Global Brewery Equipment Market By Type (Craft Brewery Equipment, and Macrobrewery Equipment), By Mode of Operation (Manual, Semi-automatic, and Automatic), By End-Use (Craft Brewery, and Macro Brewery), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 47422

- Number of Pages: 316

- Format:

- keyboard_arrow_up

Brewery Equipment Market Overview:

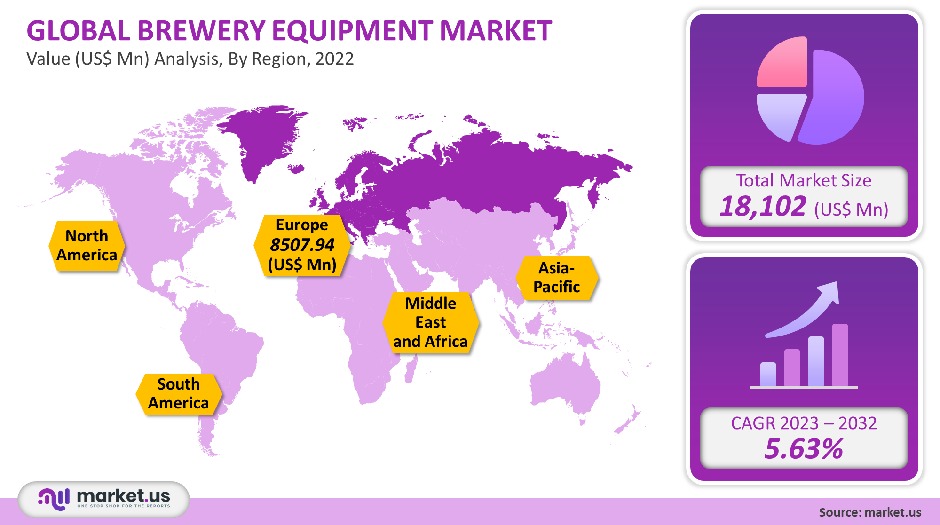

The global market for brewery equipment was valued at USD 18,102 million in 2021 and is expected to increase at a CAGR of 5.63% between 2023-2032.

The forecast period will see a rise in demand for brewery equipment due to the unique flavor of craft beer and the increasing popularity of craft beer among beer drinkers all over the globe. The growing demand for beer is responsible for the increased demand for brewery equipment. This is due to its benefits such as low calories and high amounts of antioxidants.

Beer is a liquor made from natural ingredients like hops, yeast, water, malted grains, and other ingredients. It also contains fibers and vitamins, as well as phytophagous, which can positively influence the consumer’s diet.

Global Brewery Equipment Market Analysis

Type Analysis

According to type, the market can be classified as a craft brewery or microbrewery. The market’s largest share was held by Macro brewery equipment, which accounted for 52% of the total global revenue. This is due to an enviable and steady increase in demand for standard types of beer over the forecast period.

The macro brewery equipment section can further be broken down into cooling, brewing, filtration, and filling as well as fermentation equipment. This segment also includes equipment such as spent grain silos, bright beer tanks, and generators, as well as pipes. Projections show that the demand for high-capacity equipment to make large-scale beer production will increase.

The highest anticipated CAGR for fermentation equipment is 5.74% during the forecast period. Product demand is expected to rise due to the availability of premium quality fermentation equipment as well as the need to constantly change it due to its constant use.

This segment includes various equipment like cooling, mashing, and fermentation. You will also find filters, compressors pumps, separators, and pumps. Compressors accounted for a large share of the overall market for craft brewery equipment in 2021. Because compressors provide air compression during fermentation, this is why they are in high demand.

Mode Of Operation Analysis

Automated brewery equipment held a significant revenue share in 2021. This was due to the growing demand for process automation in the beer production process due to the complexity of complex procedures.

Automation is a critical component for large breweries to strengthen their core business, which involves beer production. These key breweries focus their investment on fermentation, equipment for incremental brewing, as well as packaging. The market is expected to grow due to the above phenomenon.

The forecast period predicts a higher consumer preference for artisanal beer and handcraft beer than conventionally brewed beer. This is expected to increase demand for automated and semi-automatic brewery equipment in various regions.

Diverse breweries have recognized the need to build sustainable, modern distillery facilities. Over the forecast period, however, major constraints for emerging market players include high initial investment, maintenance costs, and electrical expenses.

End-Use Analysis

The macro brewery segment accounted for high global revenue, in 2021. The segment growth is expected to be aided by the production rate provided by the equipment.

The segment of craft breweries also includes end-user applications like microbrewery and brewpubs. Due to the high prices of beer commercially available, the segment will see growth.

Numerous alcohol manufacturers and large micro-breweries will likely be involved in the capture of craft beer markets through business strategies like acquisitions and mergers. Anheuser-Busch InBev purchased several craft breweries in order to increase their market share. This allowed them to maintain a strong presence on the global market.

There has been an increase in preference for domestic brewing kits due to factors like the possibility of making many types of craft beer at a low cost and easy production. Additionally, there is likely to be an increase in craft beer launches in other countries such as Germany, the U.K., or the U.S.

Key Market Segments

By Type

- Craft Brewery Equipment

- Macro brewery Equipment

By Mode of Operation

- Manual

- Semi-automatic

- Automatic

End-use Outlook (Revenue, USD Million, 2016 – 2027)

- Craft Brewery

- Macro Brewery

Market Dynamics

Brewery equipment consists of a range of monitoring systems and tools used in beer processing. Automation is the main driver of this market. The market is expected to grow with a growing focus by beer producers on digitization and mechanization to increase cost savings.

Beer manufacturers around the world are attracted to invest in the industry due to its growing popularity. Market players also engage in various activities to increase their market presence. These include enhanced yeast control, brewery expansion, increased focus on cellar equipment and energy recovery methods, as well as outdoor expansion.

The market is expected to grow due to an increase in the restructuring of beer laws across North America and Europe, such as the U.S. and Germany. Market growth is expected to be limited by high maintenance and capacity capital costs, as well as the cost of electricity and power consumption.

The COVID-19 pandemic is causing a sharp decline in beer consumption across all end-use markets. This is likely to have an impact on the market’s growth over the next few years. It is expected that the immediate and direct impact on beer demand from the restraint of movement will be significant. As the social distancing rules are lifted, however, it is expected that beer demand will increase.

Regional Analysis

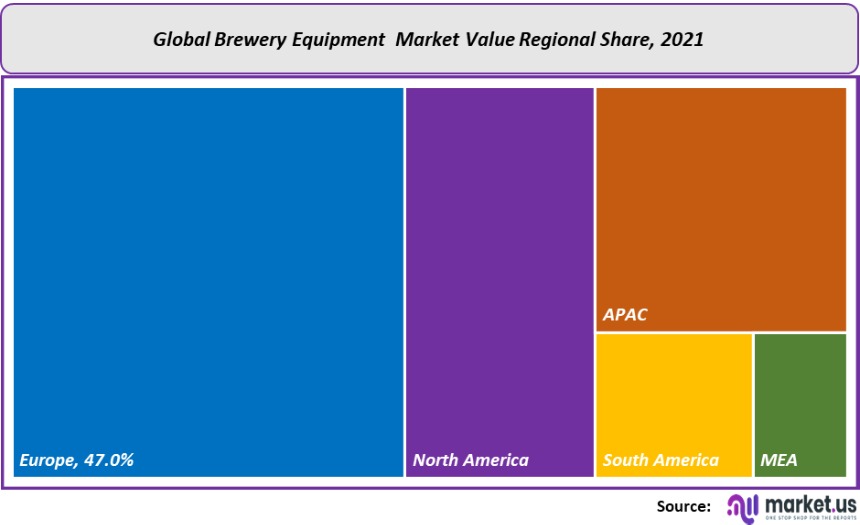

Europe held 47% of the global market revenue in 2021, and it is projected to continue its dominance over the next few years. The market is expected to see significant growth due to rising activity between multinational breweries, and craft breweries.

China is the largest market in the Asia Pacific. It will likely see the fastest growth over the forecast period. Due to the health benefits of beer, there will be a growing interest in different beer types. This will increase the demand for both macro-and craft brewery equipment.

North America held a significant revenue share for 2021 and is projected to grow at an impressive CAGR over this forecast period. A growing number of manufacturers, including those in the U.S., are focusing on unique flavors and premium drinks, which will likely increase the demand for beer equipment in the region.

Asia Pacific had the third-largest revenue share for 2021 and is projected to grow at a moderate 5.4% CAGR from 2023-2032. The forecast period will see an increase in brewery equipment demand due to the relaxation of the rules for setting up breweries owned by different economies such as India and China.

Kеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

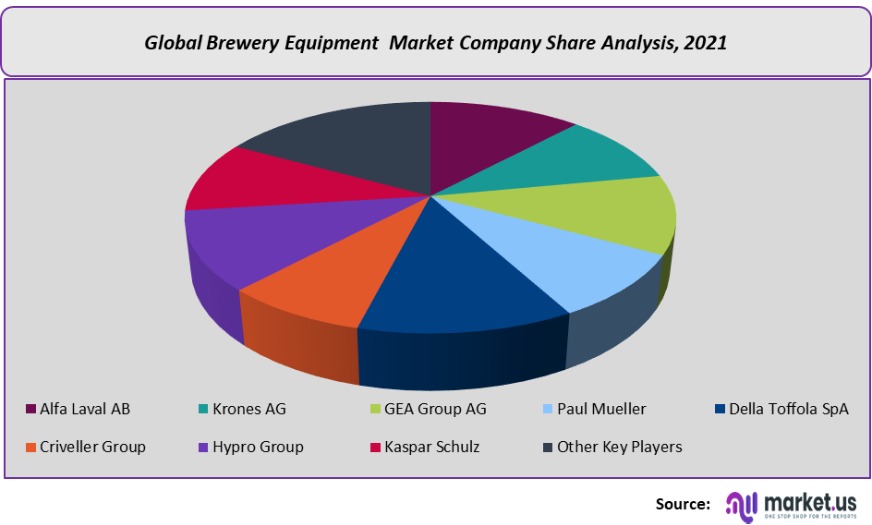

Key Companies & Market share Analysis:

Because of the large number of companies operating in both the domestic and international markets, there is fragmentation in the global market. With a substantial consumer base worldwide, the market is characterized in part by companies that operate their businesses through a dedicated distribution network.

The international market will be challenged by stiff competition from regional market players and leading suppliers of cost-effective products. New entrants are likely to face challenges due to the increased R&D efforts of market leaders to develop and provide superior equipment.

Key Market Players:

- Alfa Laval AB

- Krones AG

- GEA Group AG

- Paul Mueller

- Della Toffola SpA

- Criveller Group

- Hypro Group

- Kaspar Schulz

- Other Key Players

For the Brewery Equipment Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Brewery Equipment market size in year 2021?A: The Brewery Equipment market size was US$18,102 million in 2021.

Q: What is the CAGR for the Brewery Equipment market?A: The Brewery Equipment market is expected to grow at a CAGR of 5.63% during 2023-2032.

Q: What are the segments covered in the Brewery Equipment market report?A: Market.US has segmented the Brewery Equipment market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Type, the market has been segmented into Craft Brewery Equipment and Macrobrewery Equipment. By Mode of Operation, the market has been further divided into Manual, Semi-automatic, and Automatic. By End-Use, the market is further divided into Craft Brewery and Macro Brewery.

Q: Who are the key players in the Brewery Equipment market?A: Alfa Laval AB, Krones AG, GEA Group AG, Paul Mueller, Della Toffola SpA, Criveller Group, Hypro Group, Kaspar Schulz, and Other Key Players are engaged in Brewery Equipment Market.

Q: Which region is more attractive for vendors in the Brewery Equipment market?A: North America accounted for the largest revenue share of 47%, among the other regions. Therefore, North America Brewery Equipment market is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Brewery Equipment?A: Key markets for Brewery Equipment are the US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Q: Which segment has the largest share in the Brewery Equipment market?A: In the Brewery Equipment market, vendors should focus on grabbing business opportunities from the chewable form segment as it accounted for the largest market share in the base year.

![Brewery Equipment Market Brewery Equipment Market]()

- Alfa Laval AB

- Krones AG

- GEA Group AG

- Paul Mueller

- Della Toffola SpA

- Criveller Group

- Hypro Group

- Kaspar Schulz

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |