Global Single-use Bioprocessing Market By Product (Simple & Peripheral Elements, Apparatus & Plants, and Work Equipment), By Workflow (Upstream, Fermentation, and Downstream), By End-Use (Biopharmaceutical Manufacturer, and Academic & Clinical Research Institutes), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Mar 2022

- Report ID: 32532

- Number of Pages: 345

- Format:

- keyboard_arrow_up

Single-use Bioprocessing Market Overview:

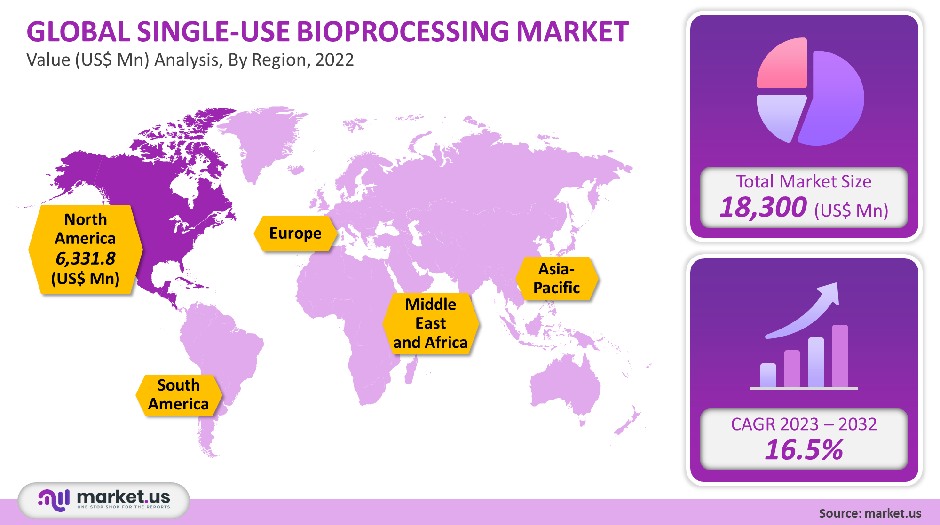

The global single-use market for bioprocessing was valued at USD 18,300 Million in 2021. This market is expected to grow at a CAGR of 16.5% from 2023-2032.

Single-Use Technology’s (SUT) advantages, such as a significant reduction in capital costs and facility construction times, have encouraged the widespread use of disposables within the bioprocessing industry. This has seen a double-digit rise in the single-use market for bioprocessing.

Global Single-Use Bioprocessing Market Scope:

Product Analysis

Simple and peripheral elements dominated single-use bioprocessing markets and held the largest revenue share at 48.51% in 2021. Regarding product availability, the most significant penetration of connectors and transfer systems, such as filters, tubing, and transfer systems, has significantly impacted this segment’s revenue generation. Bioprocess engineers are now replacing their fixed piping networks with single-use transfer lines because of the single-use system’s advancements.

Single-use bags increase manufacturing reproducibility through their strength, temperature resistance, and durability. The availability of disposable bioprocess bags for different applications in different sizes helps market players to tap untapped market opportunities and improve their market position.

However, disposable probes are in high demand within the biopharmaceutical market. This demand is evident in both the U.S.A and Europe. This segment is dominated by small, emerging players who offer single-use sensors to measure multiple attributes in bioprocessing.

Workflow Analysis

Industrial suppliers of SUSs have been focusing on developing advanced products to address the productivity challenges associated with increasing disposable bioprocesses. Upstream workflow dominated single-use bioprocessing in 2021 and was responsible for the largest revenue share at 55.4%. Single-use systems can be used upstream processes like media preparation, cell-culture seeds, and aseptic sampling.

SUT suppliers make rapid advancements to improve the use of disposables in downstream processes. This is evident in the rapid growth of the downstream processing segment, which has seen the introduction on the market of various disposable unit operations systems such as pre-packed column chromatography columns and filtration devices, pumps, heat exchangers, and pumps.

End-Use Analysis

The biopharmaceutical manufacturing segment dominated the market for single-use biologic processing, which accounted for the highest revenue share at more than 57.6% for 2021. The biopharmaceutical manufacturing sector has dramatically benefited from disposables’ rising popularity, a growing trend among contract manufacturers. Many bio manufacturers began investing in their manufacturing capabilities and installing disposable equipment to meet increasing customer demand.

Additionally, the COVID-19 Pandemic has driven the market for single-use bioprocessing. Market players are spending huge amounts to provide single-use products, such as single-use connected temperature sensor smarts, to meet current market needs. The future is promising for both academic and clinical research centers.

The market for single-use Bioprocessing will benefit from increased clinical research to discover the potential of biotherapeutics in various disease areas. This segment has also seen a rise in the number of institutes, such as the National Institute for Bioprocessing Research and Training, which offers training and expertise for the bioprocessing sector.

Key Market Segments:

By Product

- Simple & Peripheral Elements

- Bags

- Tubing, Filters, Connectors, & Transfer Systems

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensors

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Other sensors

- Others

- Apparatus & Plants

- Bioreactors, By Capacity

- Up to 1000L

- Above 1000L to 2000L

- Above 2000L

- Filtration system

- Mixing, Storage, & Filling Systems

- Chromatography Systems

- Pumps

- Other

- Bioreactors, By Capacity

- Work Equipment

By Workflow

- Upstream

- Fermentation

- Downstream

By End-Use

- Biopharmaceutical Manufacturer

- CMOs & CROs

- In-house Manufacturer

- Academic & Clinical Research Institutes

Market Dynamics:

In addition, despite the significant economic decline caused by the COVID-19 epidemic, the market saw significant growth. Many bio manufacturers and CMOs have moved their business to produce therapeutics for SARS-CoV-2. ABEC’s Custom Single Run technology (CSR) was selected by Serum Institute in September 2021 to allow large-scale single-use manufacturing of the Novavax vaccine. This vaccine is against COVID-19. Single-use systems (SUS) can be a cost-effective way to increase productivity and process efficiency for several end-users.

SUS equipment is used extensively in all phases of biomanufacturing, including pre-commercial biopharmaceutical production. This has provided opportunities for product suppliers. The introduction of automation has dramatically improved bio manufacturing efficiency.

A major driver of single-use bioprocessing is the growing number of vendors offering robust enough disposables to be used in the commercial manufacturing of biopharmaceuticals. In the near future, Big Data Analytics will be the dominant trend.

By allowing prediction and setting process parameters, the introduction of big data machines and learning-based analytical models is expected to increase product yields. CMOs has a higher adoption rate for disposables, owing to the simplicity and efficiency of SUTs when bioprocessing multiple products with fast turnaround times.

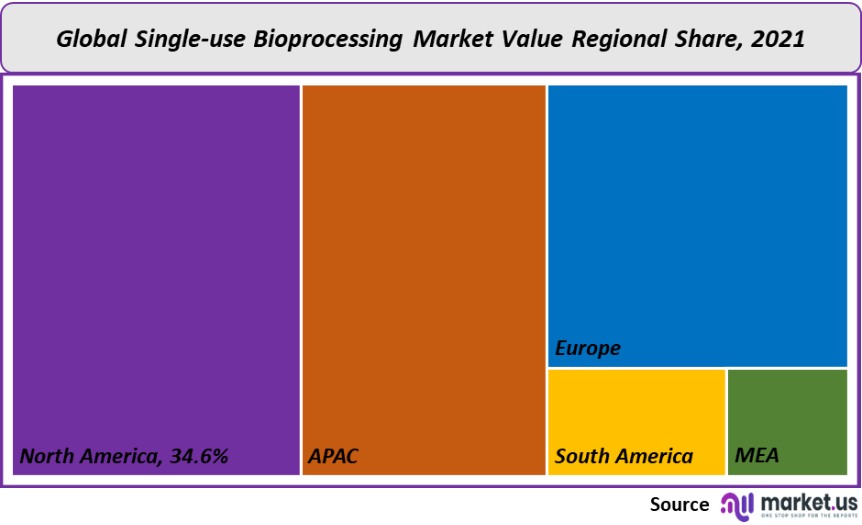

Regional Analysis

North America held a 34.6% share in the single-use bioprocessing industry in 2021. The region’s dominance is primarily due to its large-scale biopharmaceutical manufacturing capabilities in the U.S. and expanding biopharmaceutical R&D. Additionally, many contract manufacturing firms in North America are engaged in integrating disposables into their processes. This has resulted in increased investment in this market.

Fujifilm Diosynth spent USD 2 billion on its U.S. facility to create large cell cultures. This site will have eight 20,000-liter bioreactors. With its growing biopharmaceutical manufacturing sector, China has been a promising market for single-use technology in recent years.

Wuxi Biologics is a critical CDMO in China. The company started GMP-compliant operation at its China facility in February 2021. This facility has nine single-use bioreactors with a 4,000-liter capacity. This region is expected to record the fastest CAGR over the forecast period, with India and China leading the charge.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

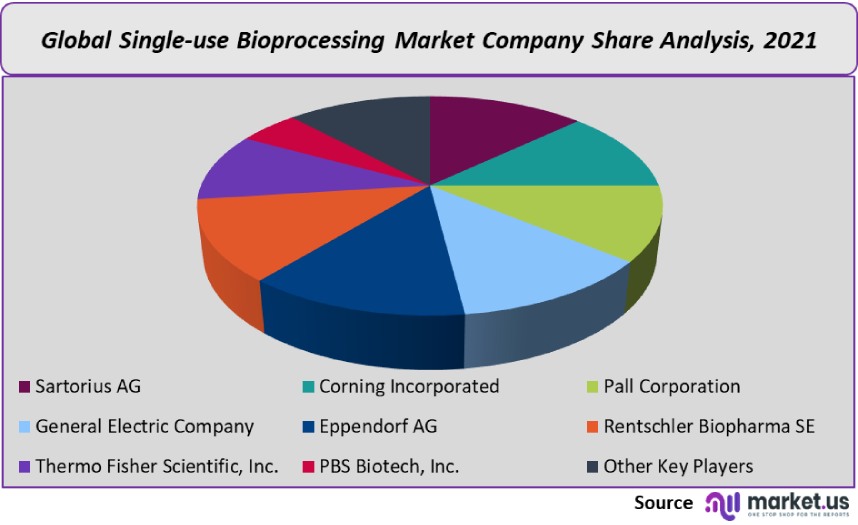

Sartorius AG, with its broad product portfolio and extensive customer base, is one of the leading players on the market. Danaher’s acquisition of GE Healthcare’s biopharma business has bolstered the company’s market position. Danaher Corporation bought GE Healthcare’s Biopharma unit for around USD 20 Billion in net cash. Captiva now owns the biopharma business.

OEMs are expanding their product lines to increase their revenue share in single-use bioprocessing. Thermo Fisher Scientific, for instance, introduced the HyPerforma Single-Use Bioreactor (SUB) in December 2020. This Product offers increased scalability, performance, and improved reliability. This Product can be used to support large-scale cell culture. These are some of the most prominent players in the single-use bioprocessing market.

Market Key Players:

- Sartorius AG

- Corning Incorporated

- Pall Corporation

- General Electric Company

- Eppendorf AG

- Rentschler Biopharma SE

- Thermo Fisher Scientific, Inc.

- PBS Biotech, Inc.

- Entegris, Inc.

- Danaher Corporation

- Kuhner AG

- Other Key Players

For the Single-use Bioprocessing Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the single-use bioprocessing market in 2021?The Single-use Bioprocessing market size is US$ 18,300 million in 2021.

What is the projected CAGR at which the single-use bioprocessing market is expected to grow at?The single-use bioprocessing market is expected to grow at a CAGR of 16.5% (2023-2032).

List the segments encompassed in this report on the single-use bioprocessing market?Market.US has segmented the Single-use Bioprocessing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been segmented into simple & peripheral elements, apparatus & plants, and work equipment; by workflow, demand has been segmented into upstream, fermentation, and downstream; by the end-use market has been segmented into biopharmaceutical manufacturer and academic & clinical research institutes.

List the key industry players of the single-use bioprocessing market?Sartorius AG, Corning Incorporated, Pall Corporation, General Electric Company, Eppendorf AG, Rentschler Biopharma SE, Thermo Fisher Scientific, Inc., PBS Biotech, Inc., Other Key Players are the key vendors in the single-use bioprocessing market.

Which region is more appealing for vendors employed in the single-use bioprocessing market?North America accounted for the highest revenue share of 34.6%. Therefore, the Single-use Bioprocessing industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the single-use bioprocessing market.The US, Mexico, Canada, China, Japan, Germany, France, UK, etc., are key areas of operation for the single-use bioprocessing market.

Which segment accounts for the greatest market share in the single-use bioprocessing industry?With respect to the single-use bioprocessing industry, vendors can expect to leverage greater prospective business opportunities through the simple and peripheral elements segment, as this area of interest accounts for the largest market share.

![Single-use Bioprocessing Market Single-use Bioprocessing Market]() Single-use Bioprocessing MarketPublished date: Mar 2022add_shopping_cartBuy Now get_appDownload Sample

Single-use Bioprocessing MarketPublished date: Mar 2022add_shopping_cartBuy Now get_appDownload Sample - Simple & Peripheral Elements

- Sartorius AG

- Corning Incorporated

- Pall Corporation

- General Electric Company

- Eppendorf AG

- Rentschler Biopharma SE

- Thermo Fisher Scientific, Inc.

- PBS Biotech, Inc.

- Entegris, Inc.

- Danaher Corporation Company Profile

- Kuhner AG

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |