Global Point-of-Sale Software Market By Deployment Mode , By Application , By End-User , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 51827

- Number of Pages: 296

- Format:

- keyboard_arrow_up

Point of Sale Software Market Overview:

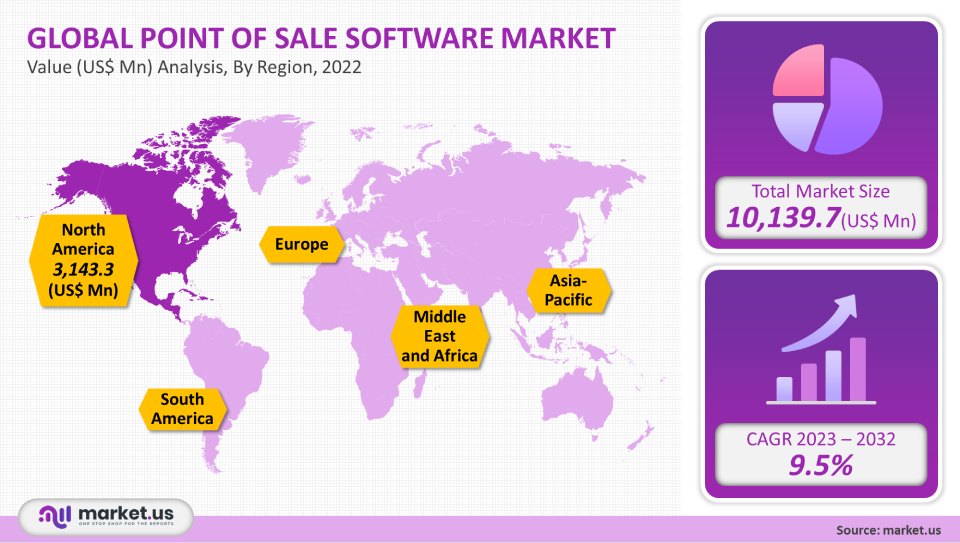

The global point-of-sale software market was valued at USD 10,139.7 million in 2021. It is expected to grow at a CAGR of 9.5% between 2023 to 2032.

Many business sectors, including travel and entertainment, were negatively affected by the COVID-19 pandemic. This subsequently harmed point-of-sale (POS) software vendors’ profitability. Point-of-sale (POS) finds applications in both mobile and fixed POS terminals.

However, the rising demand for contactless payment options was a relief, creating a favorable market environment for market players. While the pandemic harmed many sectors, there were a few industries that survived thanks to online food ordering and shopping. Online sales performance led to an increase in online food delivery and grocery orders, which favored contactless payment options.

Global Point of Sale Software Market Scope:

Application Analysis

POS software can find applications on both fixed and mobile POS terminals. Fixed systems are more secure regarding data privacy and therefore are a preferred choice for many end-users. The fixed segment had the highest revenue share at 55.0% or more in 2021 due to an increased preference for FSRs and QSRs. Mobile POS is expected to grow faster at 12.0% during the forecast period.

The segment’s growth has been fueled by its ease of payment. Wireless technology has revolutionized the way businesses and payment methods work. The POS software that is integrated into smartphones or tablets allows for quick payments via apps. The payment option that uses a smartphone or tablet to scan and bill the card reader is also possible. Small businesses are also adopting mobile POS because of its mobility, affordability, wider inventory, and store management application. This has contributed to the segment’s growth.

Deployment Analysis

The highest revenue share was 67% for the on-premise deployment of POS software in 2021. This is due to the greater data security and control offered by this deployment method. The high demand for POS software on-premise was driven by large enterprises. To limit access to financial and business data, separate front-end, as well as back-end solutions, are required. Due to security and control concerns, large enterprises prefer to install software on-premise.

The highest CAGR for cloud deployment POS software is 11.0%, which will be between 2023-2032. Cloud-based solutions deployment POS software is in high demand. This allows businesses to adapt to changing environments. A cloud-based deployment is a great option for small and medium-sized businesses that want to upgrade their software to meet growing business requirements quickly. Cloud deployment allows affordable subscription pricing, remote direct access, and sales management. Cloud deployment also provides an all-in-one solution for inventory management. These factors will drive demand for cloud-based POS software delivery to price-conscious customers.

End-User Analysis

The retail segment held the largest revenue share at 35.01% in 2021. The retail sector segment includes electronics, apparel, accessories, packaged goods, and many other items that require POS software, depending on their business functions. The retail industry trends have evolved from brick-and-mortar stores to multichannel (social network) retailing.

These changes have made it necessary to add features to POS systems for them in-store or online. Because consumers have Omni channel retail stage experiences, retailers are adopting POS software solutions more frequently. This has boosted the POS market. Businesses with POS software that could support both sales channels managed their operations and profit while others fell prey to the COVID-19 pandemic.

Restaurants will see significant increases in product demand during the forecast period. The CAGR for this market is expected to exceed 9.0%. This market is second in importance for POS vendors. The popularity of online food delivery has increased among younger generations. POS vendors must update their software in order to enable restaurants to track deliveries and accept new orders. The pandemic further fueled this trend. This severely limited the number of restaurants that can be opened. Online ordering and delivery will continue to drive investment in POS software. Restaurant POS software has seen rapid growth due to its ability to manage orders and provide marketing data analytics.

Key Segment Analysis:

Deployment Mode

- Cloud

- On-premise

Application

- Fixed POS

- Mobile POS

End-User

- Healthcare

- Hospitality

- Restaurants

- Other End-Users

Market Dynamics:

POS solutions are gaining popularity in many sectors because they offer advanced and custom analytical functions. These systems or terminals are backed with powerful software capabilities that allow business owners to simplify their day-to-day business operations while focusing on their core business activities. The development of advanced software solutions will be a key component of these systems as there is a greater demand for custom-made POS systems or check-out systems that can support various business applications. Market growth is expected to continue through the development of software that can support a variety of industries and provide analytical capabilities to monitor data from daily business operations.

The industry development is expected to grow in the coming seven years thanks to a trend to create software for standalone terminals and buildings, as well as an all-in-one solution for restaurants/retail chains. Cloud-based mPOS software has been gaining popularity due to its cost-effectiveness and ease-of-use installation. POS software can be installed on a variety of devices, including tablets, desktops, and laptops. It can be used with any operating system making it an ideal choice for vendors. A key trend in the industry is the ability to deploy web-based solutions among SMBs. Because of their accessibility via the internet, small businesses are more likely to use web-based solutions. This will drive market growth.

POS software providers consider many factors when developing software, including support for many operating systems and payment methods, as well as the ability to manage customer databases in a structured manner. Merchants require a flexible, cost-effective POS system that works with all types of hardware, including tablets, smartphones, computers, and PCs. These devices require compatible software because they run on different operating systems such as Windows, Linux, and macOS. Vendors ensure that software is available for all operating systems and devices to meet the needs of large and small businesses.

The COVID-19 pandemic changed the business landscape and has forced end-users to adopt modern point-of-sales technology. Modern POS systems that allow online orders & digital payments, as well as unified analytics, would be able to understand and meet customer expectations, adapt to market changes, plan for future lockdowns and similar situations, and make it easier to sell online and offline. To meet consumer demands during the pandemic, retail, packaged food, and other businesses chose e-commerce to sell their products online.

POS vendors seized this opportunity to improve the sector for payment solutions for restaurateurs and retailers to manage in-store and online sales information. Market vendors discovered new growth opportunities by adapting to the changing market. The restricted movement and ban of non-essential services harmed the growth in end-user revenue and, therefore, harmed the demand for compatible software and POS systems.

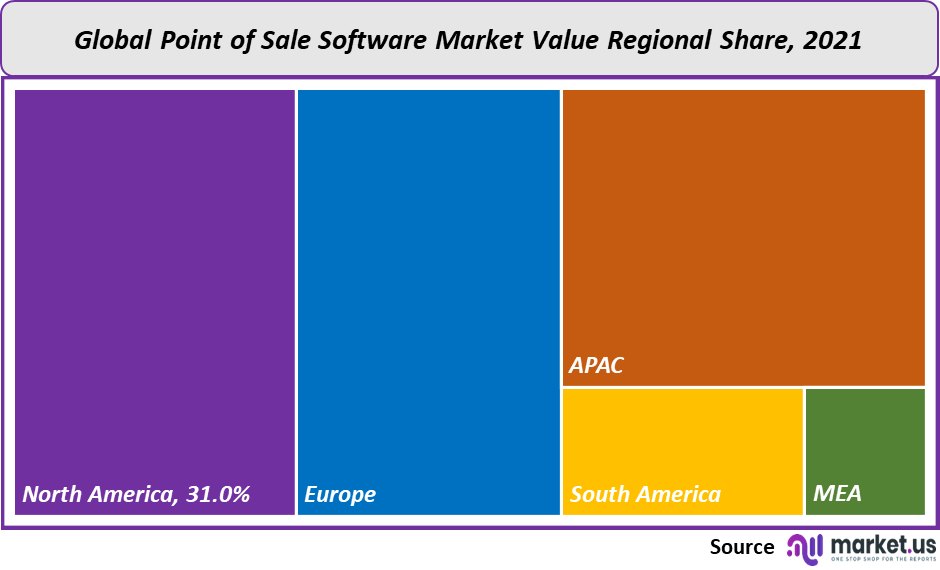

Regional Analysis:

In 2021, North America accounted for 31% of the highest revenue share. There are many POS software vendors in the region. The region also has a demand for high-end integrated POS software. Due to the increasing demand for POS software, the healthcare industry in the United States is expected to grow at the fastest rate. This is due to improvements in hospital facilities related to patient management, payment, and insurance. long-term care and community hospitals. This indicates the need for robust and cost-effective POS software that integrates with all patient financial software, insurance payment processing, reporting, and accounting to complete payment processing. The forecast period will see a rise in cashless card payments and rapid growth in the North American hospitality, retail, restaurant sectors, and healthcare industries.

Asia Pacific is expected to grow at a substantial CAGR of over 11.0% during the forecast period. Market growth is being fueled by the demand for cashless payments in restaurants, entertainment, warehousing, and other sectors in developing countries like China, India, and Indonesia. Due to strong growth in electronic payments, the region has seen a rise in the use of POS terminals. The market will continue to grow due to the increasing demand for POS systems with advanced features from rapidly growing businesses, including e-commerce, entertainment, and food service.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

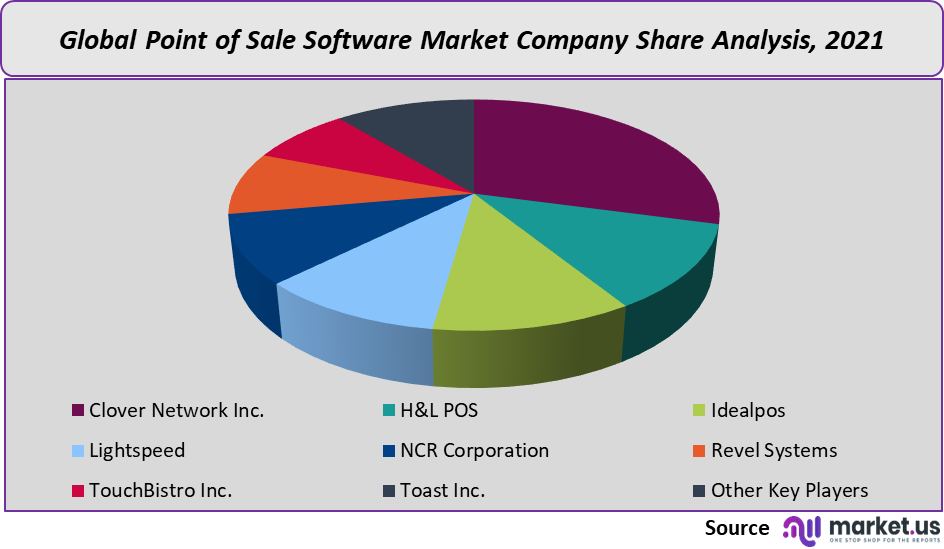

Market share Analysis:

Vendors are focused on providing industry-specific solutions at reasonable prices. To capture the opportunity, the niche market players are competing fiercely in their local markets. Light speed, for example, acquired Vend Limited in 2021. Vend Limited is an adoption of cloud-based POS systems retail management software vendor located in New Zealand. This acquisition was made to strengthen the company’s customer base and establish a strong foothold in the global Omnichannel retail market. The cloud-based segment during the forecast period is estimated to grow at the highest CAGR.

It can also be integrated with POS systems for small and medium-sized business processes. Light speed also purchased Up serve in 2020. This company provided payment solutions for the restaurant Foodservice Industry. Toast purchased an extra chef in 2021. This company provides back-office automation that can be customized for inventory management and accounts payable. This acquisition will improve Toast POS’s ability to manage the restaurant’s financial health.

Key Market Players:

The following are the top players in the global point-of-sale software market:

- Clover Network Inc.

- H&L POS

- Idealpos

- Lightspeed

- NCR Corporation

- Revel Systems

- TouchBistro Inc.

- Toast, Inc.

- Bindo Labs Inc.

- HP Inc.

- Square, Inc.

- PAX Technology

- Infor Inc.

- Intuit Inc.

- Toshiba Tec Corporation

- Agilysys Inc.

- Aptos Inc.

- Epicor Software Corporation

- GK Software

- VeriFone System Inc.

- Other Key Players

Frequently Asked Questions (FAQ)

What is the point of sale software market size in 2021?The point-of-sale software market size is US$ 10,139.7 million for 2021.

What is the CAGR for the point-of-sale software market?The point-of-sale software market is expected to grow at a CAGR of 9.5% during 2023-2032.

What are the segments covered in the point-of-sale software market report?Market.us has segmented the Global Point of sale software Market Value (Mn US$) Analysis by Region, 2022 market by geography (North America, Europe, APAC, South America, and the Middle East and North Africa). By deployment mode, the market has been segmented into cloud and on-premise. By application, the market has been further classified into fixed POS and mobile POS. By end-user application, the market is classified into restaurants, hospitality, healthcare, retail, and other end-users.

Who are the key players in the point-of-sale software market?Clover Network Inc., H&L POS, IdealPOS, Lightspeed, NCR Corporation, Oracle Micros, Revel Systems, SwiftPOS, Square Inc., TouchBistro, and Toast Inc. among others.

Which region is more attractive for vendors in the point-of-sale software market?North America accounted for the largest revenue share among the other regions in 2021. Therefore, the point of sale software in North America is expected to garner significant business opportunities during the forecast period.

What are the key markets for the point-of-sale software market?Key markets for the point-of-sale software market are the US, Mexico, and Canada.

Which segment has the largest share in the point-of-sale software market?In the point-of-sale software market, the on-premise segment is dominating the market as it is accounted for about 67% of the revenue share.

![Point of Sale Software Market Point of Sale Software Market]() Point of Sale Software MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Point of Sale Software MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Clover Network Inc.

- H&L POS

- Idealpos

- Lightspeed

- NCR Corporation

- Revel Systems

- TouchBistro Inc.

- Toast, Inc.

- Bindo Labs Inc.

- HP Inc.

- Square, Inc.

- PAX Technology

- Infor Inc.

- Intuit Inc.

- Toshiba Tec Corporation

- Agilysys Inc.

- Aptos Inc.

- Epicor Software Corporation

- GK Software

- VeriFone System Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |