Global 3d Printers Market By Type (Metal Printing, Plastics Printing, And Composites Printing), By Application (Industrial, Aerospace And Military, Healthcare, Consumer Products, And Automotive.

- Published date: May 2022

- Report ID: 11969

- Number of Pages: 328

- Format:

- keyboard_arrow_up

3D Printing Market Overview:

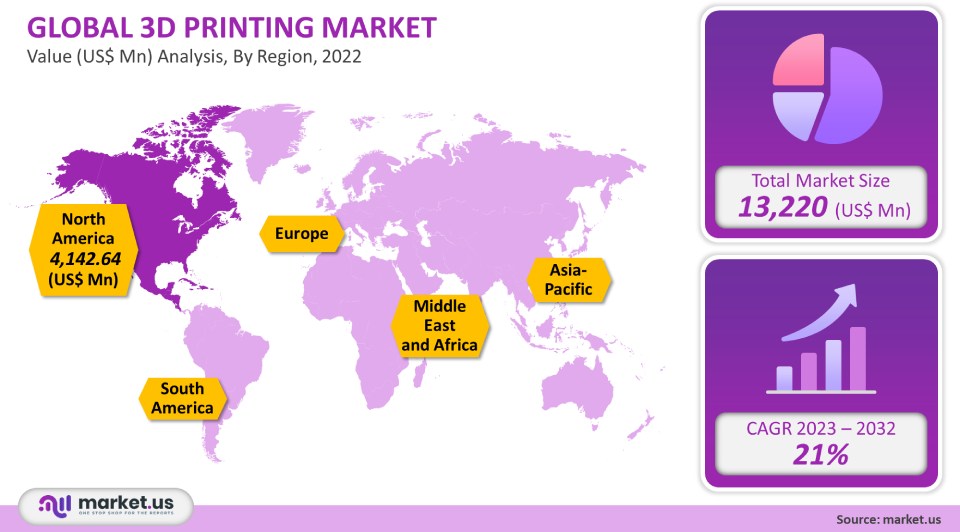

The 3D Printers Market is expected to be worth around USD 17,940 million by 2031 from USD 13,220 million in 2021, growing at a CAGR of 21% from 2021 to 2031.

3D printers shipped 2.3 million units worldwide. By 2032, the number of shipments is expected to rise to 22 million. This market will continue to grow due to the aggressive research and development in the 3D printing industry and the growing demand for prototyping applications across various industries, including healthcare, aerospace, defense, and automotive. The 3d printing market is used in various industry verticals to design products according to necessity. 3d printing system has lots of advantages in the healthcare industry. This market report overviews the 3d printing market growth, size, and other key factors.

Global 3D Printing Market Scope:

Printer type analysis

The market’s largest segment, the industrial printer segment, accounted for over 71.01% of global revenue in 2021. The printer type further sub-segments the industry into desktop and industrial 3D printers. A large percentage of industrial 3D printers is due to the widespread adoption of industrial printers within heavy industries like electronics, defense, and aerospace, as well as healthcare. These are the most popular industrial applications in these industries.

The growing industrial sector is embracing 3D printing projects’ market share for prototyping and designing. The forecast period will see the industrial printer market continue to dominate. Desktop 3-D printers were initially only used by hobbyists and small businesses. They are now being used more for domestic and household purposes. Desktop printers are also being used by the education sector (schools, universities, and educational institutes) for research and technical training.

Many small businesses now use desktop printers to diversify their business operations and offer 3D printing. The concept of “fab shops” is growing in popularity in the U.S. These fab shops allow customers to order 3D printed parts and components on demand. The forecast period will see a significant increase in demand for desktop printers.

Technology analysis

Stereolithography accounted for over 8.3% of global revenue in 2021. Technology-based segmentation was done into stereolithography (FDM), fuse deposition modeling (DMLS), select laser sintering(SLS), and laser metal deposition (EBM), as well as digital light processing, laminated object manufacture (LOM), and other segments.

Stereolithography is one of the oldest printing technologies. Stereolithography technology is popular because of its ease of operation and advantages. However, technological advances and aggressive research and development by industry experts and researchers have opened up new opportunities for other reliable and efficient technologies.

Fused Deposition Modeling (FDM), widely adopted across many 3DP processes, accounted for a significant revenue share in 2021. DLP, EBM, and inkjet printing segments will see a rise in adoption as these technologies can be used in specialized additive manufacturing processes. These technologies could be adopted due to the growing demand from aerospace, defense, healthcare, automotive, and other verticals.Software analysis

Design software dominated the market, accounting for over 32.5% of global revenue in 2021. The market is expected to remain dominant during the forecast period. The 3DP industry can be divided into four segments: design software (inspection software), printer software (printer software), and scanning software. Software used to design the objects to be printed called design software. This is especially true in aerospace, defense, and construction, as well as engineering verticals. The software connects the objects to print and the printer’s hardware.

Due to the increasing popularity of scanning objects and storing scans, scanning software will continue to be in demand. The scanning software segment is expected to grow due to its ability to store scanned images of objects regardless of their dimensions and allow for 3-dimensional printing. Due to the increasing adoption of scanners, the scanning software segment will register a 22.1% CAGR from 2023 through 2032. It is expected to generate significant revenues during this forecast period.

Application analysis

Prototyping dominated the market, accounting for over 53.2% of global revenue in 2021. The industry can be further divided by application into tooling, prototyping, and functional parts. This is due to the widespread adoption of prototyping across multiple industry verticals. Prototyping is used by the aerospace, defense, and automotive industries to precisely design and develop components and parts.

Manufacturers can use prototyping to develop high-quality products and improve their accuracy. Prototyping will continue to dominate the market over the forecast period. Functional parts are smaller joints and other metal hardware connecting components. It is crucial to accurately and precisely size these functional parts when designing machinery and systems. In line with the increasing demand for functional parts design and construction, the functional parts segment will grow at a significant CAGR (22.2%) between 2023 to 2032.

Кеу Маrkеt Ѕеgmеnts:

Following are some of the Market Segments from this industry.

By Printer Type

- Industrial 3D Printer

- Desktop 3D Printer

By Technology

- Fuse Deposition Modeling

- Stereolithography

- Selective Laser Sintering

- Inkjet Printing

- Direct Metal Laser Sintering

- Electron Beam Melting

- Polyjet Printing

- Digital Light Processing

- Laser Metal Deposition

- Laminated Object Manufacturing

- Other Technologies

By Software

- Scanning Software

- Design Software

- Printer Software

- Inspection Software

By Application

- Prototyping

- Functional Parts

- Tooling

Market Dynamics:

3D printing is often used in industrial applications. It is commonly called additive manufacturing (AM). With the help of software, additive manufacturing is a process of layer-by-layer adding material to create an object. The appropriate 3D printing technology for the process implementation is chosen from the available technologies. This last step is to deploy the process in different industries based on necessity.

Installation services are provided, along with consultation and support. All aspects of copyrights, licensing, and patenting are handled. Manufacturers can use 3D printing for prototyping, structure design, end products, modeling, time to market, and other aspects. Manufacturers can now offer higher quality products at lower prices because their production costs have decreased significantly. These benefits will result in a greater demand for 3D printers over the next few years.Misconceptions hamper the adoption of additive manufacturing about prototyping that small- and medium-sized manufacturers hold. Design companies, especially small-scale and medium-sized enterprises, are pondering before investing in prototyping as responsible investments. They don’t want to understand the benefits and advantages of prototyping fully. These companies believe prototyping is an expensive step before manufacturing. Prototyping is viewed as an expensive phase before the manufacturing of products. This perception, combined with a lack of technical knowledge, and a lack of standard process controls, will likely hinder the market growth.

The global economy has been severely affected by the COVID-19 pandemic. Regarding the COVID-19 cases, the most affected regions were the Asia Pacific and Europe. The situation deteriorated further in the U.S. The rapid spread of the virus caused the governments to order the total lockdown of key cities. The total lockdown impacted the production of 3D printer manufacturers. This was due to the labor shortage and disruption in logistics and supply chains throughout the country. The market growth was affected by the halt in 3D printing production in the first quarter and second quarter of 2020. But now, the demand for the 3d printer market will increase during the forecast period.

Regional Analysis

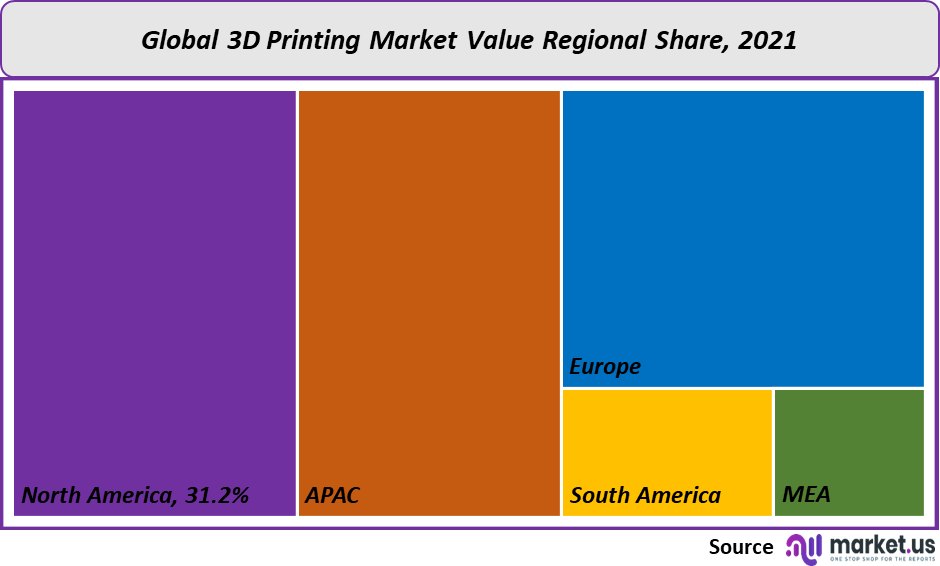

North America dominated the market, accounting for over 31.2% of global revenue in 2021. This is due to the region’s widespread adoption of additive manufacturing sectors. North American countries such as Canada and the U.S. have been early adopters of various additive manufacturing technologies. Europe is the most populous region by geographical area. Many players in the additive manufacturing industry are based there. They have strong technical knowledge about additive manufacturing processes. The European market was the second largest regional market in 2021. In 2022, the demand for 3d printing service market size in North America has increased more than in other countries.

Asia Pacific is expected to grow at the highest CAGR rate over the forecast period. The rapid adoption of AM within the Asia Pacific is due to improvements and upgrades in the region’s manufacturing industry. The Asia Pacific is becoming a hub for healthcare and automotive manufacturing. The region’s stronghold in electronics production and rapid urbanization are contributing to the growing demand for 3-D printing.

Key Regions and Countries covered іn thе rероrt:

The 3d printing market is divided into the following five major regions,

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

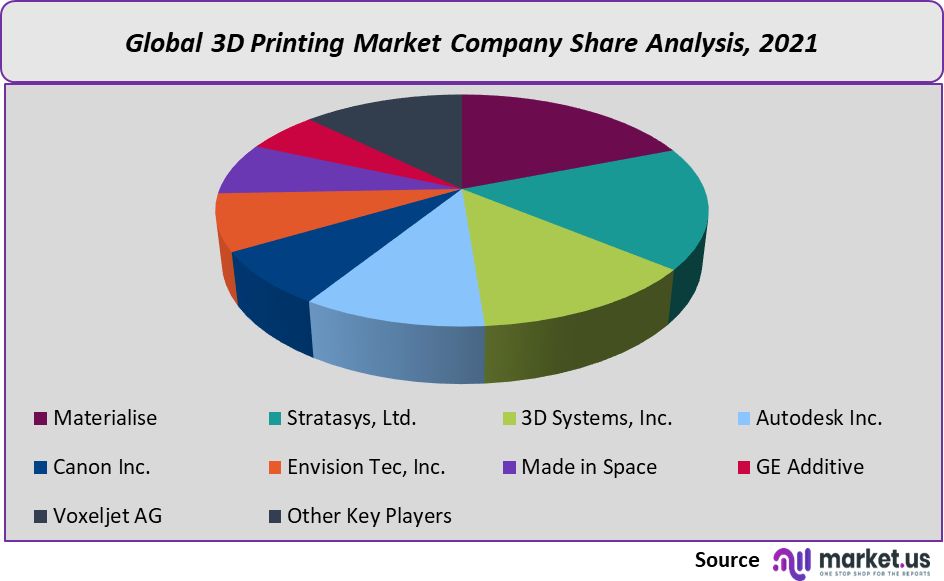

The market players are constantly improving the 3D printing technology in response to growing demand from aerospace, defense, healthcare, and other verticals for manufacturing. Major players recognize the potential for business transformation by incorporating additive manufacturing in new product development processes.

Stratasys Ltd. is a market leader in prototyping and is now leveraging the flexibility that 3D printing offers to improve the entire manufacturing value chain. The company’s innovative 3D printers feature Fused Deposition Modelling and Selective Absorption Fusion technology. This allows them to quickly and economically produce large parts for end-use using additive manufacturing. Some key players from this industry are listed below.

Маrkеt Кеу Рlауеrѕ:

Following are the Industry Players in the 3d printing market.

- Materialise

- Stratasys, Ltd.

- 3D Systems, Inc.

- Autodesk Inc.

- Canon Inc.

- Envision Tec, Inc.

- Made in Space

- GE Additive

- Voxeljet AG

- Other Key Players

For the 3D Printers Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![3D Printers Market 3D Printers Market]()

- 3D Systems

- Envision TEC

- ExOne

- Stratasys Ltd. Company Profile

- EOS

- Matsuura Machinery

- Shaanxi Hengtong Intelligent Machine

- Ultimaker

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |