Global Used Car Market By Vehicle Type (Conventional, Hybrid, Others), By Fuel Type (Diesel, Petrol, Others), By Vendor Type, By Size, By Sales Channel, By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 36636

- Number of Pages: 226

- Format:

- keyboard_arrow_up

Used Car Market Overview

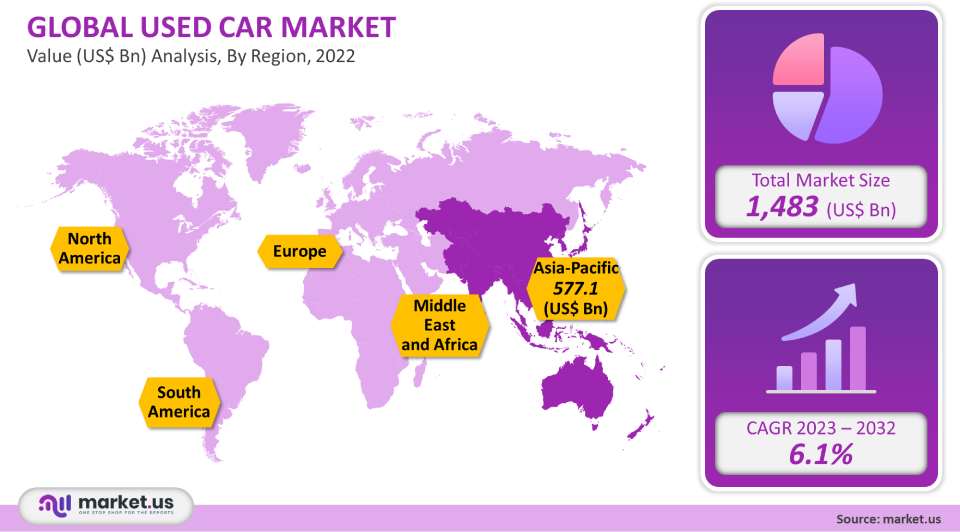

The used car market size is expected to be worth around USD 284 Billion by 2032 from USD 148 Billion in 2021, growing at a CAGR of 6.1% during the forecast period 2021 to 2031.

Owing to higher levels of competitiveness among new industry players, this market has indexed significant growth over the past few years. In 2021, 120.3 million used cars were shipped. The average price of a new vehicle has risen faster than the average wage has over the past decade, making it difficult for individuals to purchase a new car outright. This growth is also supported by investments from industry players to build their respective dealership networks.

Market Scope:

Vehicle Type Analysis

On the basis of vehicle type shipments, the conventional vehicle segment accounted for a significant market share of more than 43.2% in 2021. The hybrid vehicle sub-segment is also expected to index a substantial CAGR over the forecast period. In the last few years, electric vehicles have become a more affordable transportation option for consumers.

And this remains to be a significant driver for the sale of electric vehicles. According to price analysts, the cost of used electric vehicles has been lower than that of used hybrid cars in the past few years. The demand for luxury cars sub-segment has electric vehicle features such as technology-driven power, which is a status symbol and supports sustainability. This has also created a significant demand for used EVs.

Extensive inventories of conventional gasoline vehicles offer several options at reasonable prices. This category of vehicles represented the most important major share across all sizes, including SUVs and compact cars. A substitute for traditional gasoline vehicles is also in demand due to growing environmental and pollution concerns.

Vendor Type Analysis

In 2021, the organized vendor sub-segment accounted for the largest share volume, at over 68%. This could be attributed to the growing number of franchised sellers in this market. Market growth was also fueled by the entry of new industry players and the development of new retail models. National Automobile Dealers Association (NADA) reports that franchised dealers in the United States made more money on used vehicles than independent dealers. The organized basis of vendor type also enjoyed greater customer loyalty across all age demographics.

Over the forecast period, organized vendor segments are expected to experience high growth. This segment is expected to account for more than 2/3rds of the market in the coming years. This market is fragmented because there are many dealers around the world, particularly in developed countries such as the US, Germany, or the UK. Top dealers such as CarMax Business Services LLC, and Asbury Automotive Group, account for over half of this market’s volume.

Fuel Type Analysis

In developing countries, CNG-powered vehicles have seen a steady upsurge in used vehicle sales. In 2021, the petrol segment’s largest volume share was over 45.6%. This can be attributed to a decline in diesel vehicle use, as the government discourages the sale of used diesel vehicles. Over the forecast period, the ‘others’ segment is slated to experience significant growth.

This slump in diesel vehicle sales is partly due to strictly imposed emission standards for gasoline, NG, LPG, and diesel engines. A decline in sales of diesel engines and a surge in the demand for substitutes can also be attributed to excessive NOx emissions. The standard for petrol-powered cars is lower than that of diesel-fueled passenger vehicles. A refined engine, good fuel efficiency, and top-end solid performance have attracted large numbers of consumers in the past few years. This is expected to continue in future trends. The petrol cars segment was also driven by an increase in the inventory of petrol-based SUVs.

Size Analysis

In 2021, the advancements in the SUV segment accounted for 39.0% of the total market volume. The SUV market has been a victim of changes in the automotive market. Buyers in different regions consider SUVs ideal because they offer space and are smaller than off-road vehicles. The market’s residual value is higher today because of greater demand and broader supply. There has been a significant demand for used SUVs in Europe. Over the forecast period, the compact size sub-segment is anticipated to experience a significant increase in CAGR.

Individuals prefer compact and economical vehicles. Franchisees prefer compact cars with a high production rate and a large inventory. The demand for used compact cars has increased over the past few years due to their easy availability and affordable prices. The used SUV market has indexed significant revenue growth due to changing consumer preferences and improvements in SUVs. This trend is expected to continue in the foreseeable future

Sales Channel Analysis

The online sales channel sub-segment is expected to register significant growth in the coming years. In 2021, offline sales made up 78.4% of the total sales volume. This can be attributed to consumers’ preference for traditional purchasing methods. Online tools have made it easier for buyers and sellers to connect. Dealers can also access online information, including reviews, prices, and specifications, thus facilitating significant market growth opportunities. Online dealers empower digitally savvy customers by providing them with complete end-to-end buying capabilities, unique delivery options, extensive vehicle photos, data, and search tools.

Various dealers are growing their given customer bases and networks using technically advanced devices that integrate with AI and Machine Learning technology. AI applications can analyze dealer management system data and help in refining marketing and sales strategies. Online sales channels like mobile.de, CarMax, and eBay can be essential in country-specific growth by targeting domestic customers. Numerous online platforms have been modified to provide seamless car purchasing and selling experiences. For example, the Asbury Automotive Group, announced the product launch of Clicklane in December 2020, a digital solution that allows users to buy used cars online.

Key Market Segments:

Vehicle Type

- Conventional

- Hybrid

- Electric

Fuel Type

- Diesel

- Petrol

- Other Fuel Types

Vendor Type

- Unorganized

- Organized

Size

- SUVs

- Compact

- Mid-Size

Sales Channel

- Offline

- Online

Used Car Market Dynamics:

In recent years, the used cars market size has grown significantly, with a record number of cars being sold in 2017. There are a few key reasons why the used car market is booming. Firstly, new cars are becoming increasingly unaffordable for many people. Secondly, cars now tend to last longer than ever thanks to technological and manufacturing advancements. This means that people are holding onto their vehicles for longer and only trading them in when they absolutely need to. This is good news for consumers and the environment.

Online sales have become an important market growth factor. The internet has played a crucial role in providing consumer base access to auto markets. The market report has seen substantial growth due to affordability, available used vehicles, and a surge in personal mobility. These developments have led to a significant increase in demand for used cars. eBay Inc., for example, launched an eBay Motors app in 2019 to increase the online sale and purchase of used cars.

One of the most significant industry restraining factors is the lack of information available to potential buyers. When buying a used car, it is essential to know as much about the vehicle as possible, including its history, mileage, and any previous accidents or damage. However, often this information is not readily available, and potential buyers are forced to rely on word-of-mouth or the seller. This can lead to buyers being misled about a car’s condition, which could certainly cause problems down the road.

Another restraining factor is the high cost of repairs and maintenance. In some cases, repairs can cost more than the car’s value. The problem is that parts are often no longer available for older cars because either the manufacturer no longer exists or simply because of how old the vehicle actually is. A more recent solution to the problem of selling older cars is the advent of online marketplaces. Online marketplaces allow vehicle owners to quickly reach a wider audience and attract market potential buyers.

Automotive Industry dealers and manufacturers have focused mainly on new vehicles, excluding the used automobile industry, often seen as an afterthought. The increased competition in this market and the threat from new competitors have led to a significant increase in used car dealerships. The increased quality service and reliability of the used cars industry have changed consumer attitudes and increased sales of used passenger cars.

This market is competitive and has high standards. Investing in used vehicle management has become a requirement. The market has changed dramatically due to technological advancements like the internet and the introduction of hybrid and electric vehicles. The dealership networks make used car options viable to market participants.

Consumers are more informed about a vehicle’s characteristics, such as its residual value, quality finance charges, availability, price, and sometimes the profit margin that the seller makes when closing a deal. This knowledge has changed market dynamics and allowed customers to use their intelligence, leading to a greater number of them opting for the used cars industry instead.

Key driving factors that drive the used car market include transparency and symmetry between buyers and consumers, online sales channel market growth, and certified used vehicle programs. Many top companies have opened online and offline outlets worldwide to offer seamless car buying. AutoNation Inc., for example, opened two new Denver-area stores and expanded its pre-owned vehicle shop in September 2020. It also stated its goal of opening 130 AutoNation Inc. stores across the US by 2026.

In developed and developing nations, the ratio of used vehicles to new vehicles has increased over the past few years. This is due to the reasons mentioned earlier. Franchised dealers have the advantage of OEM support in certification and marketing programs, online inventory pooling, and access to high-quality contracts.

The COVID-19 pandemic had dramatically disrupted the automotive industry. It caused consumers to choose private transport. Financial inequalities will likely prevent the purchase of new vehicles, as commuters opt for used cars due to budget limitations.

The current economic landscape will make it difficult for the hybrid and electric cars industry to compete in this market over the next two to three years. The impacts of this pandemic on the automotive market are slated to increase the demand for mid-size vehicles. In developing countries, the onset of this pandemic has led to certain entry-level compact cars returning to the market. This market is also slated to vary as each individual has different preferences when choosing a vehicle class.

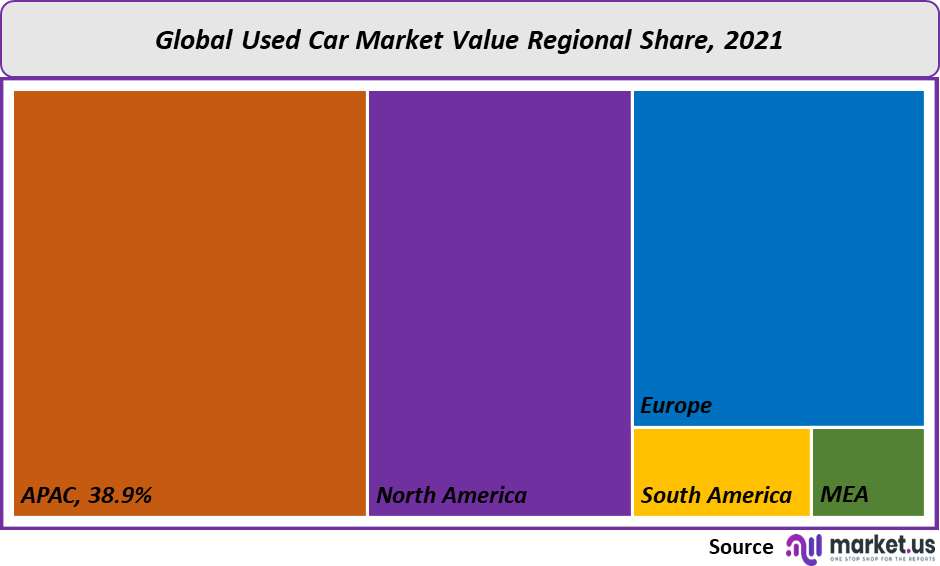

Regional Analysis

Regarding shipment volumes, the Asia Pacific segment held the largest share 38.9%, in 2021. This is mainly due to the rapid demand growth for used cars in China. The highest projected CAGR over the forecast period for the Asia Pacific region is 5%. This can be attributed to the increased sales of used cars in China, India, and other Asian countries. Despite a decline in growth over the last few years, North America held a significant market share in 2021. This region is expected to index a steady increase in the coming years.

China is expanding its market share in the Asia Pacific region thanks to the increasing number of used car trading companies. Many Indian car dealers offer a wide range of technology-enabled tools. These include mobile-based apps, virtual showrooms, cloud services for lead management, tracking sales performance, digital marketing support, and cloud services. These technological advancements in India’s used car market have created tremendous consumer opportunities. The market has significant potential in the region, including in Indonesia, Malaysia, as well as South Korea, and other developing nations.

Key Regions and Countries Covered in this Report:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

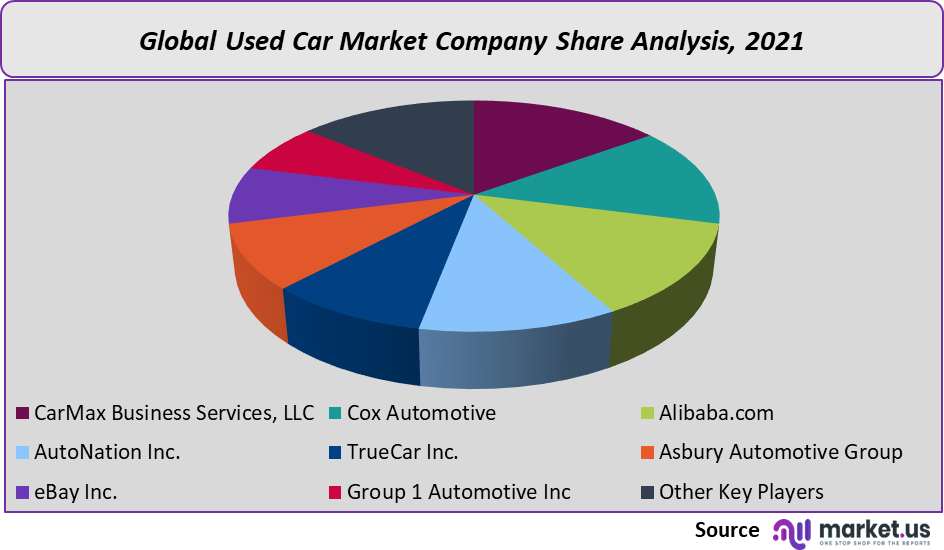

Market Share & Key Players Analysis:

With their pre-owned car sales networks, such as Maruti Suzuki’s TrueCar, Inc. Value, M&M Mahindra’s First Choice Wheels, and Toyota’s U Trust, mainstream automakers have been expanding their presence within this market. Key major players now focus on increasing their customer bases to gain a greater market maximum share. The basis of Vendor type is proactively considering strategic initiatives such as acquisitions, mergers, and collaborations. In 2020, Volkswagen announced a significant investment in the used car market through a partnership between Das WeltAuto and other used car platforms. The following are some of the most prominent major market players in the global used car market.

Market Key Players:

- CarMax Business Services LLC

- Cox Automotive

- Alibaba.com

- AutoNation Inc.

- TrueCar Inc.

- Asbury Automotive Group

- eBay Inc.

- Group 1 Automotive Inc.

- Hendrick Automotive Group

- LITHIA Motor Inc.

- Scout24 AG

- Other Key Players

For the Used Car Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

148 Billion

Growth Rate

6.1%

Forecast Value in 2032

284 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What was the size of the used car market in 2021?The used car market was valued at US$ 1483 Billion in 2021.

What is the projected CAGR at which the used car market is expected to grow at?The used car market is expected to grow at a CAGR of 6.1% (2023-2032).

List the segments encompassed in this report on the used car market?Market.US has segmented the used car market, by regions (North America, Europe, APAC, South America, and the Middle East and Africa). By vehicle type, this market has been segmented into Conventional, Hybrid, and Electric; By fuel type, it has been segmented into diesel, petrol, and other fuel types; By vendor type, this industry has been segmented into unorganized and organized players; By size, it has been segmented into SUVs, Compact, and Mid-Size; And by sales channel, this market has been segmented into offline and online sites.

List the key industry players in the used car market?CarMax Business Services LLC, Cox Automotive, Alibaba.com, AutoNation Inc., TrueCar Inc., Asbury Automotive Group, eBay Inc., Group 1 Automotive Inc., Hendrick Automotive Group, LITHIA Motor Inc., and Scout24 AG.

Which region is more appealing for vendors employed in the used car market?North America accounted for the highest revenue share of 38.9%. Therefore, the used car industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the used car market.The US, Canada, Mexico, Indonesia, China, Japan, Germany, France, UK, India, etc., are leading key areas of operation for the used car market.

Which segment accounts for the greatest market share in the used car industry?With respect to the used car industry, vendors can expect to leverage greater prospective business opportunities through the conventional vehicle segment, as this area of interest accounts for the largest market share.

![Used Car Market Used Car Market]()

- CarMax Business Services LLC

- Cox Automotive

- Alibaba.com

- AutoNation Inc.

- TrueCar Inc.

- Asbury Automotive Group

- eBay Inc.

- Group 1 Automotive Inc.

- Hendrick Automotive Group

- LITHIA Motor Inc.

- Scout24 AG

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |