Global Synthetic Biology Market By Product (Enzymes, Oligonucleotide/Oligo pools and Synthetic DNA, and Others), By Technology (PCR, NGS, and Others), By Application (Healthcare and Non-Healthcare), By End-use (Academic & Government Research Institutes, Biotechnology & Pharmaceutical Companies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Mar 2022

- Report ID: 31004

- Number of Pages: 337

- Format:

- keyboard_arrow_up

Synthetic Biology Market Overview:

In 2021, the market for synthetic biology was valued at USD 12,225.23 million. Between 2023 to 2032, it is anticipated to expand at a CAGR of 22.58%.

Synthetic biology has achieved strides that have enabled it to change technology in a variety of fields, including living things, biocomputing, and therapeutic genome editing. The development of synthetic biology products has been made possible by the areas of gene editing and gene circuit design, metagenomics discoveries, automated strain engineering, and directed evolution. These compounds, which are created by altered cells and enzymes like CAR-Ts and genome-edited soy, include sitagliptin, diamines, and leghemoglobin.

Global Synthetic Biology Market Scope:

Product Type Analysis

The product category that will generate the most revenue in 2021, with a revenue share of more than 36.01%, was oligonucleotide/oligo pools and synthetic DNA. During the projection period, this category is anticipated to increase at the quickest CAGR.

The capacity to design unique DNA oligos is one of several possibilities in molecular and synthetic biology. Custom primer services are provided by organizations like Integrated DNA Technologies and Life Technologies. Falling synthesis costs and increased need for synthetic RNA, DNA, and genes that may be used in a number of ways are driving the segment’s growth.

The market for enzymes is anticipated to see a sizable CAGR during the projected period. The manufacturing of enzymes with efficiency, economy, and the environment in mind is currently a priority for businesses. Many businesses are switching from the current phosphoramidite chemical for gene synthesis to enzyme-based chemistry. The potential use of enzymatic synthesizing to produce longer genes with a quicker turnaround time will promote industry growth.

Technology analysis

In 2021, PCR technology accounted for more than 28.3% of the total revenue. This is due to its high use, which is quick, simple, reproducible, highly specific, and sensitive.

PCR cloning can be used for gene cloning and DNA recombination. Gene quantification is also possible in synthetic biology operations. The Sony 2.0 technology from Synbio Technologies can successfully clone target gene targets without the requirement for restriction enzyme sites. These platforms are cost-effective and increase the efficiency of PCR in synthetic biology applications.

The segment growth is also driven by an increase in R&D to develop and launch reagents. A group of researchers from the U.S. and U.K. developed cellular agents in 2021. These reagents can replace enzymes in molecular biology and diagnostic reactions. They also have common synthetic biology processes such as qPCR or PCR. These technologies can be used to increase production in order to meet the rising diagnostic demand.

NGS technology is expected to experience the fastest CAGR over the forecast period. NGS’s ability to synthesize DNA sequences right from the beginning, as well as new technologies such as CRISPR/Cas9, are enabling targeted introductions of DNA sequences in living cells.

Application analysis

In 2021, the healthcare segment was responsible for 78.12% of all revenue. The scope and scale of biopharmaceutical drug discovery have been greatly improved by synthetic biology. This technology provides practical solutions to the problems associated with biopharmaceutical production, including gene design, expression optimization, and yield stability.

Synthetic biology diagnostics are a noninvasive, real-time, sensitive, and specific method of detecting cancer cells and infectious agents. Researchers use rational engineering to create biosensing systems dynamically composed of a sensor processor and reporter. Glympse Bio developed an activity-based biosensor that can detect early signs of Non-Alcoholic Steatohepatitis, predict the disease stage, and support drug development.

The largest non-healthcare revenue-generating application is bio-fuels. The fourth generation of biofuels is possible thanks to synthetic biology. Research is underway to develop alternative biofuel molecules. These are expected to help reduce Greenhouse Gas (GHG), emissions. GenScript offers GenPlus, a high-throughput gene synthesizer, combinatorial assembly library, and CRISPR/Cas9 genetic editing for biofuel production.

End-use analysis

With a market share of over 52.3%, the biotechnology and pharmaceuticals segment dominated in 2021. Biotechnology and pharmaceutical companies have used synthetic biology to create new drugs that can be used for chronic conditions. Merck, for example, has used synthetic biology to create Januvia (sitagliptin), a treatment for diabetics. Novartis also developed Kymriah, or Tisagenlecleucel, to treat B-cell acute Lymphoblastic Leukemia.

Several companies also use synthetic biology to create pathways that allow microorganisms produce relevant medicines. Amyris Inc. created yeast strains for the development of Artemenisin, an antimalarial drug. Synthetic biology can also be used to improve in-vitro drug manufacturing. Codexis uses synthetic biology to create a more efficient enzyme that can be used in the synthesis of small-molecule drugs. This market is further supported by technological advancements.

Computational protein design is a method of creating proteins from scratch. It also calculates variants of protein structure and protein design. Scientists can develop enzymes that are unique to the natural world. Ginkgo Bioworks, for example, uses computer automation to create new organisms. Arzeda also manufactures enzymes from scratch to produce rare sugars and natural sweeteners.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- Enzymes

- Oligonucleotide/Oligo pools and Synthetic DNA

- Xeno-nucleic Acids

- Cloning Technologies Kits

- Chassis Organism

By Technology

- PCR

- NGS

- Bioprocessing Technology

- Genome Editing

- Other Technologies

By Application

- Healthcare

- Non-Clinical/Research

- Clinical

- Non-Healthcare

- Specialty Chemicals

- Biotech Crops

- Bio-Fuels

- Other Non-Healthcare

By End-Use

- Academic & Government Research Institutes

- Biotechnology & Pharmaceutical Companies

- Other End-uses

Market Dynamics:

Research and development in nutrition have been influenced by changing eating habits and resource scarcity. Synthetic biology has helped identify several good food production methods. This technology can be used to produce better food yields and improve pest management. Many stakeholders see synthetic biology as an important tool for enabling growth in the nutrition industry. Impossible Foods also developed Pichia Pastori’s soy leghemoglobin for plant-based burgers.

The market is expected to grow due to the wide range of applications that synthetic biology has. The market for synthetic biology products is diverse. They are used in many sectors, including bioenergy, enzyme technology, and biology-based chemicals. Many companies are now producing synthetic biology-based textiles and materials. Companies such as Bolt Threads, Modern Meadow and Spiber are developing bio-based dyes and energy-efficient textile production techniques.

Many research and development activities have been undertaken in the area of food and nutrition due to the increasing global population and shortages of essential resources. This is where synthetic biology can help in the identification of sustainable food production systems.

This technique also helps to improve food yields and pest control management. Many companies are exploring the possibility of using synthetic biology to develop innovative food solutions. This is evident in the growing number of players entering the market. Among others, there are companies like Beyond Meat and Upside Foods that offer synthetic meats.

Market growth is expected to be influenced by increasing funding opportunities and government and private assistance. According to Built with Biology in the third quarter of 2021, synthetic biology startups received investments totaling over US$ 18000 million. The highest investment was around US$ 6.1 million in the third quarter of 2021. As the field gains momentum, these investments will rise due to new advancements in gene editing, designing of gene circuits, and metabolic engineering.

Synthetic biology is able to address environmental problems such as climate change and natural resource management. This technique can be used in combination with genetic engineering to create microorganisms capable of detecting harmful environmental contaminants. This market is expected to grow due to increased research and development in this area. Synthetic biology is used in agriculture to develop chemical-free fertilizer alternatives. Pivot Bio has developed safe synthetic nitrogen fertilizers.

Many concerns have been raised about biosafety, biosecurity, and the development of synthetic biology. These products can pose unknown risks to the environment and public health. The policies of countries in Europe, America, Asia, and elsewhere have been developed to prevent accidental or deliberate releases of pathogens and toxins. These policies could hinder the market growth.

Suspects about the origin of SARS-CoV-2, a novel coronavirus, have drawn attention to the bio-risks of synthetic biology. This is due to the use of synthesis and engineering living organisms in this area. This could lead to more stringent regulations, which can be a problem for market growth.

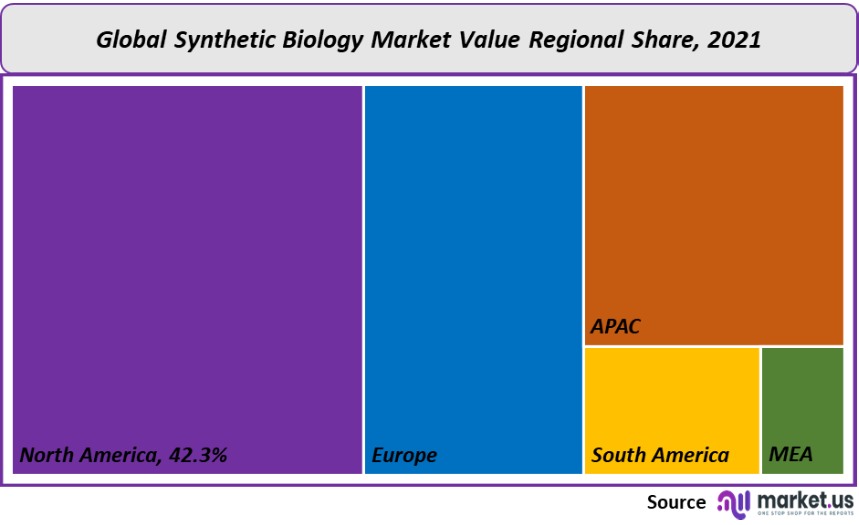

Regional Analysis

North America held the largest share, with 42.3%, in 2021. This was a result of better laws, improved financing for the development of synthetic biology products, and government support. Moderna Therapeutics and Sana Biotechnology, Poseida Therapeutics, and Greenlight Biosciences are just a few of the startups in this area. They raised more than US$ 3000 million in 2020’s first half.

The U.S. focuses primarily on research in drug discovery, genomics structure prediction, and proteomics. This has helped to propel the growth of the synthetic biology industry. Moreover, the National Institutes of Health (NIH) and private organizations like the Gates and Melinda Foundation are funding research and development in synthetic biology, which could increase the country’s market prospects.

Germany will see a rise in synthetic biology sales over the forecast period. This is due to the presence of many synthetic biology hubs, which are driving advances in this field. In order to develop minimum cells, MaxSynBio, a member of the Max Planck Society and the Ministry of Education and Research, seeks to understand fundamental cellular processes. Leaps by Bayer is a Bayer AG-owned initiative that invests in life sciences advances, including synthetic biology. The market growth in Germany is expected to be fueled by the presence of such institutions.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

Despite COVID-19’s impact, the market saw strong investments from both private and public partners. According to Synbiobeta data, the industry received a record $7.8 million investment in 2020. Join Bio is currently developing an engineering microbe to support sustainable agriculture.

Companies like Bolt Threads and Spiber have seen a rapid rise in consumer biotechnology. These companies create sustainable synthetic biomaterials that look natural but are still durable. These biomaterial-based products can be marketed as sustainable fashion clothes.

Spiber, a Japanese firm, grows spider silk using precision-engineered microbes. In 2021, the company raised $240 million. The textile sector is experiencing a biotechnological revolution that uses biology to make clothing more durable and better. Modern Meadow and VitroLabs are pioneering the production of genuine leather using a bioengineering process. Modern Meadow is a pioneer in the leather industry, making leather from yeast.

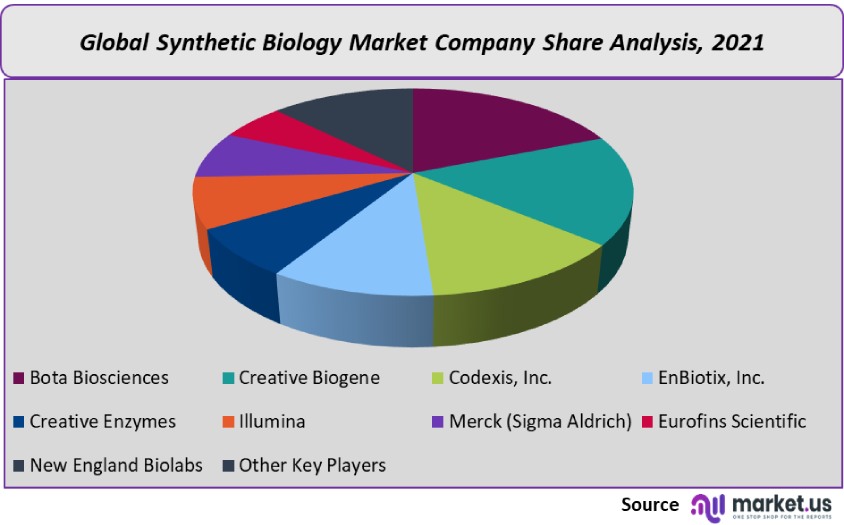

Маrkеt Кеу Рlауеrѕ:

- Bota Biosciences

- Creative Biogene

- Codexis, Inc.

- EnBiotix, Inc.

- Creative Enzymes

- Illumina

- Merck (Sigma Aldrich)

- Eurofins Scientific

- New England Biolabs

- Other Key Players

For the Synthetic Biology Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Synthetic Biology market in 2021?A: The Synthetic Biology market size is US$ 12,225.23 million in 2021.

Q: What is the projected CAGR at which the Synthetic Biology market is expected to grow at?A: The Synthetic Biology market is expected to grow at a CAGR of 22.58% (2023-2032).

Q: List the segments encompassed in this report on the Synthetic Biology market?A: Market.US has segmented the Synthetic Biology market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Enzymes, Oligonucleotide/Oligo pools and Synthetic DNA, Xeno-nucleic Acids, Cloning Technologies Kits, and Chassis Organism. By Technology, market has been segmented into PCR, NGS, Bioprocessing Technology, and Genome Editing. By Application, market has been segmented into Healthcare and Non-Healthcare. By End User, the market has been further divided into Academic & Government Research Institutes and Biotechnology & Pharmaceutical Companies.

Q: List the key industry players of the Synthetic Biology market?A: Bota Biosciences, Creative Biogene, Codexis, Inc., EnBiotix, Inc., Creative Enzymes, Illumina, Merck (Sigma Aldrich), Eurofins Scientific, New England Biolabs, and Other Key Players engaged in the Synthetic Biology market.

Q: Which region is more appealing for vendors employed in the Synthetic Biology market?A: North America accounted for the highest revenue share of 42.3%. Therefore, the Synthetic Biology industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Synthetic Biology?A: The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for Synthetic Biology Market.

Q: Which segment accounts for the greatest market share in the Synthetic Biology industry?A: With respect to the Synthetic Biology industry, vendors can expect to leverage greater prospective business opportunities through the Oligonucleotide/oligo pools and synthetic DNA segment, as this area of interest accounts for the largest market share.

![Synthetic Biology Market Synthetic Biology Market]()

- Bota Biosciences

- Creative Biogene

- Codexis, Inc.

- EnBiotix, Inc.

- Creative Enzymes

- Illumina

- Merck (Sigma Aldrich)

- Eurofins Scientific

- New England Biolabs

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |