Global Aerospace Forgings Market By Material (Aluminum, Steel, Titanium, and Others), By Aircraft (Commercial, Military, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jun 2022

- Report ID: 42727

- Number of Pages: 275

- Format:

- keyboard_arrow_up

Aerospace Forgings Market Overview:

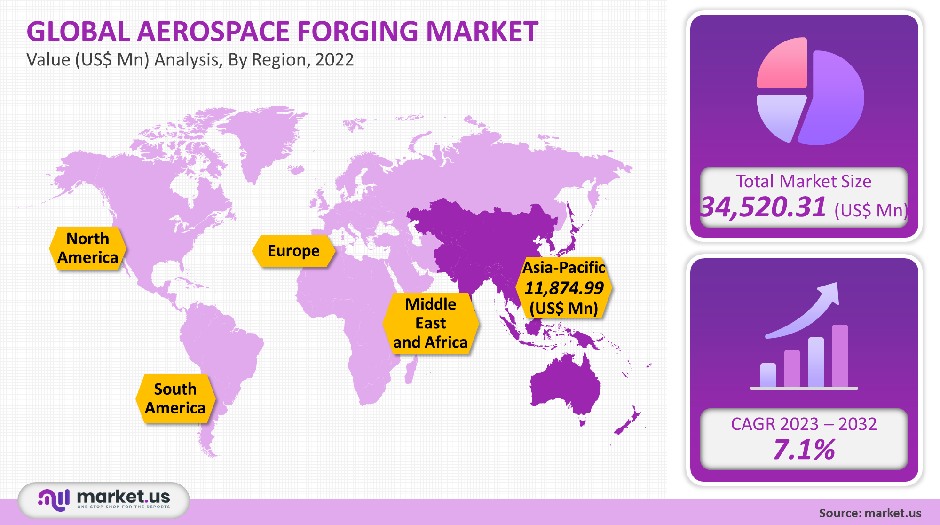

The global aerospace forgings industry was valued at USD 34,520.31 million in 2021 and is projected to grow at a 7.1% compound annual growth rate (CAGR), between 2023-2032.

Global Aerospace Forgings Market

Material Analysis

Aluminum was the biggest segment in 2021, accounting for 55.7% of its total volume. Because of its lightweight, aluminum is increasingly being used in aerospace. Today’s aircraft are lighter, more modern, and more efficient than their predecessors. Another key factor driving aluminum forged parts demand is the combination of advanced aluminum alloys with other metals.

The revenue growth rate for titanium is 7.1% between 2023-2032. It is lighter than aluminum and has superior corrosion resistance, specific strength, and the ability to withstand extreme temperatures. At a rapid rate, titanium is being used in aircraft.

It’s also very compatible with other materials like carbon fiber. Forgings companies have to deal with difficulties when forgings titanium materials.

Other materials, such as Nickel-based Alloys, Stainless Steel, Copper, and Magnesium Alloys, are also used by the aerospace industry. Aerospace forgings vendors are focused on the demand for precision forged parts.

Aircraft Analysis

In terms of volume, the commercial aircraft segment held 51.1% of the market share in 2021. It is expected to experience the fastest growth between 2023 and 2032. Recent years have seen a strong increase in new aircraft demand due to increased travel demand. Long-term demand for forged components will increase with the growth of air passenger traffic in the Asia Pacific.

Airbus and Boeing combined have delivered more than 21,000 jetliners worldwide in the past ten years. This represents a 66% increase over the decade prior. Airbus has released the most recent data and says that the Asia Pacific will see a demand for 10,040 more aircraft deliveries in the years 2028-2038.

A significant part of rising passenger traffic will be the growing middle-class population in emerging countries. The same data shows that the Asia Pacific’s middle-class population has increased from 32% to 50% between 2008 and 2018.

Over the forecast period, the military segment will experience significant growth. The increasing demand for military planes due to an expanding defense budget is expected to continue to drive the growth of this segment. The increasing focus on military modernization and global security has led to an increase in defense spending. This could also create opportunities and challenges for suppliers and contractors to defense contractors.

Key Market Segments

Material

- Aluminum

- Steel

- Titanium

- Others

Aircraft

- Commercial

- Military

- Others

Market Dynamics

Aerospace forgings are driven by increasing passenger traffic from various regions. Airbus and Boing, which are giants in passenger traffic, will see an increase in commercial aircraft deliveries in the future. The International Air Transport Association predicts that air passenger numbers will double in the next decade compared with today. Air transportation services will be used by nearly 8.2 million passengers by 2037.

The U.S. aerospace industry is expected to grow due to continued investments in military equipment, strong air transportation demand, and continuous investments in newer technology. It is expected that operators will replace older models with lighter, more efficient, and more fuel-efficient models. Boeing published data that 9,130 new aircraft would be delivered in North America by 2038.

Aerospace and defense require large numbers of forged components made from various alloys. Over the next decade, demand for components like turbines and landing gears as well as engine parts and machined pieces is expected to increase. These components are ideal for aerospace applications because of their strength.

Other key factors that could promote the use of forged parts in the long term include R&D in new materials, methods, and the development of special and high-performance alloys. The development of the 3rd generation Al-Li alloys is expected to improve the aircraft’s performance and design.

Aerospace forgings market growth will be driven by factors such as the adoption of new materials (including high performance and special alloys) and R&D to develop new manufacturing methods. Complex parts can also be manufactured using techniques like precision die forgings.

Precision die forgings allow for the production of critical parts of aircraft. It has precise dimensions and geometric features that are more accurate.

These parts don’t require any lubrication. Forged parts are able to provide mental strength and reliability for landing gear, engine, fuselage, and tail assemblies of aircraft. Forgings also make it possible to create rotating parts, such as the turbine’s blades shafts, rotor, rings, disks, and blades.

The COVID-19 epidemic caused the global aerospace industry to experience an unprecedented crisis.As a result, airline travel plunged due to travel restrictions and regulations. Also, the temporary closures of OEM and component manufacturing plants had a negative impact on demand. Companies like Airbus, Boeing, and others suffered significant losses in 2020. Boeing lost US$ 12,000 million in 2020 as a result of a halting of production. The company will need to return to 2019 levels in three years.

India, along with other developing countries, reduced their forgings production in the early period of the pandemic. The Association of Indian Forgings Industry reports that nearly 50% of foundries operated at half of their operational capacities during the COVID-19 lockdown period. This was due to low demand and temporary closures of aerospace and auto manufacturing plants.

India can still benefit from the effects of the lockdown period COVID-19, as several companies look to shift production from China to India.

The casting industry is challenging the forgings market. Cast products are being used in certain applications to replace forged products. Cast technology has made it possible to replace forged products with cast products. Casting technology has made it possible to manufacture many forged components, including transmission parts and crankshafts. The technology advancements have resulted in large investments in casting products like aerospace structural parts, which have replaced forgings.

Heavy industry includes forgings because it takes up large amounts of space, produces large and bulky products, and has large machine tools and other heavy equipment. Large capital is required for heavy industry. To transport finished components and store them, skilled professionals are needed.

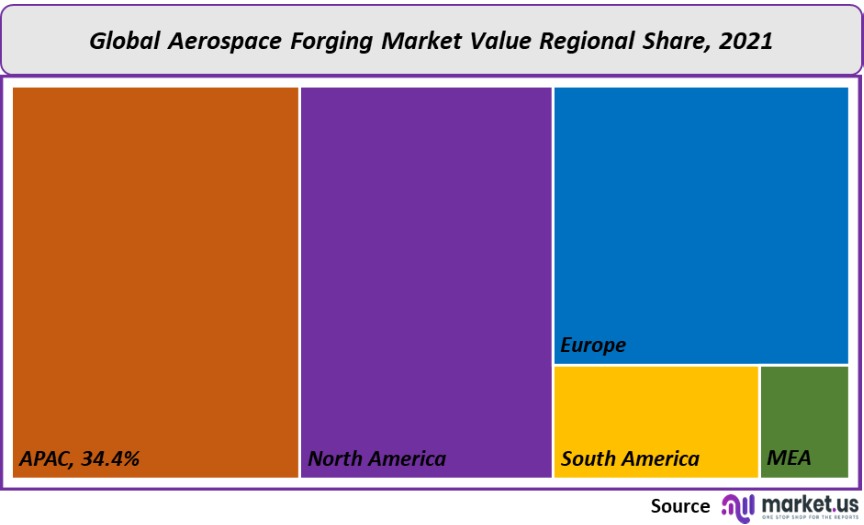

Regional Analysis

The Asia Pacific held a larger market share of 34.4% in global aerospace forgings in 2021, both in terms of volume and revenue. China is the aviation market that is growing the fastest. It will likely attract more than 8,000 new plane deliveries in the next 20 years. From 2019 to 2028, the robust demand will provide US$ 1,600 million in opportunities for aftermarket service.

China ranks second in defense spending. China has allocated almost US$ 293,000 million to the defense industry in 2021, a 4.7% increase over 2020. China is expected to continue to have a significant market for aerospace forgings.

China is the world’s largest producer and consumer of forgings. In 2021, China was responsible for 15.4% of global revenue. The country is expected to continue its growth at a CAGR of 4.2% over the forecast period. China is a major supplier of forgings to Europe, the U.S., and Europe.

Recent years have seen a decline in margins and high machinery & gear costs for small and medium Chinese companies.

Although the UK has several aircraft manufacturing companies, such as Leonardo and BAE system, the majority of aerospace companies in the country are aerospace parts manufacturing businesses. This sector is a leader in the production and maintenance of high-quality components for both military and commercial aircraft. Only a few OEMs such as Airbus or Boeing drive demand for forged components within the aerospace sector.

Most market players see capacity expansion as the most important strategic initiative. This is followed by product development and acquisitions. To improve their market position, many small and medium players are adopting new growth strategies. Wuxi Paike New Materials Technology Co. placed a September 2020 order for a new rolling mill to produce aerospace engine components. It is capable of producing engines of over 1,500mm in height.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

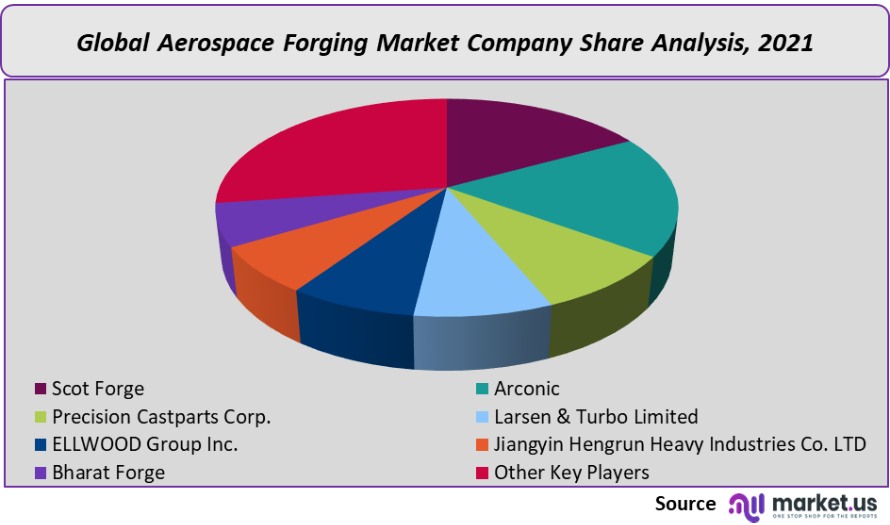

Market Share Analysis

Market vendors are likely to be able open new sales channels with the advancement of advanced materials, such as titanium and lightweight aluminum.

Market players will continue to invest in new production capacity and forgings presses. Otto Fuchs KG a Germany-based company invested in 30,000 tons of forgings machinery in 2019. This was for the production of engines, landing equipment, and structural components.

Key Market Players

The aerospace forgings market is dominated by the following

- Scot Forge

- Arconic

- Precision Castparts Corp.

- Larsen & Turbo Limited

- ELLWOOD Group Inc.

- Jiangyin Hengrun Heavy Industries Co. LTD

- Bharat Forge

- Other Key Players

For the Aerospace Forgings Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Aerospace Forgings market in 2021?A: The Aerospace Forgings market size was US$ 34,520.31 million in 2021.

Q: What is the projected CAGR at which the Aerospace Forgings market is expected to grow at?A: The Aerospace Forgings market is expected to grow at a CAGR of 7.1% (2023-2032).

Q: List the segments encompassed in this report on the Aerospace Forgings market?A: Market.US has segmented the Aerospace Forgings market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material, market has been segmented into Aluminum, Steel, Titanium, and Others. By Aircraft, the market has been further divided into Commercial, Military, and Others.

Q: List the key industry players of the Aerospace Forgings market?A: Scot Forge, Arconic, Precision Castparts Corp., Larsen & Turbo Limited, ELLWOOD Group Inc., Jiangyin Hengrun Heavy Industries Co. LTD, Bharat Forge, and Other Key Players engaged in the Aerospace Forgings market.

Q: Which region is more appealing for vendors employed in the Aerospace Forgings market?A: Asia Pacific is accounted for the highest revenue share of 34.4%. Therefore, the Aerospace Forgings industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Aerospace Forgings?A: The U.S., Canada, U.K., Germany, France, Italy, China, India, Japan, and Brazil are key areas of operation for Aerospace Forgings Market.

Q: Which segment accounts for the greatest market share in the Aerospace Forgings industry?A: With respect to the Aerospace Forgings industry, vendors can expect to leverage greater prospective business opportunities through the Aluminum segment, as this area of interest accounts for the largest market share.

![Aerospace Forgings Market Aerospace Forgings Market]()

- Scot Forge

- Arconic

- Precision Castparts Corp.

- Larsen & Turbo Limited

- ELLWOOD Group Inc.

- Jiangyin Hengrun Heavy Industries Co. LTD

- Bharat Forge

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |