Global Telecom API Market By Type (Messaging API, WebRTC API, Payment API, and Other Types), By End-User (Enterprise Developers, Internal Telecom Developers,and Others), and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032.

- Published date: Apr 2022

- Report ID: 29489

- Number of Pages: 286

- Format:

- keyboard_arrow_up

Telecom API Market Overview:

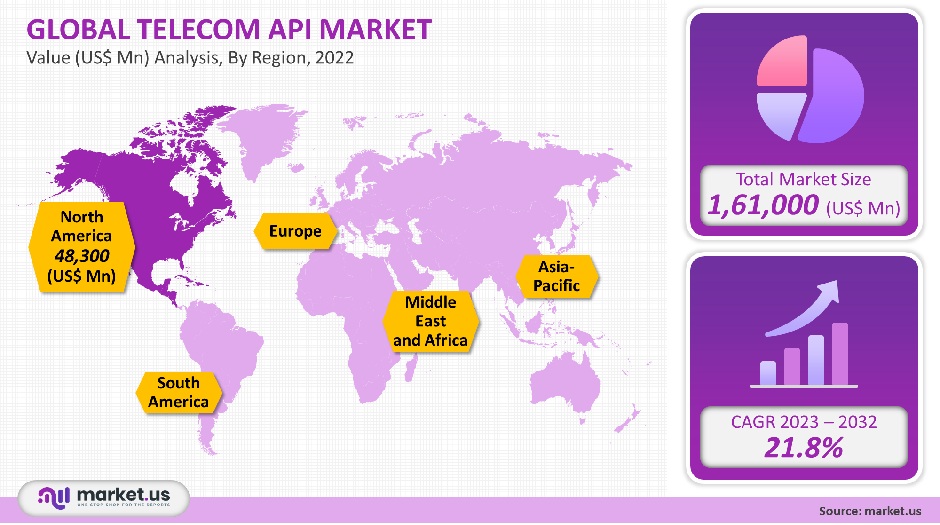

The global telecom API market was valued at USD 1,61,000 million in 2021. It is expected to grow at a 21.8% CAGR between 2023 to 2032.

Telecom API is used to provide web-based banking, cloud computing, identity management, and telecom software. It compiles standard protocols as well as programming instructions. Telecom API is a cost-effective solution that increases the performance of the web-based app. These communication protocols allow developers to concentrate on developing mobile apps rather than creating them from scratch.

API is a popular application in all areas of mobile apps and services, as well as online payments. It includes voice and video calling, location-tracking apps, messaging apps, and API. In the past few decades, there has been an increase in demand for mobile-based technology. Therefore, telecom APIs are more important.

Global Telecom API Market Scope:

Type Analysis

In 2021 the largest market share was held by sub-segment message API. It represented more than 32%. It is expected to grow at a greater than 22.9% CAGR between 2023-2032. High demand for RCS Services has resulted in a large number of messaging APIs. SMS penetration is rising as more businesses use SMS services to personalize marketing efforts and improve customer service. This is driving the need for messaging APIs.

The sub-segment IVR API, which is a part of the telecom API marketplace, will also see significant growth during this forecast period. This can be explained in part by the increased number of BPO suppliers in developing markets such as India and South Africa. A significant revenue share was held by the sub-segment located API at 11.9 % in 2021.

End-User Analysis

Due to large-scale adoption and high penetration, the enterprise developer segment holds more than 34% of the market. A-2-P messages are used primarily in large-scale companies to announce promotions, offers, and changes to company policies. Most organizations use majority messaging software & tools that help drive market growth.

Over the forecast period, the market for telecom APIs will see a 21.8% CAGR in the sub-segment partner developers. CSPs and developers can use partner APIs to create a single-point data-sharing platform that allows them to share information. This will enable them to develop services like streaming services and payment services. These services can be produced by developers and supported by telecom companies to manage their service infrastructure.

Partner developers have a larger customer base than enterprise developers, which will result in them growing over the estimated period.

Маrkеt Ѕеgmеntѕ:

By Types

- Messaging API

- WebRTC API

- Payment API

- IVR API

- Other Types

By End-User

- Enterprise Developers

- Internal Telecom Developers

- Partner Developers

- Long Tail Developers

Market Dynamics:

Due to the increasing penetration of the Internet of Things (IoT) and device integration, the market will see a positive impact during the forecast period. Because of their single point of interaction between multiple nodes in the network, telecom APIs can enable IoT solutions that are end-to-end. The third-party service provider is no longer required to integrate systems. IoT penetration will drive an explosion in demand for telecom APIs. According to The State of Mobile 2021, a report from the GSMA, which examines the global IoT connectivity market, it is predicted that 25,200 million IoT connections will be available by 2025. This should support market growth.

In the coming year, the number of startups in telecom API will rise in emerging markets like Africa or the Asia Pacific. This is expected to create new opportunities for telecom API service providers. In order to encourage the growth of startups in telecom, industry giants Google and Vodafone have formed partnerships and made arrangements with technology supplier groups and communication service providers from emerging markets. They make available their APIs to developers and help propel the market.

Despite the tremendous benefits of telecom API, market growth has been slowed due to data security concerns by end-users. According to a recent study on data security, API attacks make up the largest percentage of all attacks on web applications that are commercial or enterprise. This could lead to data breaches, which can allow malicious parties access to the end-user’s name, IMEI number, and contact details.

Regional Analysis

Over the forecast period, North America accounted for 30% of the market share and was the most dominant market in 2021. This growth can be explained by the significant presence of prominent players in the telecom API market, such as Google LLC, Broadcom, Inc., Oracle Corporation, and AT&T Inc. The rapid adoption of technology like 4G advances in 5G technology is driving the market’s rapid growth. The integration of 4G and 5G technology with APIs enables communication services like video and also voice calls, as well as speech & video integration services, to be delivered efficiently, increasing business productivity.

Because of its growing subscriber number of mobile and increased use of 5G technology, APAC is expected to be the most desirable region.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

The market is highly competitive and fragmented. Each country or region is dominated by a few key players. This includes the majority of the CSPs in the region. To expand their presence, these market players pursue new organic and inorganic growth strategies such as partnerships, mergers, and acquisitions, joint ventures, or collaborations. AT&T Inc., Google LLC, Verizon Communication Inc., Telefonica S.A., Twilio Inc., Apigee Corp., Alcatel-Lucent, Orange, Aepona Ltd., Fortumo OU, and Others The key vendors in the Telecom API market are the key players.

Telecom API providers introduce new products and services in order to increase their market share. India’s Reliance Jio was the first to achieve Open API Platinum compliance in 2021. This is a sign of a growing trend toward open APIs to create an open ecosystem for startups in the telecom sector. The following are some of the most l players in the global telecom API market:

Маrkеt Key Рlауеrѕ:

- AT&T, Inc.

- Google LLC

- Verizon Communication, Inc.

- Telefonica S.A.

- Twilio Inc.

- Apigee Corp.

- Alcatel-Lucent

- Orange

- Aepona Ltd.

- Fortumo OU

- Other Key Players

For the Telecom API Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Telecom API market size in 2021?A: The Telecom API market size is $ 1,61,000 million in 2021.

Q: What is the CAGR for the Telecom API market?A: The Telecom API market is expected to grow at a CAGR of 21.8% during 2023-2032.

Q: What are the segments covered in the Telecom API market report?A: Market.US has segmented the Global Telecom API Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, the market has been segmented into Messaging API, WebRTC API, Payment API, IVR API, and Other Types. By End-User, the market has been further divided into Enterprise Developers, Internal Telecom Developers, Partner Developers, and Long Tail Developers.

Q: Who are the key players in the Telecom API market?A: AT&T, Inc., Google LLC, Verizon Communication, Inc., Telefonica S.A., Twilio Inc., Apigee Corp., Alcatel-Lucent, Orange, Aepona Ltd., Fortumo OU, Other Key players are the key vendors in the Telecom API market

Q: Which region is more attractive for vendors in the Telecom API market?A: North America accounted for the highest revenue share of 30% among the other regions. Therefore, the Telecom API market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Telecom API?A: Key markets for Telecom API are the USA, India, China, and Germany.

Q: Which segment has the largest share in the Telecom API market?A: In the Telecom API market, vendors should focus on grabbing business opportunities from the Messaging API segment as it accounted for the largest market share in the base year.

![Telecom API Market Telecom API Market]()

- AT&T, Inc.

- Google LLC

- Verizon Communication, Inc.

- Telefonica S.A.

- Twilio Inc.

- Apigee Corp.

- Alcatel-Lucent

- Orange

- Aepona Ltd.

- Fortumo OU

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |