 2021’s revenue share. This is due to the low price of MAP and its high levels of phosphorous. It is an essential source of nitrogen as well as phosphorus and is therefore the most important phosphate fertilizer. It is an important granular fertilizer in agricultural applications. Triple superphosphate was the second-largest product category in 2021. It is a highly concentrated fertilizer with approximately 44% di-phosphorus pentoxide.

TSP’s market share will grow due to increasing demand from global agriculture. DAP, and SSP, among others, are other products. DAP can also help in many industrial processes, such as metal finishing. DAP is added to milk to create cheese cultures. It can also be used to preserve yeast fermentation. DAP is also a fire retardant. DAP is expected to be in high demand due to rising agricultural demand in emerging countries like India and Brazil.

Application Analysis

With a high revenue share, cereals & grain application was the most lucrative segment in 2021. The increase in demand for major cereals & grain worldwide due to growing populations has resulted in high demand for fertilizers. Oilseeds & Pulses accounted for the second largest market share. This segment is projected to grow at a 5.4% CAGR over the forecast period. This is due to increased demand for agricultural products in these regions, such as soybean, groundnut, sesame seed, sunflower, sesame, and many others.

The product promotes plant growth and has been shown to be highly effective in the cultivation of many oilseeds & pulses. The use of the product for seed treatment is considered to be highly effective for the production of vegetables and fruits, such as tomatoes, chilies, and onions. The use of the product in cultivation results in increased food production, better seed development, plant maturation, root development, and improved crop yields.

Key Market Segments

By Product

- Triple Superphosphate (TSP)

- Mono-ammonium Phosphate (MAP)

- Single Superphosphate (SSP)

- Di-ammonium Phosphate (DAP)

- Other Products

By Application

- Fruits & Vegetables

- Oilseeds & Pulses

- Cereals & Grains

- Other Applications

Market Dynamics

Phosphorus rock is the largest global source of phosphorus. The U.S. is the world’s largest producer and user of phosphate stones, which are primarily used in the production of the product. The market is driven by rising demand for food worldwide. Because of the growing world population and rising food demand, there is a surge in global demand for Phosphor. The expected rise in raw materials costs as a result of increased investments in new mine expansions will continue for the foreseeable future.

Therefore, rising mining costs have an impact on the cost of raw materials around the world. Emerging economies across the globe are realizing the importance to use the product in agriculture production. Brazil and India, two of the world’s largest agrarian nations, support the use of fertilizers phosphate to improve crop yields, which has encouraged farmers in these countries and local entrepreneurs to increase their use of fertilizer grade phosphate.

Many global businesses that deal with the agricultural sector, agricultural inputs, and fertilizers were negatively impacted by the COVID-19 epidemic. Because the majority of Asian Pacific countries are agrarian economies and have significant impacts on the overall operations, such as a slowdown in agricultural activities or a temporary pause in cross-border commerce, it has a major impact on the operations of both farmers and agricultural companies in the Asia Pacific.

These disruptions eventually lead to disruptions in all major agricultural sectors across the region. The COVID-19 pandemic caused sharp increases in the prices of primary raw materials such as ammonia or sulfur. This was due to tightening supply and curtailments at refineries.

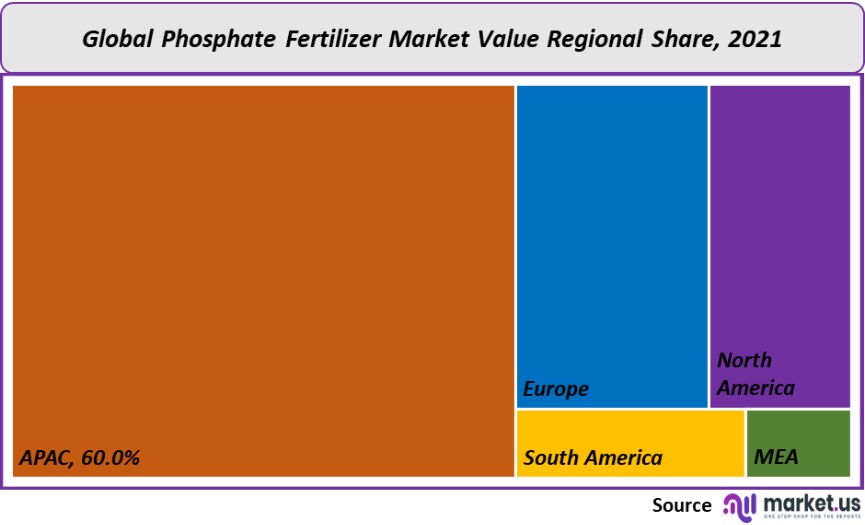

Regional Analysis

In 2021, the Asia Pacific region was responsible for 60% of revenue. This is due to increased food production and growing demand for food products, such as rice or vegetables from Asia Pacific’s import-dependent countries. Indian agriculture is the backbone of the economy. It provides employment to half of the workforce and contributes around 17% of the country’s GDP. India is home to many important crops, including wheat, rice, pulses, and spices.

India is one of Asia’s fastest-growing agro-based markets. The market’s demand is expected to increase during the forecast period. Europe was the second-largest regional segment in terms of revenue in 2021. This market is expected to expand at a CAGR of 6% over the forecast period. This is due to the high level of agricultural production in the region. Germany is the fourth-largest agricultural producer in the region. France is the sixth largest, accounting for almost 1/3 of all the EU’s agricultural land.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

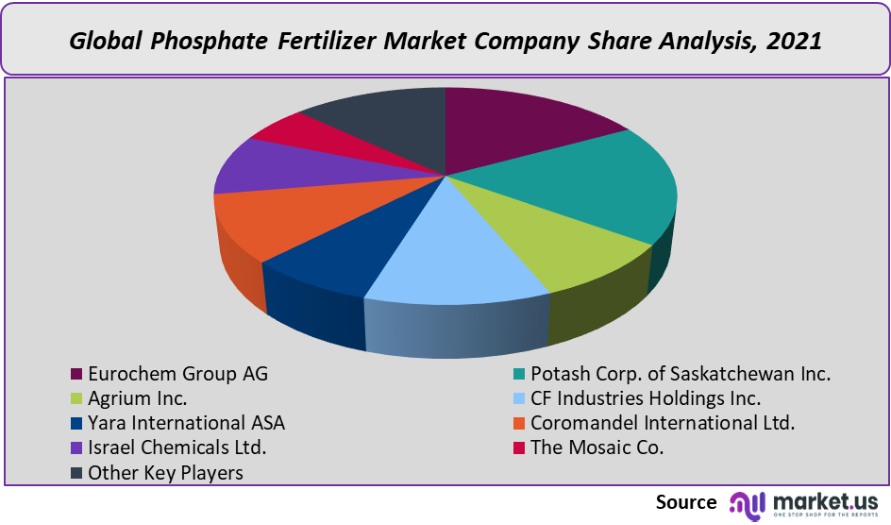

Market Share & Key Players Analysis:

The market is fragmented due to the presence of many manufacturers of fertilizers, particularly in agriculture-dependent countries. The market is undergoing a shift in focus as the agrochemical demands are increasing. EuroChem Group has signed an agreement with Serra do Salitren to acquire a phosphate plant in Brazil in August 2021. This acquisition is expected to strengthen the company’s ability to produce and distribute crop nutrients.

Market Key Players:

- Eurochem Group AG

- Potash Corp. of Saskatchewan Inc.

- Agrium Inc.

- CF Industries Holdings Inc.

- Yara International ASA

- Coromandel International Ltd.

- Israel Chemicals Ltd.

- The Mosaic Co.

- Other Key Players

For the Phosphate Fertilizers Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

61.37 Billion

Growth Rate

5%

Forecast Value in 2032

104.96 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Phosphate Fertilizer Market in 2021?The Phosphate Fertilizer Market size is US$ 61,372 million in 2021.

What is the projected CAGR at which the Phosphate Fertilizer Market is expected to grow at?The Phosphate Fertilizer Market is expected to grow at a CAGR of 5% (2023-2032).

List the segments encompassed in this report on the Phosphate Fertilizer Market?Market.US has segmented the Phosphate Fertilizer Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been further divided into Triple Superphosphate (TSP), Mono-ammonium Phosphate (MAP), Single Superphosphate (SSP), Di-ammonium Phosphate (DAP), and Other Products. By Application, the market has been further divided into Fruits & Vegetables, Oilseeds & Pulses, Cereals & Grains, and Other Applications.

List the key industry players of the Phosphate Fertilizer Market?Eurochem Group AG, Potash Corp. of Saskatchewan Inc., Agrium Inc., CF Industries Holdings Inc., Yara International ASA, Coromandel International Ltd., Israel Chemicals Ltd., The Mosaic Co., and Other Key Players are engaged in the Phosphate Fertilizer market

Which region is more appealing for vendors employed in the Phosphate Fertilizer Market?APAC is expected to account for the highest revenue share of 60%. Therefore, the Phosphate Fertilizer industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Phosphate Fertilizer?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Phosphate Fertilizer Market.

Which segment accounts for the greatest market share in the Phosphate Fertilizer industry?With respect to the Phosphate Fertilizer industry, vendors can expect to leverage greater prospective business opportunities through the mono-ammonium phosphate segment, as this area of interest accounts for the largest market share.

![Phosphate Fertilizers Market Phosphate Fertilizers Market]() Phosphate Fertilizers MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample

Phosphate Fertilizers MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample - Eurochem Group AG

- Potash Corp. of Saskatchewan Inc.

- Agrium Inc.

- CF Industries Holdings Inc.

- Yara International ASA

- Coromandel International Ltd.

- Israel Chemicals Ltd.

- The Mosaic Co.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |