Global Thermal Paper Market By Width (2.25” (57mm) and 3.125” (80mm)), By Application (Lottery & Gaming, Point of Sale (PoS), and Tags & Labels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 18414

- Number of Pages: 204

- Format:

- keyboard_arrow_up

Thermal Paper Market Overview:

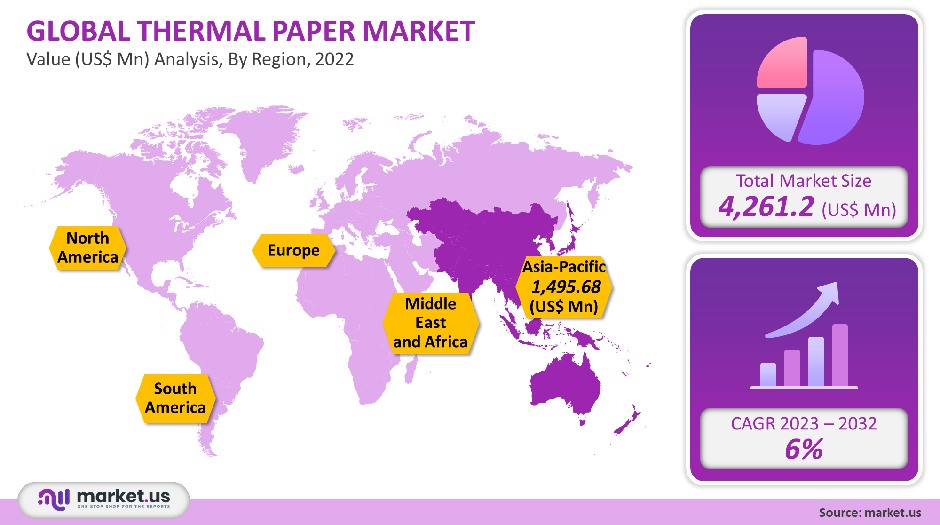

The global thermal paper market accounted for USD 4,261.2 million in 2021. It is estimated to grow at a compound annual growth rate (CAGR) of 6% between 2023 to 2032.

Market growth is expected to be driven by the increasing popularity of Point of Sale (PoS), machines that allow retail transactions to take place.

Product demand will also be driven by the increasing importance of labeling/providing detailed descriptions of ingredients in the food products and beverage industries. This is to prevent adulteration practices. In the near future, industry growth will be aided by the increasing use of Radio-Frequency Identification tags (RFID) in the healthcare sector. The thermal paper market report gives an overview of the market growth, size, and other key factors.

Global Thermal Paper Market Scope:

Width analysis

There are three categories for the market: 2.25″ (57mm), 3.125″ (80mm), and others. Thermal paper producers make these sheets in a variety of widths ranging from 1.46″ (37mm) to 4.33″ (110mm), as well as in full-scape and bespoke sizes. Because there is such high demand for the 3.125″ type of paper for use in POS terminals and lottery tickets, they are used in the highest amount out of all of these widths. Due to the rise in supermarkets and hypermarkets as well as the use of digital billing counters in brick-and-mortar stores, there is a high demand for this type of paper form in this market sector.

However, the 2.25″ width category also accounts for a sizeable portion of the market trends due to its widespread use in ticketing and labeling applications. Additionally, 2.25″ thermal paper is used in Card payment terminals, and throughout the course of the projection period, it is predicted that the market insights for 2.25″ paper will continue to grow steadily due to the growth in cashless transactions in developing nations.

Application analysis

Point-of-Sale (PoS), which accounted for 65.1% of the global revenue share in 2021, led the thermal paper market share. Because of its ease of printing, the product is popular in PoS machines. The segment has also seen a wide range of mobile PoS Terminals used in public utilities, transportation, and retail markets. The demand for PoS transactions is increasing in emerging economies like India, China, and Vietnam. The market growth will be slowed by the gradual adoption of electronic receipts.

The fastest expected CAGR for tags & labels is 6.9% during the forecast period. The primary drivers of segment growth are likely to be the growing use of tags and labels in the retail industry, food & drink, and pharmaceutical industries. The segment will also be driven by the increasing adoption of detailed labeling within the pharmaceutical industry. These labels can be found in both the type of paper and hallmark forms.

They provide details about the nutritional ingredients as well as avoid duplication. It is used in the pharmaceutical industry to provide information about manufacturing, expiry dates, composition, bar codes, and other related data for products such as drugs, injections, and pharmaceutical equipment.

End uses of Thermal papers are retail stores, supermarkets, and warehouses. Also, in the labeling and packaging sector are the industrial and logistical end-uses.

Кеу Маrkеt Ѕеgmеntѕ

By Width

- 2.25” (57mm)

- 3.125” (80mm)

- Other Widths

By Application

- Lottery & Gaming

- Point of Sale (PoS)

- Tags & Labels

- Other Applications

Market Dynamics:

In 2021, the U.S. market’s largest segment was PoS (Point-of-Sale). The primary reason for segment growth was the high penetration of PoS machines to carry out daily transactions. The segment’s growth has been aided by the widespread use of portable PoS devices for issuing parking tickets.

The main raw material for the production of thermal papers is leuco dye. Over 82.1% of global leuco-dye production is made in China. The implementation of strict pollution control rules in China has resulted in an unprecedented increase in the leuco dye price, which in turn has increased the cost of thermal paper. The leuco dye molecules react with the developer when heated, resulting in the printed image on base paper. Many thermal paper production images are in black and white. However, dye technology has made it possible to create images in other colors.

The forecast period will see a growing preference for electronic receipts to facilitate purchase transactions. This is likely to be a significant threat to product demand. Market growth will be impeded by the U.S. and European restrictions on bisphenol A-based products due to their adverse effects on human reproduction. The market declined during the pandemic, due to a decline in production rates.

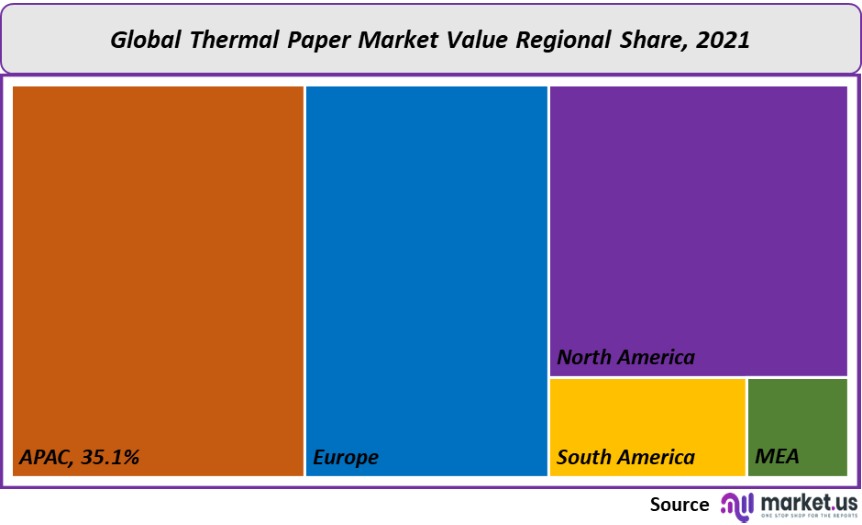

Regional Analysis

The Asia Pacific region was the dominant market, accounting for more than 35.1% of total revenue in 2021. Due to rapid growth in the retail sector and rising demand for healthcare products, billing operations have seen a rise in product utilization. The market has also seen a rise in cashless payments and contactless payments. Europe is now a major manufacturing center for nutritional supplements and other products.

This is due to the presence of prebiotic manufacturers such as Friesland Campina Doo (The Netherlands) and Beneo (Belgium). These companies are gradually adopting labels and tags in order to comply with the labeling standards and prevent adulteration. From 2023 to 2032, the MEA regional market will experience the second-highest average CAGR.

This is due to high product demand, which has been attributed to an increase in the number of shopping malls and retail stores in Saudi Arabia. Over the forecast period, U.S. product demand is expected to increase at a 4.6% CAGR. Major food and beverage products companies such as Tyson Foods, Cargill Foods, and JBF are expected to increase the use of printed labels and tags. This will likely fuel product demand.

A detailed analysis of key regions is given below including North America, Europe, Asia- Pacific, South America, and Middle East & Africa.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

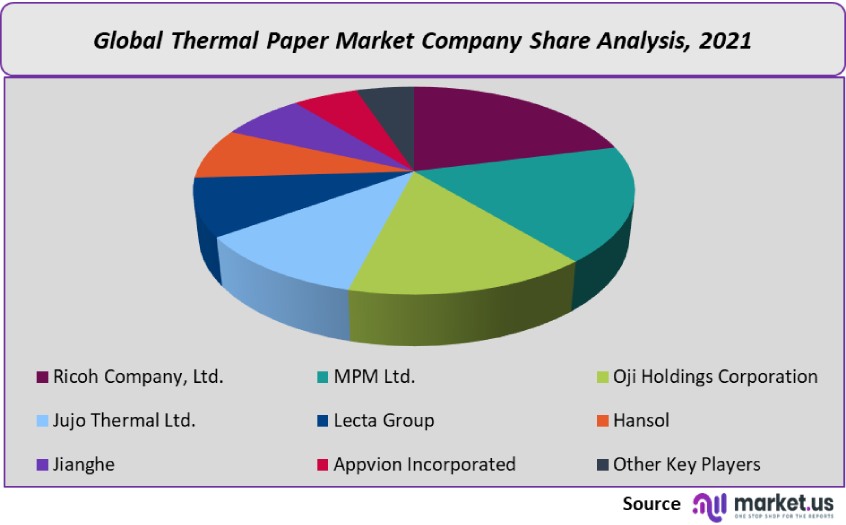

Market Share & Key Players Analysis:

The global market is highly oligopolistic and fierce price competition exists between companies. This market is highly competitive and has tight margins. Companies’ profitability is heavily dependent on the price of raw materials as well as the automation required to make the production process more efficient. The industry profit margins also vary depending on the level of integration.

Market key players are given including Ricoh Company Ltd., MPM Ltd, Mitsubishi Paper Mills, Oji Holdings Corporation, Koehler Group, Iconex LLC, Domtar Corporation, Appvion Operations Inc, Kanzaki Specialty Papers Inc. and other key companies, and key trends.

Маrkеt Кеу Рlауеrѕ:

Major players from the Thermal Paper industry are given below,

- Ricoh Company, Ltd.

- MPM Ltd.

- Oji Holdings Corporation

- Jujo Thermal Ltd.

- Bizerba USA Inc.

- Lecta Group

- Hansol Paper Co Ltd

- Henan Province JiangHe Paper Co.

- Jiangsu Wampolet Paper Co.,

- Appvion Incorporated

- Mitsubishi HiTec Paper Europe GmbH

- Mitsubishi Paper Mills Limited

- Koehler Paper Group

- Twin Rivers Paper Company

- Chenming Paper Holdings Ltd

- Iconex LLC

- NAKAGAWA Manufacturing (USA), Inc.

- Nippon Paper Industries Co. Ltd

- Domtar Corporation

- Appvion Operations, Inc.

- Jujo Thermal Limited

- Henan Province

- Kanzaki Specialty Papers Inc.

- Guangdong Guanhao High-Tech Co.

- Gold Huasheng Paper Co., Ltd.

- Shandong Chenming Paper Holdings Ltd

- Other Key Players

Frequently Asked Questions (FAQ)

What is the size of the Thermal Paper market in 2021?The Thermal Paper market size is US$ 4,261.2 million in 2021.

What is the projected CAGR at which the Thermal Paper market is expected to grow at?The Thermal Paper market is expected to grow at a CAGR of 6% (2023-2032).

List the segments encompassed in this report on the Thermal Paper market?Market.US has segmented the Thermal Paper market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Width, market has been segmented into 2.25” (57mm) and 3.125” (80mm). By Application segment, the market has been further divided into Lottery & Gaming, Point of Sale (PoS), and Tags & Labels

List the key Market Players of the Thermal Paper market?Ricoh Company, Ltd., MPM Ltd., Oji Holdings Corporation, Jujo Thermal Ltd., Lecta Group, Hansol, Jianghe, Appvion Incorporated, and Other Market Players engaged in the Thermal Paper market trend.

Which region is more appealing for vendors employed in the Thermal Paper Business?APAC accounted for the highest revenue share of 35.1%. Therefore, the Thermal Paper industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the Thermal Paper business?China, Japan, India, the US, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for Thermal Paper Market.

Which segment accounts for the largest share of market in the Thermal Paper industry?With respect to the Thermal Paper industry, vendors can expect to leverage greater prospective business opportunities through the 3.125” (80mm) segment, as this area of interest accounts for the largest market share.

![Thermal Paper Market Thermal Paper Market]()

- Ricoh Company, Ltd.

- MPM Ltd.

- Oji Holdings Corporation

- Jujo Thermal Ltd.

- Bizerba USA Inc.

- Lecta Group

- Hansol Paper Co Ltd

- Henan Province JiangHe Paper Co.

- Jiangsu Wampolet Paper Co.,

- Appvion Incorporated

- Mitsubishi HiTec Paper Europe GmbH

- Mitsubishi Paper Mills Limited

- Koehler Paper Group

- Twin Rivers Paper Company

- Chenming Paper Holdings Ltd

- Iconex LLC

- NAKAGAWA Manufacturing (USA), Inc.

- Nippon Paper Industries Co. Ltd

- Domtar Corporation

- Appvion Operations, Inc.

- Jujo Thermal Limited

- Henan Province

- Kanzaki Specialty Papers Inc.

- Guangdong Guanhao High-Tech Co.

- Gold Huasheng Paper Co., Ltd.

- Shandong Chenming Paper Holdings Ltd

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |