Global Aluminum Foil Market By Product Type (Wrapper Foils, Containers Foils, Foil Lids, and Other Products), By End-Use (Packaging and Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 64625

- Number of Pages: 317

- Format:

- keyboard_arrow_up

Aluminum Foil Market Overview:

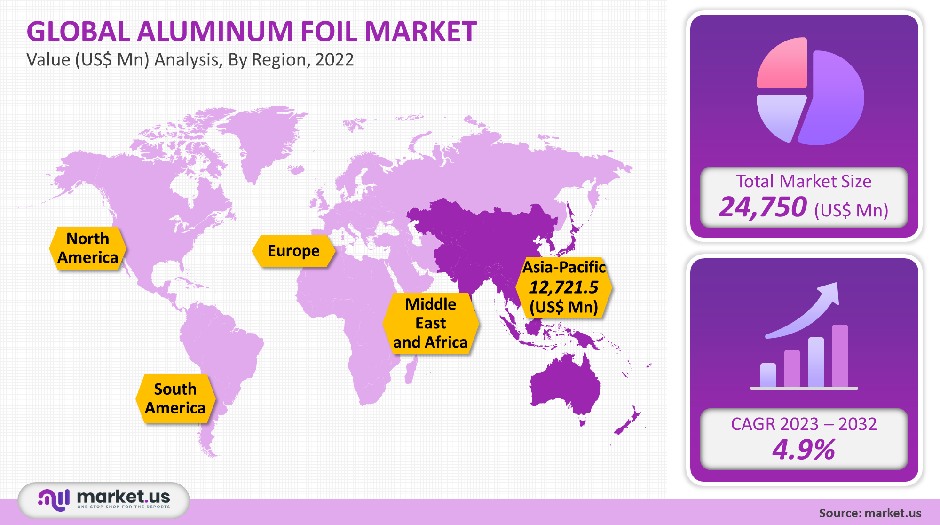

The global aluminum foil market value was USD 24,750 million in 2021. It is projected to grow at a compound periodic rate of growth (CAGR of 4.9%) between 2023-2032.

As the product gain popularity in packaging, it is expected that market growth will be enhanced. The increasing value for (EV) electric vehicles, as well as the increasing need for the system of air conditioning, are expected to rise.

The manufacturing of aluminum foil has increased due to rising pharmaceutical demand. Polfarmex for instance indulges in a blister pack packaging that is new in November 2021. This will allow it to increase its production capacity by 61%.

Global Aluminum Foil Market Scope:

Product Type Analysis

Wrapper foils were the market leader in revenue, with a share greater than 20.6%. This trend will likely continue through the forecast period. Container foil is predicted to experience the highest growth rate over the forecast period. It had a revenue share exceeding 14.4% by 2021.

Aluminum foils are very popular in the packaging sector due to their lightweight and superior barrier properties, cost-effectiveness, and simple-to-use nature. This has resulted in increased demand from restaurants, household households, supermarkets, and food delivery businesses.

A variety of beverage and food companies around the globe have proposed extending strategies to respond to the increasing demand for packaged food. Nestle USA announced, in June 2021 that it would expand its frozen food unit in South Carolina, U.S.A, with an investment of US$ 100 million. These investments are expected to drive packaging consumption and ultimately benefit market development during the forecast period.

Blister packs are expected to see significant growth because of the investment in the industries of pharmaceutical over the forecast period.

End-Use analysis

Packaging accounted for over 65.8% of global market revenue in 2021. It is expected that this share will continue to rise at a steady rate. This segment is further divided into food & beverages, tobacco, pharmaceuticals, and others. The largest revenue share for packaging end-use in 2021 was held by the food and beverage segment. The demand for packaged food is increasing due to global urbanization. This trend is expected to continue through the forecast period.

In terms of revenue, the industrial sector is expected to grow at a 4.1% CAGR during the forecast period. It is further broken down into HVAC, battery, and others. Finstock is widely utilized in HVAC and refrigeration. Aluminum foils are expected to expand in this sector due to the demand for energy-efficient equipment with lower carbon emissions. The world’s leading air conditioner manufacturers are expanding their capabilities to meet the growing demand.

In electrolytic capacitors of lithium-ion EV batteries, aluminum foils are also employed. The increased demand for EVs is expected to lead to steady growth of the industrial segment

Кеу Маrkеt Ѕеgmеntѕ

By Product

- Wrapper Foils

- Containers Foils

- Foil Lids

- Pouches

- Blister Packs

- Other Products

By End-Use

- Packaging

- Food & Beverage

- Pharmaceutical

- Tobacco

- Others

- Industrial

- HVAC

- EV Battery

- Others

Market Dynamics:

The U.S. remained the largest North American market in 2021. It is expected that this trend will continue during the forecast period. The product is used extensively by the food & beverages, automotive, FMCG, as well as FMCG industries. The country is attempting to boost the manufacturing of various end-use industries, which is expected to drive aluminum foil demand in the forecast period.

To safeguard the domestic aluminum industry, the U.S. implemented an anti-dumping duty on foils and aluminum products in countries like Oman. Novelis Inc. planned US$ 7 million investments in July 2021 in order to reopen its aluminum foil manufacturing unit at Terre Haute in Indiana. U.S. Novelis Inc. discontinued its production in 2014 because of unfavorable economic conditions.

EVs comprise a large part of batteries. For electrolytic capacitors, lithium-ion and aluminum foil batteries are used. Product demand is expected to increase as a result of the growing EV market. Toyota Motor, for instance, announced in October 2021 a US$ 1.3 billion plan to build an EV and hybrid battery plant in North Carolina, U.S.A.

Due to their lightweight, corrosion resistance, and insulation capabilities, the aluminum foils market is booming in the building and construction sector. Aluminum foil usage is expected to rise due to increased investments in the building industry. For example, 2021 saw a US construction budget of US$ 1,589.0 trillion. This is 8.2% less than US$ 1,469.2 trillion in 2020.

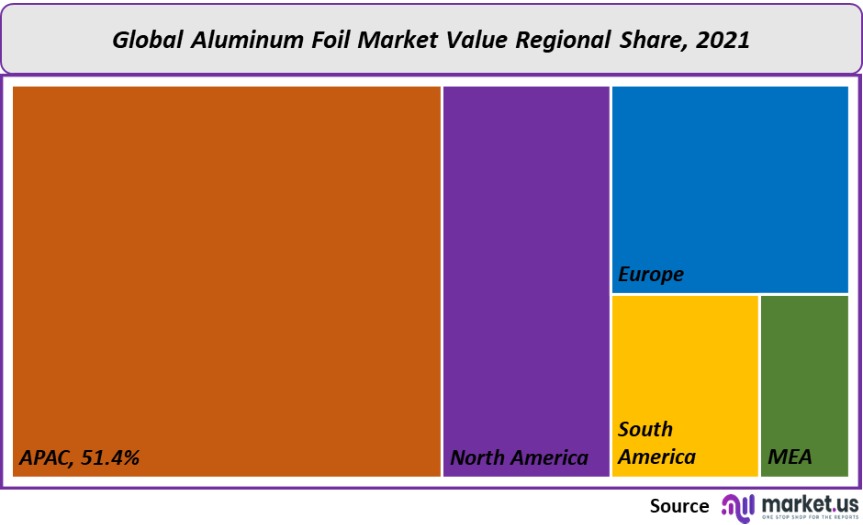

Regional Analysis

The Asia Pacific had a revenue sharing of over 51.4% on the global market in 2021. Product demand is expected to increase due to increasing demand from the packaging sector. SRF Limited, India’s board, approved INR 422.5 crore (US$ 5.60billion) to build an aluminum foil production plant in Jaitapur in Indore in January 2022. It will serve the packaging needs of both domestic and foreign food & beverages industries.

North America is forecast to see a 6.1% annual rate of growth in revenue over 2023-2032. Market growth should be aided in part by a more intense focus on EV-battery production. In March 2021 the Canadian government announced that it was investing US$ 100 million into Lion Electric’s battery-making facility in St-Jerome Quebec.

Europe is predicted to record important growth over the forecast period. The foils market has seen growth due to factors like initiatives or steps taken by the government to support food exports, as well as decarbonization targets. The U.S. government’s October 2021 lifting of steel and aluminum trade tariffs is expected to lead to an increase in aluminum foil exports over the forecast time.

Increased take-out restaurants catering to the middle class will be a major driver in the Middle East and African regions. In order to promote awareness and reduce packaging in countries, like Saudi Arabia or the UAE, the government has taken several initiatives.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

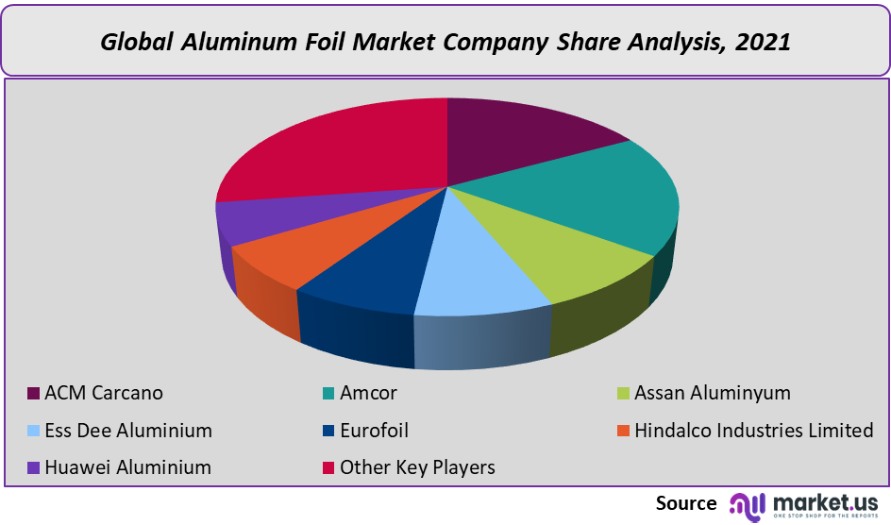

This market is highly competitive, fragmented, and has many players. Also, companies must compete with alternative packaging like paper, glass, or plastic. For companies to be competitive in this market, they must constantly communicate with their customers.

Companies are compelled to invest in expanding manufacturing units due to increasing product demand. Shyam Metalics announced an INR 300 crore ($3.97 billion) investment in September 2021 for a packaging plant. These are the top players in the global market for aluminum foil:

Маrkеt Кеу Рlауеrѕ:

- ACM Carcano

- Amcor

- Assan Aluminyum

- Ess Dee Aluminium

- Eurofoil

- Hindalco Industries Limited

- Huawei Aluminium

- Other Key Players

For the Aluminum Foil Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Aluminum Foil market in 2021?A: The Aluminum Foil market size is estimated to be US$ 24,750 million in 2021.

Q: What is the projected CAGR at which the Aluminum Foil market is expected to grow at?A: The Aluminum Foil market is expected to grow at a CAGR of 4.9% (2023-2032).

Q: List the segments encompassed in this report on the Aluminum Foil market?A: Market.US has segmented the Aluminum Foil market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Wrapper Foils, Containers Foils, Foil Lids, Pouches, Blister Packs, Other Products. By End Use, the market has been further divided into Packaging and Industrial.

Q: List the key industry players of the Aluminum Foil market?A: ACM Carcano, Amcor, Assan Aluminyum, Ess Dee Aluminium, Eurofoil, Hindalco Industries Limited, Huawei Aluminium and Other Key Players engaged in the Aluminum Foil market.

Q: Which region is more appealing for vendors employed in the Aluminum Foil market?A: APAC is expected to account for the highest revenue share of 51.4 %. Therefore, the Aluminum Foil Technology industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Aluminum Foil?A: South Korea, Germany, Canada, Japan, Brazil & The US, are key areas of operation for Aluminum Foil Market.

Q: Which segment accounts for the greatest market share in the Aluminum Foil industry?A: With respect to the Aluminum Foil industry, vendors can expect to leverage greater prospective business opportunities through the Packaging segment, as this area of interest accounts for the largest market share.

![Aluminum Foil Market Aluminum Foil Market]()

- ACM Carcano

- Amcor

- Assan Aluminyum

- Ess Dee Aluminium

- Eurofoil

- Hindalco Industries Limited

- Huawei Aluminium

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |