Global Sickle-Cell Disease Treatment Market By Treatment (Pharmacotherapy, Blood Transfusion, and Bone Marrow Transplant), By End-User (Hospitals, Specialty Clinics, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jun 2022

- Report ID: 44935

- Number of Pages: 331

- Format:

- keyboard_arrow_up

Sickle Cell Disease Treatment Market Overview:

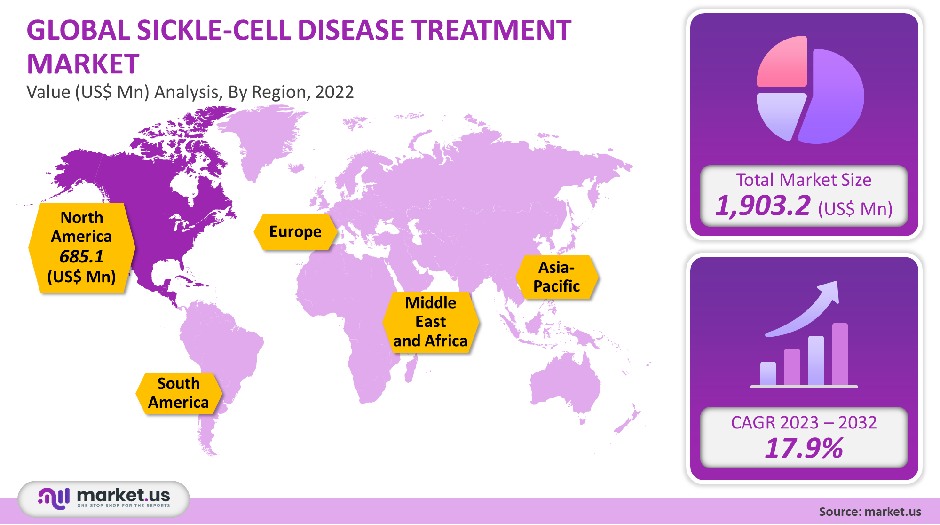

The global market for Sickle-Cell Disease (SCD) Treatment was worth USD 1,903.2 million in 2021 and is forecast to experience a 17.9% CAGR during 2023-2032.

Sickle cell disease is a blood disorder that is inherited by hereditary, that causes rigid, abnormal, sickle-shaped blood cells (RBCs). It is caused by mutations within the beta-globin genes. The severity of the condition varies from person to person.

Global Sickle-Cell Disease Treatment Market Analysis

Treatment Analysis

There are currently two options for sickle-cell disease treatment: palliative and symptomatic. SCD patients aged 16 and under can receive bone marrow donation. However, this is not a curative treatment. The risks of BMT in adults make it difficult for younger patients to have the procedure. Treatments include blood transfusions and medications to prevent or reduce complications.

Endari and Hydroxyurea remain the only approved drugs to treat SCD. A potential launch of promising candidates such as voxelotor (GBT 440), rivipansel, crizanlizumab, and Altemia will support the rapid growth of pharmacotherapy in sickle-cell disease treatment.

With a market share of over 48%, blood transfusion was the dominant treatment for sickle cell diseases. However, pharmacotherapy is expected to be the leader of the market by 2032 due to its strong pipeline and numerous promising drug launches during the forecast period.

End-User Analysis

The hospital segment will dominate the market during the forecast period. A volatile organic compound is a major reason for hospital admissions. It accounts for approximately 250, 000 emergency room visits per year in the US. This will favor the expansion and development of the hospital segment over the forecast period.

The growth of specialty clinics is being driven by the growing number of clinics. There are also frequent outpatient visits because SCD is often associated with multiple manifestations. This is another reason this segment has grown. The rising number of drug-using patients is driving the growth of care at home. This is likely to increase the growth in the other segments.

Key Market Segments

By Treatment

- Pharmacotherapy

- Blood Transfusion

- Bone Marrow Transplant

By End-User

- Hospitals

- Specialty Clinics

- Other End-Users

Market Dynamics

There are many types of sickle cell anemia. These can be genotypic or phenotypic depending on the mutations in hemoglobin genes. About 300,000 children are born each year with the disease. People of Middle Eastern, African, or South Asian descent often have sickle cell disease.

Global market growth is expected to be driven by improved healthcare, increased immigration, and a large population of African-Americans. The current treatment of chronic SCD primarily involves hydroxyurea injections and blood transfusions. A majority of patients are allergic to hydroxyurea. Patients with no resistance to hydroxyurea offer limited benefits and carry long-term safety risks.

Patients who have received blood transfusions can be exposed to blood-borne infections, iron overload, fever, and allergic reactions. Around 25% of patients suffering from sickle cell disease are transfusion-dependent. BMT is the only curative treatment.

However, it’s only recommended for a very small proportion of patients. Hydroxyurea was FDA-approved as a treatment for SCD until 2017. It was known under the names Droxia and Hydrea. Endari by Emmaus Life Sciences was approved by the FDA for the treatment of severe complications in SCD. It is available for both pediatric and adult patients. Endari was the FDA’s second approved drug.

The favorable government policies, increasing awareness of hematological cancers, increased investment, and improved healthcare infrastructure are expected to drive lucrative growth in emerging markets such as Nigeria and South Africa.

Regional Analysis

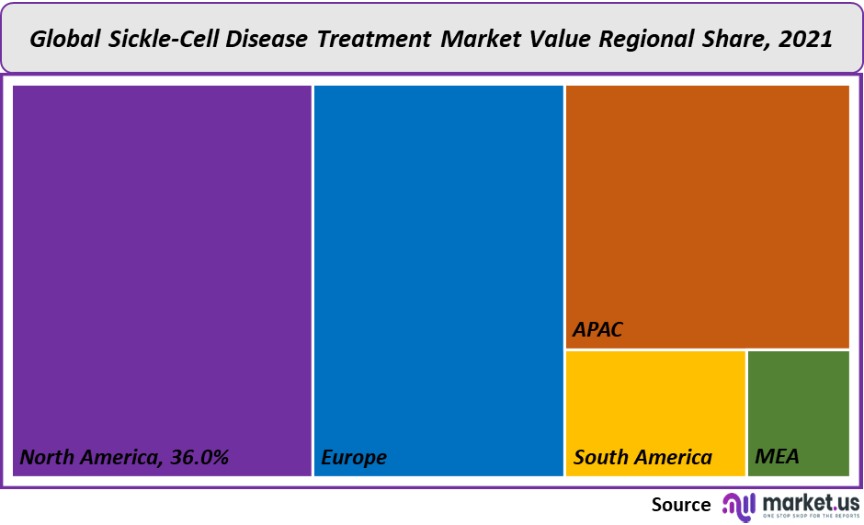

North America held a dominant position in the global sickle cell anemia treatment market, with a 36% share in 2021. France is followed closely by the U.K. France is expected to see a CAGR of almost 18% but the U.S. will continue to hold its lead position throughout the forecast period. This could be due to factors like the possible launch of pipeline drugs and increased adoption of novel therapeutics.

The European migrant crises, which led to an increase of immigrant people from Africa, South Asia, and Western Asia, are major factors driving the market in EU5 markets. The seven main markets will expand at a cumulative CAGR of more than 17%.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

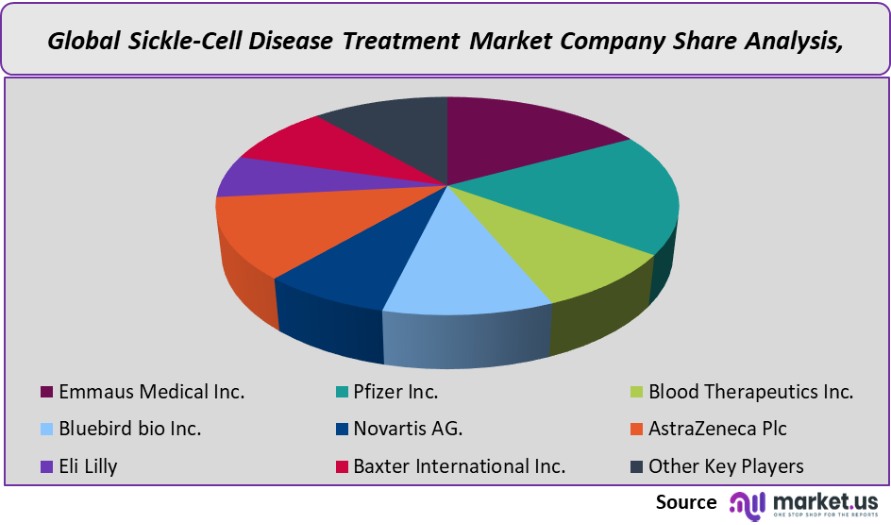

Emmaus Medical, Inc., Global Blood Therapeutics, Inc., bluebird bio, Inc., Pfizer, Inc., Novartis AG, and Novartis AG are just a few of the players that operate in the sickle cells anemia market. Endari’s strong sales are expected to propel Emmaus Medical into the top spot in 2023. Global Blood Therapeutics Sancilio has the potential to capture a significant market share once their pipeline candidates-voxelotors or Altemia are approved.

The promising results of late-stage pipeline drugs, such as Novartis’ crizanlizumab from Novartis and Pfizer’s Rivipansel from Pfizer, have also been demonstrated. Market growth is expected to be positive with the introduction of disruptive therapeutics, such as Modus Therapeutics’ Sevuparin and Prolong Pharmaceuticals’ Sanguine. In the near future, gene therapies will be introduced to the sickle-cell disease treatment market, such as Bluebird Bio’s Lentiglobin, Bellicum Pharmaceuticals BPX 501, and Gamida Cells’ Cordin.

Маrkеt Кеу Рlауеrѕ:

- Emmaus Medical Inc.

- Pfizer Inc.

- Blood Therapeutics Inc.

- Bluebird bio Inc.

- Novartis AG.

- AstraZeneca Plc

- Eli Lilly

- Baxter International Inc.

- Other Key Players

For the Sickle Cell Disease Treatment Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Sickle-Cell Disease Treatment market in 2021?The Sickle-Cell Disease Treatment market size is US$ 1,903.2 million in 2021.

What is the projected CAGR at which the Sickle-Cell Disease Treatment market is expected to grow at?The Sickle-Cell Disease Treatment market is expected to grow at a CAGR of 17.9% (2023-2032).

List the segments encompassed in this report on the Sickle-Cell Disease Treatment market?Market.US has segmented the Sickle-Cell Disease Treatment market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Treatment, the market has been segmented into Pharmacotherapy, Blood Transfusion, and Bone Marrow Transplant. By End-User, the market has been further divided into Hospitals, Specialty Clinics, and Other End-Users.

List the key industry players of the Sickle-Cell Disease Treatment market?Emmaus Medical Inc., Pfizer Inc., Blood Therapeutics Inc., Bluebird bio Inc., Novartis AG., AstraZeneca Plc, Eli Lilly, Baxter International Inc., and Other Key Players are engaged in the Sickle-Cell Disease Treatment market

Which region is more appealing for vendors employed in the Sickle-Cell Disease Treatment market?North America is expected to account for the highest revenue share of 36%. Therefore, the Sickle-Cell Disease Treatment industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Sickle-Cell Disease Treatment?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Sickle-Cell Disease Treatment Market.

Which segment accounts for the greatest market share in the Sickle-Cell Disease Treatment industry?With respect to the Sickle-Cell Disease Treatment industry, vendors can expect to leverage greater prospective business opportunities through the blood transfusion segment, as this area of interest accounts for the largest market share.

![Sickle Cell Disease Treatment Market Sickle Cell Disease Treatment Market]() Sickle Cell Disease Treatment MarketPublished date: Jun 2022add_shopping_cartBuy Now get_appDownload Sample

Sickle Cell Disease Treatment MarketPublished date: Jun 2022add_shopping_cartBuy Now get_appDownload Sample - Emmaus Medical Inc.

- Pfizer Inc Company Profile

- Blood Therapeutics Inc.

- Bluebird bio Inc.

- Novartis AG.

- AstraZeneca Plc Company Profile

- Eli Lilly

- Baxter International Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |