Global Synthetic Aperture Radar Market By Frequency (Single and Multiple), By Platform (Ground and Airborne), By Mode (Single and Multi), By Application (Commercial and Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 41505

- Number of Pages: 212

- Format:

- keyboard_arrow_up

Synthetic Aperture Radar Market Overview:

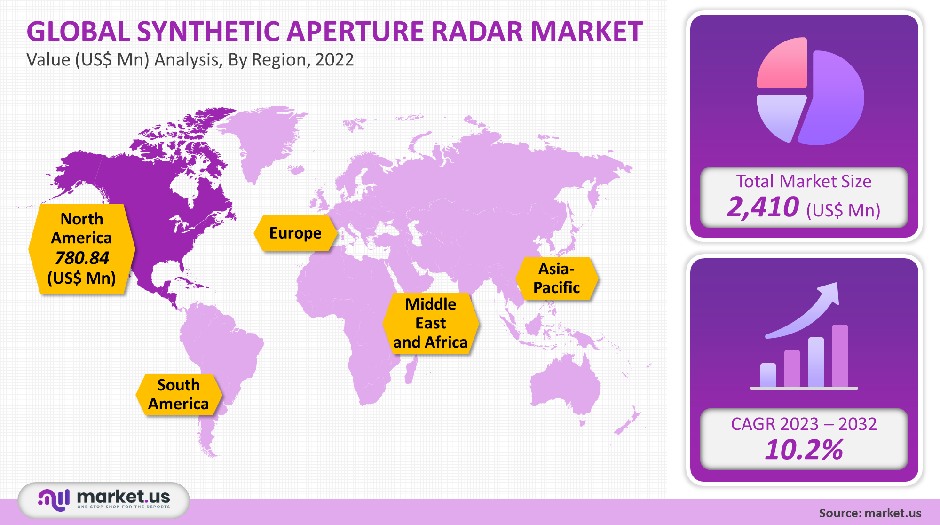

The global synthetic aperture radar market value was USD 2,410 million in 2021 and is forecast to grow at a 10.2% compound annual growth rate (CAGR), between 2023-2032.

The remote sensing technology used in synthetic aperture radar (SAR), allows for the creation of high-resolution two- and three-dimensional images of objects around the globe using remote sensing technology.

A conventional radar system, it will require a longer antenna to produce high-resolution images. This dramatically increases the weight and costs of the satellite. To achieve 10m spatial resolution with a satellite operating at a wavelength of 5 cm, an antenna approximately 4,250m long is needed. This is the size of 47 football fields.

In order to replicate a huge antenna, synthetic aperture technology employs a smaller number of antennas. The antennas gather data from multiple acquisitions and combine them to create a high-resolution image.

Global Synthetic Aperture Radar Market

Frequency Analysis

With an 82.7% market share in 2021, the single frequency segment was dominant. This market dominance is due to its simplicity and ability to monitor specific areas using specialized wavelengths. Because it is cost-effective and lightweight, single frequency SAR has been used on ground and airborne systems over the years for earth observation.

Due to its ability to monitor and capture images at different frequencies, the multi-frequency SAR has seen steady growth. Due to its superior penetration through clouds and inclement weather, multi-frequency SAR has not been deployed as widely as space-based SAR.

SAR single-frequency has been further divided into X, L, and C and other frequencies such as S, Ka, and Ku. The most popular bands are X, L, and C. Ka, K, as well as Ku, are not used much for synthetic aperture radars because of their limited wavelength range. Wavelength is crucial in SAR because it determines the signal’s penetration ability through an object.

L band is the longest wavelength at 30-15 cm. It can be used to monitor geophysical conditions, biomass mapping, vegetation mapping, and geophysical monitoring.

C band SAR operates within the range of 7.5-7.8 cm. It has moderate penetration and is suitable to applications like maritime ocean navigation and vegetation mapping. L and C bands were used by most SARs, but the L band has the greatest penetration ability.

While the X-band SAR applies at a lower wavelength of 3.8 to 2.4 cm, it offers high-resolution imagery that is suitable for defense surveillance and agriculture. It also provides an analysis of wind movements over the ocean and urban monitoring. These benefits are expected to increase the adoption of single-frequency radars and significantly impact segment growth.

Platform Analysis

With a market share of 83.5%, the airborne segment was the dominant player in 2021. The market’s top share was 83.5% in 2021, thanks to the ability of airborne systems to scan and capture larger areas than ground-based search and rescue (SAR) systems.

Three platforms fall under the umbrella of synthetic aperture radars: spacecraft, aircraft, UAVs,s and unmanned air vehicles. The largest market share is held by the aircraft platform due to increased demand in the defense sector for surveillance. UAVs will show the greatest growth rates due to their increasing demand in military and commercial operations as well as lower deployment costs for the SAR systems.

Ground-based SAR is a short-range device that monitors the earth’s surface. It can be used to monitor critical deformations such as tunnel construction and mining and structural health monitoring. Ground-based SAR can also be mounted to a moving vehicle or structure. It has been widely used in urban monitoring and commercial applications. This system can be used to monitor, scan for, detect and capture applications like archaeology or road conditions. Because of their limited scanning capabilities, these systems are expected to see steady growth.

Mode Analysis

Multi-mode dominated the market in 2021, with 72.7% of the share. This market dominance is due to the widespread adoption of SAR which can operate in different modes to harness the characteristics of each model. SAR can operate in three operating modes: ScanSAR (or strip map), and spotlight mode (or spotlight mode).

The most basic model is a strip map. It has a narrow swath. This mode is concentrated on a single area, making it suitable for monitoring areas such as urban sites, illegal activity, agriculture, and coastal. ScanSAR mode offers extensive coverage and images of large areas. While spotlight mode can be used to detect changes in congested urban environments.

Multi-mode systems are able to capture images based on the application requirement. Multi-mode, application-specific images can be captured by multi-modeSAR. This makes it more economical than single-mode. Multi-mode SAR allows you to utilize any of the operating modes. It also provides better elevation angles, multiple sub-swaths, and the ability to capture images. Multimode systems will be more popular and can fuel segment growth.

Application Analysis

With 53.7% of the market, defense dominated in 2021. This is due to the increasing number of surveillance activities like spying on others, tracking and mapping enemy troop movements, and gathering intelligence data, which has led to an increase in the adoption of SAR for military purposes.

In addition, the military has increased spending to develop and integrate missiles with SAR. This will increase the missile’s accuracy and targeting. The use of SAR has brought a new dimension to reconnaissance. It was the catalyst for the development of technologies such as foliage penetration and ground-moving target indication. This is expected to lead to increased adoption of these systems in military operations.

SAR’s crisp, clear imagery has been adopted for commercial purposes in order to monitor urban areas, hills, and oceans. SAR is used in many fields including geology and architecture. SAR allows researchers to better predict natural disasters such as earthquakes and floods.

SAR can be used in urban areas to monitor infrastructure, public safety, road network monitoring, and dam integrity monitoring. SAR will be more widely used for commercial purposes and is expected to grow in popularity.

Key Market Segments

Frequency

- Single

- X

- L

- C

- Others

- Multiple

Platform

- Ground

- Airborne

- Spacecraft

- Aircraft

- UAV

Mode

- Single

- ScanSAR

- Stripmap

- Spotlight

- Multi

Application

- Commercial

- Defense

Market Dynamics

SAR can operate at multiple frequencies. It is, therefore, able to function in bad weather conditions and without sunlight. Market growth is expected to be driven by these factors over the forecast period. Market growth is expected to be driven by the increasing need for situational awareness as well as early warnings regarding natural disasters and possible enemy threats.

Synthetic aperture radar can produce high-quality digital photos of terrains, forests, urban areas, snow-clad mountain peaks, and oceans. This data can be used for updating existing maps or creating new ones. This is a cost-effective way to survey large areas of land with high precision and accuracy.

These high-quality images allow for sophisticated analysis of data which can be used in digital terrain models to provide information on land cover. This data can be used in applications such as vegetation cover mapping, biomass estimation, and mineral exploration. It also allows for biological water monitoring to monitor for research purposes. SAR captures precise topographical features and surface features, which is why it is highly adopted by government agencies for research.

Integration of synthetic aperture radar into the command, control, and communications (C4ISR), the environment is expected to gain momentum in the near future. SAR data is retrieved by defense agencies using separate systems and displays. The process of analyzing data from SAR is time-consuming and tedious. C4ISR integration will give the operator the tools to analyze the data, plan, task, execute military missions and accelerate SAR’s adoption within the defense sector.

Market growth is likely to be affected by high development costs and government regulations on limited bandwidth. The U.S. government placed a limit of 0.25m on a resolution for commercial SAR data collection. This ban prevents non-U.S. businesses from transmitting SAR data exceeding 0.25 m beyond the U.S. This rule has been lifted, and companies can now sell data at a higher resolution of 0.25m or more for commercial purposes. The government will support companies with their data and help them relax the

rules. This will allow them to better serve the market, which should contribute to market growth.Regional Analysis

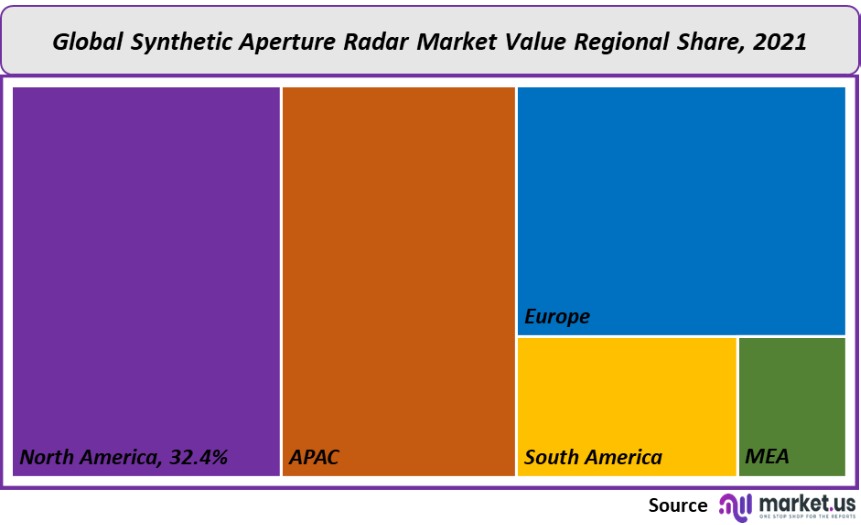

North America was the dominant market player with a 32.4% share in 2021. This can be attributed to the strong presence of synthetic aperture radar producers and increasing military spending on upgrading existing detection systems in the region.

The U.S. Department of Defense and National Aeronautics and Space Administration (NASA), have increased investment in SAR satellite projects. Europe is forecast to see steady growth in the forecast period, with the launch of the BIOMASS satellite for earth observation by the European Space Agency (ESA), in 2021.

The Asia Pacific is expected the most growth over the forecast period. India, China, and India are the largest contributors. China launched Gaofen-7, an orbital satellite for earth observation with synthetic aperture radar in 2019.

NASA and India Space Research Organization are currently working together to launch NISAR (a satellite that observes the earth) in 2022. In the Asia Pacific region, there will be an increase in demand for border security surveillance.

Latin American countries like Brazil, Argentina, and Brazil have contributed the most to this market. Argentina launched the SAOCOM-1a satellite back in 2018. SpaceX is planning to launch another satellite SAOCOM-1b by 2020.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis

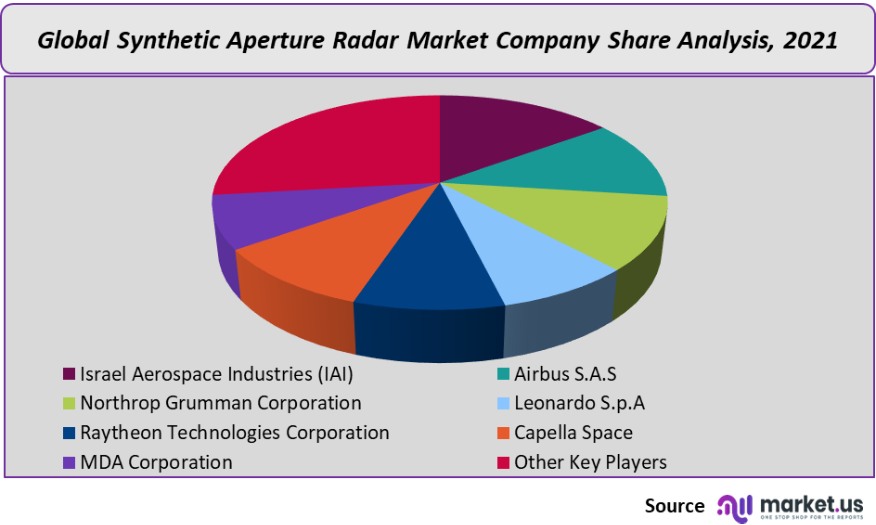

Because of the presence of multiple players, this market is relatively fragmented. The growth of these companies is dependent on the availability of financial capital from investors and government support.

Market players are actively involved in strategic partnerships, as well as making investments to preserve their market position. RS Metric formed an alliance to provide SAR Metal Signals in November 2019. This made ICEYE the first to offer a powdered-iron ore database.

This market is home to many startups like ICEYE, Capella Space, Urthcast, Synspective Inc., Ursa Space Systems, and Urthcast. Many of these startups are looking for funding to support their projects. Synspective Inc., a Japanese startup, received funding from investors like SHIMIZU CORPORATION, Mitsubishi UFJ Trust and Banking Corporation, Space-a START 1 Limited Partnership, and Abies Ventures Fund I, L.P.

Key Market Players

The prominent players in the market for synthetic aperture radar include:

- Israel Aerospace Industries (IAI)

- Airbus S.A.S

- Northrop Grumman Corporation

- Leonardo S.p.A

- Raytheon Technologies Corporation

- Capella Space

- MDA Corporation

- Other Key Players

For the Synthetic Aperture Radar Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Synthetic Aperture Radar market?A: The Synthetic Aperture Radar market size is projected to generate revenues of approx. US$ 2,410 million (2023-2032).

Q: What is the projected CAGR at which the Synthetic Aperture Radar market is expected to grow at?A: The Synthetic Aperture Radar market is expected to grow at a CAGR of 10.2% (2023-2032).

Q: List the segments encompassed in this report on the Synthetic Aperture Radar market?A: Market.US has segmented the Synthetic Aperture Radar market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Frequency, market has been segmented into Single and Multiple. By Platform, the market has been further divided into Ground and Airborne. By Mode, market has been segmented into Single and Multi. By Application, the market has been further divided into Commercial and Defense.

Q: List the key industry players of the Synthetic Aperture Radar market?A: Israel Aerospace Industries (IAI), Airbus S.A.S, Northrop Grumman Corporation, Leonardo S.p.A, Raytheon Technologies Corporation, Capella Space, MDA Corporation, and Other Key Players engaged in the Synthetic Aperture Radar market.

Q: Which region is more appealing for vendors employed in the Synthetic Aperture Radar market?A: North America is expected to account for the highest revenue share of 32.4%. Therefore, the Synthetic Aperture Radar Technology industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Synthetic Aperture Radar?A: U.S., Canada, U.K., Germany, France, and Italy are key areas of operation for Synthetic Aperture Radar Market.

Q: Which segment accounts for the greatest market share in the Synthetic Aperture Radar industry?A: With respect to the Synthetic Aperture Radar industry, vendors can expect to leverage greater prospective business opportunities through the single frequency segment, as this area of interest accounts for the largest market share.

![Synthetic Aperture Radar Market Synthetic Aperture Radar Market]() Synthetic Aperture Radar MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample

Synthetic Aperture Radar MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample - Israel Aerospace Industries (IAI)

- Airbus S.A.S

- Northrop Grumman Corporation Company Profile

- Leonardo S.p.A

- Raytheon Technologies Corporation

- Capella Space

- MDA Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |