Global Service Procurement Market By Component (Transaction Management, Strategic Sourcing, Process Management, Spend Management, Contract Management, and Category Management), By Enterprise Size (SMEs and Large Enterprises), By Vertical (BFSI, Retail, Manufacturing, Healthcare, IT & Telecom, and Other Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Aug 2022

- Report ID: 35173

- Number of Pages: 290

- Format:

- keyboard_arrow_up

Service Procurement Market Overview:

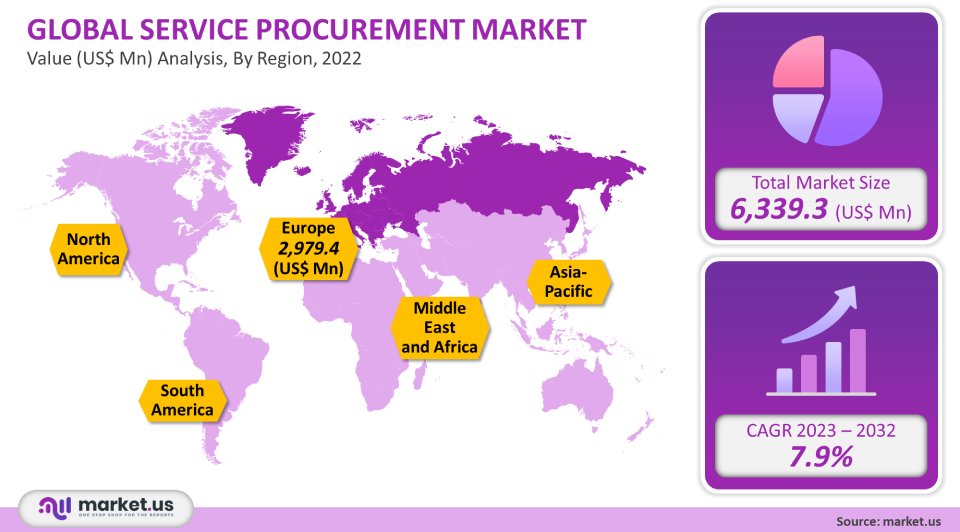

The global service procurement market value was USD 6,339.3 million in 2021. This market is projected to grow at a 7.9% CAGR, between 2023-2032.

As the world begins to recover from the COVID-19 pandemic there is increasing demand for digital, collaborative, agile, and plug-and-play services. This helps reduce supply risk and ultimately streamline capital and cash flows. The COVID-19-induced uncertainties are expected to digitally transform procurement services. This will lead to market growth over the forecast period.

Global Service Procurement Market Analysis:

Component Analysis

With a market share of more than 35%, strategic sourcing dominated the market in 2021. Companies can now choose better sourcing strategies because of the growing number of issues, such as the natural catastrophes, COVID-19 pandemic, and political unrest, that have a long-lasting effect on their businesses. Companies can also achieve efficiency and high-performance goals through strategic sourcing by conducting a deep analysis of their suppliers and internal processes. Therefore, strategic sourcing can help organizations save money and ensure that their sourcing strategies are effectively executed.

The segment of transaction management will see significant growth during the forecast period. Transaction management is an essential component that allows end-users to increase business profitability and build long-term relationships with suppliers. This segment is expected to grow due to increased focus by organizations on optimizing price, purchase order, and delivery in the overall transaction process. Market growth is further expected to be driven by increasing automation and the growing need for market vendors that can help understand complex commercial transaction dynamics within enterprises.

Organizational Analysis

A high market share was held by large enterprises in 2021. Large companies that plan to manage complex procurement deals and bag deals will continue investing in these services. They will remain the largest segment. These services are popular among large companies because they allow for a reduction in operational costs while removing business complexities.

The Small and Medium Enterprises (SMEs), segment, is expected to experience a substantial growth rate during the forecast period. Medium and small-scale businesses are shifting their attention from general operations management to specific business processes management to make fast decisions. The global market is witnessing a growing demand for procurement services by the SME industry. The forecast period will also see an increase in the demand for improved internal procurement processes within organizations to standardize and streamline the entire procurement process.

Vertical Analysis

The manufacturing vertical segment held a significant market share in 2021. The growth of this sector was greatly influenced by the management of supply chains that have shorter lead times. The largest market driver until 2032 will remain to manufacture. The manufacturing sector’s services are focused on improving the supply-chain dynamics of direct inputs.

The retail sector held a good share of the market in 2021. It is predicted to experience a significant growth rate over this period. The retail sector is customer-oriented and is characterized by changing customer needs and spending habits. These services can be used to align multiple operations and maximize returns on investments in the retail environment. With the integration of more advanced technologies like AI as well as Machine Learning, procurement service offerings will offer many additional features to the end-user. This will open up new avenues for growth.

Key Market Segments:

By Component

- Transaction Management

- Strategic Sourcing

- Process Management

- Spend Management

- Contract Management

- Category Management

By Enterprise Size

- SMEs

- Large Enterprises

By Vertical

- BFSI

- Retail

- Manufacturing

- Healthcare

- IT & Telecom

- Other Verticals

Market Dynamics:

Although the pandemic had a negative impact on demand for 2020, when businesses closed down their manufacturing operations due to lockdown restrictions and firms cut costs, there has been a decent recovery in 2021. Outsourced procurement services that are proficient in managing the procurement process in both businesses and enterprises are known as service procurement. As organizations increasingly rely on digitalization for their procurement functions, and businesses track payments and purchases, procurement as a service will be a prominent part of the global marketplace in 2021. Post-COVID-19, the advent of digitalization to rapidly automate business processes like procurement and souring is increasing in popularity. Market growth is predicted to be a result. The integration of technology in procurement functions allows for supplier management, strategic sourcing, and other business processes to be more efficient and proactive. This will allow businesses to lower costs and increase their profitability. It is important to use the latest technology to help enterprises predict the future in order to provide procurement services.

The forecast period will see a steady increase in market demand. Supply chains all over the globe are focused on streamlining and modernizing their processes to increase productivity and efficiency in business operations. This will lead to a rise in demand for digital procuring services. With the advent of new technologies, there is a greater need to improve procurement functions within organizations. This will help boost the market growth in the long term. In the wake of the current pandemic, many traditional procurement models were not viable.

The importance of global service procurement providers has changed from managing negotiation contracts to exclusive business partners and strategic agreements to ensure long-term business continuity. In the same way, awareness of service procurement has increased dramatically among enterprises over the last few years. The market growth is being facilitated by the unique selling point of custom services.

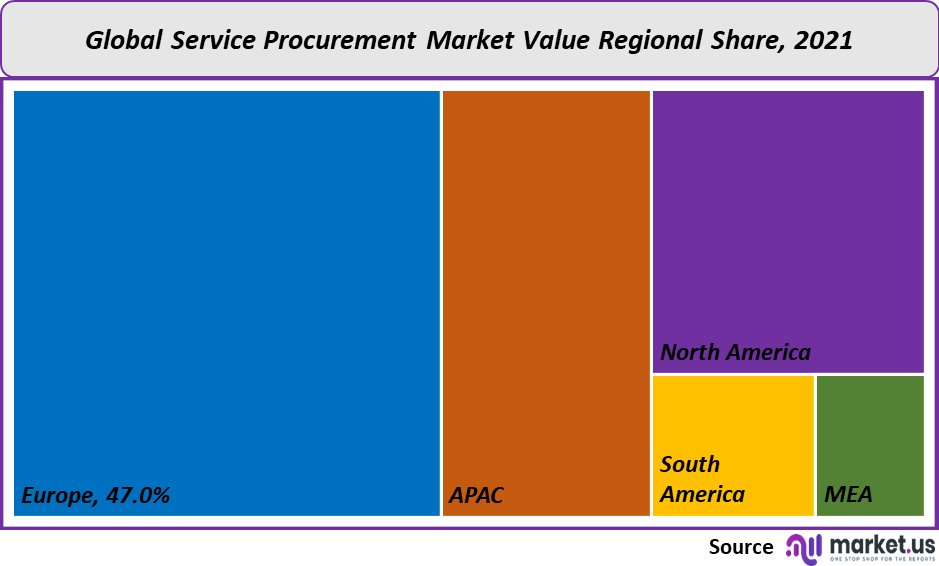

Regional Analysis:

Europe was the largest market in the world in 2021, accounting for 47% of global revenue. The European market is mature with modest growth. The key drivers of regional market growth include the increased focus on procurement service providers offering tailored service plans to their clients and the growing demand from European manufacturing firms for enhancing the procurement process. Market growth can also be attributed to the rising demand for modernized tools that enable organizations to make data-driven decisions about managing their procurement operations.

Asia Pacific will grow at the fastest CAGR from 2023-2032 due to an increase in demand for digital tools to streamline and manage supply chain operations. This region is seeing a rise in internet use for direct and indirectly procuring services. There is a growing demand for new supply sources in countries such as India and China where supply markets can be very tight. Over the forecast period, the demand to procure as a service will increase significantly to manage the new sources.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

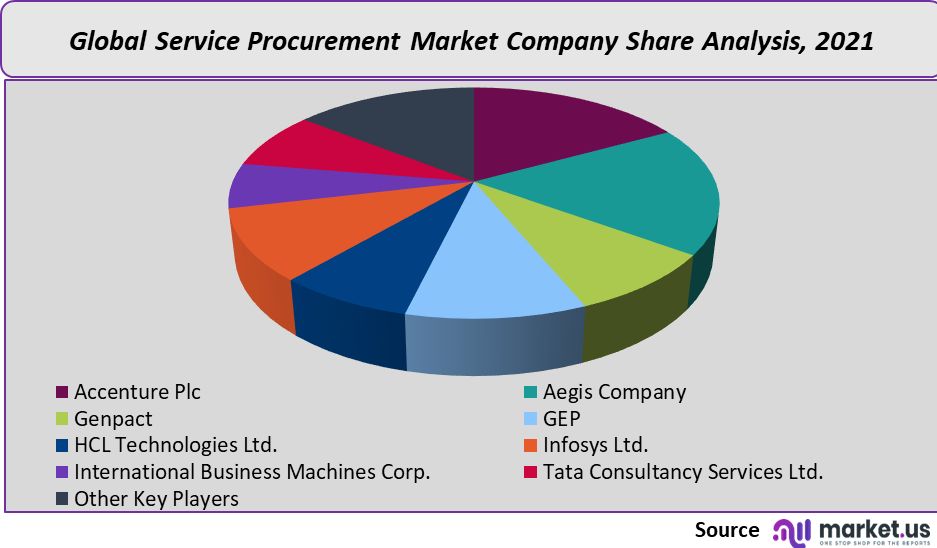

For most vendors in this industry, providing customized and industry-specific solutions is a long-term strategy. Mergers & acquisitions will be a key growth strategy in order to capitalize on regional expertise and knowledge, while also gaining market share. M&A strategies focus on strengthening the company’s capability in providing supply chain transformation for businesses. Companies also work with suppliers to address cross-functional business issues and simplify compliance requirements.

Маrkеt Кеу Рlауеrѕ:

- Accenture Plc

- Aegis Company

- Genpact

- GEP

- HCL Technologies Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- Tata Consultancy Services Ltd.

- Other Key Players

For the Service Procurement Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Service Procurement market in 2021?The Service Procurement market size is US$ 6,339.3 million in 2021.

Q: What is the projected CAGR at which the Service Procurement market is expected to grow at?The Service Procurement market is expected to grow at a CAGR of 7.9% (2023-2032).

Q: List the segments encompassed in this report on the Service Procurement market?Market.US has segmented the Service Procurement market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been segmented into Transaction Management, Strategic Sourcing, Process Management, Spend Management, Contract Management, and Category Management. By Enterprise Size, the market has been further divided into SMEs and Large Enterprises. By Verticals, the market has been further divided into BFSI, Retail, Manufacturing, Healthcare, IT & Telecom, and Other Verticals.

Q: List the key industry players of the Service Procurement market?Accenture Plc, Aegis Company, Genpact, GEP, HCL Technologies Ltd., Infosys Ltd., International Business Machines Corp., Tata Consultancy Services Ltd., and Other Key Players are engaged in the Service Procurement market

Q: Which region is more appealing for vendors employed in the Service Procurement market?Europe is expected to account for the highest revenue share of 47%. Therefore, the Service Procurement industry in Europe is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Service Procurement?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Service Procurement Market.

Q: Which segment accounts for the greatest market share in the Service Procurement industry?With respect to the Service Procurement industry, vendors can expect to leverage greater prospective business opportunities through the strategic sourcing segment, as this area of interest accounts for the largest market share.

![Service Procurement Market Service Procurement Market]()

- Accenture plc Company Profile

- Aegis Company

- Genpact Ltd. Company Profile

- GEP

- HCL Technologies Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- Tata Consultancy Services Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |