Global Hydrogen Generation Market By Technology (Coal Gasification, Steam Methane Reforming, and Others), By Application (Methanol Production, Petroleum Refining, Ammonia Production, and Others), By Systems (Merchant and Captive), By Source (Coal, Natural Gas, Water, and Biomass), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 54728

- Number of Pages: 231

- Format:

- keyboard_arrow_up

Hydrogen Generation Market Overview:

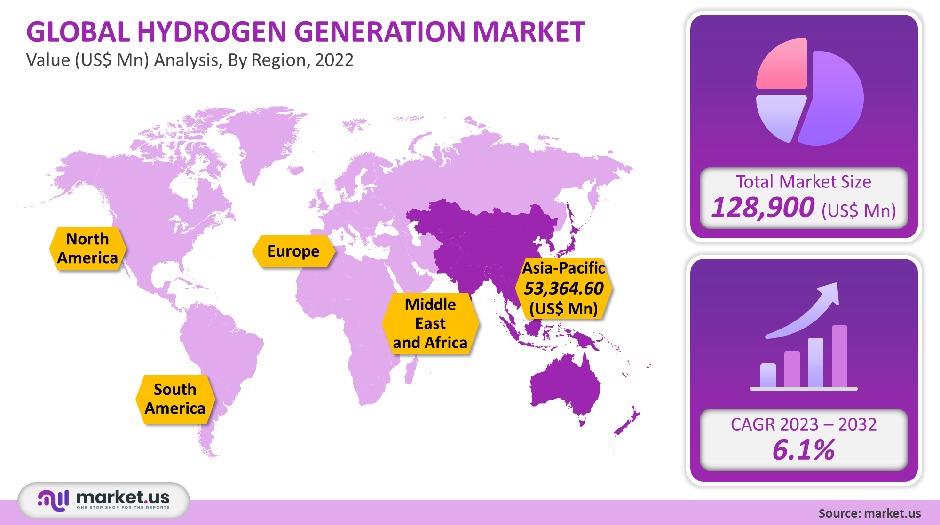

The global hydrogen generation market value was USD 128,900 million in 2021. This market is expected to expand at a CAGR of 6.1% between 2023-2032.

The demand for cleaner fuels and increased government regulations regarding desulphurization will drive the global hydrogen generation market. Hydrogen is an efficient energy carrier. This quality is expected to play a significant role in hydrogen’s further penetration into other markets.

Global electricity demand is forecast to increase by almost two-thirds over the current period. The projects related to the distribution of power & utilities are expected to boost demand for the hydrogen generator market growth during the forecast period.

Global Hydrogen Generation Market

Technology Type Analysis

Based on Technology Type, the market is further divided into Steam Methane Reforming Coal Gasification, and Others. The steam methane Reforming process is a mature, advanced technology for hydrogen generation.

Growing global demand for hydrogen generation is a key driver for steam-methane reformers technology. Because steam methane Reforming is the most economically viable method for hydrogen production, Operational benefits like high conversion efficiency and steam methane reformed process are also driving the market growth. The Steam Methane Reforming market is expected to maintain its lead over the forecast period.

Coal Gasification had a 34.58% share in the global Hydrogen Generating Market in 2021. Coal gasification is a method that uses coal to make hydrogen. This practice has been around for almost two centuries. Furthermore, it’s also recognized as a mature technology in hydrogen generation. The U.S. has an enormous domestic coal supply. America will benefit from the use of coal to make hydrogen for transportation.

Other technologies include electrolysis and the pyrolysis of water, as well as electrolyzes. The number of electrolysis plants that produce hydrogen from water has increased over the past decade. PEM technology holds a significant market share since it does not emit any carbon dioxide.

Most electrolysis projects are currently located in Europe, but new and upcoming projects were announced in Australia and China.

Application Analysis

Ammonia production was the dominant segment of the market, accounting for the highest revenue share at more than 20.28% in 2021. The ammonia manufacturing segment will keep its lead over the forecast period. Ammonia’s potential to be used as a fuel, hydrogen carrier and energy store is a great opportunity for renewable hydrogen technologies.

The ammonia plants typically produce hydrogen from fossil fuel feedstock. Natural gas is the most frequent fuel for a steam methane reforming (SMR) machine. Ammonia can be made from coal by a partial oxidation process (POX).

According to estimates, the market will experience steady growth as hydrogen demand rises. Methanol, which is one of the most important chemical products, is a promising building block for more complex chemical compounds like acetic acid and methyl-tertiary butyl ether, dimethyl ether, and methylamine. Methanol is the simplest of the alcohols. It can be converted into CO2 or H2 to make it. This will reduce atmospheric CO2 emissions significantly.

Hydrogen-based power generator technology has successfully positioned itself in mature markets like North America and Europe where clean and efficient energy is a key aspect. It is cost-effective, reliable, and meets the high demand for hydrogen-based power generation.

Some of the most important uses of hydrogen include the conversion of crude oil to various end-user products like transport fuels and petrochemical fuel stock. The most common hydrogen-consuming processes in a refinery include hydro-cracking and hydro treatment. Hydro treatment is used to remove any impurities, including Sulphur.

It accounts for a significant share of all refinery hydrogen consumption globally. Hydrocracking, which uses hydrogen to convert heavy residual oils to higher-value oil products, is known as hydrocracking.

Source Analysis

The natural gas segment dominated the market in 2021. Natural gas reforming is used to produce hydrogen, carbon monoxide, or carbon dioxide. The cheapest way to make hydrogen is from natural gas. It is expected to maintain its lead in the forecast period.

Systems Analysis

Based on systems, the market was dominated by the merchant generation segment in 2021. Merchant generation of hydrogen refers to hydrogen being produced at a central production plant and then transported to a customer by a bulk tank or pipeline.

Many countries like the U.S. and Canada have a large natural gas pipeline network that could be used for transporting and distributing hydrogen. The forecast period will see the merchant generation segment maintain its lead.

Key Market Segments

Technology

- Coal Gasification

- Steam Methane Reforming

- Others

Application

- Methanol Production

- Petroleum Refining

- Ammonia Production

- Power Generation

- Transportation

- Others

Systems

- Merchant

- Captive

Source

- Coal

- Natural Gas

- Water

- Biomass

Market Dynamics

The U.S. was one of the first countries to use clean energy solutions worldwide for power generation, manufacturing, transportation, and other sectors. The U.S. Department of Energy, Department of Transportation (DOT), and Department of Energy (DOE) introduced a Hydrogen Posture plan in December 2006. This plan was designed to increase R&D, validate technologies and establish a framework for the development of hydrogen infrastructure.

The Federal government also set deliverables to aid in the development of the nation’s hydrogen infrastructure. The National Hydrogen Energy Vision was used to develop the plan. The key goals of the government agency include the construction and maintenance of hydrogen stations in the country that are cost-effective and efficient.

These factors will likely drive demand for hydrogen generation in the U.S.

In June 2012, Germany’s Ministry of Transport decided to create a nationwide hydrogen network and improve the infrastructure for hydrogen refueling stations. The Ministry of Transport signed a Letter of Intent (LoI), along with industry players, including Total, The Linde Group, Air Products and Chemicals Inc., Daimler AG, and Air Liquide.Regional Analysis

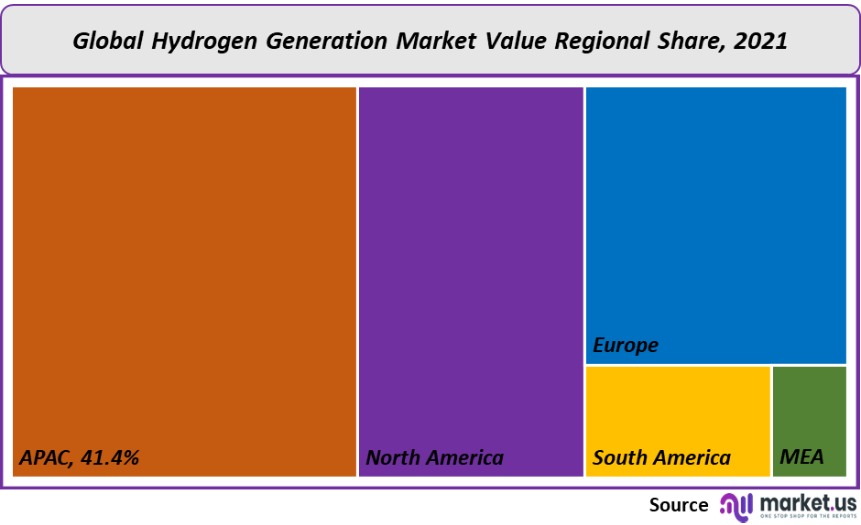

The Asia Pacific was the dominant market region in the world in 2021 and had the highest revenue share at over 41.40%. China was the top revenue earner in the Asia Pacific market in 2021. In the Asia Pacific region, there are more refineries, including those in India and China. This has boosted hydrogen generation. Furthermore, some governments in Asia Pacific countries like Australia and Japan are looking into greener and cleaner options for hydrogen generation.

The region’s hydrogen producers are seeking to expand their reach to target developing nations like South Africa, Indonesia, and Vietnam.

This will help them increase their revenue. U.S.-based market players, such as Praxair Inc. or Air Liquide, are seeking to expand operations in countries where there is increasing demand for hydrogen. This is part of their strategic expansion plans.

For many years, North America’s hydrogen generation industry has seen rapid growth. With contributions from every technology and application, the industry has been growing at a rapid pace. The fastest-growing sectors are ammonia production and Methanol production. This sector has seen significant growth in countries like the U.S. and Canada over the last five years.

Due to the European Commission’s announcements through organizations such as Fuel Cells Joint Undertakings (FCH JU), hydrogen generation will grow in the region. These projects are intended to increase fuel cell vehicle adoption in Europe. This will help develop supportive hydrogen infrastructure for fuel cell vehicles in major European countries.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

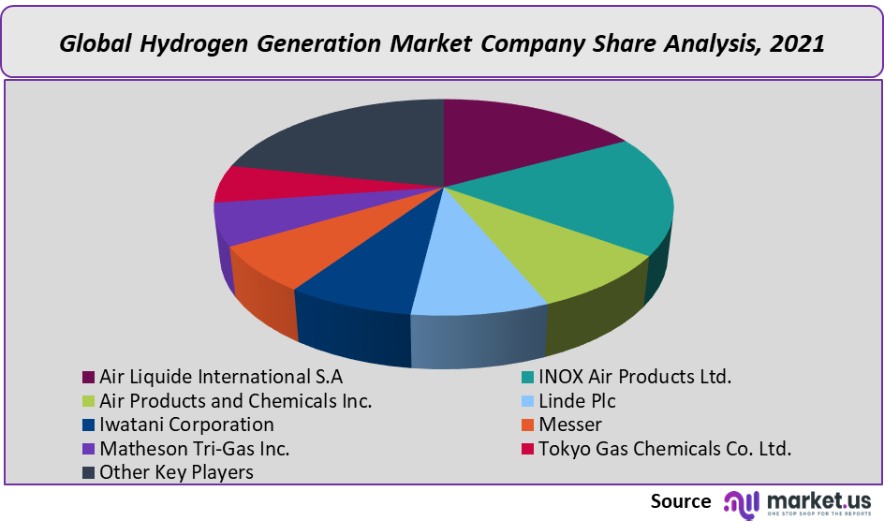

Market Share Analysis

There are key players who participate in R&D and continuous innovation. The hydrogen generation market is competitive. This is a key factor for companies in the hydrogen generation industry. Matheson Tri-Gas Inc. purchased Linde HyCO, a business that produces hydrogen, carbon Monoxide, or syngas.

This acquisition will enable the company to grow its capabilities and support the petrochemicals and refining sectors. Air Liquide today announced that the company will produce and market renewable liquid hydrogen to the U.S. West Coast mobility market. It is expected that the large-scale project will produce 30 tons of liquid hydrogen per hour using biomass technology.

Key Market Players

These are the top players in the global hydrogen production market:

- Air Liquide International S.A

- INOX Air Products Ltd.

- Air Products and Chemicals Inc.

- Linde Plc

- Iwatani Corporation

- Messer

- Matheson Tri-Gas Inc.

- Tokyo Gas Chemicals Co. Ltd.

- Other Key Players

For the Hydrogen Generation Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Hydrogen Generation market in 2021?A: The Hydrogen Generation market size was US$ 128,900 million in 2021.

Q: What is the projected CAGR at which the Hydrogen Generation market is expected to grow at?A: The Hydrogen Generation market is expected to grow at a CAGR of 6.1% (2023-2032).

Q: List the segments encompassed in this report on the Hydrogen Generation market?A: Market.US has segmented the Hydrogen Generation market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Technology, market has been segmented into Coal Gasification, Steam Methane Reforming, and Others. By Application, the market has been further divided into Methanol Production, Petroleum Refining, Ammonia Production, Power Generation, Transportation, and Others. By Systems, market has been segmented into Merchant and Captive. By Source, the market has been further divided into Coal, Natural Gas, Water, and Biomass.

Q: List the key industry players of the Hydrogen Generation market?A: Air Liquide International S.A, INOX Air Products Ltd., Air Products and Chemicals Inc., Linde Plc, Iwatani Corporation, Messer, Matheson Tri-Gas Inc., Tokyo Gas Chemicals Co. Ltd., and Other Key Players engaged in the Hydrogen Generation market.

Q: Which region is more appealing for vendors employed in the Hydrogen Generation market?A: Asia Pacific is accounted for the highest revenue share of 41.40%. Therefore, the Hydrogen Generation industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Hydrogen Generation?A: The U.S., Canada, Mexico, Germany, U.K., Spain, Italy, France, Russia, China, India, Japan, and South Korea are key areas of operation for Hydrogen Generation Market.

Q: Which segment accounts for the greatest market share in the Hydrogen Generation industry?A: With respect to the Hydrogen Generation industry, vendors can expect to leverage greater prospective business opportunities through the steam methane reforming segment, as this area of interest accounts for the largest market share.

![Hydrogen Generation Market Hydrogen Generation Market]()

- Air Liquide International S.A

- INOX Air Products Ltd.

- Air Products and Chemicals Inc.

- Linde Plc

- Iwatani Corporation

- Messer

- Matheson Tri-Gas Inc.

- Tokyo Gas Chemicals Co. Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |