Global Sunitinib Malate Market By Cancer Type: (Pancreatic Neuroendocrine Tumors, Gastrointestinal Stromal Tumor (GIST), Advanced Kidney Cancer) By Purity: (Purity > 99%, Purity > 98%, Purity > 97%) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Feb 2022

- Report ID: 84959

- Number of Pages: 348

- Format:

- keyboard_arrow_up

Sunitinib Malate Market Overview:

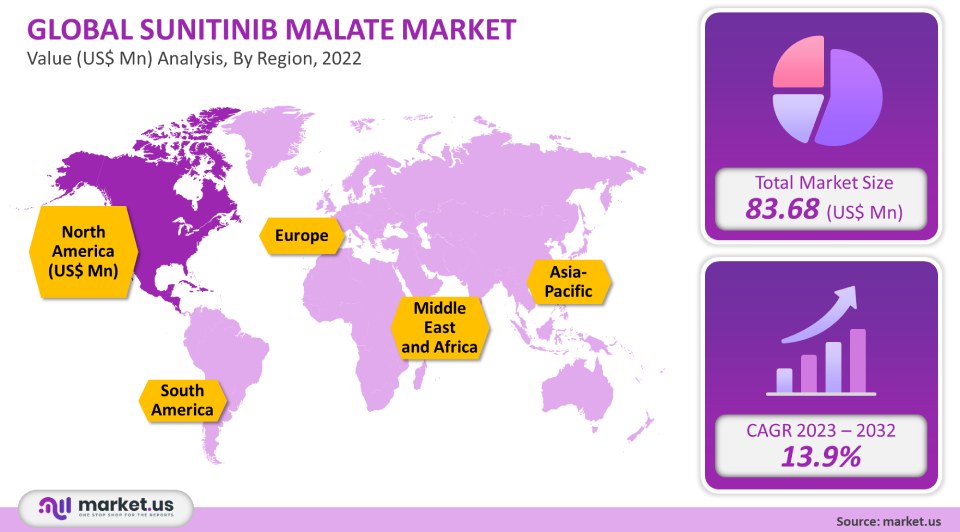

The global Sunitinib Malate Market is projected to reach a valuation of USD 199.93 Mn by 2032 at a CAGR of 13.9%, from USD 83.68 Mn in 2022.

Sunitinib is used to treat gastrointestinal stromal tumors (GIST; a type of tumor that grows in the stomach, intestine (bowel), or esophagus (the tube that connects the throat with the stomach) in people with tumors that have not been treated successfully with imatinib (Gleevec) or people who cannot take imatinib. Sunitinib Malate is a drug that helps keep cancer cells from growing by blocking specific proteins. Sunitinib Malate is an orally administered drug approved by the FDA (Food and Drug Administration). It is sold under the brand name Student.

The biggest market for the drug sunitinib malate is the US, followed by Germany and Japan. In 2020, The market in the US was valued at US$ 19.7 Million. This is mostly attributed to the higher frequency of pancreatic cancer. The increasing adoption of sunitinib malate to treat Primitive Neuro-Ectodermal Tumors (pNET) is another reason for the further growth of this market in the US.

Sunitinib malate has been found to cause many side effects, such as fatigue, hypertension, etc. There are certain eligibility criteria for patients to receive the administration of this drug, with the general administration or treatment timeline being four weeks, which is then followed by two weeks of abstinence.

Segmentation:

By Cancer Type:

- Pancreatic Neuroendocrine Tumors

- Gastrointestinal Stromal Tumor (GIST)

- Advanced Kidney Cancer

By Purity:

- Purity > 99%

- Purity > 98%

- Purity > 97%

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- The Middle East and Africa

Key Players:

- Pfizer Inc.

- AstraZeneca Inc.

- Endo Pharmaceuticals Inc.

- Topcare pharmaceutical Co. Ltd.

- Reliance Life Sciences Pvt. Ltd.

- Ipsen Pharma Ltd.

- Hetero Drugs Ltd.

- Bristol-Myers Squibb Ltd.

- Teva Pharmaceutical Industries Ltd.

- Reallife Sciences Pvt. Ltd.

Drivers:

A main driver for the global sunitinib malate market is the growing prevalence of pancreatic cancer, and pNETs (pancreatic neuroendocrine tumors). Owing to the poor prognosis rate in the early stages of pancreatic cancer and the insufficient availability of alternative drug treatments for advanced pNETs, the demand for Sunitinib malate is expected to continue to increase.

An increase in healthcare expenditures, as well as pharmaceutical research & development funding is also expected to have a positive impact on the global sunitinib malate market.

Restraints:“Stutent,” the brand name for Sunitinib Malate, is sold at a high cost. One capsule of this drug is sold at an average price of $ 641, making it difficult for individuals to purchase.

The side effects of Stutent are numerous and include, heart failure, heart attack, and damage to the liver. This factor could hinder the adoption of this drug.Opportunities:

Technological developments and increased awareness concerning these types of diseases are expected to create additional opportunities for players in this market.

The FDA, in recent years, has taken a few measures by granting pre-market approval for the use of this drug in clinical settings as a means of complementing the progress of cancer drugs.

Certain elements such as the high frequency of cancer, the increasing association between private and public areas to provide different cancer therapy solutions, and emerging awareness related to the treatment and cure for cancer have all led to the further growth of this market.Trends:

An increase in the occurrence of pancreatic cancer, kidney cancer, and GIST is anticipated to boost the sales of sublimate malate.

Key Developments:

- 17th Feb 2021: India’s Glenmark Pharmaceuticals has launched a generic version of sunitinib oral capsules called Sutib to treat kidney cancer, which is around 96% less expensive than Pfizer’s Stutent.

- 03rd Feb 2022: Graybug Vision Inc. declared that it was entering three upcoming medical and investor conferences concerned with sublinate malate.

For the Sunitinib Malate Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Sunitinib Malate Market Sunitinib Malate Market]()

- Pfizer Inc Company Profile

- AstraZeneca Inc.

- Endo Pharmaceuticals Inc.

- Topcare pharmaceutical Co. Ltd.

- Reliance Life Sciences Pvt. Ltd.

- Ipsen Pharma Ltd.

- Hetero Drugs Ltd.

- Bristol-Myers Squibb Ltd.

- Teva Pharmaceutical Industries Ltd. Company Profile

- Reallife Sciences Pvt. Ltd.

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |