Global Water Treatment Chemicals Market By Product Type (Coagulants & Flocculants, Biocide & Disinfectant, pH, and Other product types), By End-Use (Power, Oil & Gas, Chemical Manufacturing, and Other End-Uses) and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032.

- Published date: Mar 2022

- Report ID: 31750

- Number of Pages: 328

- Format:

- keyboard_arrow_up

Water Treatment Chemicals Market Overview:

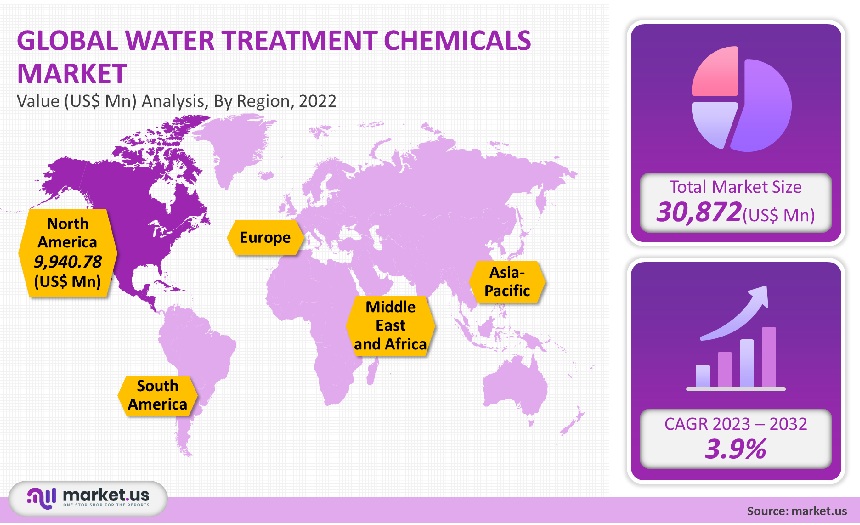

The global market for water treatment chemicals was valued at USD 30,872 million in 2021. The market is estimated to grow at a compound annual growth rate of 3.9% between 2023-2032.

This is due to the growing demand for sugar, ethanol, fertilizers, and geothermal energy. Due to the increasing use of saline treatment to meet rising water demands, the market will see promising growth in Africa and the Middle East. Desalination is the most used technology in the Middle East.

Saudi Arabia heavily relies on desalination for its water supply. The region is a significant consumer of industrial chemicals due to its high water use for oil and gas industries. The most common process in the region is desalination. It makes use of large-scale scale inhibitors and coagulants.

Global Water Treatment Chemicals Market Scope:

Product Type Analysis

Tanks of chemical products for oil or gas plants coagulate, flocculate, and other chemical products. Coagulants/flocculants were the largest product segment with a revenue share of 38.1% or more in 2021, and coagulants/flocculants were the largest product segment. These coagulants are available in organic and inorganic forms, including aluminum sulfate or aluminum hydroxide chlorine.

Coagulants are added to wastewater treatment to remove suspended solid particles of 90% or more. Because most treatment plants incorporate sedimentation, this is why coagulants are necessary. The coagulation process accelerates the sedimentation process.

It is crucial to control microbiological activity during manufacturing and industrial processes. Biocides and disinfectants are second in popularity because they help maintain manufacturing efficiency and protect manufacturing systems. They reduce the risk of contamination and prevent dangerous microbial growth. They can be used to maintain water conditions for food, water wastewater, and treated water.

They are used in the sugar, ethanol, and water treatment industries to properly treat wastewater. Biocides are also used to control bacteria in the ethanol fermentation process.

End-Use Analysis

Due to the increasing water scarcity in North America, Europe, and other developed countries, major players have switched to recycling and reusing water. With more than 39.2% revenue share, municipal emerged as the largest end-use segment in 2021. This is largely due to the high use of chemicals for municipal wastewater treatment.

Due to the rising costs of municipal waste treatment, industrialists were encouraged to establish or improve wastewater treatment and reuse facilities. Fluid treatment can include emulsion breaking and flocculation as well as sludge elimination.

Oil and gas have become a major end-use sector due to their high use in oil refineries and subsequent high wastewater generation. Petroleum refineries and chemical plants use steam and water for various processes, including desalination, fluid catalyst cracking units, and cooling towers.

Water treatment is essential to ensure that chemical plants and petroleum refineries can continue to function reliably and sustainably. This will increase demand for chemicals within the oil and natural gas industry during the forecast period.

Key Market Segments:

By Product Type

- Coagulants & Flocculants

- Biocide & Disinfectant

- pH, Adjuster & Softener

- Defoaming Agent & Defoamer

- Other product types

By End-Use

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Other End-Uses

Market Dynamics:

The rapid growth in the industrial sector and increased urbanization will lead to a significant increase in water treatment chemical markets for flocculants and coagulants, as well as corrosion inhibitors and pH boosters. Due to strict regulations and the substantial decline in freshwater resources, these chemicals will be in great demand.

One prominent trend on the market is the increase in demand for fluid treatment units, which can be used to treat small and medium-sized companies in their facilities. This will ensure zero discharge.

Region Analysis

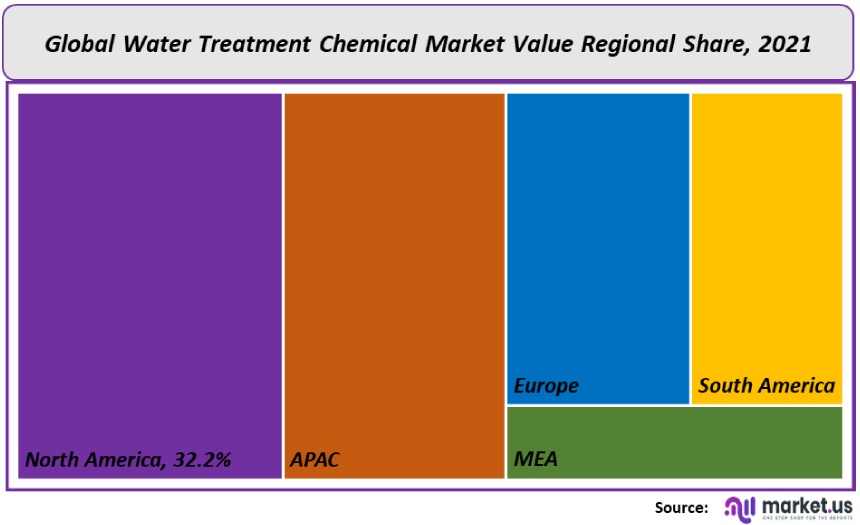

In 2021, North America held more than 32.2% of the market. Hydraulic fracturing has led to an increase of unconventional sources such as tight oil and shale in North Dakota and West Texas. This has resulted in a greater penetration of water treatment plants within the upstream oil and gas sector. This will have a positive effect on the market over the forecast period.

Over the forecast period, the U.S. will grow at a 2.4% CAGR. This is possible because of strict regulations governing the disposal and production of wastewater. According to the International Trade Administration (ITA), the United States is a leader in energy production, consumption, and supply (presence of thermoelectric power plants). The U.S. Power Industry’s rising demand for chemicals to treat water will positively impact market growth.

The demand for boiler chemicals will rise in Asia Pacific’s emerging economies due to increased manufacturing, industrial, and power sector growth. China is increasingly looking for pretreated water due to high heavy metals and suspended parts.

China Water Risk (CWR) works for several government agencies in China and worldwide. CWR reports on the risks and impacts of wastewater in China’s agricultural, power, food, and textile industries. CWR reports help address problems and contributes to water treatment efforts.

Key Regions and Countries covered іn thе report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

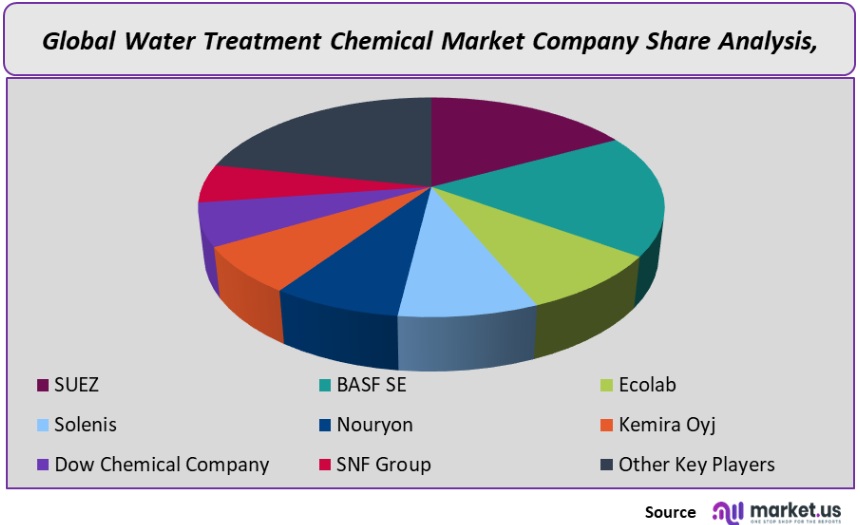

Market fragmentation is a fact of life. Manufacturers are known for their high degree of integration. There are in-house production facilities for raw materials and long-term supply agreements between raw material suppliers.

Companies sell their products on both the domestic and international markets through various distribution channels including direct supply agreements and third-party suppliers. These suppliers not only buy the final products from the manufacturer but also distribute them throughout the region via a large product distribution network.

Businesses can now supply direct, manufacture, distribute, apply, and have control over the final product. Companies have seen increased profits due to their involvement at every stage of the value chain. This has allowed them to lower the cost of distribution and allow them to better manage the pricing of the products. Here are the top players in the water treatment chemicals market:

Маrkеt Key Рlауеrѕ:

- SUEZ

- BASF SE

- Ecolab

- Solenis

- Nouryon

- Kemira Oyj

- Dow Chemical Company

- SNF Group

- Cortec Corporation

- Buckman

- Solvay S.A.

- Other Key Players

For the Water Treatment Chemicals Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Water treatment chemicals Market size in 2021?A: The Water treatment chemicals Market size is US$ 30,872 million in 2021.

Q: What is the CAGR for the Water treatment chemicals Market?A: The Water treatment chemicals Market is expected to grow at a CAGR of 3.9% during 2023-2032.

Q: What are the segments covered in the Water treatment chemicals Market report?A: Market.US has segmented the Global Water treatment chemicals Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Coagulants & Flocculants, Biocide & Disinfectant, Defoamer & Defoaming Agent, pH, Adjuster & Softener and other product Type. By End-Use, market has been further divided into Power, Oil & Gas, Chemical Manufacturing, Mining & Mineral Processing, and Other End-Uses.

Q: Who are the key players in the Water treatment chemicals Market?A: SUEZ, BASF SE, Ecolab, Solenis, Nouryon, Kemira Oyj, Dow Chemical Company, SNF Group, and Other Key Players are the key vendors in the Water Treatment Chemical market

Q: Which region is more attractive for vendors in the Water treatment chemicals Market?A: North America accounted for the highest revenue share of 32.2% among the other regions. Therefore, the Water treatment chemicals Market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for water treatment chemicals?A: Key markets for Water treatment chemicals are the U.S., Canada, Mexico, Germany, U.K., France, Spain, China, India, Japan, Indonesia, Brazil, Colombia, Saudi Arabia, Azerbaijan, Uzbekistan, Turkey, Turkmenistan, Iran, Kazakhstan, and Georgia.

Q: Which segment has the largest share in the Water treatment chemicals Market?A: In the Water treatment chemicals Market, vendors should focus on grabbing business opportunities from the Coagulants & Flocculants segment as it accounted for the largest market share in the base year.

![Water Treatment Chemicals Market Water Treatment Chemicals Market]() Water Treatment Chemicals MarketPublished date: Mar 2022add_shopping_cartBuy Now get_appDownload Sample

Water Treatment Chemicals MarketPublished date: Mar 2022add_shopping_cartBuy Now get_appDownload Sample - SUEZ

- BASF SE

- Ecolab

- Solenis

- Nouryon

- Kemira Oyj

- Dow Chemical Company

- SNF Group

- Cortec Corporation

- Buckman

- Solvay S.A.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |