Global Sutures Needle Market By Shape (Compound-cure Shaped Needles, Straight Shaped Needles, J Shape Needle, Half Curved), By Type (Tapercut Needle, Blunt Point Needle, Reverse Cutting Needle, Round Bodied Needle, Conventional Cutting Needle, Spatula Needle), By Application (Cardiovascular, General Surgery, Orthopedic Procedures, Gynecological Procedures, Veterinary Procedures, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2022

- Report ID: 14640

- Number of Pages: 223

- Format:

- keyboard_arrow_up

Sutures Needle Market Overview

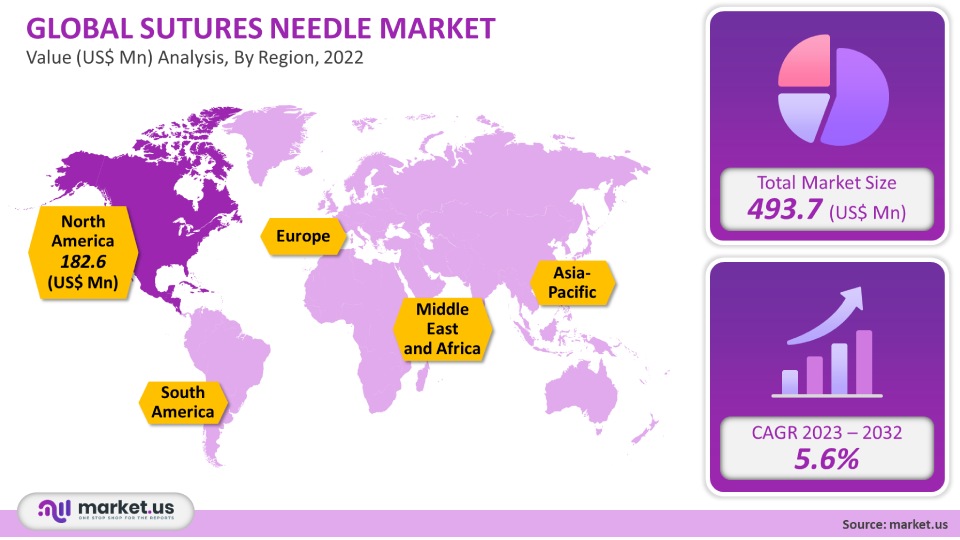

The Sutures Needle Market was valued at USD 493.7 million in 2021. It is expected to grow at a CAGR of 5.6% between 2023 and 2032. The market is growing due to increased surgical procedures for heart and chronic diseases. The development of new technologies will also benefit the suture needle market. Healthium Medtech, for example, released Truglyde SN2355, a combination of suture needles specifically designed for COMOC MG, in May 2020. This is a new surgical approach to managing Postpartum Hemorrhage, one of the most common causes of maternal death.

Global Sutures Needle Market Scope:

Shape Analysis

In 2021, straight-shaped needles had a 42.0% revenue share. This segment growth can be attributed to the growing popularity of rhinoplasty and abdominal surgery. It can also be used in microsurgery to treat nerve and vascular injuries. Unlike other needles, the straight-body needle can be used to suture tissue. It is easy to use and can be operated manually. Over the forecast period, the half-curved needle segment will grow rapidly. Because a half-curved needle is more predictable and takes up less space than straight needles, it will grow rapidly. The increasing demand for this product in skin closing surgeries and its excellent handling qualities will result in a market that is expected to grow.

Type Analysis

The largest revenue share, at 36.0% or more, was for tapercut needles in 2021. Taper-point needles puncture easily permeable tissues (such as subcutaneous layers and dura) while minimizing fascia tear. This is expected to increase the demand for suture tools. Over the forecast period, the blunt point needle segment will grow rapidly. The blunt point needle is a good alternative to taper needles. It is also safer than traditional curved needles and is expected to grow rapidly.

Application Analysis

In 2021, the cardiovascular segment was responsible for 37.0% of all revenue. This is due to increased cardiovascular diseases and technological breakthroughs in imaging, diagnosis, and surgical equipment. Other segments include gastrointestinal surgery and obstetrics surgeries. Due to an increase in obese women and a rise in health problems in women, this category is likely to increase significantly.

Key Market Segments:

By Shape

- Compound-Cure Shaped Needles

- Straight Shaped Needles

- J Shape Needle

- Half Curved

By Type

- Tapercut Needle

- Blunt Point Needle

- Reverse Cutting Needle

- Round Bodied Needle

- Conventional Cutting Needle

- Spatula Needle

By Application

- Cardiovascular

- General Surgery

- Orthopedic Procedures

- Gynecological Procedures

- Veterinary Procedures

- Others

Market Dynamics:

The demand for surgical treatment is expected to rise due to the rising number of cardiovascular diseases. The WHO estimates that cardiovascular diseases accounted for 32% of all deaths worldwide and caused 17.9 million deaths in 2019. Many of these deaths may also be due to strokes and heart attacks.

Market growth will be boosted by various initiatives, including mergers and acquisitions. Ethicon, part of Johnson & Johnson Medical Devices Companies, launched the ProxiSureTM Suturing Device in the United States in August 2017. It is an innovative laparoscopic suturing system that combines Ethicon’s endomechanical, suture, and curved needle technology. ProxiSureTM is designed to provide precise suturing in limited locations. It is especially suited for bariatric and general colorectal operations. The curved needle also improves the surgeon’s ability to suture different tissue layers. As a result, there is a growing market for suture needles.

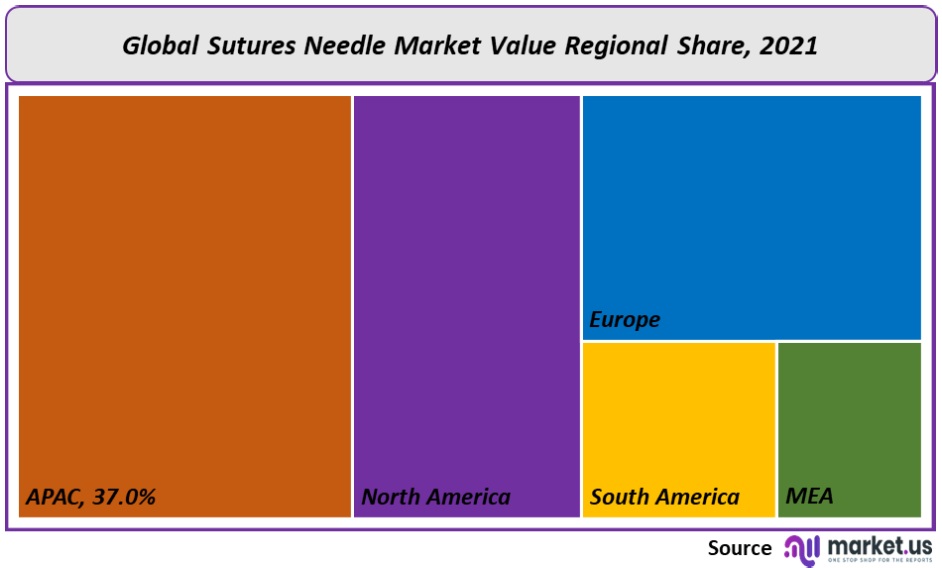

Regional Analysis

North America was the dominant market, with a revenue share of 37.0% in 2021. This is due to the high incidence of cardiovascular diseases and the high adoption rate of minimally invasive treatment for orthopedic and cardiovascular diseases. These diseases currently account for over one-third of all American deaths. According to the American Heart Association, cardiovascular diseases will continue to be the leading cause of death and morbidity among the elderly. Their numbers are predicted to increase by more than doubling between now and 2032.

Asia Pacific is projected to grow at a 5.3% CAGR between 2023 and 2032. This is due to the introduction of technologically superior goods due to market participants’ investments, rising consumer disposable income, large volumes of surgeries, and new products.

Healthium, for example, acquired Shri SGK Labs AbGel sponge company in Mumbai in August 2021. This acquisition will expand its surgical and post-surgical care product lines. The acquisition has increased their product range, including hemostats and a urology portfolio. They also have gloves, surgical sutures, needles, staplers, and ligation clips. This acquisition has been a boon with the rising demand for suture needles.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

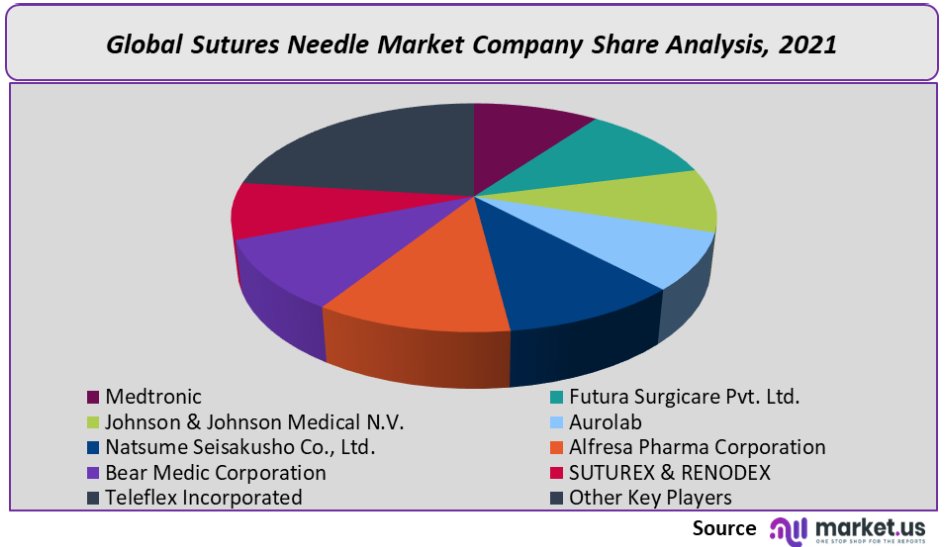

Market Share & Key Players Analysis:

Companies are working to improve their product offerings and expand their distribution networks by forming partnerships and collaborations to increase their market share. Ethicon, a Johnson & Johnson Medical Devices subsidiary, launched the ProxiSure Suturing Device (USA) in August 2017. This highly advanced laparoscopic suturing machine incorporates Ethicon’s endomechanical, suture, and curved needle technology. The company expects an increase in revenue with the new product launch.

Market Key Players:

- Medtronic

- Futura Surgicare Pvt. Ltd.

- Johnson & Johnson Medical N.V.

- Aurolab

- Natsume Seisakusho Co., Ltd.

- Alfresa Pharma Corporation

- Bear Medic Corporation

- SUTUREX & RENODEX

- Teleflex Incorporated

- Other Key Players

For the Sutures Needle Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Sutures Needle market in 2021?The Sutures Needle market size is US$ 493.7 million in 2021.

What is the projected CAGR at which the Sutures Needle market is expected to grow at?The Sutures Needle market is expected to grow at a CAGR of 5.6% (2023-2032).

List the segments encompassed in this report on the Sutures Needle market?Market.US has segmented the Sutures Needle Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By shape, the market has been segmented into Compound-cure Shaped Needles, Straight Shaped Needles, J Shape Needle, Half Curved; by type, the market has been segmented into Tapercut Needle, Blunt Point Needle, Reverse Cutting Needle, Round Bodied Needle, Conventional Cutting Needle, Spatula Needle, and the application market has been segmented into Cardiovascular, General Surgery, Orthopedic Procedures, Gynecological Procedures, Veterinary Procedures, Others.

List the key industry players of the Sutures Needle market?Medtronic, Futura Surgicare Pvt. Ltd., Johnson & Johnson Medical N.V., Aurolab, Natsume Seisakusho Co., Ltd., Alfresa Pharma Corporation, Bear Medic Corporation, SUTUREX & RENODEX, Teleflex Incorporated, Other Key Players are the key vendors in the Sutures Needle market.

Which region is more appealing for vendors employed in the Sutures Needle market?North America accounted for the highest revenue share of 37%. Therefore, the Sutures Needle industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the Sutures Needle Market.The US, Canada, Mexico, China, Japan, Germany, France, UK, etc., are leading key areas of operation for Sutures Needle Market.

Which segment accounts for the greatest market share in the Sutures Needle industry?With respect to the Sutures Needle industry, vendors can expect to leverage greater prospective business opportunities through the straight-shaped needles segment, as this area of interest accounts for the largest market share.

![Sutures Needle Market Sutures Needle Market]()

- Medtronic

- Futura Surgicare Pvt. Ltd.

- Johnson & Johnson Medical N.V.

- Aurolab

- Natsume Seisakusho Co., Ltd.

- Alfresa Pharma Corporation

- Bear Medic Corporation

- SUTUREX & RENODEX

- Teleflex Incorporated

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |