Global Aluminium Foil Packaging Market By Product (Pouches, Foil Wraps, Containers, Blisters, and Other Products), By End-Use (Food & Beverage, Tobacco, Pharmaceutical, Cosmetic and other end-uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 58767

- Number of Pages: 233

- Format:

- keyboard_arrow_up

Aluminium Foil Packaging Market Overview:

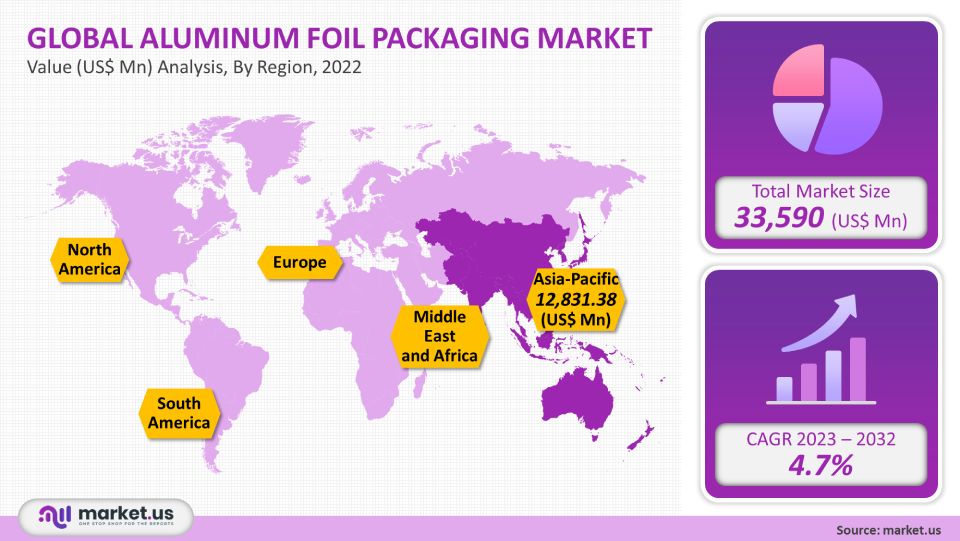

Global market for Aluminium Foil Packaging valued at USD 33,590 Million in 2021. It is estimated to grow at a CAGR of 4.7% between 2022 and 2032.

Aluminum foil is being used in beverage and food packaging applications and will be a major driver of industry growth. Due to the changing lifestyles of consumers and an increasingly urban population, the processed food industry is experiencing high growth. The availability of packaged food products via online channels is also supporting industry growth.

Global Aluminum Foil Packaging Market Scope:

Product Analysis

Wraps made up of aluminum foil captured the foil packaging market in 2021 and represented the highest revenue share. Mostly used for making snack pouches and liquid cartons as well as pharmaceutical pouches and confectionery wraps. Foil wraps are a popular product because of their wide range of applications in different industries.

Pouches can be used to package products for the personal care, cosmetics, food, and food industries. Pouches are very popular due to their simplicity and cost-effectiveness.

Containers made up of Aluminum foil retain reflectivity and brightness which attracts attention to the product in retail environments. These foil containers can also be printed with branding designs or color lacquered. Aluminum foil containers will be attractive options due to the growing requirement for organic packaging in the food and beverage industry.

Aluminum foil capsules are the other main product segment. The plastic-based pods were used to pack ground coffee. Due to environmental concerns, Coffee brands are slowly shifting to aluminum foil-based capsule pods.

End-Use Analysis

Segments such as Food and beverage intimidated the market, accounting for 46.0% of the total revenue in 2021. Packaging products such as containers, pouches, lids, and capsules can be used to package bakery, coffee/tea, dairy and confectionery, dry foods and beverages, meats, and seafood. The widespread use of aluminum foils for packaging purposes in the food and beverage industry is due to their flexibility, lightness, aroma protection, food safety, and wide availability.

Aluminum foil can be used to line cigarette packets with tobacco, which is a perishable commodity. Aluminium-paper laminate is used to preserve the scent of cigarettes in cigarette boxes. It also looks like aesthetic tobacco packaging. This segment’s CAGR is projected to be 3.4%.

In the pharmaceutical sector, aluminum foil is used to make blister covers and foil laminates-based bags or pouches. The pharmaceutical sector is very sensitive to contamination by capsules, tablets, and lozenges. Aluminum foil serves many purposes because of its strong resistance to light and gases.

Key Market Segments:

By Product

- Foil Wraps

- Pouches

- Blisters

- Containers

- Other Products

By End-Use

- Food & Beverage

- Tobacco

- Pharmaceutical

- Cosmetic

- Other End-Uses

Market Dynamics:

The industry is expected to grow due to technological advances such as the modification of atmosphere technology (MAP), which locks the freshness of food by controlling the mixture of gases like oxygen, carbon dioxide, and nitrogen within flexible packaging.

Market players’ profit margins are heavily dependent on raw material costs. The industry faces a major challenge due to fluctuating aluminum prices and uncertainty about the availability of affordable or consistent raw materials. Industry growth is being resisted by the high adoption of flexible plastic alternatives such as bags and pouches at low prices.

Due to the lockdowns in place across major economies, the Covid-19 pandemic severely affected global industrial production. The market has benefited from the fact that the primary end-users for aluminum foil packaging have not been affected, unlike other industries.

Regional Analysis:

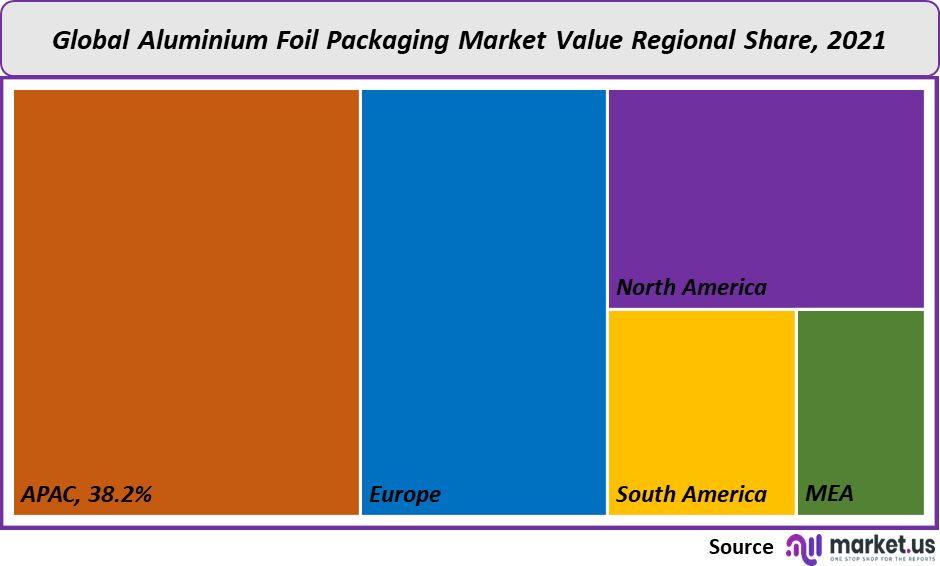

The Asia Pacific was the dominant region, with 38.2%. Asia Pacific’s growth market is due largely to the expansion of the middle-class as well as expanding consumer markets in end uses. These include food, drink, and pharmaceuticals. China and India are the two most important markets due to their high levels of manufacturing investment and large consumers.

U.S. drug companies gradually shift to flexible packaging like blisters because of their efficiency. In the future, blister packs will likely be more efficient than aluminum foil packaging.

Europe’s market for sustainable packaging will experience substantial growth due to growing awareness. The industry will also see benefits from the strict regulations the government has set in place to reduce plastic packaging.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

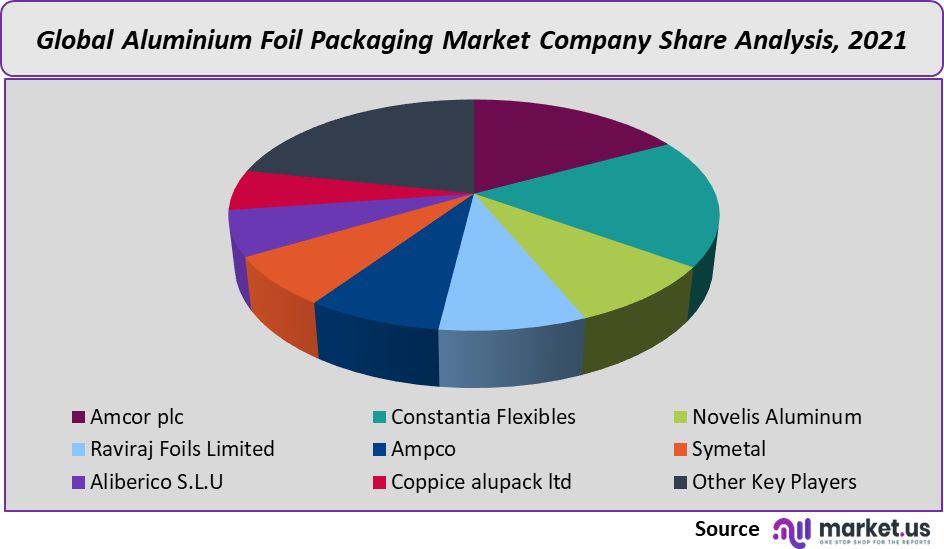

Market Share & Key Players Analysis:

The market’s key players are increasingly focusing more on mergers, acquisitions, and integrations to expand their product lines and customer base. Amcor plc has acquired Bemis Company Inc. in America, a packaging manufacturer. This acquisition has greatly enhanced the former’s product range, customer base, manufacturing capability, and geographical presence around the globe. The following companies are leaders in the global aluminum foil packaging business:

Market Key Players:

- Amcor plc

- Constantia Flexibles

- Novelis Aluminum

- Aliberico S.L.U

- Coppice alupack ltd

- Raviraj Foils Limited

- Ampco

- Symetal

- Other Key Players

For the Aluminium Foil Packaging Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Aluminum Foil Packaging market size in 2021?The Aluminum Foil Packaging market size is US$ 33,590 million for 2021.

Q: What is the CAGR for the Aluminum Foil Packaging market?The Aluminum Foil Packaging market is expected to grow at a CAGR of 4.7% during 2023-2032.

Q: What are the segments covered in the Aluminum Foil Packaging market report?Market.US has segmented the Global Aluminum Foil Packaging Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Foil Wraps, Pouches, Blisters, Containers and Other Products. By End-Use, market has been further divided into Food & Beverage, Tobacco, Pharmaceutical, Cosmetic and Other End-Uses.

Q: Who are the key players in the Aluminum Foil Packaging market?Amcor plc, Constantia Flexibles, Novelis Aluminum, Raviraj Foils Limited, Ampco, Symetal, Aliberico S.L.U, Coppice alupack ltd., Aleris Corporation, Ardagh Group and Other Key Players, are the key vendors in the Aluminium Foil Packaging market.

Q: Which region is more attractive for vendors in the Aluminum Foil Packaging market?APAC accounted for the highest growth rate of 38.2% among the other regions. Therefore, the Aluminum Foil Packaging market in APAC is expected to garner significant business opportunities for the end-uses during the forecast period.

Q: What are the key markets for Aluminum Foil Packaging?Key markets for Aluminum Foil Packaging are South Korea, China, and Japan.

Q: Which segment has the largest share in the Aluminum Foil Packaging market?In the Aluminum Foil Packaging market, End-Uses should focus on grabbing business opportunities from the Food and Beverage segment as it accounted for the largest market share in the base year.

![Aluminium Foil Packaging Market Aluminium Foil Packaging Market]() Aluminium Foil Packaging MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Aluminium Foil Packaging MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Amcor plc

- Constantia Flexibles

- Novelis Aluminum

- Aliberico S.L.U

- Coppice alupack ltd

- Raviraj Foils Limited

- Ampco

- Symetal

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |