Global Nitrogenous Fertilizer Market By Product Type (Urea, Methylene Urea, and Other Product types), By Application (Cereals & Grains, Oilseeds & Pulses, and Other applications) and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032.

- Published date: Sep 2021

- Report ID: 26710

- Number of Pages: 325

- Format:

- keyboard_arrow_up

Nitrogenous Fertilizer Market Overview:

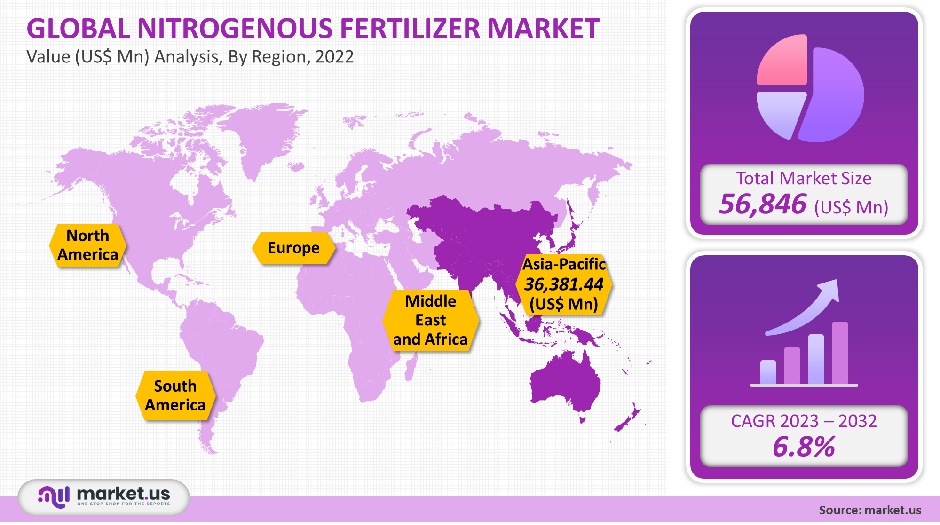

The nitrogenous fertilizer market size is expected to be worth around USD 117.20 billion by 2032 from USD 56.84 billion in 2021, growing at a CAGR of 6.8% during the forecast period from 2022 to 2032.

This is due to the growing popularity of agriculture at a commercial level around the globe.

There has been a significant increase in the demand for nitrogenous fertilizers for agriculture to improve yield and nutrition. These fertilizers are available in many agricultural commodities, including fruits, vegetables, and cotton.

Changes in the climate can have a significant impact on crop production. These can cause seasonal changes in crop supply and demand. Fertilizers are an essential ingredient in agricultural practice for crop-type growth enhancement. Many crops use fertilizers.

Global Nitrogenous Fertilizer Market Scope:

Product Type Analysis

Urea, which is 46% nitrogen content, is the most important nitrogenous fertilizer. In terms of revenue, the urea product category accounted for 32.4% of the largest share in 2021. China and India are the countries with the largest producers and consumers of urea in the world.

The higher cost of urea and the lower amount of nitrogen in urea is the reason for the growth of the nitrogenous fertilizer market. Due to its rapid hydrolysis, significant amounts of ammonia can be lost. This is what forms ammonium carbonate. Due to rapid hydrolysis of the area, large amounts of urea can be placed near seeds. This can cause ammonia injury. It is important to properly place urea fertilizers concerning seeds.

The ammonia product category accounted for 17.2% of the total revenue share in 2021. This is due to ammonia’s higher leaching loss resistance and excellent solubility. Because it is more nitrogen than any commercial fertilizer, ammonia is a key pillar in the nitrogen-based fertilizer market. Users can apply it directly to the soil as a plant fertilizer or convert it to other types.

Ammonium sulfurate nitrate, amide fertilizers, and calcium nitrate are among the other segments (diammonium phosphate, calcium-cyanimide, etc.). Calcium nitrate is a nitrogen-containing nitrate formed when crushed limestone reacts with nitric acids. Amide fertilizers are soluble in water and decompose quickly in the soil.

Application Insights

In 2021, the cereals and grains segment had a 43.3% revenue share. This is due to the highest level of care required by cereals and grains crop types to produce higher yields and generate higher profitability for farmers and the entire agriculture industry trends.

Anhydrous ammonia, ammonium nitrate, urea, and ammonium nitrate are all used in cereals & grains because they require less nitrogen to support the plant’s optimal growth.

Oilseeds and pulses were in second place in the application segment. It is projected to grow at a CAGR (in terms of revenue) of 6.2% over the forecast period. This growth can be anticipated by the need to increase the percentage of seeds germinating and obtain dense pulse canopies.

Essential crops, oilseeds, and pulses supply the human body with essential vitamins, minerals, and proteins. The proper application of this product on farms that grow oilseeds and pulses will result in a better crop yield and better soil conditions.

Fiber plants and ornamental flowers are two other examples. To promote ornamental and fiber plants, nitrogenous fertilizers can be used. These plants can be prevented from becoming too fertile by using slow-release formulations. Slow-release formulations allow nitrogen to be slowly released and is used at its maximum level.

Маrkеt Ѕеgmеntѕ:

By Product Type

- Urea

- Methylene Urea

- Ammonium Nitrate

- Ammonium Sulfate

- Other Product types

By Application

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other applications

Market Dynamics:

One of the most needed nutrients for plants is nitrogen. Although it is found in nature, only a small number of plants can absorb it. It is artificially supplied to plants as nitrogenous fertilizers. It is available in many forms, including ammonium sulfurate, calcium ammonium, and ammonia. Each form has different nutrient levels. These products regulate the growth of plants and provide a better texture.

The key raw materials used in the production of the product are nitrogen and hydrogen. Nitrate is the primary nutrient in fertilizers.Plants require large amounts of it. It is essential for photosynthesis, allowing plants to grow organic food from sunlight. It is also essential for almost every aspect of plant biology. A lack of nitrogen in plants can cause yellowing and poor growth. A nitrogen surplus can cause enormous vegetative growth, leading to poor fruiting and flowering.

Emerging economies worldwide are beginning to understand the importance of the product for the production capacities of agricultural products. Farmers from developing countries like India, China, and Rwanda are now better informed about the proper use of chemicals.

Local manufacturers also provide services in the areas of technology and crop nutrition. The companies also educate the users on the possible harms resulting from excessive fertilizer use and the appropriate storage and disposal methods.

Many institutions are working together to spread awareness about the benefits of using products that can improve agricultural yield. These include the Global Alliance for Climate-Smart Agriculture (GACSA) and International Fertilizer Development Center. Similar initiatives are leading to an increase in global consumption.

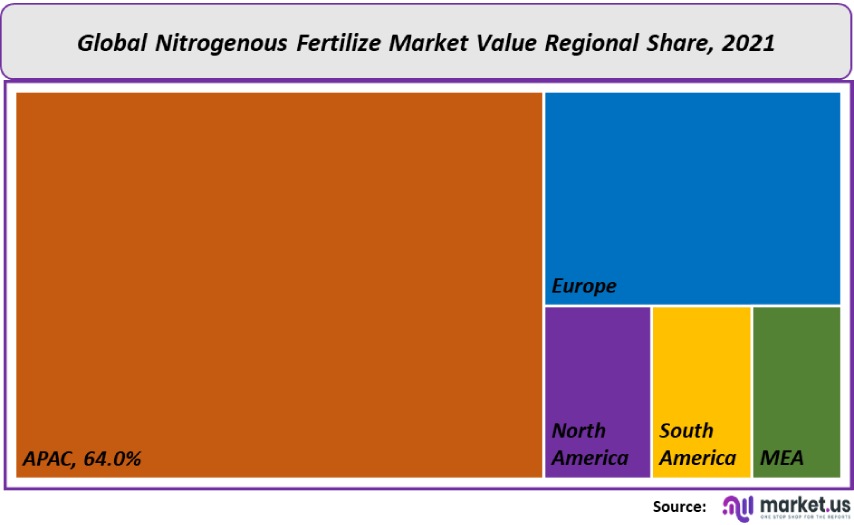

Regional Analysis

In terms of revenue, the APAC region held the largest share, above 64%, in 2021. This is due to greater cultivation areas, favorable climate conditions, and a higher number of rural residents. Due to growing food demand and increasing food security, multinational nitrogenous fertilizer manufacturers are opening manufacturing plants in Asia. A detailed analysis of the Nitrogenous Fertilizer market is given in the report.

China is the largest consumer of the product and consumes approximately one-third of the global total. This fertilizer plays a critical role in maintaining food safety in China, allowing for greater growth in both grain and non-grain yields. Some of China’s most important food crops are barley, soybeans, potatoes, tea, wheat, tomato, beans, peanuts, and millet.

In terms of revenue, Europe ranked third in the regional segment in 2021. It is expected to grow at a CAGR of 7.3 % in the near future. This is due to the region’s large land area devoted to agriculture and grasslands. The majority of NPK compounds come from Russia and Norway. Russia supplies the region with nitrate and phosphate-based advanced fertilizers. All of Egypt, Algeria, and Algeria are represented.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

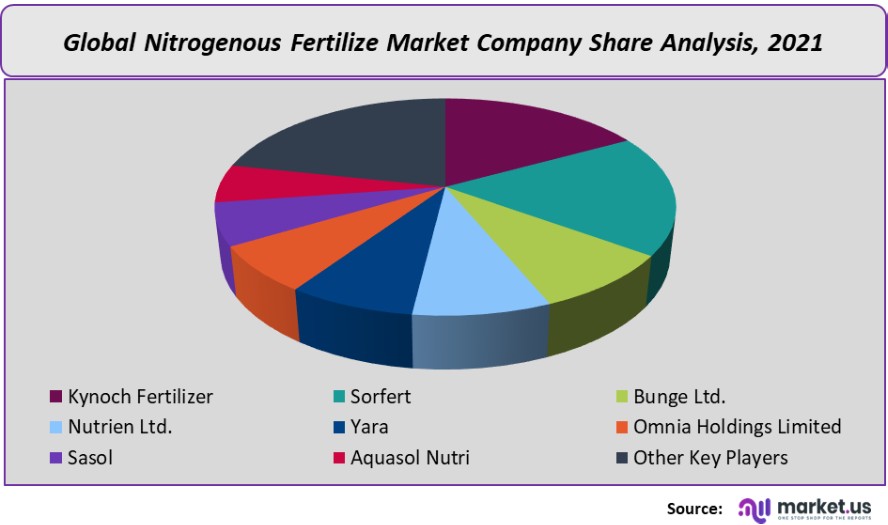

Market players are focused on the development of sustainable nitrogenous fertilizers. Manufacturing technology, product portfolios, regulatory approvals, and pricing all significantly impact the market’s growth. The market’s local players are primarily focused on retaining their customers and offering tailored services to farmers.

Many Asian Pacific manufacturers are also looking to expand their manufacturing capabilities due to the increasing use of agrochemicals, especially in China and India. To meet the growing product.

Below, some of the major key players are given including Coromandel International Limited, Kynoch Fertilizer, Yara International, Omnia Holdings Limited, Koch Fertilizer, and other major players.

demand around the globe, players are more inclined to increase their investments. The market for nitrogenous fertilizer includes some prominent players, such as

Маrkеt Кеу Рlауеrѕ:

- Kynoch Fertilizer

- Sorfert

- Bunge Ltd.

- Nutrien Ltd.

- Yara International

- Omnia Holdings Limited

- Sasol

- Aquasol Nutri

- TriomfSA

- Rolfes Agri (Pty) Ltd.

- Coromandel International Ltd.

- Koch Industries

- Other Key Players

These are the key insights from the Nitrogenous Fertilizer market.

For the Nitrogenous Fertilizer Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the Nitrogenous fertilizer market size in 2021?The Nitrogenous fertilizer market size is $ 56,846 million in 2021.

What is the CAGR for the Nitrogenous fertilizer market?The Nitrogenous fertilizer market is expected to grow at a CAGR of 6.8% during 2023-2032.

What are the segments covered in the Nitrogenous fertilizer market report?Market.US has segmented the Nitrogenous Fertilizer market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into Urea, Methylene Urea, Ammonium Nitrate, Ammonium Sulfate, and Other Product types. By End User, the market has been further divided into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Other Applications.

Who are the key players in the Nitrogenous fertilizer market?Kynoch Fertilizer, Sorfert, Bunge Ltd., Nutrien Ltd., Yara, Omnia Holdings Limited, Sasol, Aquasol Nutri, TriomfSA, Rolfes Agri (Pty) Ltd., and other key players are the key vendors in the Nitrogenous fertilizer market.

Which region is more attractive for vendors in the Nitrogenous fertilizer market?APAC accounted for the highest revenue share of 64% among the other regions. Therefore, the Nitrogenous fertilizer market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

What are the key markets for Nitrogenous fertilizer?Key markets for Nitrogenous fertilizer are Asia and especially China.

Which segment has the largest share in the Nitrogenous fertilizer market?In the Nitrogenous fertilizer market, vendors should focus on grabbing business opportunities from the urea segment as it accounted for the largest market share in the base year.

![Nitrogenous Fertilizer Market Nitrogenous Fertilizer Market]() Nitrogenous Fertilizer MarketPublished date: Sep 2021add_shopping_cartBuy Now get_appDownload Sample

Nitrogenous Fertilizer MarketPublished date: Sep 2021add_shopping_cartBuy Now get_appDownload Sample - Kynoch Fertilizer

- Sorfert

- Bunge Ltd. Company Profile

- Nutrien Ltd.

- Yara International

- Omnia Holdings Limited

- Sasol

- Aquasol Nutri

- TriomfSA

- Rolfes Agri (Pty) Ltd.

- Coromandel International Ltd.

- Koch Industries

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |