Global Needle Coke Market By Type (Petroleum-based, Coal-based), By Application (Graphite electrodes, Special carbon materials, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Sep 2021

- Report ID: 32264

- Number of Pages: 332

- Format:

- keyboard_arrow_up

Needle Coke Market Overview:

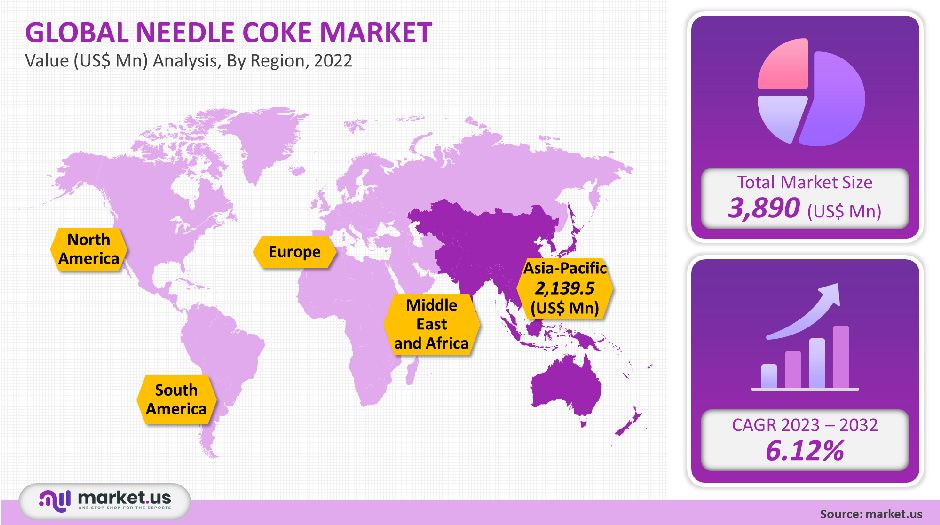

The rapid increase in electric vehicles has caused a rise in demand for needle cocaine. Global needle coke sales grew at 6.12% CAGR over the forecast period to USD 3,890 million in 2021.

There are enormous opportunities for manufacturers to discover the potential applications of lithium-ion cells in Hybrid Electric Vehicles (HEV) and Battery Electric Vehicles (BEV).

Global Needle Coke Market Scope:

Product Analysis

Super-premium grades dominated the market, accounting for 46.0% volume share in 2021. Due to its exceptional properties and low sulfur content (less than 0.4%), this grade is popular in steel and carbon applications. Super-premium grades have a low coefficient (CTE) of thermal expansion, low puffing rate, and large particle sizes.

This allows for 5% more productivity in steel scrap recycling. These grades also make higher-quality, ultra-high-power (UHP) graphite electrodes.

Premium grade is more time-consuming and has a reduced capacity.

The rapid growth in demand for this grade in the Asia Pacific has dramatically increased its price over the past few decades. Needle coke is used to make various graphite products like specialty graphite blocks and partially processed graphite.

Application Analysis:

A decline in crude oil prices will cause a rapid increase in needle coke production, which is used in silicon metals and ferroalloys.

It is used extensively as an electrode in ferroalloy and marketplace silicon metals. These cokes are required for graphite electrodes, which are used to produce submerged arc furnaces with high capacities. Consumer preference for natural graphite over synthetic products in Li-ion cells will significantly increase needle coke use.

One of the main factors driving demand for lithium-ion batteries is the growing demand for smartphones and other wearable devices.

Manufacturers may add between 5% and 20% of CPC in rubber compounds to improve wear resistance without using abrasives.

In rubber compounding applications, needle coke can enhance the rubber’s friction characteristics. Petroleum coal is used to increase wear and tear properties in polymer applications.

Key Market Segments:

By Product

- Super-premium

- Premium-grade

- Intermediate-grade

By Application

- Electrode

- Silicon metals & ferroalloys

- Carbon black

- Rubber compounds

- Other Applications

Market Dynamics:

While electric vehicles were not widely used, their penetration was still limited. However, the trend to adopt a hybrid-electric automobile is likely to grow in the coming decade due to numerous measures to reduce carbon dioxide and other emissions.

The market for needle-coke is expected to grow because of this switch to hybrid electric cars.

The primary raw material for the production of graphite-electrodes from arc furnaces within the steel and aluminum industries is needle coke.

It is a unique type of coke with superior properties, such as high-temperature resistance, high electric resistance, oxidizability, and Coefficient of Thermal Expansion. More than 40% of the raw materials costs for graphite electrodes are accounted for by needle coke.

Steel has been significantly increasing in developed countries throughout Europe and the Americas, owing to the abundance of scrap.

India accounts for 60% of all steel production. More than 90% of steel is made using an electric furnace in the Middle East. These factors have led to sufficient demand for needle coke from these furnaces.

Market players invest in R&D to create needle coke from low-value heavier hydrocarbon streams. Needle coke made from low-value, heavier hydrocarbon streams can withstand high temperatures of up to 2800°C.

Market players are also increasing their refinery margins due to rising product prices. With the help of captive raw materials supply, market players like Phillips 66, Sumitomo Chemical Corporation, and Mitsubishi Chemical Corp. have a competitive advantage, especially in times of price fluctuation.EAF is made from recycled steel scrap. It contains about 90% to 100% of the primary material. This process involves high-power electric arcs to heat the metal to a melting point of 1,650°C and then convert it into high-quality carbon steel.

They are non-polluting and provide efficient metallurgical controls. The market is consuming needle coke to make EAFs.

Regional Analysis

It is expected that the recovery of the North American economy and the growth of many important end-use businesses will remain key driving factors for steel production. The development of new technologies, such as the electric-arc furnace or EAF, is key to the growth of mini-mills.

They currently account for 60% of domestic U.S. production. This product was exported by Philips 66 to over 370 kilotons per year in 2021, making it the most famous producer.

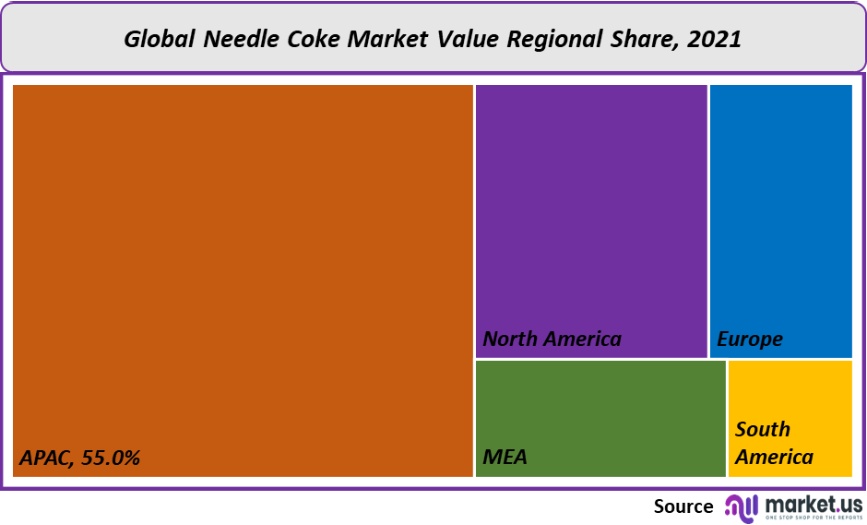

The Asia Pacific was the top regional market in 2021, accounting for more than 55%. India is expected to benefit from government initiatives to promote domestic manufacturing. These initiatives will reduce dependence on imports and increase regional production.

This should create lucrative opportunities both for industrial producers and graphite manufacturers. HEG Limited, Graphite India Limited, and Graphite India Limited are major Indian buyers of pitch needle coal.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

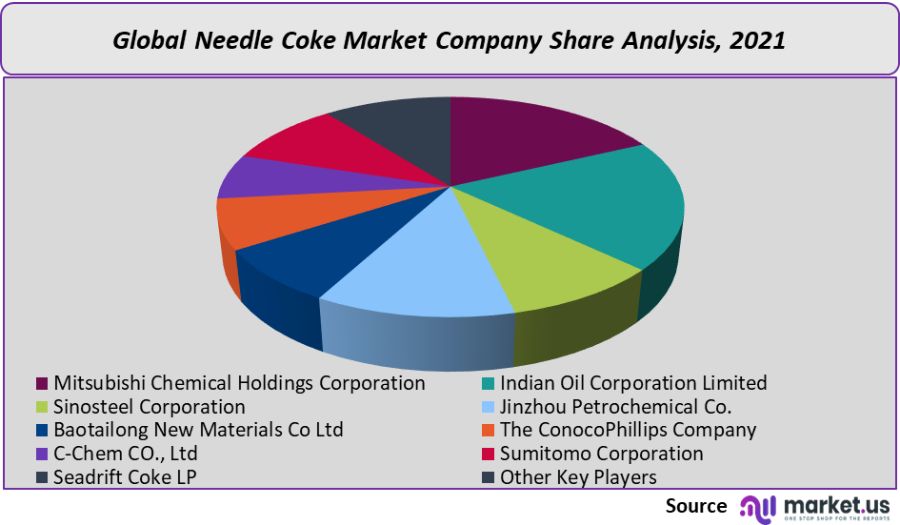

With the presence of large-scale companies, the global needle coke market remains fragmented. Market players invest in R&D to create needle coke from low-value heavy hydrocarbon streams without any significant feed pre-treatment.

Due to the increased demand in steel production and the manufacture of lithium-ion cells for the automotive industry, needle coke prices rose significantly in 2021. Several Chinese petroleum coke plants have closed due to stringent regulations on carbon emissions. This has had a negative impact on the cost of needle coke.

The market’s key players include Phillips 66; Asbury Carbon Inc. and Seadrift Coke L.P., Sumitomo Chemical Company, Mitsubishi Chemical Corp., JXTG Nippon Oil & Energy Corp., and Indian Oil Corporation Limited:

Маrkеt Кеу Рlауеrѕ:

- Mitsubishi Chemical Holdings Corporation

- Indian Oil Corporation Limited

- Sinosteel Corporation

- Jinzhou Petrochemical Co.

- Baotailong New Materials Co Ltd

- The ConocoPhillips Company

- C-Chem CO., Ltd

- Sumitomo Corporation

- Seadrift Coke LP

- Other Key Players

For the Needle Coke Market research study, the following years have been considered to estimate the market size:

Particular Scope Region - North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Historic Year 2013 to 2018 Estimated Year 2019 Forecast Year 2020 to 2027 Frequently Asked Questions (FAQ)

Q: What is the Needle Coke market size in 2021?A: The Needle Coke market size is US$ 3,890 million for 2021.

Q: What is the CAGR for the Needle Coke market?A: The Needle Coke market is expected to grow at a CAGR of 6.12% during 2023-2032.

Q: What are the segments covered in the Needle Coke market report?A: Market.US has segmented the Global Needle Coke Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Super-premium, Premium-grade, Intermediate-grade. By End User, market has been further divided into Electrode, Silicon metals & ferroalloys, Carbon black, Rubber compounds, Other Applications.

Q: Who are the key players in the Needle Coke market?A: Mitsubishi Chemical Holdings Corporation, Indian Oil Corporation Limited, Sinosteel Corporation, Jinzhou Petrochemical Co., Baotailong New Materials Co Ltd, The ConocoPhillips Company, C-Chem CO., Ltd, Sumitomo Corporation, Seadrift Coke LP, Other Key Players, are the key vendors in the Needle Coke market.

Q: Which region is more attractive for vendors in the Needle Coke market?A: APAC is expected to account for the highest revenue Share of 55.0% among the other regions. Therefore, the Needle Coke market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Needle Coke?A: Key markets for Needle Coke are India, China, Egypt & Others.

Q: Which segment has the largest share in the Needle Coke market?A: In the needle coke market, vendors should focus on grabbing business opportunities from the super-premium segment as it accounted for the largest market share in the base year.

![Needle Coke Market Needle Coke Market]()

- Mitsubishi Chemical Holdings Corporation

- Indian Oil Corporation Limited

- Sinosteel Corporation

- Jinzhou Petrochemical Co.

- Baotailong New Materials Co Ltd

- The ConocoPhillips Company

- C-Chem CO., Ltd

- Sumitomo Corporation

- Seadrift Coke LP

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |