Global Automotive Interior Leather Market By Vehicle (Passenger Cars, Trucks & Buses, and Light Commercial Vehicles), By Material (Synthetic and Genuine), By Application (Headliners, Upholstery, Seat Belt, Carpet, and Other Application), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov 2021

- Report ID: 15207

- Number of Pages: 244

- Format:

- keyboard_arrow_up

Automotive Interior Leather Market Overview

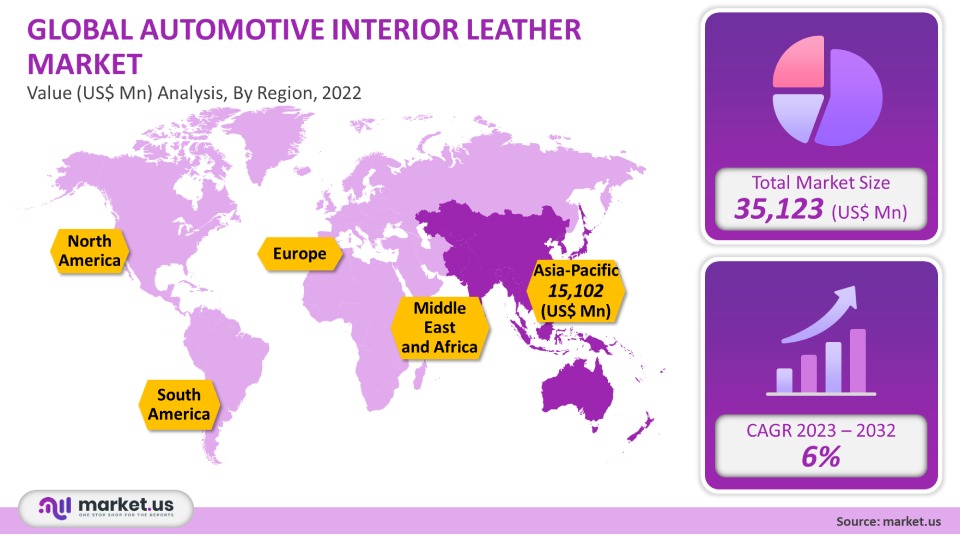

The Automotive Interior Leather global market was valued at USD 35,123 million in 2021. It is projected to grow at a 6% CAGR from 2023-2032. A key trend driving the market growth is the rising number of automotive manufacturing activities in emerging markets like India and China. In the future, the market will see an increase in demand for synthetic/artificial Leather in less expensive motor vehicle options.

Global Automotive Interior Leather Market Analysis

Material Analysis

The automotive interior leather market was dominated by genuine leather in terms of its value in 2021. It is a byproduct of the meat industry. In 2021, genuine leather contributed the most to the global automotive interior leather market in value. Bayerische Motoren Werke AG, Land Rover, and Rolls-Royce Motor Cars Limited are some of the most significant end users.

Synthetic leather is rapidly gaining popularity because of the increasing consumer disposable income, constant technological advancements, and better product performance than other leather alternatives. The rapid growth of the automobile industry will likely open up new markets for synthetic leather producers.

Vehicle Analysis

The largest vehicle segment for automotive leather in passenger vehicles is expected to be Passenger Vehicles, with a revenue share exceeding 50%. Light Commercial Vehicles (LCV) will emerge as the most promising segment during the forecast period.

Passenger vehicle production is expected to increase due to increased use and protection from environmental conditions like heat and dust. APAC is home to two of the largest manufacturing centers for passenger vehicles, India and China. These countries are seeing a continuous rise in passenger vehicle production. Due to rapid urbanization, sales are also on a steady growth path. Projections for growth in the market are based on a rise in passenger vehicle demand.

Profitable growth in commercial transportation services, such as taxis, is expected to complement the LCV segment’s growth. The adoption of interior leather for cars is encouraged by improved road infrastructure and rapid urbanization in emerging countries.

Application Analysis

Based on their application, the market can be segmented into headliners, seat belts, upholstery, carpet, and others. The call will be led by upholstery for the duration of the forecast. Automotive upholstery requires the use of both professional knowledge and the ability to use specialized machinery and materials. The main application of upholstery is the reupholstering and recovering seats and trims for a vehicle’s interior. Because they are subject to the most wear and damage, the seats are most often reupholstered.

Key Market Segments

By Vehicle

- Passenger Cars

- Trucks & Buses

- Light Commercial Vehicles

By Material

- Synthetic

- Genuine

By Application

- Headliners

- Upholstery

- Seat Belt

- Carpet

- Other Application

Market Dynamics

Artificial leather is becoming more popular, which will increase investment. The trend has been towards synthetic/artificial versions cheaper than genuine leather. Artificial leather production costs are lower than natural leather and require a much simpler manufacturing process.

Asia Pacific’s automotive manufacturing sector is increasing. China and India are key growth drivers for the industry in the Asia Pacific. Automotive production is driven in these countries by steady GDP growth, income growth, and government support. China is the world’s largest automobile manufacturer in the volume of vehicles produced. Even in a recession, Asia Pacific saw an increase in automobile production. A rising per-capita income has led to a higher demand for cars in the domestic market. Due to lower overheads and labor costs, many luxury brands like BMW have relocated their manufacturing plants from the United States to China.

Natural leather is derived from dead animals. Numerous countries have developed guidelines and established laws to protect the rights of animals. For many countries, animal rights laws are a significant hurdle for manufacturers of natural skin. PETA programs have helped to raise awareness about animal exploitation and have significantly contributed to the increase in demand for leather substitutes. A primary reason why manufacturers are switching to synthetic leather is the increasing supply-demand gap within the natural leather industry.

The lower manufacturing cost of synthetic leather is another factor that drives its popularity of synthetic leather. Synthetic leather is cheaper than natural leather in terms of manufacturing costs. Synthetic leather can also be made faster. This has led to increased investment in artificial skin and will likely lead to greater market penetration.

Government regulations and environmental legislation have influenced increased demand for synthetic skin. The pollution caused by natural leather production, especially tanning, has led to a shift in preference for synthetic leather. This is another reason why synthetic leather is becoming more popular.

Artificial leather can also pose serious environmental hazards. PVC, which is derived from plastic, contains carcinogens as well as other toxic chemicals. These chemicals can transfer to the skin of users through contact. PVC also has a slow biodegradation rate, making it a more harmful material for the environment. PU does not have the same toxicity issues as PVC. However, it is only toxic in its manufacturing process and can be sealed once dried.

Regional Analysis

The Asia Pacific was the largest region for automotive interior leather in 2021. It accounted for 43% global market share in terms of revenue. Europe followed the Asia Pacific with a revenue share in 2021. North America was the third-largest market in 2021. Central & South America and Middle East & Africa accounted for low revenue shares.

China is Asia Pacific’s largest synthetic leather market. China’s automotive industry, a crucial application segment, is seeing rapid growth. The country has many growth factors, including abundant resources, easy access and penetration of premium vehicles, and easy accessibility to the most up-to-date technologies. The automotive interior-leather market of Asia Pacific is forecast to increase due to the rapidly growing automotive sector in emerging countries like India, China, and other Asian nations. The Asia-Pacific automotive interior market is expected to boost the fastest due to rising per-capita incomes, an increasing middle-class population, and improving living standards. The automotive industry’s rapid growth should increase the region’s product demand. China, India, and Bangladesh will likely be the primary drivers of regional market growth. China is a key producer and consumer of leather all over the world. Many industry players in the Asia Pacific are increasing their manufacturing capacities.

The European market accounted for a large share of the global automotive interior market, with a valuation of US$ million. Europe experienced significant growth because of the dominant automotive and consumer appliance sectors. Many countries in the region have refocused their efforts on low-cost, bio-based products with long-lasting durability after the economic downturn. The area will likely demand more synthetic leather than genuine leather. European companies are trying to increase vehicle sales through attractive pricing strategies that attract customers.

Key Regions and Countries covered in thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

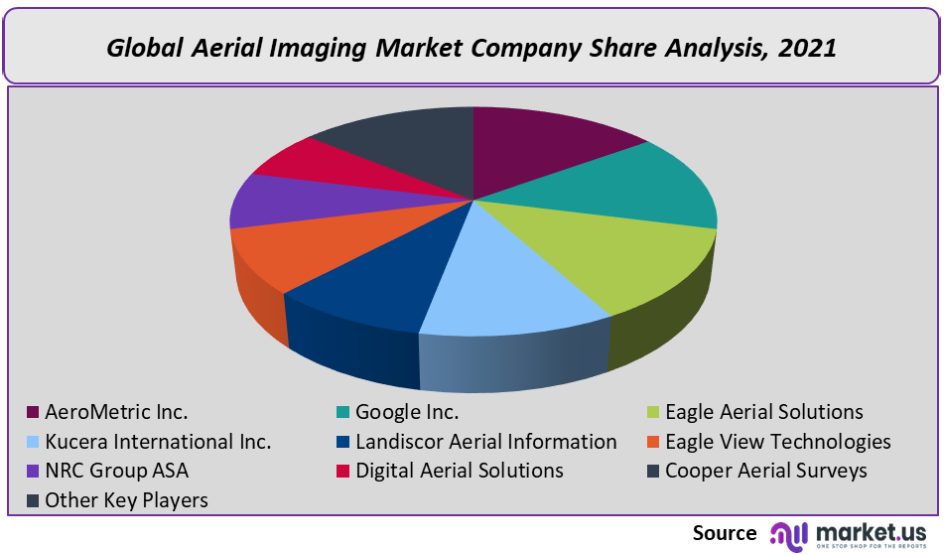

Global automotive interior leather markets are highly fragmented. Some players have carved a niche for particular regions or car types. The market is thriving because of the strategic collaborations between companies. To adapt to changing consumer preferences, companies are focusing on strategic partnerships. However, expansion strategies will remain highly sought after by leading players.

Маrkеt Кеу Рlауеrѕ:

- Alphaline Auto

- San Fang Chemical Industry Co. Ltd.

- Eagle Ottawa LLC

- Nan Ya Plastics Corporation

- Wollsdorf Leder Schmidt & Co Ges.m.b.H.

- Boxmark

- Tata International Ltd

- K. Leather Corporation

- Other Key Players

For the Automotive Interior Leather Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Automotive Interior Leather Market in 2021?The Automotive Interior Leather Market size is US$ 35,123 million in 2021.

Q: What is the projected CAGR at which the Automotive Interior Leather Market is expected to grow at?The Automotive Interior Leather Market is expected to grow at a CAGR of 6% (2023-2032).

Q: List the segments encompassed in this report on the Automotive Interior Leather Market?Market.US has segmented the Automotive Interior Leather Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Vehicle, the market has been further divided into Passenger Cars, Trucks & Buses, and Light Commercial Vehicles. By Material, the market has been further divided into Synthetic and Genuine. By Application, the market has been further divided into Headliners, Upholstery, Seat Belt, Carpet, and Other Application.

Q: List the key industry players of the Automotive Interior Leather Market?Alphaline Auto, San Fang Chemical Industry Co. Ltd., Eagle Ottawa LLC, Nan Ya Plastics Corporation, Wollsdorf Leder Schmidt & Co Ges.m.b.H., Boxmark, Tata International Ltd, D.K. Leather Corporation, and Other Key Players are engaged in the Automotive Interior Leather market

Q: Which region is more appealing for vendors employed in the Automotive Interior Leather Market?APAC is expected to account for the highest revenue share of 43%. Therefore, the Automotive Interior Leather industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Automotive Interior Leather?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Automotive Interior Leather Market.

Q: Which segment accounts for the greatest market share in the Automotive Interior Leather industry?With respect to the Automotive Interior Leather industry, vendors can expect to leverage greater prospective business opportunities through the genuine material segment, as this area of interest accounts for the largest market share.

![Automotive Interior Leather Market Automotive Interior Leather Market]() Automotive Interior Leather MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample

Automotive Interior Leather MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample - Alphaline Auto

- San Fang Chemical Industry Co. Ltd.

- Eagle Ottawa LLC

- Nan Ya Plastics Corporation

- Wollsdorf Leder Schmidt & Co Ges.m.b.H.

- Boxmark

- Tata International Ltd

- K. Leather Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |