Global Submarine Cables Market By Application (Submarine Power Cables and Submarine Communication Cables), By Voltage (Medium Voltage, High Voltage, and Extra High Voltage), By Component (Dry Plant Products and Wet Plant Products), and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032.

- Published date: Aug 2022

- Report ID: 35160

- Number of Pages: 360

- Format:

- keyboard_arrow_up

Submarine Cables Market Overview:

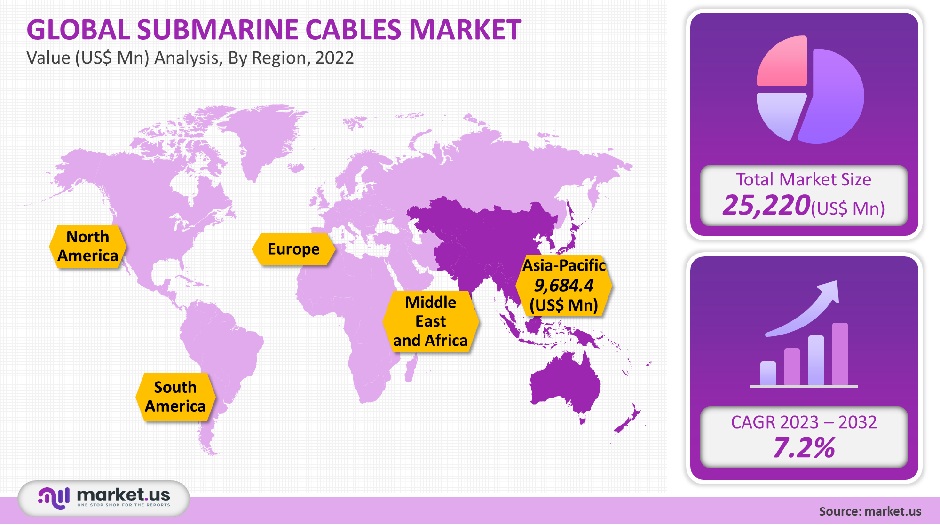

The market for submarine cables worldwide was valued at USD 25,220 million in 2021. It is expected to grow at a 7.2% CAGR, from 2023 to 2032.

The market is driven by increasing offshore wind farm investments, growing data traffic, and investments made by OTT providers to meet the needs. Submarine cables are used extensively for power and communications applications. They are used extensively for power transmission to oil rigs and power generation from offshore wind farms to power stations.

The demand for low-power cables is increasing due to the increased demand for interconnecting power grids in other countries. For inter-regional/country communication, submarine communication cables are used.

Global Submarine Cables Market Scope:

Application Analysis

In 2021, the submarine power cable segment was responsible for the highest revenue share at around 61.7%. The market for submarine power cables is being driven by increased demand for inter-country connections and expansions of offshore wind industry capacity. Moreover, increasing offshore wind farms, as well as the electrification of offshore oil-and-gas networks, has increased research and development, which in turn has led to a higher demand for submarine power cables.

Submarine communication cables accounted for a large share of the market and are expected to grow at a 6.8% compound annual growth rate between 2023 and 2032. The rapid growth of urbanization and economic activity has fueled growth in infrastructure and construction segments both in developing and advanced countries. There is a growing demand from different sectors, including the power, telecom, energy, and energy industries. This will drive demand for the product in the future.

The market for submarine cables has seen an increase in demand due to the increasing focus on offshore renewable energy generation, which will meet future energy security targets, as well as provide access to remote landmass and interlinking national grids to reduce energy consumption.

Voltage Analysis

The highest revenue share, at around 66.9%, was in the high voltage segment. High voltage cables with voltages above 33kV are used extensively for power transmission and distribution. The main drivers of the high voltage cables market are the rising demand for HVDC submarine power cables, and increasing investments in offshore wind power.

HV cables also reduce transmission losses, allowing for efficient power transmission. HVDC power systems are rapidly evolving and allow electricity to be transferred from large capacity, high-power sources to the mainland.

Medium voltage cables represented a substantial share of the market and is expected to grow at a compound annual rate of 5.7% between 2023 and 2032. This is due to the use of MV cables for power transmission in offshore oil and gas infrastructure. The MV cables market is being driven by the increasing demand from offshore oil & gas operations.

Component Analysis

The market for submarine communication cables is split into dry plant products and wet plant products that are based on components. The component type market for submarine cables was led by the dry plant products segment.

The market share for dry plant products was 74% in 2021. This is due to the cost-effectiveness of dry plant products and recent advances in the industry, such as SDM cables that have more fibers and greater capacity, aluminum conductors, and smart cables: repeater pump farming, repeater pumps, emergency alerts for earthquakes or tsunamis, virtualized submarine networks and artificial intelligence.

The wet plant products segment accounted for 26% market share in 2021 and is expected to experience the highest growth rate during the study period. A submarine cable plant is located between the beach manholes. Submarine cable system equipment can be installed between these manholes. The wet plant includes submarine cables, OADMs repeaters, repeaters, and branching units as well as gain equalizers and filters.

Key Market Segments:

By Application

- Submarine Power Cables

- Submarine Communication Cables

By Voltage

- Medium Voltage

- High Voltage

- Extra-High Voltage

By Component

- Dry Plant Products

- Wet Plant Products

Market Dynamics:

Around 91% of data traffic is carried by submarine communication cables. Their total carrying capacity is also in the terabits per second range. They are therefore the most valuable cables for OTT providers like Facebook, Google, Amazon, and Microsoft. In October 2021 NEC, the Japanese IT firm announced plans to build a submarine cable with four million fiber optics for Facebook. It is expected that the submarine will have a bandwidth of up to 500MB per second and 24 fiber pairs.

Submarine cables are considered a critical part of an economy by most countries. Therefore, regulations have been established to protect them. The Australian Communications and Media Authority (ACMA), for instance, has established safety zones to prevent damage to these cables that run through Australia and the Rest of the World. It also allows for the legalization of new submarine cable projects.

Industry growth will be driven by the efficient power transmission systems and distribution systems from renewable energies and the development of offshore wind farms. The Government of Japan, for example, is building a floating wind far 12 miles from the coast. It is expected that 140 floating turbines will be installed by 2020.

Manufacturers have been encouraged to participate actively in the maintenance, installation, and commissioning of submarine cables due to growing demand. Ciena Corporation upgraded the Europe India Gateway (EIG), submarine cable system to speed track and strengthened connectivity between businesses in Europe, India, and the Middle East in February 2020.

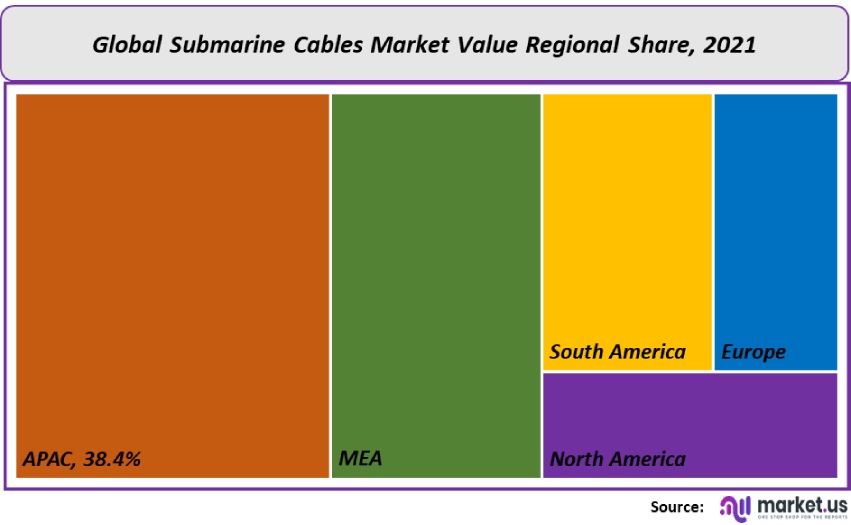

Regional Analysis

In 2021, the Asia Pacific region held 38.4% of the total market. China is the top-ranked country in terms of the deployment and adoption of wind farms. IEEFA reported that China had 4.6GW1 operational offshore wind power capacity as of 2021. China installed 1.8GW offshore wind power capacity in 2021, which represents 41% of the global 4.5GW.

China approved 24 offshore wind power plants off Jiangsu Province’s coast in 2019. They have a combined capacity of 6.7GW and an investment injection of US$ 18.2 billion. These offshore wind projects are supported by China’s biggest utilities, China Energy Group, and China General Nuclear Power Corp.

MEA accounted for approximately 25.0 % of the total submarine communication cable revenue in 2021. The demand has increased due to EMEA’s increasing investments. Altibox Carrier, a submarine network tech company, and Xtera announced in March 2020 that the Euroconnect-1 submarine cable would be constructed from Norway to the UK. It is expected to reach Stavanger, Norway, and Newcastle, the UK.

Due to increased investments in wind farms, and inter-country and island connections, the South American market is expected to grow at a 5.8% compound annual growth rate between 2023 and 2032. In 2021, several submarine cable projects were launched.

For example, Google announced plans for Firmina in June 2021. This open-subsea cable will link the US East Coast with Las Toninas (Argentina) and land in Brazil and Uruguay. The company hopes to increase internet connectivity in South America by establishing a new connection. It also plans to expand its cable investments in the region.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

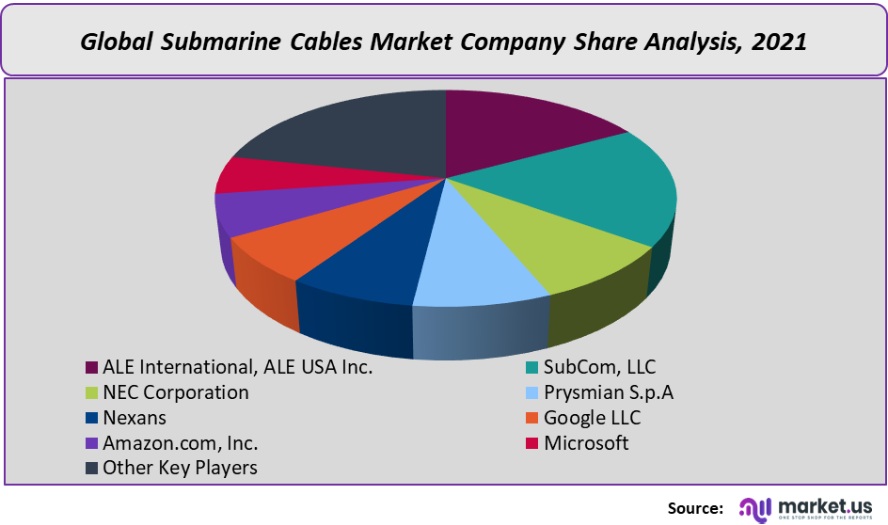

Alcatel-Lucent and TE Sub-Com were the global market leaders in 2021. Other small and medium-sized submarine cable companies are concentrating on smaller projects in various regions. Many submarine cable suppliers are also involved in offshore oil and gas projects, undersea electric cables, and other marine infrastructure projects all over the world. In 2017, Alcatel Submarine Networks, a Nokia subsidiary, was awarded a turnkey contract (EPCI) to supply and install DC/FO technology for the Johan Castberg Field in the Barents Sea.

It’s also worth noting that Google owns the world’s longest submarine cable, Curie Cable. This bridge connects Chile and Los Angeles. As a result, the majority of companies offer and connect submarine cables through partnerships, contracts, and consortiums. These companies do not resell cables, but finance investment in cables. The following are some of the most prominent players in global submarine cable markets:

Маrkеt Кеу Рlауеrѕ:

- ALE International

- ALE USA Inc.

- SubCom, LLC

- NEC Corporation

- Prysmian S.p.A

- Nexans

- Google LLC

- Amazon.com, Inc.

- Microsoft

- NKT A/S

- ZTT

- Other Key Players

For the Submarine Cables Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Submarine cables market size in 2021?A: The Submarine cables market size is US$ 25,220 million for 2021.

Q: What is the CAGR for the Submarine cables market?A: The Submarine cables market is expected to grow at a CAGR of 7.2% during 2023-2032.

Q: What are the segments covered in the Submarine cables market report?A: Market.US has segmented the Global Submarine Cables Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Application, market has been segmented into Submarine Power Cables and Submarine Communication Cables. By Voltage, market has been further divided into Medium Voltage, High Voltage, and Extra High Voltage. By Component market has been divided into Dry and wet Plant Product.

Q: Who are the key players in the Submarine cables market?A: ALE International/ALE USA Inc., SubCom, LLC, NEC Corporation, Prysmian S.p.A, Nexans, Google LLC, Amazon.com, Inc., Microsoft, NKT A/S, ZTT, and Other Key Players are the key vendors in the Submarine Cables market

Q: Which region is more attractive for vendors in the Submarine cables market?A: APAC is expected to account for the highest revenue share of 38.4% among the other regions. Therefore, the Submarine cables market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Submarine cables?A: Key markets for Submarine cables are the UK, India, China, Argentina, Brazil, Uruguay & Others

Q: Which segment has the largest share in the Submarine cables market?A: In the Submarine cables market, vendors should focus on grabbing business opportunities from the Submarine Power Cable segment as it accounted for the largest market share in the base year.

![Submarine Cables Market Submarine Cables Market]()

- ALE International

- ALE USA Inc.

- SubCom, LLC

- NEC Corporation

- Prysmian S.p.A

- Nexans

- Google LLC

- Amazon.com, Inc. Company Profile

- Microsoft Corporation Company Profile

- NKT A/S

- ZTT

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |