Global Smart Card Market By Type (Contact Cards, Contactless Cards, and Others), By Application (Secure identity applications, and Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019-2028

- Published date: Nov 2021

- Report ID: 19653

- Number of Pages: 374

- Format:

- keyboard_arrow_up

Smart Card Market Overview

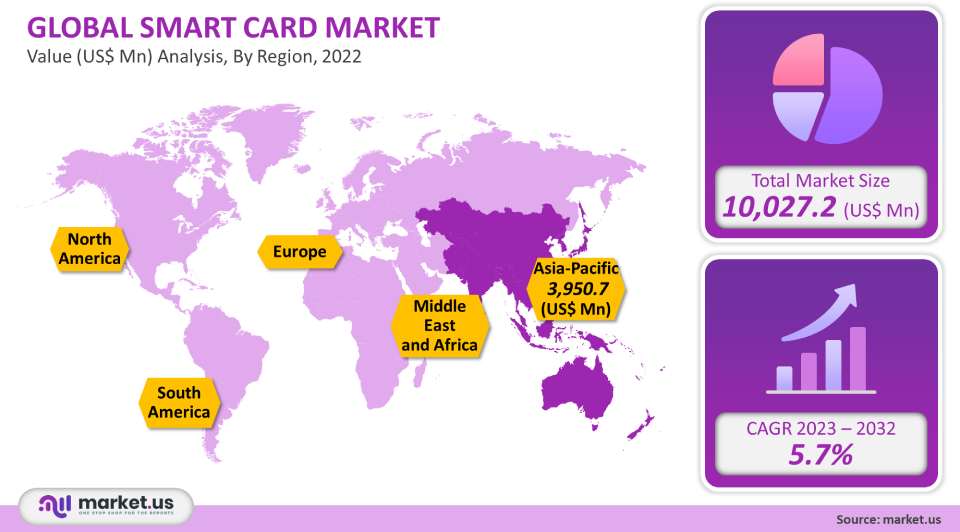

The worldwide smart card market size was valued at US$ 10.02 billion in 2021 and is expected to grow at a CAGR of 5.7% from 2023 to 2032. It is projected that developments in micro-embedded electronics and the increased adoption of the Internet of Things (IoT) will foster industrial growth. Organizations’ increased propensity to digitalize payment processes and store personal data effectively is accelerating industry growth. Smart cards, also known as Integrated Circuit Cards (ICC), are essential to achieving these goals. It’s a physical card that contains microcontrollers.

Global Smart Card Market Scope:

Type Analysis

The ‘Contact Type’ segment, accounted for the majority of this market’s revenue major share in 2021. The primary factors influencing this segment’s growth are the lower costs associated with contact-based cards. The ‘Multi-Component’ type is anticipated to register the fastest growth. Faster processing times and improved data security are among the benefits that have contributed to this increase. Consequently, it encourages users and payment service providers to include contact-type cards in their own apps.

Application analysis

In 2021, the BFSI segment accounted for the largest share of the smart card industry. The use of this product by banking sectors and financial institutions has a number of advantages, including safe data transfer and personal data protection.

Because of the growing popularity of smartphones, which encourage mobile transactions, the telecommunications industry is predicted to dominate the application segment of this market. Mobile ticketing, mobile banking, and SIM & data card use are all encouraged by the increasing usage of mobile devices. Global industry growth is being immensely influenced by these aforementioned communications applications.

Key Market Segments:

By Type

Contactless Cards

Contact Cards

Multi-Component Cards

By Application

BFSI

Telecommunication

Government

Healthcare

Retail

Hospitality

Other Applications

Market Dynamics:

Microcontrollers are physically present on the smart card. Smart card contact pads have inbuilt memory that contains safety encryptions. For the user, these cards typically have short-range communication that is tamper-resistant. These clever features are typically included with payment cards. These smart cards are crucial for transactions with high levels of security.

They can protect data, facilitate rapid secure transactions and guarantee secure payments. Additionally, a lot of legal documents, including e-documents and visas, have smart card features. Smart cards enable authentication, data storage, and application processing. The market for smart cards is indexing significant demand due to the need for consistently fewer payments. When using smart cards, access cannot be gained by outside parties without the cardholder’s consent.

Additionally, these chip cards have storage space for passwords, private keys, and account numbers. Smart cards can be used to access content from a distance thanks to satellites and chips connected to them. Both healthcare and telecoms have a significant demand for smart cards. In these areas, contactless payments are desperately needed.

Prior to the onset of this pandemic, there was a growing trend in consumer knowledge of the advantages of tap-and-pay cards and their use. However, the use of contactless payments swiftly expanded as a result of the outbreak and the propagation of COVID-19. People employ contactless payment methods during the pandemic to buy groceries, household goods, etc., which forces restricted contact and social distancing norms. The goal of consumers during transactions is to reduce their vulnerability. In May 2020, Fiserv Inc. (US) conducted research that found that users viewed contactless (tap-and-pay) cards as the quickest and safest method of payment.

A Harris Poll study done in May 2020 on behalf of Fiserv found that 42% of customers thought tap-and-pay credit cards were the most effective at halting the spread of the virus. Cash and checks were rated by consumers as being 6% and 4% less safe respectively, in terms of limiting the spread of COVID-19. The survey found that since 2019, more people now believe that tap-and-pay cards are the most secure, preferred, handy, and quickest mode of payment. Owing to the benefits they offer, smart cards have recently attracted a lot of interest from consumers. However, one of the things limiting the growth of the smart card market share is its price. Setting up smart cards for access control and other applications requires significant initial financial outlays. Smart cards need readers in order to decrypt encryptions and retrieve data in order to grant logical or physical access. These readers require extra purchases in order to be deployed. Smart card readers typically cost between US$50 and US$300. And smart cards are priced between US$2 and US$10.

A blockchain is a cutting-edge approach that gives businesses the ability to quickly develop safe apps that follow rigorous security guidelines. Blockchain applications can benefit from smart cards’ capacity to maintain cryptographic keys, which allows for speedy and safe transactions. They act as safes to store private keys. When smart cards are linked to the web through POS scanners, the keys stored on them can be compared to keys stored in online libraries. If the match is successful, users are successfully authenticated. This is projected to assist banks and other ecosystem operators in better safeguarding and certifying the identity of their users, thus minimizing the incidence of cyber thefts.

The electronic version of identity cards is a digital identity card. Digital identification cards, as opposed to paper-based identity cards, like passports and driving licenses, can be remotely authenticated digitally. Their access to banking services, government programs, educational institutions, etc., is thus made possible. Mobile phones are anticipated to act as digital identity cards to access workplace services and data in the next three to four years.

Growing economies can do away with conventional paper-based identification procedures thanks to the availability and affordability of the technology required for digital identity cards. Digital identity cards are becoming increasingly necessary as governments of many nations employ this technology to identify and meet the needs of their respective populations.

COVID-19 Impact Analysis

The COVID-19 pandemic has brought about a global economic disaster as it has had a significant impact on a number of sectors, including government, transportation, and education. Various shutdowns, a lack of labor or raw materials, and other related factors have hindered manufacturing units. As a result, there is now a massive imbalance between supply and demand. Foreign trades are also restricted as a result of closed international borders, inoperable distribution networks, and different laws requiring a government to take precautions for the health and safety of the general public. However, it is anticipated that there will be more attention paid to hygiene and sanitation as people’s concerns about living a better and safer lifestyle grow. A gradual rise in the demand from the BFSI and medical sectors is also anticipated to fuel this market.

Compared to other sectors, the smart card market growth for both the telecommunications and healthcare industries is less affected. The progression in market size may be observed due to the ever-expanding medical sector during the mid-to-long term. Providing effective medical care and maintaining patient privacy are becoming more difficult due to a surge in healthcare data. Smart cards offer safe data storage and straightforward data transfer solutions, thereby resolving both problems. Due to COVID-19, this market experienced a significant decline in 2020, but it still has a ton of potential because of vast production and assembly facilities, which may present opportunities for market participants once this market has recovered from the COVID-19 crisis.

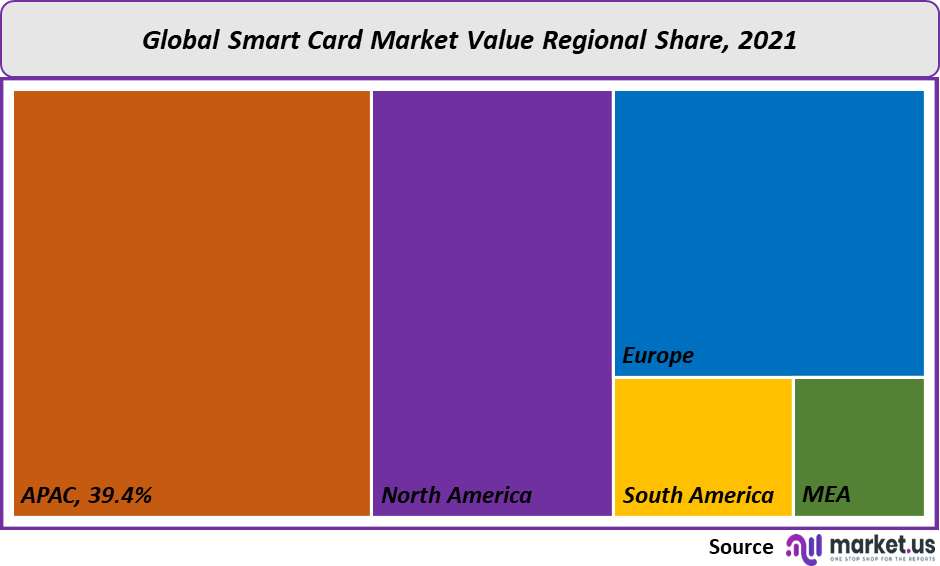

Regional Analysis

In 2021, the Asia Pacific region dominated the market as a whole and generated 39.4% of the total revenue. Due to increasing demand, particularly in the retail, government, BFSI, healthcare sectors, and transportation sectors, several APAC countries now employ smart card solutions. These nations are driven by strong financial systems that are progressively going digital and the incorporation of cutting-edge chip-based solutions by government organizations for better process monitoring. In a number of APAC nations, smart cards are used to buy tickets for transportation services like buses, ferries, and metros. The Asia Pacific is the largest market in the smart card market.

Due to its enormous consumer base and the existence of several smart card makers, China is anticipated to have the biggest demand for smart cards in the region. Smart cards, when used properly, have shown to be a highly effective deterrent to theft and fraud across all industries. The need for smart cards is fueled by government agencies’ initiatives like the Indian Aadhar card, which is used in a variety of industries. Security worries, particularly those that arise in the public realm, are also anticipated to contribute to this market’s expansion in the APAC. Due to the growing number of transactions made using smart debit and credit cards in nations like the UK and France, the demand for smart cards in the region has increased; Europe is predicted to develop at a significant rate as well. In the UK, consumers used smart debit cards to make about 15,000 million payments in 2018, up from 10,000 million in 2015, according to the UK Finance Organization report “UK Payment Markets Summary 2019.” Additionally, the presence of a sizable population segment with better incomes and spending on smart devices is projected to drive market expansion prospects in the region.

Key Regions and Countries Covered In this Report:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

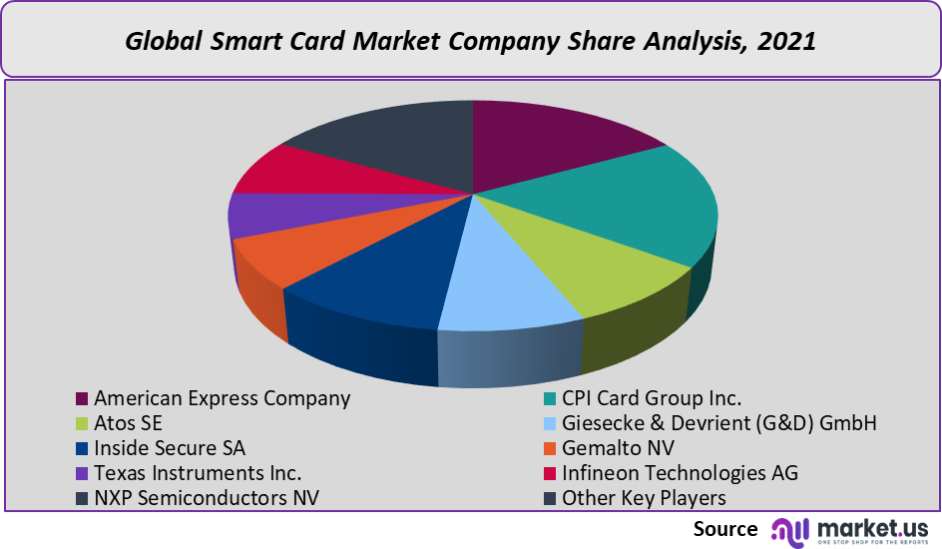

Market Share & Key Players Analysis:

The main focus of these industry companies is on implementing inorganic expansion methods by acquiring other ecosystem members. For customers in the hospitality and travel industries, Onyx CenterSource Company, a major participant with headquarters in the United States, introduced a new virtual smart credit card in September 2020. This essentially aids the business in tightly controlling or limiting use to increase security, first contact resolution, and decrease queries. There is an increase in the use of mobile phones and smart cards which are the major key factors in market growth.

In order to expand its offering of metal-based contactless prepaid payment cards, IDEMIA, a French company that specializes in augmented identities, purchased XCore Technologies in October 2019.

Leaders in this sector are concentrating on creating technologically cutting-edge solutions to meet/ cater to evolving consumer needs. For instance, Infineon Technologies AG announced a reference design for a cutting-edge biometric smart card architecture in July 2021 in collaboration with IDEX Biometrics ASA. The design makes use of Infineon’s SLC38BML800 security controller with GPIO interfaces and IDEX Biometrics’ TrustedBio solutions.

This makes it possible to verify fingerprints quickly, accurately, and efficiently. The development of smart cards and readers that enable quick identity authentication, access control, and payments is the main emphasis of market participants.

Key Market Players:

Prominent players dominating the market include

CPI Card Group Inc.

Atos SE

Giesecke & Devrient (G&D) GmbH

Inside Secure SA

Gemalto NV

Texas Instruments Inc.

Infineon Technologies AG

NXP Semiconductors NV

Other Key Players

For the Smart Card Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

10.02 Billion

Growth Rate

5.7%

Forecast Value in 2032

18.45 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the smart card market in 2021?The smart card market was valued at US$ 10.02 billion in 2021.

What is the projected CAGR at which the smart card market is expected to grow at?The smart card market is expected to grow at a CAGR of 5.7% (2023-2032).

List the segments encompassed in this report on the smart card market?Market.US has segmented the Smart Card market by Region (North America, Europe, APAC, South America, and the Middle East and Africa). By Type, this market has been segmented into Contactless cards, Contact Cards, and Multi-component cards. By Application, this market has been further divided into BFSI, Telecommunication, Government, Healthcare, Retail, Hospitality, and Others.

List the key industry players of the smart card market?American Express Company, CPI Card Group Inc., Atos SE, Giesecke & Devrient (G&D) GmbH, Inside Secure SA, Gemalto NV, Texas Instruments Inc., Infineon Technologies AG, NXP Semiconductors NV, and Other Key Players.

Which region is more appealing for vendors employed in the smart card market?APAC accounted for the highest revenue share of 39.4%. Therefore, the smart card industry in this region is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the smart cards?The US, Canada, the UK, Germany, Russia, India, Japan, China, Brazil, and Mexico are key areas of operation for the smart card market.

Which segment accounts for the highest market share in the smart card industry?With respect to the smart card industry, vendors can expect to leverage greater prospective business opportunities through the contact type segment, as this area of interest accounts for the majority of the market share.

![Smart Card Market Smart Card Market]()

- American Express Company

- CPI Card Group Inc.

- Atos SE

- Giesecke & Devrient (G&D) GmbH

- Inside Secure SA

- Gemalto NV

- Texas Instruments Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |