Global Softgel capsule Market by Product Type (Non-animal based and Gelatin /Animal based), By Application (Antacid & Anti-flatulent Preparations, Anti-inflammatory Drugs, and Others), by Manufacture (Pharmaceutical Companies, Nutraceutical Companies, and Other companies) and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032.

- Published date: Apr 2022

- Report ID: 29378

- Number of Pages: 304

- Format:

- keyboard_arrow_up

Softgel Capsule Market Overview:

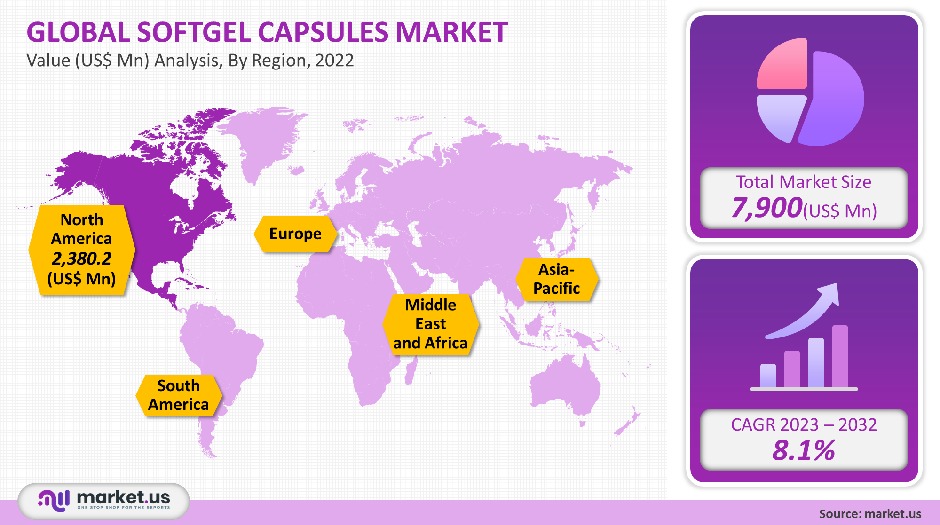

In 2021, the global soft gel capsule market was esteemed at USD 7,900 million. The market is expected to increase at an average annual rate (CAGR of 8.1%) between 2023-2032.

Softgel capsules have many advantages, including ease of swallowing, taste, and odor masking as well as increased bioavailability, atmospheric stability, improved absorption, and bioavailability. Modern manufacturing technology allows for more benefits to traditional capsules. These benefits include controlled drug release, tamper-evident, and the ability to articulate potent APIS. They also have attractive aesthetics and longer shelf life.

Global Softgel Capsules Market Scope:

Product type analysis

Gelatin has been the preferred excipient for manufacturers for over 80 years because of its unparalleled advantages over all other excipients. In 2021, the market was dominated by the gelatin-based/animal-based segment.

Gelatin’s wide acceptance on the market is because of its simple of digestion, patient compliance, superior mechanical resistance, tamper-evident capsule production, seal quality, abundant resources availability, and inert raw material.

Manufacturers are now using a mixture of porcine and bovine gelatin to create capsules. This is because of their classic features. Bovine gelatin increased capsule firmness while porcine gelatin added plasticity and clarity to the articulation. Non-animal capsules showed 8.2% CAGR despite the benefits of gelatin-based capsules. Market growth will be boosted by increased demand for vegan medication, especially after the COVID-19 pandemic.

Application analysis

The largest share, 27.3%, was attributed to the vitamins & dietary supplement segment. Vitamins can be affected by atmospheric oxidation and degrading when they are packaged as tablets or gummies. Softgel capsules are the best choice because they protect from UV radiation and oxidation, thus increasing their shelf life.

Research shows that vitamins taken in soft gel capsules are more easily absorbed into the bloodstream than those in tablet form. Softgel capsules are a popular form of vitamin, which has led to a large market share in this application segment. This segment saw the highest CAGR (8%) during the forecast period. The pandemic triggered a surge in Vitamin D and C sales in countries like India and USA.

Because of the increased acceptance of healthy lifestyles among the masses in order to combat the pandemic, health supplements occupied second place in the application segment. Pre- and post-natal soft gel capsules were well received, which led to an increase in sales, which aided in the growth of the pregnancy market.

Market share for antibacterial and antibacterial drugs, anti-flatulent and antacid preparations, anti-inflammatory drugs, and anti-emetic preparations has been descending.

Manufacture Analysis

In 2021, the nutraceutical sector accounted for 39.0% of the total market. Nutraceutical companies are primarily focused on the development of vitamins, minerals, health supplements, and other nutritional products. Softgel formulations are a major part of the development of nutraceutical products. These formulations make up nearly 32% of all nutraceutical manufacturers’ total revenue.

Its high market shares and growth has been because of its large market share and increasing awareness among developing countries about health supplements. Because of the increased collaboration with SMEs, outsourcing soft gel capsules, and the increase in sales, Pharma occupied the second largest market share.

This directly influenced the growth of the Contract Manufacturing Organization (CMO). Softgel capsule production has increased in the cosmeceutical sector because of the growing demand for hair and skin care products.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Non-animal based

- Gelatin /Animal-based

By Application

- Antacid & Anti-flatulent Preparations

- Anti-anemic Preparations

- Anti-inflammatory Drugs

- Antibiotic & Antibacterial Drugs

- Cough & Cold Preparations

- Health Supplement

- Vitamin & Dietary Supplement

- Pregnancy

By Manufacturer

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organization

Market Dynamics:

Softgel manufacturers have been concentrating on the development of non-gelatin-based capsules that use plant-based polymers in recent years. Starch, HPMC, and gums like Pullulan are all important ingredients. Vegetarians can take gelatin-free capsules for their medicinal needs.

Non-gelatin-based capsules offer technical benefits to both manufacturers and suppliers. Aenova and other companies have seen a double-digit increase in sales revenue because of the vegetable capsules they launched. Euro caps are working on a soft gel chewable capsule that has a better taste masking capability. Roquette and Catalent are also market leaders in vegan capsules, aiming to expand their reach among vegans.

Most companies started research to develop oral vaccinations after the COVID-19 pandemic. Catalent, the soft gel capsule leader, teamed up with a top clinical-stage immunotherapy firm to meet the urgent need for oral vaccines. Studies are also being done to see if vitamin D capsules can reduce the severity of mild or severe respiratory discomfort caused by SAR-Cov-2 viral infection. The impact of the pandemic on the pharmaceutical and nutraceutical industries was different.

This period saw an increase in the nutraceutical market because of increased vitamin, nutrition, and other supplement consumption. Nutraceuticals are in high demand because of product launches that use special capsule designs.

With a shift toward the elderly population, vitamin capsule demand has increased because of a healthier lifestyle. Because of the pandemic, there was a significant increase in market sales. The growth of the market is also because of the increased research into developing capsules for potent and crucial drug molecules, also the development of capsules to treat drugs that require multiple excipients such as oncology medicines. Patients prefer capsules to other oral dosage forms.

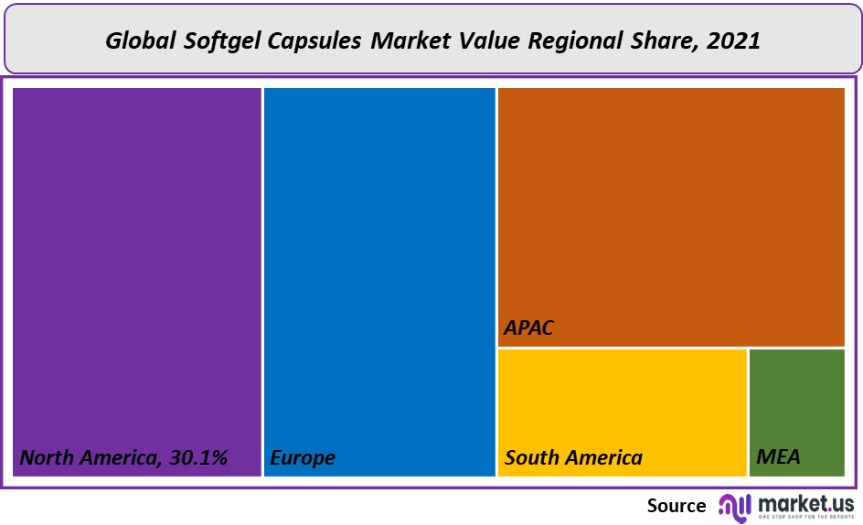

Regional Analysis

North America holds the largest market share, 30.13%, in Soft gels in 2021. The region has major players and improved production technology. They also have increased R&D spending to expand their product range. The largest market share is also because of the presence in the region of pharma leaders and health-conscious consumers.

APAC, however, is the fastest-growing market with a CAGR of 8.7%. Its high growth is because of the large presence of generic medicine producers in China and India, rising demand for cost-efficient therapies, rapidly growing economic conditions, and rise in contract manufacturing organizations within the region.

European market growth will be boosted by the increase in personalized medicine spending and the adoption of high-tech processing to produce soft gels more efficiently.

Key Regions and Countries covered in the Rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

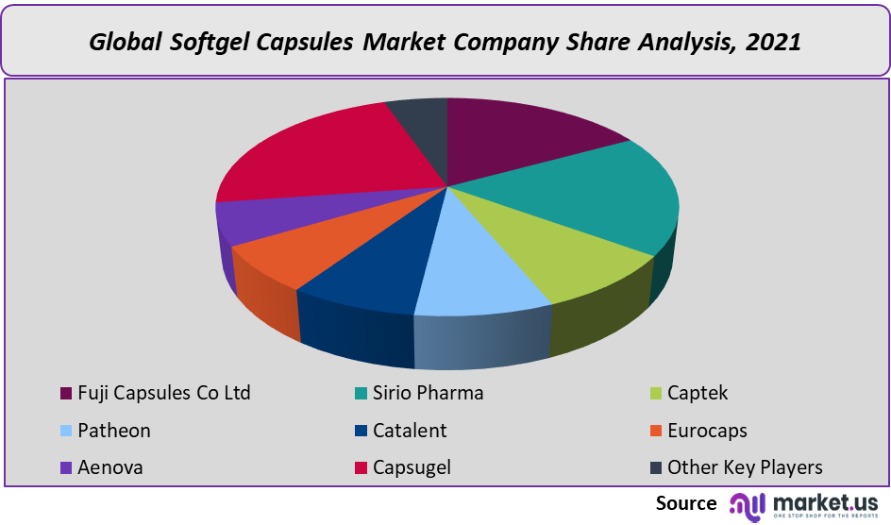

Market Share & Key Players Analysis:

Due to the existence of contract producers and SMEs around the world, the market is extremely fragmented. Large manufacturers are increasingly outsourcing soft gel capsules to reduce their equipment costs and ensure a fair price for the market. Market leaders conduct research to develop capsules, tablets in capsules, and controlled-release medication to protect their market position.

Market leaders are focused on strengthening their manufacturing capabilities to acquire a strong position. purchased an Oxfordshire facility to increase biologics capabilities within the U.K. Europe and the Middle

Кеу Маrkеt Рlауеrѕ:

- Fuji Capsules Co Ltd

- Patheon

- Aenova

- Sirio Pharma

- Catalent

- Capsugel

- Captek

- Eurocaps

- Other Key Players

For the Softgel Capsule Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Soft Gel Capsules market size in 2021?A: The Soft Gel Capsules market size was US$ 7,900 million in 2021.

Q: What is the CAGR for the Soft Gel capsule market?A: The Soft Gel capsule market is expected to grow at a CAGR of 8.1% during 2023-2032.

Q: What are the segments covered in the Soft Gel Capsules market report?A: Market.US has segmented the Soft Gel Capsules market by geographic (North America, Europe, APAC, South America, Middle East, and Africa). By Type, the market has been segmented into Non-animal based & Gelatin /Animal-based. By application market has been segmented into Antacid & Anti-flatulent Preparations, Anti-anemic Preparations, Anti-inflammatory Drugs, Antibiotic & Antibacterial Drugs, Cough & Cold Preparations, Health Supplement, Vitamin & Dietary Supplement, and Pregnancy. By manufacture, the market has been segmented into Pharmaceutical Companies, Nutraceutical Companies, Cosmeceutical Companies, and Contract Manufacturing Organizations

Q: Who are the key players in the Soft Gel capsule market?A: Fuji Capsules Co Ltd, Patheon, Aenova, Sirio Pharma, Catalent, Capsugel, Captek, Eurocaps, and Other Key Players

Q: Which region is more attractive for vendors in the Soft Gel Capsules market?A: The North America accounted for the largest market share, with 30.13%. Therefore, the Soft Gel Capsules market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Soft Gel Capsules?A: Key markets for Soft Gel Capsules Are The US, Canada & Mexico

Q: Which segment has the largest share in the Soft Gel Capsules market?A: Gelatin-based/ animal-based segment accounted for the largest share in the Soft Gel Capsules market

![Softgel Capsule Market Softgel Capsule Market]()

- Fuji Capsules Co Ltd

- Patheon

- Aenova

- Sirio Pharma

- Catalent

- Capsugel

- Captek

- Eurocaps

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |