Global Pigment Dispersion Market By Product Type (Inorganic Pigments and Organic Pigments), By Application (Plastics, Inks, and Coatings) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 35249

- Number of Pages: 312

- Format:

- keyboard_arrow_up

Pigment Dispersion Market Overview:

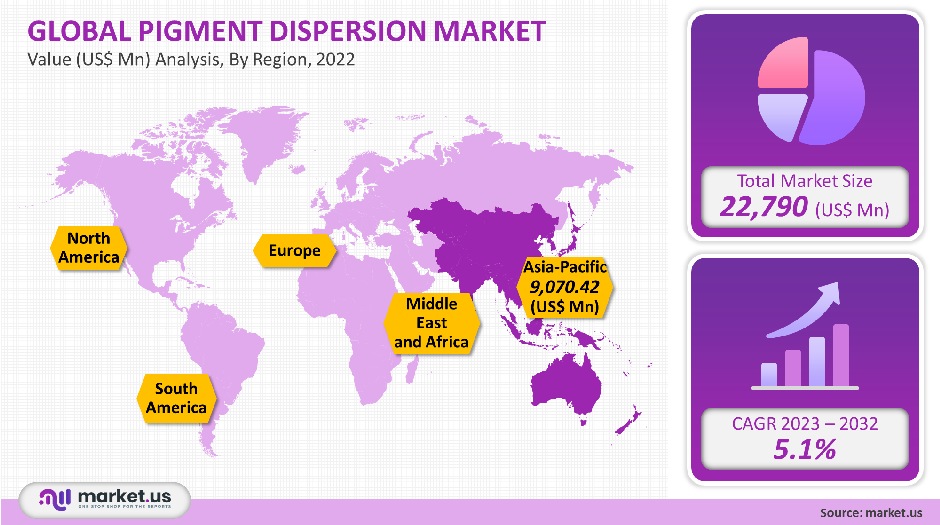

The global market for pigment dispersions was worth USD 22,790 million in 2021. It is projected to grow at a CAGR of 5.1% between 2023 and 2032.

The forecast period will see steady growth in the global packaging industry in terms of food and non-food packaging and printing labels. This is expected to drive demand for pigment dispersions

Global Pigment Dispersion Market Scope:

Product type analysis

Inorganic products dominated the market, accounting for over 55.2% of global revenue in 2021. Inorganic pigment dispersion can be made from inorganic compounds like chromates, metal oxides, and sulfates by using various chemical formulations. You can use inorganic pigment dispersion in many applications such as plastics, paints, coatings, or printing inks.

Inorganic pigment dispersion tends to be lighter than organic pigment dispersion. However, for applications that require greater durability, organic pigment dispersion may be preferred. Organic pigment dispersion can fade if it is exposed to the sun continuously, unlike inorganic pigment.

Inorganic pigment dispersion can be more economical than organic pigment and has better dispersion properties on different substrates due to its smaller particle sizes. Iron oxide and titanium dioxide are two of the most popular inorganic pigment dispersions.

Organic pigments are made up of carbon rings and carbon chains. They are transparent because of their large particle sizes. There are many types of organic pigments available, including azo pigments and phthalocyanine, lake, and quinacridone.

Organic pigments have a higher color strength than inorganic ones. However, high prices and poor dispersion abilities are hindering organic pigments’ growth. Printing inks, paints and coatings, rubber, and plastics all use organic pigments.

Application analysis

The market’s largest segment, coatings applications, accounted for over 38.5% of global revenue in 2021. The growth in building and construction due to infrastructure development in many countries such as India, China, Saudi Arabia, and India is expected to drive the market for pigment dispersions in the future. Organic pigments for coatings will also be in high demand due to the increasing demand for green construction.

Because pigment dispersion is more effective at coloring printing inks than dyes, it has been widely used to replace them. The pigment dispersion-based inks are composed of dyes, which are dissolved in a carrier liquid.

However, the pigment dispersion-based inks contain fine particles that are suspended in the carrier fluid. These inks can use both organic and inorganic dispersions, but the percentage of the latter is relatively high due to their lower price and better dispersion abilities.

The forecast period will see an increase in plastic consumption in many end-use industries such as construction, automotive, medical devices, and electrical & electronic. Many plastics are used in construction, including floorings, high-performance safety windows, insulation materials, and storage tanks. They also serve as pipes, domes/skylights, cables, doors, and pipes. This market is in constant development and offers moderate growth potential.

Pigment dispersion can be used in plastics with polyolefins for food packaging and non-food packaging. It is also used in building and construction products, coverings and gutters, sheets, and films. Because of the potential for UV radiations to affect pigment dispersion properties, pigment dispersions are used in plastic applications that require direct sunlight exposure.

Pigment dispersion is used in packaging to enhance branding and improve visual design. This often attracts customers.

For flooring applications that require the use of pigment dispersion, epoxy and polyurethane are used. For coloring rubber sheets, tire sidewalls, and equipment used in surgery in the medical sector, pigment dispersion is used.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Inorganic Pigments

- Organic Pigments

By Application

- Plastics

- Inks

- Coatings

Market Dynamics:

The most popular polymers in single-service food packaging are polyethylene terephthalate, polypropylene, and polystyrene. The overall demand for pigments will be driven by factors such as the increasing use of plastic, paper & board materials, and the use of diverse colorants to create attractive packaging.

Some of the more toxic inorganic pigments can be replaced by organic pigments. Organic pigments can be costly and have limited properties. In order to create environmentally-friendly synthetic pigments, manufacturers are investing in research and development.

Titanium dioxide The most popular inorganic pigment is because of its non-toxic chemical stability and versatility for plastic and paperboard food packaging. Zinc dioxide is a synthetically made pigment that is less toxic to humans. The highest proportion of global demand for pigments for plastic and paper and paperboard food packaging is currently held by zinc oxide, iron oxide, and titanium dioxide.

Regional Analysis

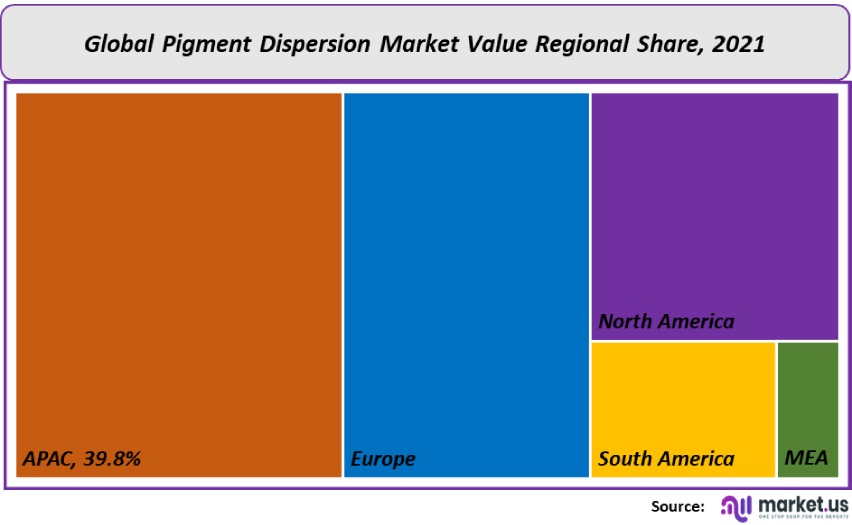

The Asia Pacific was the dominant market, accounting for over 39.8% of global revenue in 2021. This is due to the abundance of raw materials and low-cost labor. It has attracted many manufacturers from different industries to establish production plants in the Asia Pacific region in order to reap greater benefits. The coatings application segment in South Korea is expected to have the largest share of the overall pigment dispersion industry growth over the forecast period.

South Korea’s market for pigment dispersion is expected to grow due to the increased infrastructure spending and the increasing government spending on public infrastructure. Additionally, South Korea’s low unemployment rate and high disposable income will drive the demand for pigment dispersions for packaging applications in various end-use industries such as food and beverage and consumer goods.

Germany accounted for the largest share of Europe’s pigment dispersion market in terms of both revenue and volume. The region’s growth is expected to be aided by the support of many European countries and growing industrial facilities. The region is projected to benefit from the growing popularity of green technology and strict environmental regulations.

In the US, the growing number of QSRs and quick-service restaurants (QSRs) is driving the demand for pigment dispersion. They use pigment dispersion in food packaging and printing ink applications. There are strict guidelines in the USA regarding the types of pigment dispersions that can be used in food packaging. Many inorganic pigments can become toxic when they come in contact with foods.

According to the FDA, food coloring agents and printing inks can only be made from materials that are approved by the FDA. Food packaging is not allowed to use pigments that contain polynuclear aroma hydrocarbons or benzopyrene at levels exceeding 0.5 and 5.0 parts, respectively.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

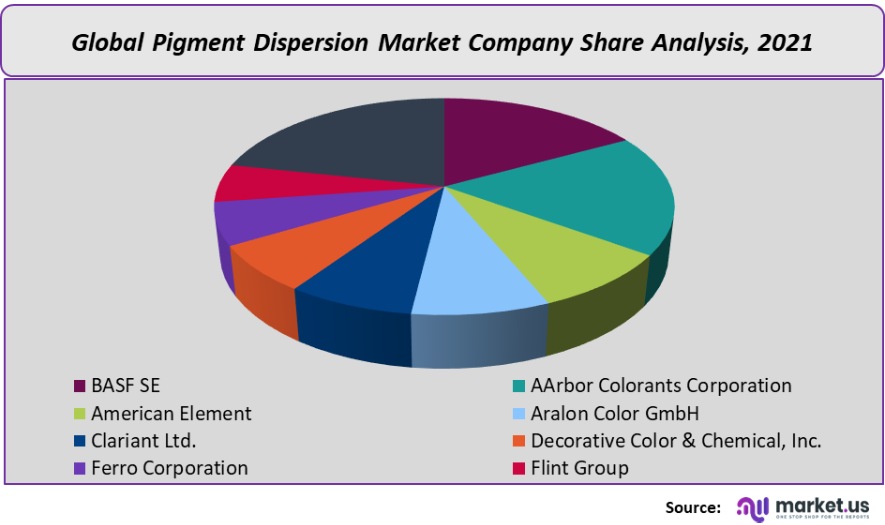

The global pigment dispersion market is fragmented. Major players are involved in product development, strategic partnerships, mergers and acquisitions, and joint ventures to vertically incorporate across the value chain. This reduces operational costs and allows for higher profit margins.

In March 2019, BASF SE joined forces with Landa Labs in order to launch its second stir-in pigment, eXpand. Blue (EH 6001) is sold under the Colors & Effects label. eXpand! Blue (EH 6001) can be used for automotive coatings as well as outdoor coating applications.

Organic Dyes and Pigments also acquired Premier Colors, Inc. in December 2020 to expand its business in Providence and serve the customers of the former. Premier Colors, Inc. is a South Carolina-based company that supplies specialty chemicals and pigment dispersions to the paper, textile, paints and coatings, and leather industries. These are the major players in the global pigment dispersion industry.

Маrkеt Кеу Рlауеrѕ:

- BASF SE

- AArbor Colorants Corporation

- American Element

- Aralon Color GmbH

- Clariant Ltd.

- Decorative Color & Chemical, Inc.

- Ferro Corporation

- Flint Group

- Heubach GmbH

- Kama Pigments

- Other Key Players

For the Pigment Dispersion Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Pigment Dispersion market size in 2021?A: The Pigment Dispersion market size is $ 22,790 million in 2021.

Q: What is the CAGR for the Pigment Dispersion market?A: The Pigment Dispersion market is expected to grow at a CAGR of 5.1% during 2023-2032.

Q: What are the segments covered in the Pigment Dispersion market report?A: Market.US has segmented the Pigment Dispersion market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Inorganic Pigments and Organic Pigments. By End User, the market has been further divided into Plastics, Inks, and Coatings.

Q: Who are the key players in the Pigment Dispersion market?A: BASF SE, AArbor Colorants Corporation, American Element, Aralon Color GmbH, Clariant Ltd., Decorative Color & Chemical Inc., Ferro Corporation, Flint Group, Heubach GmbH, Kama Pigments, and Other Key Players

Q: Which region is more attractive for vendors in the Pigment Dispersion market?A: APAC is expected to account for the highest revenue Share of 39.8% among the other regions. Therefore, the Pigment Dispersion market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Pigment Dispersion?A: Key markets for Pigment Dispersion are South Korea, Germany, and the US.

Q: Which segment has the largest share in the Pigment Dispersion market?A: In the Pigment Dispersion market, vendors should focus on grabbing business opportunities from the Inorganic product segment as it accounted for the largest market share in the base year.

![Pigment Dispersion Market Pigment Dispersion Market]()

- BASF SE

- AArbor Colorants Corporation

- American Element

- Aralon Color GmbH

- Clariant Ltd.

- Decorative Color & Chemical, Inc.

- Ferro Corporation

- Flint Group

- Heubach GmbH

- Kama Pigments

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |