Global Ammonium Nitrate Market By Product Type (Solid ammonium and Liquid ammonium), By Application (Fertilizers, Explosives and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Mar 2022

- Report ID: 31489

- Number of Pages: 322

- Format:

- keyboard_arrow_up

Ammonium Nitrate Market Overview:

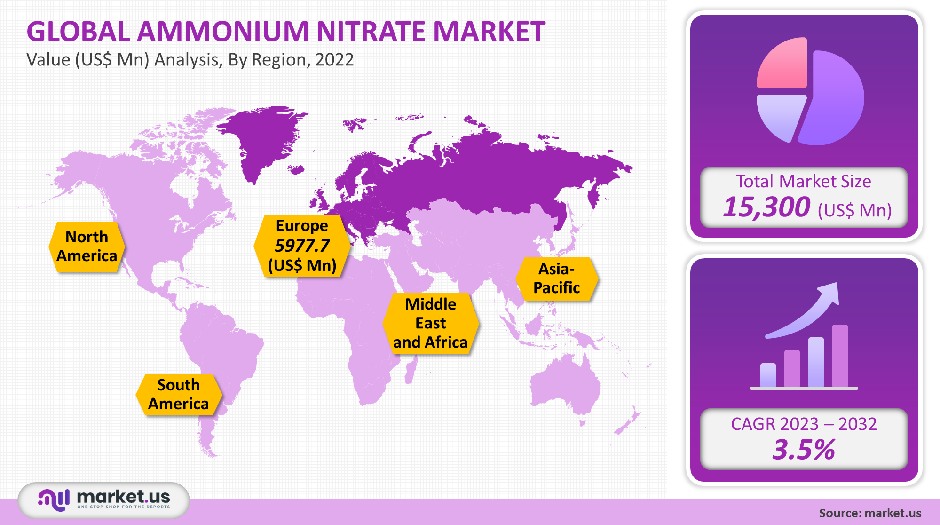

In 2021, the global market for ammonium nitrate was valued at USD 15,300 million and will grow at 3.5 % annually between 2023-2032.

The market is expected to grow due to the rising demand for the product in fertilizers that use it as a nitrogen source. Also, explosive manufacturing is a major market for the product, which is expected to help propel industry growth.

Global Ammonium Nitrate Market Scope:

Product Type analysis

Two forms of ammonium nitrate are available: solid ammonium and liquid ammonium. In 2021, the market’s largest share was held by the solid form. It is expected to continue its dominance in the future.

The solid ammonium nitrate consists of two components of varying densities. The higher density components are used in a wide range of industries, but most commonly in military and demolition.

Application analysis

In 2021, fertilizer was the biggest application segment in terms of revenue. The product is more nutritious than its substitute, Urea. The increasing global population has forced farmers to increase their crop production yields. This has resulted in high demand for fertilizers and accelerated the industry’s growth.

Rising demand for soybean, maize, and barley for various non-food and food applications, including biofuel production, is expected to drive demand for fertilizers. This will have a positive effect on the industry trend. From 2023 to 2022, the industry trend is positive as the demand for fertilizers should grow at a 4.4% CAGR.

ANFO, or Ammonium Nitrate fuel oil, contains approximately 94% porous Ammonium Nitrate. This is an industrial explosive mix that is widely used for mining operations such as the extraction of coal and metal. Market growth will be driven by increasing mining activities in different countries worldwide, including the U.S.A, Argentina, and India.

Projections for blasting products will continue to grow due to the rising demand for bauxite (manganese), diamonds, and other base metals. High investments made by mining companies in the exploration of new sites for valuable metals or minerals are expected to further fuel market growth for mining applications.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Solid ammonium

- Liquid ammonium

By Application

- Fertilizers

- Explosives

- Other Applications

Market Dynamics:

It is easy to produce ammonium Nitrate because of the abundance of key raw materials like citric acids, and sodium carbonate. High competition has led to a decline in profits for many industry players. They have integrated their strategies from raw material production to distribution.

China accounted for a large share of global fertilizer consumption, due to the country’s high fertilizer production volume. China was the biggest nitrogen fertilizer consuming country in 2016 and this trend is expected to continue.

The demand for high-quality crops is growing rapidly, which is driving the increase in fertilizer usage over the past few decades. This has led to an increase in the demand for ammonium and nitrate, which has resulted in the remodeling and expansion of old production facilities.

In the last few years, terrorist acts involved the use and sale of Ammonium Nitrate. This has led the government of the United States to revise strict regulations concerning the usage of this product. The Department of Homeland Security Appropriations Law Public Law 110-161 states that the U.S. Government is responsible for the regulation of the sale and transfer of Ammonium Nitrate.

While ammonium Nitrate is easily available for fertilizer purposes, there are restrictions in place. A legit license is required to use the product in certain countries such as the United States and India. The market is expected to be affected by the restriction due to possible fertilizer bomb production.

Product temperatures exceeding 400 degrees Fahrenheit may explode if heated, contaminated, or placed in an enclosed area without adequate ventilation. There are safety guidelines for product handling, storage, and manufacturing. OSHA stipulates that the construction of new ammonium Nitrate facilities must not involve any combustion.

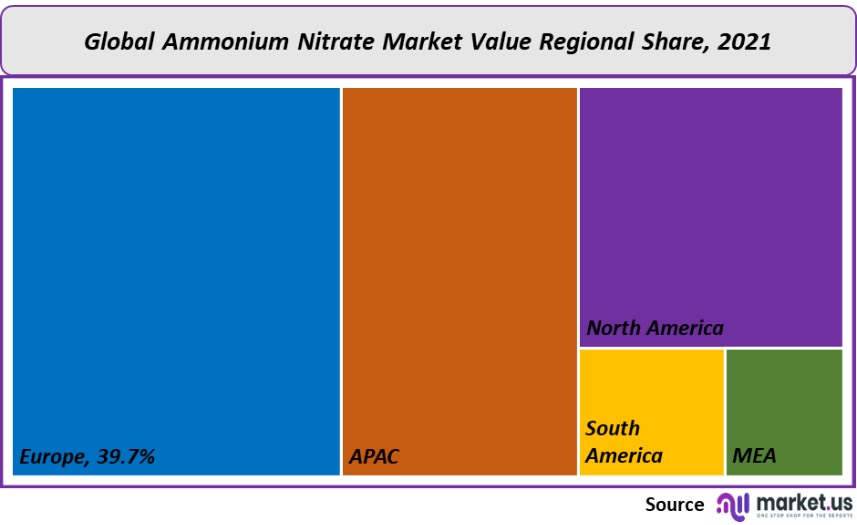

Regional Analysis

Europe was the dominant market, accounting for over 39.07% of global revenue in 2021. The industry was dominated by the U.S.A., Europe, China, and Japan in 2021 in terms both of production and consumption. However, high levels of urea in fertilizer application to substitute the product in Spain (and Portugal) have hampered product demand over recent years. This trend is expected to continue for the next eight years and could impact industry growth in Europe.

China’s ammonium nitrogen nitrate exports increased by more than 25% in July 2015 to Oman (Thailand), Malaysia (Malaysia), and Thailand (Thailand). The region’s growing fertilizer manufacturing sector due to rising domestic consumption will likely drive product demand during the forecast period.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

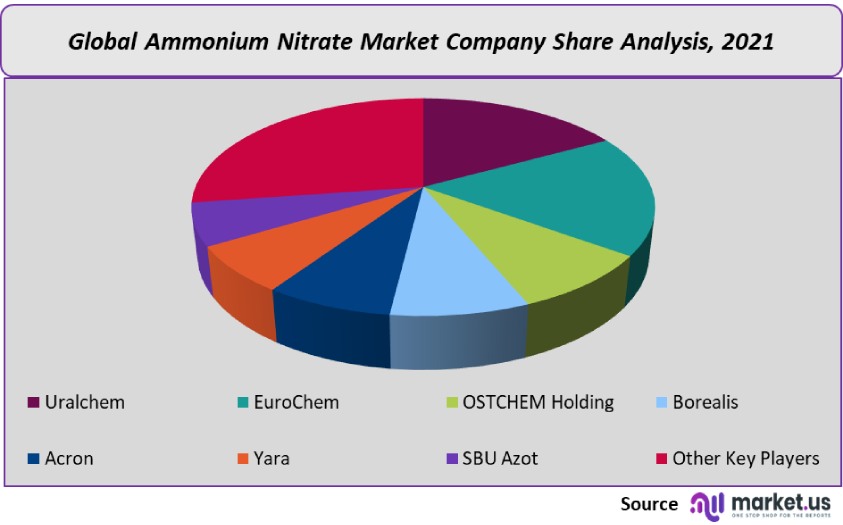

Market Share & Key Players Analysis:

The market is competitive due to the presence of many buyers and suppliers. Due to high initial investments in equipment such as screeners, driers, and recycle – Slurry mixers, as well as tight profit margins, the industry rivalry will likely be lower over the forecast period.

India has seen a decrease in ammonium nitrate distributors and manufacturers over recent years. This is due to stricter regulations and shorter margins. Gujrat Hari Narmada Valley Fertilizers is the only major manufacturer of the product in India, thus contracting the market

Мarkеt Кеу Рlауеrѕ:

- Urаlсhеm

- ЕurоСhеm

- ОЅТСНЕМ Ноldіng

- Воrеаlіѕ

- Асrоn

- Yаrа

- ЅВU Аzоt

- Other Key Players

For the Ammonium Nitrate Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Ammonium Nitrate market in 2021?A: The Ammonium Nitrate market size is estimated to be US$ 15,300 million in 2021.

Q: What is the projected CAGR at which the Ammonium Nitrate market is expected to grow at?A: The Ammonium Nitrate market is expected to grow at a CAGR of 3.5% (2023-2032).

Q: List the segments encompassed in this report on the Ammonium Nitrate market?A: Market.US has segmented the Ammonium Nitrate market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Application, market has been segmented into Solid ammonium and Liquid ammonium. By End-User, the market has been further divided into Fertilizers, Explosives, and Other Applications.

Q: List the key industry players of the Ammonium Nitrate market?A: Urаlсhеm, ЕurоСhеm, ОЅТСНЕМ Ноldіng, Воrеаlіѕ, Асrоn, Yаrа, ЅВU Аzоt, Іnсіtес Ріvоt, Zаklаdу, Оrіса, and Other Key Players engaged in the Ammonium Nitrate market.

Q: Which region is more appealing for vendors employed in the Ammonium Nitrate market?A: Europe is expected to account for the highest revenue share of 39.8%. Therefore, the Ammonium Nitrate Technology industry in Europe is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Ammonium Nitrate?A: U.S., Ukraine, Poland, China, Europe, India & The US, are key areas of operation for Ammonium Nitrate Market.

Q: Which segment accounts for the greatest market share in the Ammonium Nitrate industry?A: With respect to the Ammonium Nitrate industry, vendors can expect to leverage greater prospective business opportunities through the Solid ammonium segment, as this area of interest accounts for the largest market sharew.

![Ammonium Nitrate Market Ammonium Nitrate Market]()

- Urаlсhеm

- ЕurоСhеm

- ОЅТСНЕМ Ноldіng

- Воrеаlіѕ

- Асrоn

- Yаrа

- ЅВU Аzоt

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |