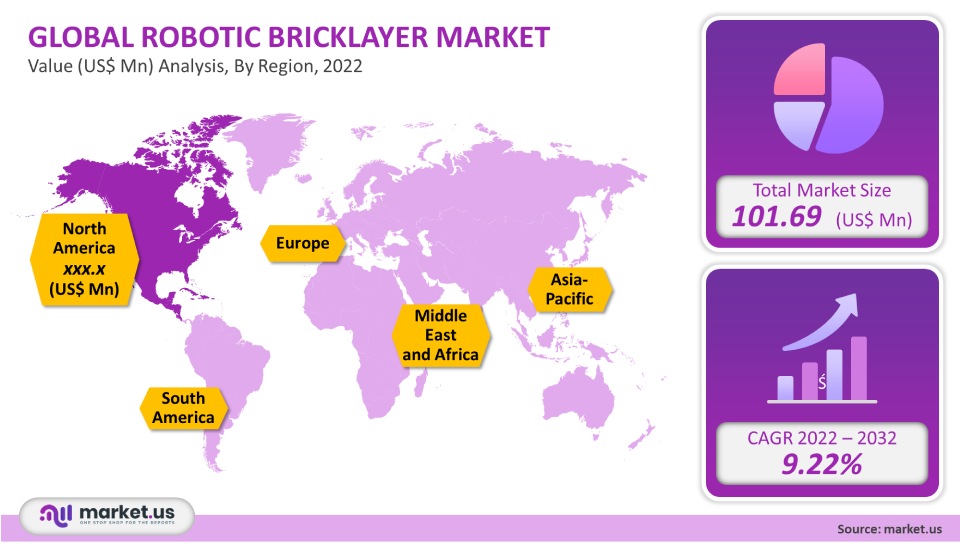

Robotic Bricklayer Market By Automation (Fully Autonomous, Semi-Autonomous), By Application (Commercial Buildings, Residential Buildings, Public Infrastructures, Nuclear Dismantling and Demolition, Other Applications), By Modality (Mounted, Cobot) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Feb 2022

- Report ID: 83544

- Number of Pages: 330

- Format:

- keyboard_arrow_up

Robotic Bricklayer Market Introduction:

The construction sector uses many resources and robotics as potential solutions to improve its efficiency. Perpetually, the construction industry faces lots of issues ascribed to labor efficiency, which is low, and work quality which is also inadequate that resulting in a high onsite accident rate. Bricklaying is the dreariest and most monotonous of tasks in the construction industry. The tedious nature of this heightens the chances of errors. Bricklaying robots, in any case, enable this industry to execute such repetitive chores effectively.

The construction robot industry is steadily acquiring a more significant foothold by supplanting manual-centric tasks as numerous new businesses are beginning to utilize innovations such as AI in robotics.

Bricklaying robots are widely used in the construction industry, which uses machines to help set the initial building blocks. Robots layer concrete upward from the structure in place of human labor. They are considered profoundly valuable as they can place around 400-500 blocks an hour, compared to manual labor, which can only set around 65-80 blocks. A robot works on proficiency by aiding in wrapping up tasks quicker. Apart from traditional labor processes, it facilitates lesser timeframes while maintaining accuracy. A robot bricklayer can lay up to 3000 blocks daily, decreasing the project’s general term. It diminishes labor costs by up to 50%. The finishing process of wall alignments can be further developed by utilizing a robotic bricklayer. A robotic bricklayer is capable of arranging blocks and assisting with critical work deficiency issues.

Market Segmentation:

By Automation –

- Fully Autonomous

- Semi-Autonomous

By Application –

- Commercial Buildings

- Residential Buildings

- Public Infrastructures

- Nuclear Dismantling and Demolition

- Other Applications

By Modality

- Mounted

- Cobot

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Market Dynamics:

Drivers:

A growing number of building renovation activities across Europe and the US are a significant factor augmenting the demand for demolition robots since they eliminate labor-intensive activities involved in the demolition process to a considerable extent. Furthermore, the rapid expansion of buildings and construction projects in urban areas has increased the demand for bricklaying robots. Robotization and digitization levels are fuelling more excellent adoption rates in the construction industry, which has generally been hesitant to adopt new advancements. The robotic bricklayer market is expected to grow exponentially due to these factors and the lack of time-consuming nature of these machines.

Restraints:

The cost of a bricklaying machine is relatively high. The prerequisite of financial assets to embrace innovations is a significant obstacle hindering the further development of the robotic bricklayer market. These construction robots can perform exercises through arms, modern equipment arrangements, PLCs, and various other advancements. Sensors and devices in an automated framework are indistinguishable components and lead to significant expenses. Construction bricklaying robots have a high initial cost compared to the offered compensation. These variables could potentially restrain the further development of this market.

Opportunities:

Numerous enactments have been presented regarding the repair of old buildings and the development of new ones, thereby creating additional opportunities for this market. It also expands the awareness among customers concerning innovative security upgrades. This sets the tone for greater levels of modernization, where construction robots are being utilized for numerous applications such as bricklaying, painting, loading, etc. These factors are anticipated to create opportunities for this industry.

Trends:

Construction robotics and drones utilizing sensors such as Lidar with Global Positioning System technologies can provide vital information about a given worksite. Along with AI, it can help to predict what tasks are necessary.

Doxel Inc. manufactured a small tread-based robot that uses AI, which can help predict tasks & scans, as well as assess the progress of a specific construction project by traversing the site. The information it collects is used to detect potential errors and discrepancies early.

Barcelona-based Scaled Robotics offers construction robotics that mobile devices can remotely control.

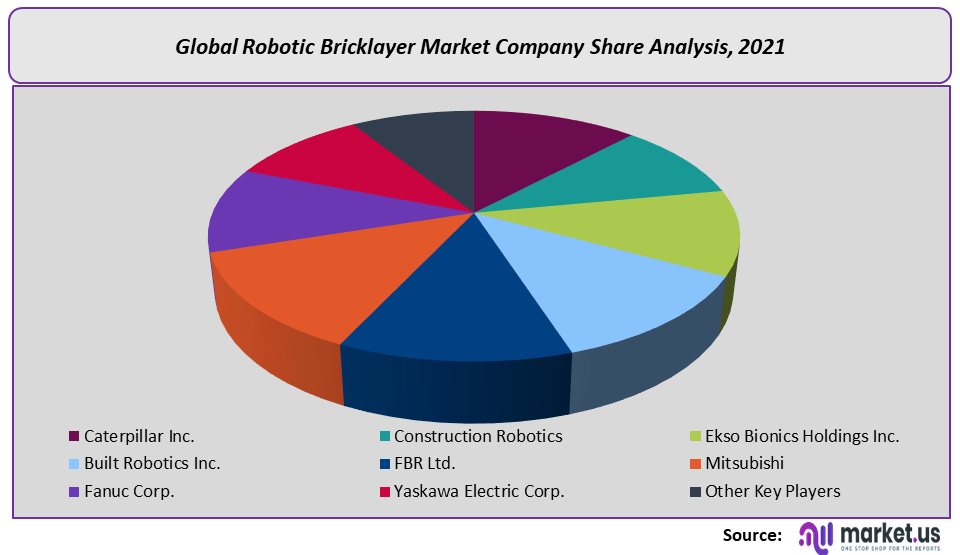

Competitive Landscape:

Key Players:

- Caterpillar Inc.

- Construction Robotics

- Ekso Bionics Holdings Inc.

- Built Robotics Inc.

- FBR Ltd.

- Mitsubishi

- Fanuc Corp.

- Yaskawa Electric Corp.

- Adept Technology Inc.

- Apex Automation and Robotics

Key Developments:

- In July 2018, Caterpillar Inc. invested USD 2.6 million in Fastbrick Robotics to develop, manufacture, and sell Fastbrick’s robotic bricklaying technology.

- In June 2020, Caterpillar acquired assets from Marble Robot, a robotics company.

- Doxel Inc. manufactured a small tread-based robot that does use AI, which can help predict tasks & scans and assess the progress of a given construction project by traversing the site. The information it collects is used to detect potential errors and discrepancies early.

- Barcelona-based Scaled Robotics offers construction robotics remotely controlled by mobile devices.

- In July 2020, Hyundai Robotics partnered with Hyundai E&C for joint R&D of construction robotics technology. Through this partnership, both companies worked on developing robots for construction sites.

- In November 2019, Boston Dynamics announced construction partnerships with Holobuilder, Faro, and Trimble. This partnership built custom payloads and tools, such as Revit and BIM360, for various construction processes.

For the Robotic Bricklayer Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Robotic Bricklayer Market Robotic Bricklayer Market]()

- Caterpillar Inc.

- Construction Robotics

- Ekso Bionics Holdings Inc.

- Built Robotics Inc.

- FBR Ltd.

- Mitsubishi Electric Corporation Company Profile

- Fanuc Corp.

- Yaskawa Electric Corp.

- Adept Technology Inc.

- Apex Automation and Robotics

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |