Global Rubber Gloves Market By Material (Natural Rubber/Latex, Nitrile, Neoprene, and Other Material Types) By Product (Disposable and Durable), By Type (Powdered and Powder Free), By Distribution Channel (Online and Physical), By End-Use (Medical & Healthcare, Automotive, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2022

- Report ID: 12907

- Number of Pages: 351

- Format:

- keyboard_arrow_up

Rubber Gloves Market Overview:

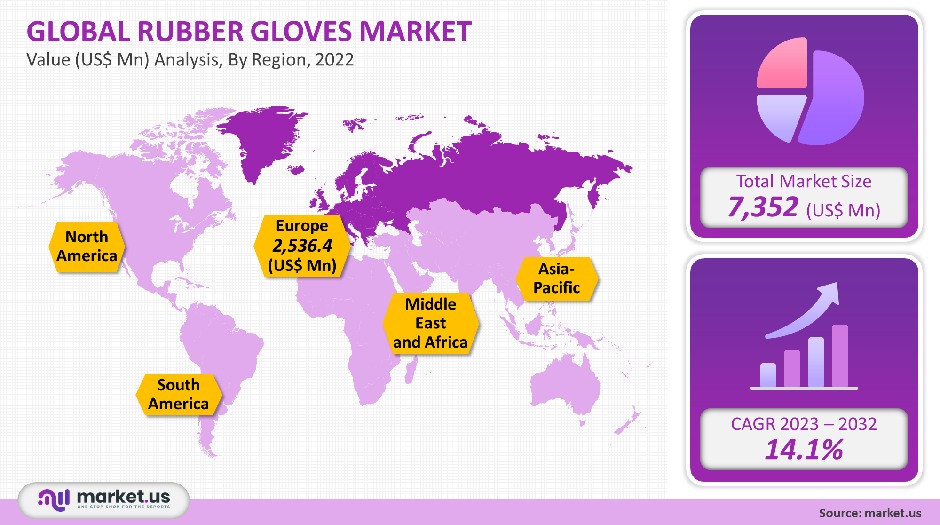

The global rubber gloves market was valued at USD 7,352 Million in 2021. It is projected to grow at a compound annual growth rate (CAGR) of 14.1% between 2023 and 2032.

The market is expected to grow due to rising awareness from industry players about the importance of worker safety at work and the high cost associated with workplace hazards.

Global Rubber Gloves Market Scope:

Material analysis

Natural rubber dominated the market, accounting for 41.2% of the total revenue in 2019. This is due to their use in various industries, including medical and healthcare, food processing, and chemical, as well as protection against hand infections and injuries. As they have been approved by FDA for chemical handling as well as medical surgery, latex gloves are expected to be in high demand.

From 2020 to 2027, the nitrile market is expected to grow at a 15.8% CAGR. Nitrile gloves have many properties, including heat resistance, chemical resistance, and high barrier protection. These rubber gloves are also more resistant to chemical burns than vinyl or latex gloves. This is why their market growth will be rapid.

By performing a polymerization operation on chloroprene, neoprene can be produced. Neoprene-based gloves have a high resistance to stretching and are more comfortable than latex or nitrile gloves. These rubber gloves are highly sought-after by food preparation workers, lab workers, and medical professionals.

Rubber gloves can also be made from isoprene rubber and chloroprene. The segment growth is expected to be driven by high heat and chemical resistance, coupled with excellent release properties. The market will also be driven by rising government spending in various developing countries for the healthcare sector.

Product analysis

Disposable rubber gloves dominated the market, accounting for 71.2% of the total revenue in 2019. This segment is forecast to grow at a 15.1% CAGR over the forecasted time. Disposable rubber gloves will be in high demand among workers in the medical and food processing industries. They have to use different rubber gloves for different operations. These disposable gloves are economical and can be used once only.

Due to the COVID-19 pandemic in the world, disposable rubber gloves have seen a significant increase in demand. Personal Protective Equipment (PPE) has also been on the rise. Healthcare workers have increased the use of disposable gloves to prevent cross-contamination during treatment.

Rubber gloves can be used in heavy-duty areas such as construction, oil and gas, chemical, and automotive. These gloves can be reused many times and have other environmental benefits such as strength, durability, low waste generation, and sustainability. These rubber gloves are thicker than disposable gloves and offer greater tear resistance. They also provide better hand safety.

Due to the closures of many factories due to the COVID-19 epidemic, durable rubber gloves are expected to see a slowdown in demand. However, the markets are expected to grow as governments take the necessary steps to reopen manufacturing facilities and improve the economic situation.

Type analysis

and was responsible for 70.9% of the total revenue in 2019. This segment is forecast to grow at a 15.8% CAGR over the forecasted time. The rubber gloves are chlorinated, making them less form-fitting and avoiding the need for powder. Due to their popularity in many industries, such as chemical, food processing, and medical, the demand for these rubber gloves will increase over the forecast period.

Powdered rubber gloves are expected to see a rise in demand over the forecasted time. The powder makes it easier to don and remove gloves, and also allows for a better grip. There are two main types of powders, calcium carbonate, and cornstarch. To prevent skin allergies, various health agencies have placed restrictions on the use of powders in rubber gloves.

The growth of powder-free gloves is expected to be high, especially if the user has wet hands. They are double chlorinated and are easy to put on. Their high price is due to extra chlorination. Manufacturers are currently working to lower their prices.

As powdered rubber gloves are not allowed by many agencies, such as the U.S. Food Drug Administration, their demand is likely to slow. Their low cost and availability make them a popular choice for everyday use in the local community, as well as in laboratory experiments at colleges and schools.

Distribution Channel analysis

With a revenue share of 69.1%, the physical distribution channel segment was the dominant market. This segment is expected to grow at 10.0% in the future, due to its ease of supply chain management. Gloves are made and distributed by wholesalers to end consumers. This allows consumers to purchase gloves whenever and wherever they like.

Due to rapid advancements in the eCommerce industry, the online distribution channel segment will grow quickly over the forecast period. Delivery times may be longer in certain cases due to the distance or inaccessibility of the delivery address.

Particularly in remote areas, the physical distribution channel is more prominent than online channels due to their high delivery costs and inability to deliver. The adoption of online channels has increased dramatically due to the worldwide COVID-19 pandemic. This is because many governments have imposed tight lockdowns and consumers are reserving their right to stay indoors.

Online channel companies have made huge investments in the COVID era to expand their supply chain reach, cater to long-distance customers, keep delivery costs low and satisfy consumers. They also achieved economies of scale. To gain an advantage over their competitors, they offer numerous deals based on cart value.

End-Use analysis

Market leaders in 2019, the medical and healthcare market, accounted for 69.8% of the total revenue. This is due to the widespread use of gloves by doctors and patients to prevent cross-contamination and transmission during medical tests and surgeries. The global spread of the COVID-19 pandemic will likely increase healthcare workers’ demand for exam gloves for testing and examination purposes.

From 2020 to 2027, the demand for rubber gloves in automobiles will increase by 7.9%. The automotive industry is prone to many hazards at work, including sharp edges and harmful chemicals. Rubber gloves are chemical resistant and can be used to prevent accidents from grease, oil, or gasoline.

Request a free sample to learn more about the report.

The oil and gas industry uses rubber gloves a lot. Because workers are often exposed to heavy-duty equipment like pipes and chains, there’s a chance of chemical irritation, crush, cut, puncture, and puncture. These gloves provide excellent grip and allow the user to use many tools and machinery with high safety standards.Rubber gloves are expected to see a 9.0% increase in demand. They provide an additional level of hygiene for various processes, such as the preparation, handling, and washing of meats, seafood, vegetables, desserts, and beverages. These rubber gloves also protect against food-borne diseases.

Кеу Маrkеt Ѕеgmеntѕ

By Material

- Natural Rubber/Latex

- Nitrile

- Neoprene

- Other Material Types

By Product

- Disposable

- Durable

By Type

- Powdered

- Powder Free

By Distribution Channel

- Online

- Physical

By End-Use

- Medical & Healthcare

Automotive

Oil & Gas

Food & Beverages

Other End-Uses

Market Dynamics:

In light of the COVID-19 pandemic, many governments around the world are investing large in the supply of personal protective equipment (PPE) such as gowns, masks, and face shields. Major market players have begun to collaborate with hospitals, medical facilities, NGOs, and other organizations in order to supply PPE equipment directly. This allows them to compete against each other.

The United States, one of North America’s most prominent countries, places a lot of emphasis on the safety of workers in the automotive, oil and natural gas, and chemical industries.

According to the United States Bureau of Labor Statistics 2018, 23.0% of all industrial injuries are caused by the lack of safety rubber gloves. Due to strict safety regulations, companies are becoming more aware of workplace safety, which is expected to boost the market.

People are increasingly concerned about hygiene and want to prevent the spread of infection, viruses, es, and bacteria through poor handling of food products in restaurants, food and drink industries, and bakeries. Companies are now urging workers to use proper protective equipment to keep food products safe from infection. These factors will drive rubber glove demand.

Due to strict regulations regarding employee safety, rubber gloves are becoming more popular in heavy-duty industries like construction, chemicals, and automotive. These rubber gloves also offer superior grip and easy operation, which are not possible with bare hands.

Rubber gloves are being more widely used around the world as a result of the high prevalence of healthcare-associated infections (HAIs), also known as hospital infections, which people contract during hospital visits, even for routine procedures.

According to the WHO data, the number of HAI cases is increasing every year. Governments have enhanced the provision of rubber gloves in hospitals to all patients in order to minimize this rate.

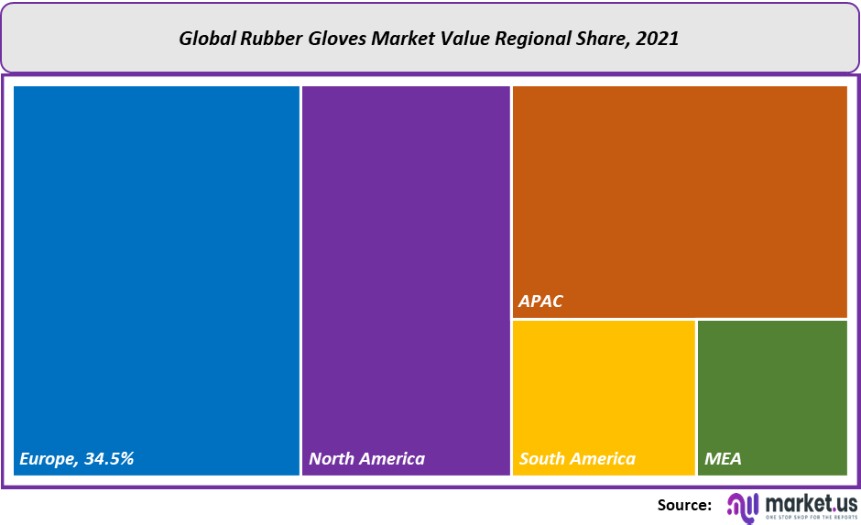

Regional Analysis

Europe dominated the market, accounting for 34.5% of the total revenue in 2019. Due to the need for protective gloves in many industries, including food and drink, metal manufacturing, oil & gas, automotive, chemicals, and other sectors, there is a rising demand for rubber gloves. The rapid spread of the COVID-19 pandemic, which has ravaged countries like Germany and Italy, has also led to high demand for rubber gloves within the medical industry.

North American healthcare spending has grown due to a growing awareness of the importance of protecting against communicable and infectious diseases. The market will be driven by high hygiene spending in the food- and beverage sector over the forecasted time.

In the Asia Pacific, the demand for rubber gloves is expected to rise rapidly. This is due to the fact that governments in various countries, including India, South Korea, and Thailand, are spending large amounts to develop the medical industry, as well as to promote international medical tourism.

Many governments in major countries like China, India, Brazil, Germany, Brazil, and Italy have invested heavily to develop a supply chain for medical supplies, such as gloves, masks, and sanitizers.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

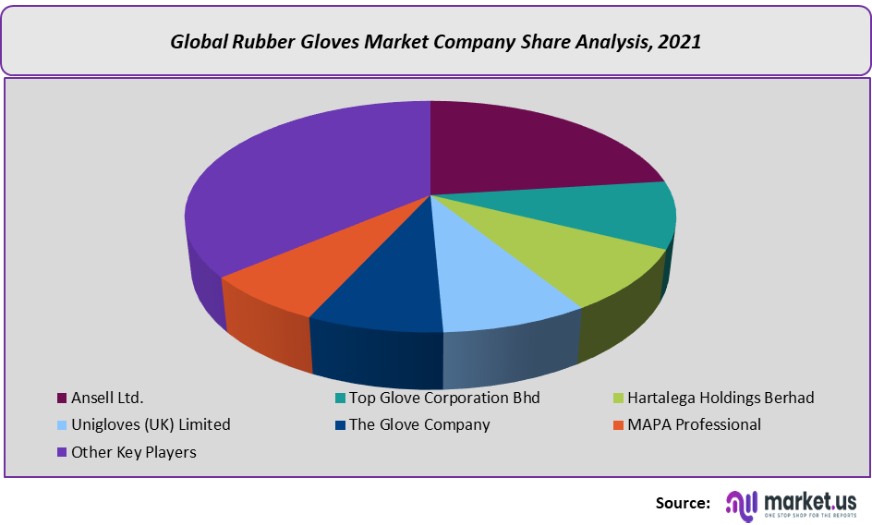

Due to a large number of local and multinational market players, the market is highly competitive. Market participants use supply chain development to increase their product offerings and reach a wider audience, strengthening their market competitiveness.

Market participants have formed strategic partnerships with other value chain players to increase their geographic portfolio and achieve economies of scale in the COVID-19 era. Market players also consider expanding their distribution networks as one of the most important strategies.

Маrkеt Kеу Рlауеrѕ:

- Ansell Ltd.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Unigloves (UK) Limited

- The Glove Company

- MAPA Professional

- Other Key Players

For the Rubber Gloves Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Rubber Gloves market size in 2021?A: The Rubber Gloves market size is projected to generate revenues of approx. US$ 7,352 million (2023-2032).

Q: What is the CAGR for the Rubber Gloves market?A: The Rubber Gloves market is expected to grow at a CAGR of 14.1% during 2023-2032.

Q: What are the segments covered in the Rubber Gloves market report?A: Market.US has segmented the Rubber Gloves market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material, market has been segmented into Natural Rubber/Latex, Nitrile, Neoprene, and Other Material Types. By Type, the market has been further divided into Powdered, Powder Free.

Q: Who are the key players in the Rubber Gloves market?A: Ansell Ltd. Top Glove Corporation Bhd Hartalega Holdings Berhad Unigloves (UK) Limited The Glove Company MAPA Professional, and Other Key Players

Q: Which region is more attractive for vendors in the Rubber Gloves market?A: Europe is expected to account for the highest revenue share of 34.5% among the other regions. Therefore, the Rubber Gloves market in Europe is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Rubber Gloves?A: Key markets for Rubber Gloves are South Korea, Germany, and the US.

Q: Which segment has the largest share in the Rubber Gloves market?A: With respect to the rubber gloves industry, vendors can expect to leverage greater prospective business opportunities through the powder free rubber gloves segment, as this area of interest accounts for the largest market share.

![Rubber Gloves Market Rubber Gloves Market]()

- Ansell Ltd. Company Profile

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Unigloves (UK) Limited

- The Glove Company

- MAPA Professional

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |