Global Bio-Based Construction Polymer Market by Product Type (Polyurethane, Epoxies, PLA, PHA), By Application (Pipe, Profile, Insulation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2021

- Report ID: 22258

- Number of Pages: 375

- Format:

- keyboard_arrow_up

Bio-Based Construction Polymers Market Overview

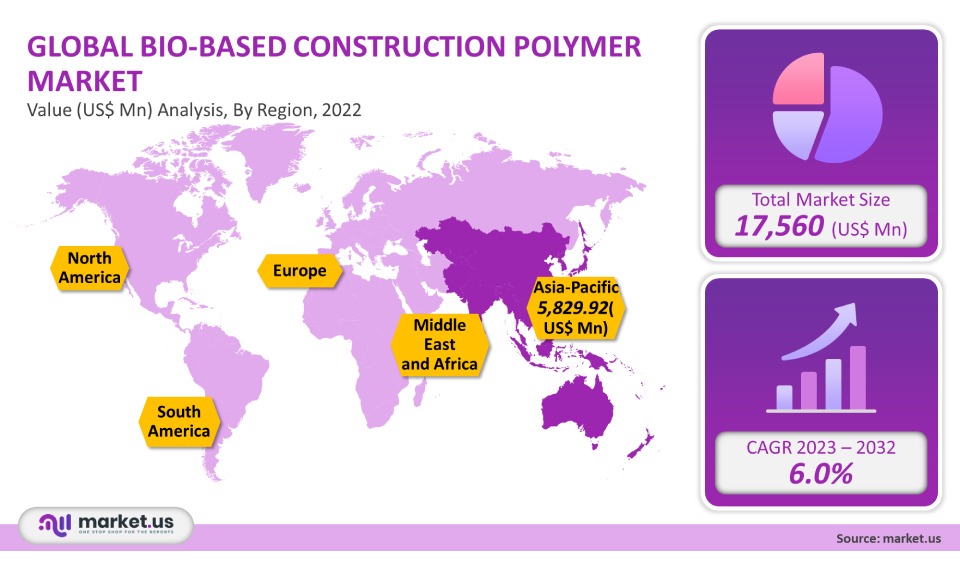

The Global Bio-Based Construction Polymers Market was worth US$ 17,560 million in 2021 with a CAGR value of 6.0%.

The bio-based construction market is expected to rise due to growing concern about the use of petrochemical products and the increased adoption of renewable products. A major source of greenhouse gases is fossil fuel use in many industrial operation facilities. The growing concern about carbon dioxide emissions from large-scale manufacturing units has led to a shift in the industry towards bio-based products.

The use of bio-based plastics in the construction industry has grown due to increased R&D to create eco-friendly, renewable products. High production costs and less developed global supply chain value chains will likely hinder growth. The market for bio-based products has not been fully developed enough to take advantage of the economies of scale. Recently, technology has made it possible to produce bio-based polymers using bacterial fermentation. This technology uses renewable sources like fatty acids and cellulose to synthesize monomers.

Global Bio-Based Construction Polymer Market Scope:

Product type analysis

Polyurethane was the most popular product in the global market and accounted for more than 27.3% of the total volume share in the 2021 bio-based construction polymer industry. Over the next eight years, this product segment will see a 10.7% CAGR. There is significant potential for the market to use bio-based polyurethanes in insulation, particularly in Europe and the U.S.

Due to its broad range of uses in construction such as paints, coatings, adhesives, wood, and concrete repair, the market for bio-based epoxies will see moderate growth in the coming years. PLA and PHA will experience the fastest growth due to increased use and other advantages. PLA is a bio-derived monomer, used in the construction industry to suspend, foam, pore form agent, binder, and coating glue. PHA, which is made from microorganisms, can be used as a viscosity, coating, and performing agent. Polytrimethylene Terephthalate (PTT), and Polybutylene succinate, both bio-based plasticizers, are also available.

Application analysis

Pipe, profile, and insulation are the main applications. The largest application segment was a pipe which accounted for over 38.2% of global demand in 2021. Plastics have been used in many different applications by the construction industry, including pipe fittings as well as insulation.

A growing number of fittings and pipe segments are using plastic compounding. This is due to their lower cost, long-term durability, corrosion resistance, lightweight, and low cost. There are many common applications for bio-based polymers in construction: windows and doors, roofing, plumbing, cement, flooring, sealing, adhesives, and insulation. Market growth is expected to accelerate due to the rising use of bio-based polymers in profile engineering for all types of composite structures. In the next eight years, profile application is expected to grow by 10.9%. Other construction applications are bridge bearings and the FRP bridge sections.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Polyurethane

- PHA

- PLA

- Epoxies

By Application

- Profile

- Pipe

- Insulation

Market Dynamics:

The favorable regulatory framework in various countries, as well as initiatives taken by regional governments to support the use of biopolymers, will likely have a positive influence on the growth of the bio-based polymers market over time. Bio-based raw materials are supported by regulations like the Lead Market Initiative, U.K., and Bio Preferred, U.S. Major manufacturers are shifting focus to developing sustainable technologies. They are collaborating with various bio-based tech firms to manufacture these plasticizers.

Segmentation has been made for the market based upon product, applications, and geographic location. Based on product, segments of the bio-based polymers market have been made into epoxies Polyethylene Tetherate (PET), cellulose-acetate, Polyurethane, and epoxies. Other product includes Ethylene Propylene Diene Monomer (EPDM), Polyamide (PA), rubber, Polybutylene Adipate-co-terephthalate (PBAT), Polyethylene (PE), Polyhydroxyalkanoates (PHA), Polybutylene Succinate (PBS), Polylactic Acid (PLA), and starch blends.

Pipe, profile, and insulation are important applications. Other applications include wiring, flooring, and films. Original Equipment Manufacturers, or OEMs, are the major users of the bio-based polymer. Manufacturers have formed partnerships to meet the demand from many different end-use industry players, including construction and bio-plastic. Bio-On partnered with COPRAB to invest in biopolymers. The increased efficiency and high product performance of Bio-No’s products led to a stronger collaboration

Regional Analysis

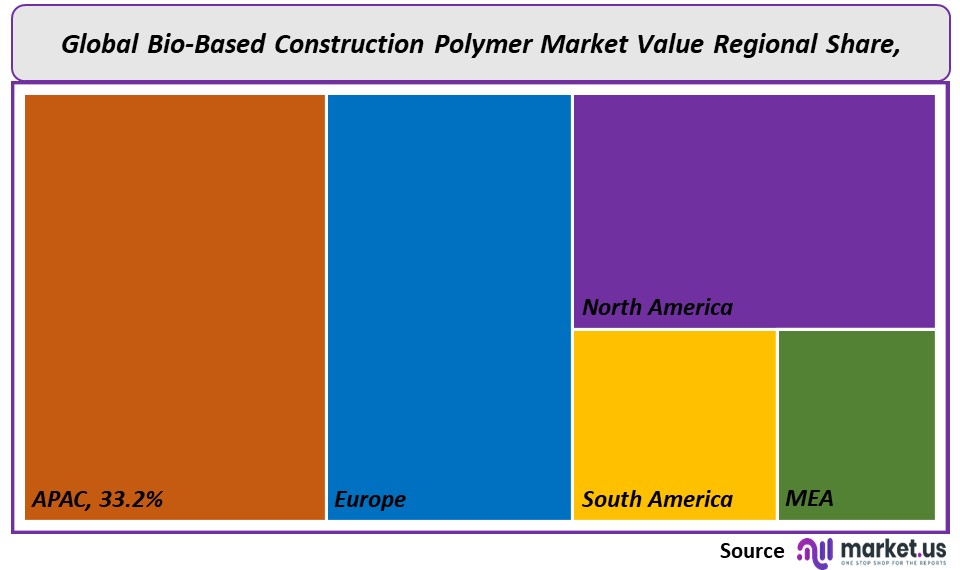

It is expected that emerging markets in the Asia Pacific (with a revenue share of 33.2%) and South America will see significant demand. The favorable environment for bio-based products and infrastructure development in countries like Brazil, India, China, and China is expected to lead to high growth.

Europe and North America are experiencing moderate growth. The lack of infrastructural development in these regions means that countries like the U.S. will see a decrease in their market share.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

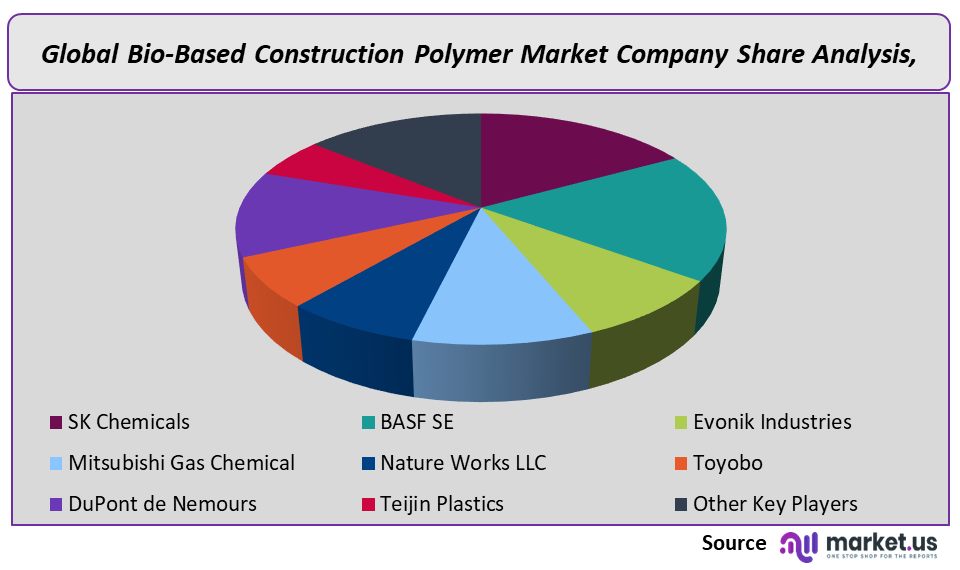

The market is extremely competitive. It is likely to consolidate and there will be an increase in strategic alliances, mergers, and acquisitions. Major companies include SK Chemicals SE, Mitsubishi Gas Chemical, (BASF SE), Evonik Industries, DuPont de Nemours Nature Works LLC, Toyobo, and Teijin Plastics.

Маrkеt Кеу Рlауеrѕ:

- SK Chemicals

- BASF SE

- Evonik Industries

- Mitsubishi Gas Chemical

- Nature Works LLC

- Toyobo

- DuPont de Nemours

- Teijin Plastics

- Other Key Players

For the Bio-Based Construction Polymers Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Bio-Based Construction Polymer market in 2021?The Bio-Based Construction Polymer market size is US$ 17,560 million in 2021.

Q: What is the projected CAGR at which the Bio-Based Construction Polymer market is expected to grow at?The Bio-Based Construction Polymer market is expected to grow at a CAGR of 6.0% (2023-2032).

Q: List the segments encompassed in this report on the Bio-Based Construction Polymer market?Market.US has segmented the Bio-Based Construction Polymer market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Polyurethane, Epoxies, PLA, PHA. By Application, the market has been further divided into Pipe, Profile, Insulation.

Q: List the key industry players of the Bio-Based Construction Polymer market?SK Chemicals, BASF SE, Evonik Industries, Mitsubishi Gas Chemical, Nature Works LLC, Toyobo, DuPont de Nemours, Teijin Plastics and Other Key Players engaged in the Bio-Based Construction Polymer market.

Q: Which region is more appealing for vendors employed in the Bio-Based Construction Polymer market?APAC accounted for the highest revenue share of 33.2%. Therefore, the Bio-Based Construction Polymer industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Bio-Based Construction Polymer?China, Japan, India, South Korea are key areas of operation for Bio-Based Construction Polymer Market.

Q: Which segment accounts for the greatest market share in the Bio-Based Construction Polymer industry?With respect to the Bio-Based Construction Polymer industry, vendors can expect to leverage greater prospective business opportunities through the Polyurethane segment, as this area of interest accounts for the largest market share.

![Bio-Based Construction Polymers Market Bio-Based Construction Polymers Market]() Bio-Based Construction Polymers MarketPublished date: May 2021add_shopping_cartBuy Now get_appDownload Sample

Bio-Based Construction Polymers MarketPublished date: May 2021add_shopping_cartBuy Now get_appDownload Sample - SK Chemicals

- BASF SE Company Profile

- Evonik Industries

- Mitsubishi Gas Chemical

- Nature Works LLC

- Toyobo

- DuPont de Nemours

- Teijin Plastics

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |