Global Smart Lock Market By Type (Deadbolt, Padlock, Lever Handles, and Others), By Application (Residential, Enterprise, Hospitality, Critical Infrastructure, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 29356

- Number of Pages: 268

- Format:

- keyboard_arrow_up

Smart Lock Market Overview:

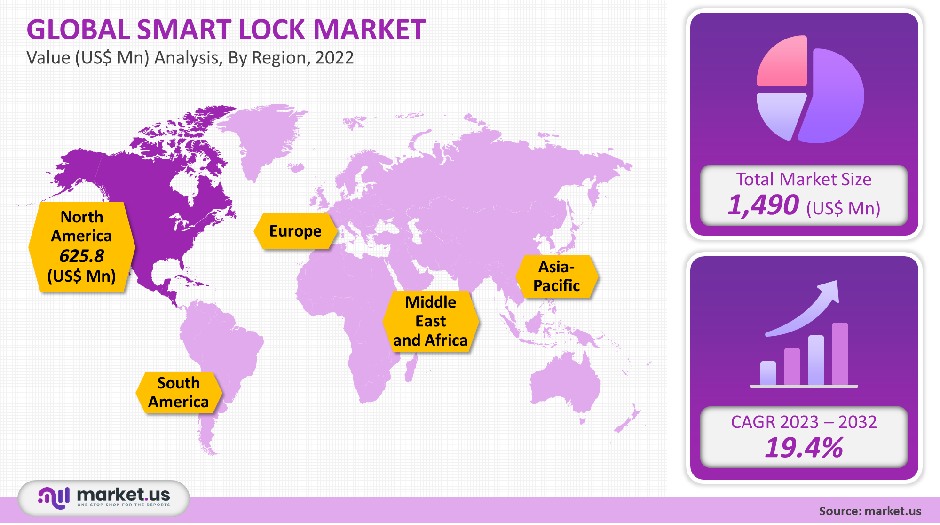

Global smart lock sales were valued at USD 1,490 million in 2021. From 2023 to 2032, it is expected to grow at a CAGR of 19.4%. The global demand for smart locks was 8.9 million units in 2021.

Global Smart Lock Market

Type Analysis

In 2021, deadbolts accounted for the largest revenue share at over 47% and will continue to dominate the industry in the future. This is due to the numerous benefits of deadbolts, including ease of use and durable locking mechanisms. Kwikset is one of the most prominent players in this market. They have added advanced deadbolts that include customizable user codes, low battery warning, and one-touch locking to their portfolio. This will allow them to attract a wide user base.

The significant growth in the construction industry will drive the fastest expected CAGR of 23.0% for lever handles during the forecast period. This segment will also benefit from modernization efforts in the hospitality industry to meet security requirements. Many smart lever handles are used in commercial interior doors.

The push-down handle is more convenient than the knob and requires less grasping and turning. It is expected that the padlock segment will grow at a substantial CAGR in the coming years. This is due to many benefits, including high-end security and user activity management. Smart padlocks are used more frequently while on the move to protect the luggage.

Application Analysis

In the 2021 smart locks market, the residential segment was dominant with over 65% of the revenue share. It is expected to continue its dominance for the next seven years. Its high revenue generation is mainly due to its growing global smart home penetration, as well as the increasing number of renovation and new projects in the sector over recent years.

These devices will also be more affordable due to the increased availability of security tools like motion detectors, door, and window opener sensors, and remote locking/unlocking. A large number of residential customers are interested in locks that can be used with Z-Wave and ZigBee technologies.

Hospitality is expected to expand at a CAGR of 25% or more between 2023 and 2032. Smart locks have been deployed aggressively in the hospitality industry to address guests’ increasing security concerns. This is expected to encourage the use of keyless access devices in the future.

Market leaders are offering innovative solutions to the hospitality industry. Hoomvip is an app-based service that allows you to access rental properties. In October 2018, Hoomvip installed ENTR smart doors by TESA to improve security and ease of access. This adoption also drives up the hotel’s brand values, which in turn drives their adoption throughout the sector.

Key Market Segments

Type

- Deadbolt

- Padlock

- Lever Handles

- Others

Application

- Residential

- Enterprise

- Hospitality

- Critical Infrastructure

- Others

Market Dynamics

The growth in Internet of Things penetration and the advent of technologies like Artificial Intelligence [AI] and Machine Learning(ML) are expected to increase the adoption of smart locks during the forecast period. The increasing awareness of smart locks by consumers, especially in the hospitality and residential sectors, is driving their increased adoption.

A significant increase in the use of smartphones in 2021 is approximately 10%, compared to 2020. Smartphones and mobile apps have become increasingly important tools for many tasks. Some of the most prominent market players include innovative techniques such as Bluetooth-based locking/unlocking or WiFi-enabled locking/unlocking using smartphones or other devices. For easier entry of passwords or patterns-based locking/unlocking, touch panels can also be used.

Smart locks are also being pushed by a growing number of companies offering innovative home automation technology. In order to offer commercially viable products, industry players concentrate on the development of advanced technologies, such as remote locking/unlocking doors, windows, and entrances. In addition, manufacturers are now integrating their products and allowing voice control of locks, as voice assistants are becoming more common in households. Customers will appreciate these innovations as they seek more convenient locking/unlocking options.

Smart locks are highly in demand globally. Due to the increase in construction activity in North America and the Asia Pacific, smart locks have seen tremendous growth in recent years. A lock is the most important element of a connected house when connected to a hub for smart homes. Customers expect products that meet their every need. They also consider key factors such as price, size, battery life, and design when choosing locks.

Our analysis of the COVID-19 industry impact shows that smart locks have gained considerable traction in these unusual times. The ongoing pandemic is likely to bring many opportunities to the market. Because the locking/unlocking processes can be done using voice recognition and smartphones/smart devices, there are fewer physical touches required.

These technologies enable manufacturers to meet client requests for touchless/contactless interfaces to operate their products, giving them a competitive advantage in these difficult times. The key strategies industry players expect to use to increase their customer base in the coming years are new product development and the incorporation of advanced/touchless techs.

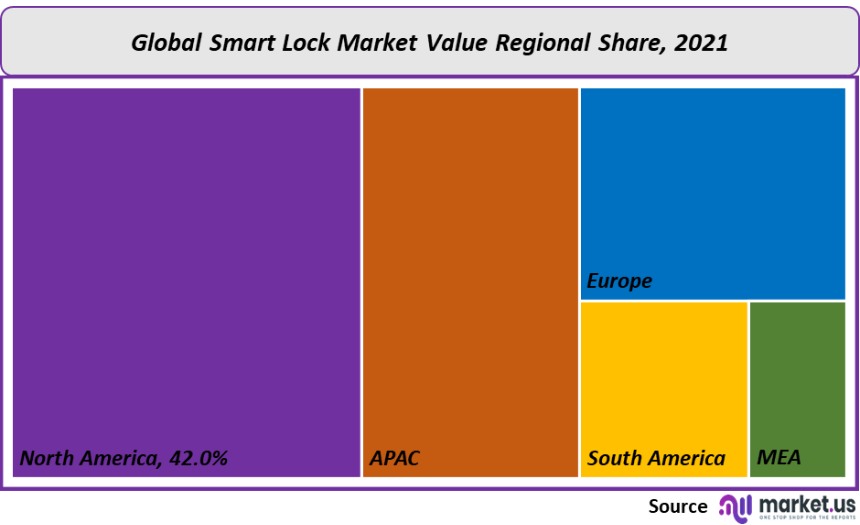

Regional Analysis

North America held the largest market share at 42% in 2021. This dominance is expected to continue over the forecast period. This is mainly due to the rapid adoption of technology and growing penetration of smart homes in the U.S. Their adoption has been made possible by the favorable regulatory framework.

The Asia Pacific is expected to be the fastest-growing region. It will show a CAGR of over 24% between 2023-2032. It can be attributed to the significant rise in the number and quality of commercial and residential projects.There are also ongoing smart city initiatives in India. The region’s smart home penetration has also seen significant growth. This is a key factor in increasing awareness of advanced gadgets. However, market growth is likely to be limited by the fact that Australian government norms require product modification and enhancement.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

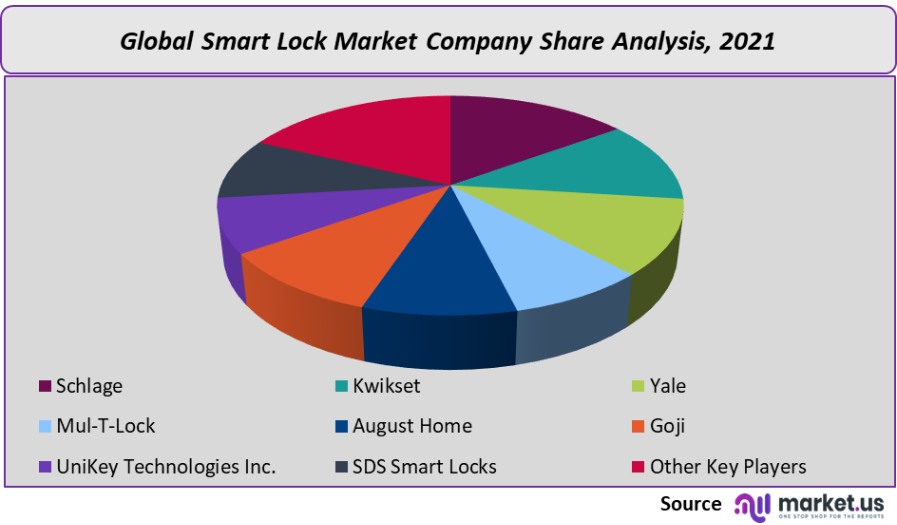

Market Share Analysis

In the past few years, the industry has seen rapid changes and is now moving toward consolidation. The top companies are always striving for a dominant market share. To differentiate themselves from competitors and increase market share, many companies have taken up partnerships, acquisitions, and R&D investments.

IoT application to develop touchless locks technologies has gained tremendous traction in the current pandemic. Many companies have begun offering solutions that are minimally human-contact. Kwikset introduced its expanded line of products in March 2020 with the Microban SilverShield tech, which helps prevent bacterial growth on door hardware. The company plans to grow its partnership and introduce keyless entry as well as advanced smart locks at the end of 2021.

Major Key Players

The following are some of the major players in the global smart locks market:

- Schlage

- Kwikset

- Yale

- Mul-T-Lock

- August Home

- Goji

- UniKey Technologies Inc.

- SDS Smart Locks

- Other Key Players

For the Smart Lock Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the smart lock market size in 2021?A: The smart lock market size is $ 1,490 million for 2021.

Q: What is the CAGR for the smart lock?A: The smart lock is expected to grow at a CAGR of 19.4% during 2023-2032.

Q: What are the segments covered in the smart lock report?A: Market.US has segmented the Global smart lock Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By type, market has been segmented into deadbolt, lever handles, padlock, and others. By application, market has been further divided into residential, hospitality, enterprise, critical infrastructure, and others.

Q: Who are the key players in the smart lock?A: Schlage, Kwikset, Yale, Mul-T-Lock, August Home, Goji, UniKey Technologies Inc., SDS Smart Locks, and Other Key Players are the key vendors in the Smart lock.

Q: Which region is more attractive for vendors in the smart lock?A: North America accounted for the highest market share of 42.0% among the other regions. Therefore, the smart lock in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for smart lock?A: U.S., Canada, Germany, and U.K. are key areas of operation for smart lock market.

Q: Which segment has the largest share in the smart lock?A: In the smart lock, vendors should focus on grabbing business opportunities from the deadbolts segment as it accounted for the largest market share in the base year.

![Smart Lock Market Smart Lock Market]()

- Schlage

- Kwikset

- Yale

- Mul-T-Lock

- August Home

- Goji

- UniKey Technologies Inc.

- SDS Smart Locks

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |