Operating Room Integration Systems Market By Type (Hybrid O.R., Integrated O.R., Digital O.R.), By Component(Software, Services), By Application(General Surgery, Orthopedic Surgery, Other Applications),By End-User (Hospitals, Clinics, And Others),and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032.

- Published date: Aug 2022

- Report ID: 40133

- Number of Pages: 385

- Format:

- keyboard_arrow_up

Operating Room Integration Systems Market Overview:

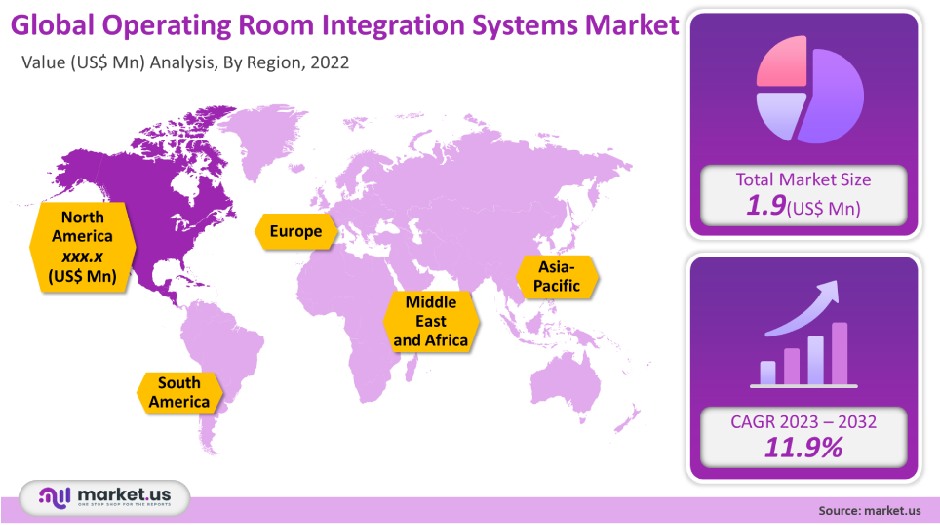

The Operating Room Integration Systems Market is projected to reach a valuation of USD 5.85 Bn by 2032 at a CAGR of 11.9%, from USD 1.9 Bn in 2021.

An OR Integration System is designed to simplify and streamline the OR by consolidating data, access to video, and controls for all of these devices at a central command station, allowing staff to perform many of their tasks efficiently without needing to move around the OR. OR Integration also commonly involves suspending monitors and imaging modalities within the OR, removing trip hazards caused by cabling, and allowing for easy access and visibility through surgical video.

Due to the emergence of advanced diagnostic and imaging technologies for Operating Rooms (also known as Operation Theater), these rooms are becoming increasingly congested and complex with a multitude of OR devices and monitors.

In addition to booms, surgical tables, surgical lighting, and room lighting positioned throughout the OR, multiple surgical displays, communication system monitors, camera systems, image capturing devices, and medical printers are all quickly becoming associated with a modern OR.

The OR is a demanding environment that requires focus, efficiency, communication, and sound expertise. Without OR integration, surgical teams must navigate around an OR to perform a variety of tasks. These tasks include checking a computer system for patient information, writing this information on a whiteboard, moving to the wall to control OR lighting, stepping into the surgical field to display or change the video they are viewing, and more. The movement and time required to complete these tasks slow the completion of a procedure and detracts needed attention from a patient.

OR Integration Systems consolidate and organize all patient data for the surgical staff during a procedure, minimizing congestion and streamlining information across multiple platforms.1 Through OR Integration, surgical staff has centralized access to the controls and information they need – to view patient information, control room or surgical lighting, display images during surgery, and more – all from a centralized control panel.

OR Integration enables OR staff to increase productivity and safety levels, as well as improves efficiency, thus allowing them to remain focused on delivering optimal patient care.

Detailed Segmentation

This market is categorized on the basis of Type, Component, Application, End-User, and Region:

By Type

- Hybrid O.R.

- Integrated O.R.

- Digital O.R.

By Component

- Software

- Services

By Application

- General Surgery

- Orthopedic Surgery

- Cardiovascular Surgery

- Neurosurgery

- Thoracic Surgery

- Other Applications (Gynecological, Urological, Ophthalmic, Dental, ENT, and Pediatric Surgeries)

By End-User

- Hospitals

- Clinics

- Ambulatory Surgery Centers

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Market Dynamics

Market growth for the global operating room/OR integration is driven by the increasing adoption of minimally invasive surgical procedures, technological advancements in various medical devices, as well as redevelopment projects & funding aimed at improving OR infrastructure. The growing prevalence of chronic and life-threatening diseases is subsequently boosting the demand for OR integration systems in various surgical procedures.

The lack of coordination among surgical teams results in an increased frequency of errors in the OR. Avoidable errors in the OR, which usually occur before or after a surgical procedure, have led to adverse effects, which risk patient safety in the process. These errors include communication breakdowns among or within a surgical team, patients, their families, and care providers, the delay or failure in diagnosing an underlying condition, and delay or failure to administer treatment in a timely manner.

COVID-19 has been designated as a public health emergency of international concern, which has generated a need to manage space, workforce, and provisions in hospitals to provide optimum care to patients. Moreover, several measures have been implemented to prevent in-hospital transmissions.

To cope with the increased influx of COVID-19, respective governments and medical authorities are focusing on setting-up new hospitals and medical facilities with a standard OR designated for the purposes of COVID patient surgeries. These operating rooms are separate from the main OR in order to reduce the risk of contamination. Thus, the demand for operating room integration systems in hospitals has increased as a result of this pandemic.

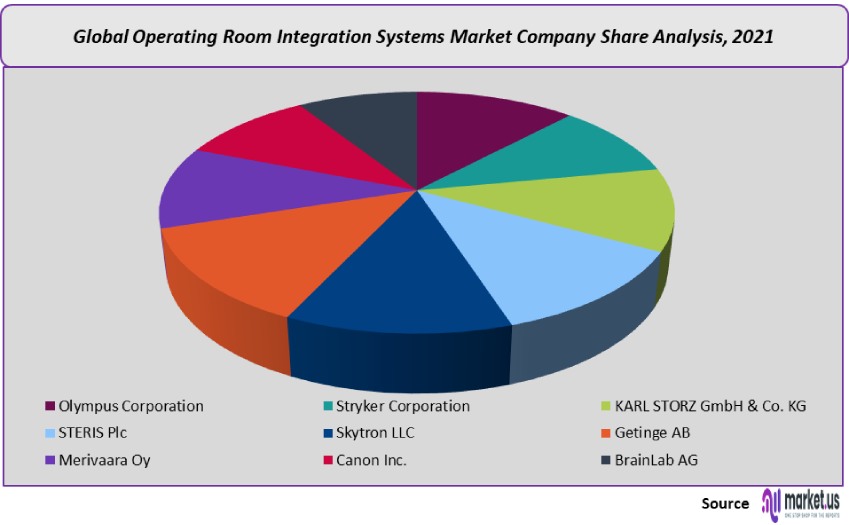

Key players:

- Olympus Corporation

- Stryker Corporation

- KARL STORZ GmbH & Co. KG

- STERIS Plc

- Skytron LLC

- Getinge AB

- Merivaara Oy

- Canon Inc.

- BrainLab AG

- Doricon Medical Systems

Recent Developments

- STERIS, KARL STORZ Endoscopy-America (Germany), and American Medical Depot (U.S.) entered into a contract with Defense Logistics Agency (U.S.) to provide integrated operating room components for military services and federal civilian agencies.

- Olympus to support endoscopic AI diagnosis education for doctors in Thailand.

- Olympus acquires Israeli medical device company Medi-Tate, to boost their global urology economic growth.

- Olympus completes the transfer of its regenerative medicine business Olympus RMS to Rohto Pharmaceutical.

- Stryker Introduces market-leading Tornier Shoulder Arthroplasty Portfolio and Launches New Tornier Perform™ Humeral System.

- Stryker announced a partnership with Texas Health Hospital Mansfield, the first medical institution that has committed to taking the Journey to Zero, adopting the full suite of Stryker products to support their journey to eliminate harm for healthcare providers and patients in an operating room.

For the XXXXX Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Operating Room Integration Systems Market Operating Room Integration Systems Market]() Operating Room Integration Systems MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample

Operating Room Integration Systems MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample - Olympus Corporation

- Stryker Corporation Company Profile

- KARL STORZ GmbH & Co. KG

- STERIS Plc

- Skytron LLC

- Getinge AB

- Merivaara Oy

- Canon Inc.

- BrainLab AG

- Doricon Medical Systems

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |