Global Commercial Seed Market By Product, By Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 23825

- Number of Pages: 349

- Format:

- keyboard_arrow_up

Commercial Seed Market Overview:

The Commercial Seed Market is expected to be worth around US$ 150.9 Bn by 2031 from US$ 73.6 Bn in 2021, growing at a CAGR of 7.99% during the forecast period 2021 to 2031.The market’s growth is largely driven by commercial seed manufacturers’ ability to increase the production of crops and decrease arable land.

By 2050, the world population is expected to exceed 10 billion. This is expected to fuel the demand for food, which will, in turn, drive the market. The rising disposable income per person is predicted to cause an inefficient and excessive consumption of resources. Due to commercial demand for seeds’ ability to improve crop yield, this is expected to be a lucrative opportunity. This Commercial Seeds market report gives an overview of the market size, value, growth, and other key factors & industry trends.

Global Commercial Seed Market Analysis

Product Information

The highest market share was held by maize (corn) in 2021. corn was also used in animal feed. Its seed demand is expected to rise due to growing meat consumption, especially in emerging markets. Furthermore, corn products used for starch manufacturing and sweeteners are expected to drive segment growth during the forecast period.

Soybean will expand at an 8.6% compound annual growth rate during the forecast period. Soybean’s large oil production capacities and high protein content are expected to drive demand. Soybean is widely used as animal feed. It is also used in direct food sources and as a raw material in many industrial food producers.

Wheat consumption is driven by population growth. Around 80.8% of the crop can be used for food products. China is the largest global producer of wheat. The CIS and United States are the major exporters.For many of the world’s population, rice is their staple food. Rice demand is expected to increase by around 1.0% annually. This is also correlated with population growth. Because of its large food consumption, Asia has a significant market for the rice segment. But, the main obstacles to growth include high dependence on labor and low yield productivity.

Type Analysis

Genetically Modified (GM) seeds make up more than half of the commercial seed market. The increased area under GM crops and acceptance of gm harvest by different regions will support market growth.

According to the international service for acquiring agri-biotech applications, the area of GM crops increased by 8.9% last year. A major portion of this increase was due to production in countries like the USA, Canada, and India. At the same time, a notable increase in area under GM crops can be seen in countries like China, Indonesia, Pakistan, Bangladesh, and Vietnam.

The forecast period will see strong growth in genetically modified crop types seed markets due to the increasing acceptance of GM crops and the launch of various beneficial traits.

Key Market Segments

The market is segmented based on the Type & Basis of Product.

By Product

- Soybean

- Rice

- Maize (Corn)

- Canola (Rapeseed)

- Cereals

- Vegetable

- Cotton

- Other Products

By Type

- Conventional seeds

- Genetically Modified (GM) seeds

Market Dynamics

The latest advances in molecular biology have made it possible to map plant genetic codes more efficiently and cost-effectively. Farmers can effectively deal with major agricultural challenges such as high demand. They can increase their production by using Genetically Modified seeds (GM). Due to their high efficiency in agricultural production, biotechnology seeds have a large demand.

U.S.A., Canada, Argentina, Canada, and India are some major countries adopting GM crop cultivation. GMO crops were more than 10% of arable land in 2016, with significant variation between regions.

Climate change is a significant obstacle to commercial seed market trends due to significant agricultural methane emissions. Major contributors to methane emission by enteric fermentation are the digestive systems of ruminant animals and rice cultivation. According to the World Resources Institute (WRI), significant strategies can be used to reduce greenhouse gas emissions in agricultural production. This will help to address climate change.

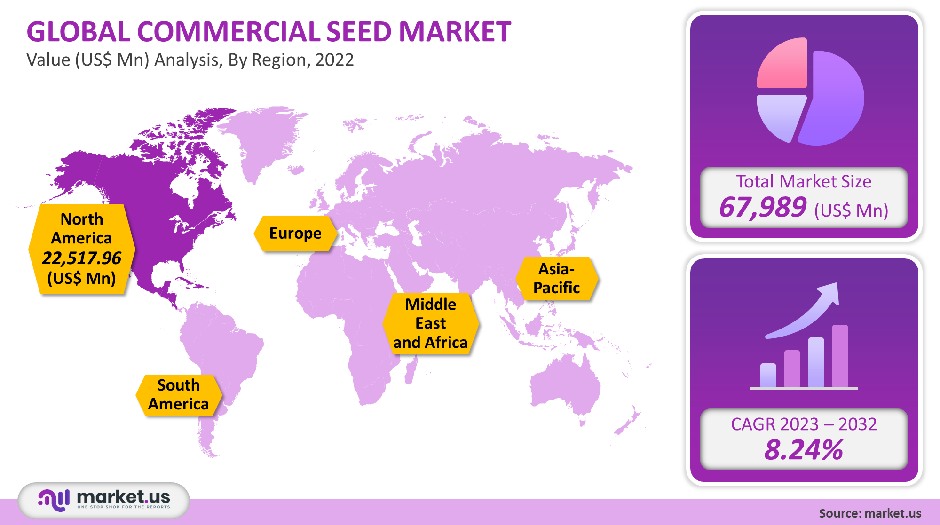

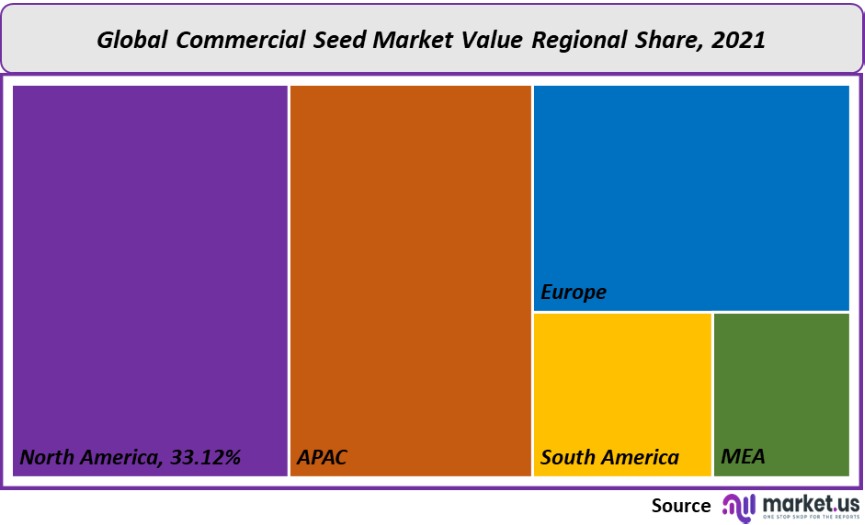

Regional Analysis

North America held the largest market share at 33.12% in 2021. The region’s market will grow due to extensive R&D and supportive government regulations. Precision farming is a new method of gathering more precise data from farmers. This should increase farmers’ awareness about these seeds.

Central and South America are expected to grow at the fastest CAGR rate of 10.9% during the forecast period. A wide range of farming practices and structures make the agriculture sector an integral part of the region’s economic structure. This includes smallholders in Central America, farmers in Brazil, and Argentine farmers. Latin America plays a significant role in global agricultural trade. Brazil, Argentina, and Chile are the largest exporters of soybeans and corn.

Asia Pacific’s agriculture industry includes both basic agricultural systems in India and Japan. It also has the highest technical standards in Japan. Common features are the dominance of smallholders in the region and the importance of rice. Australasia is an exception.

A detailed analysis of key regions is given below, including North America, Europe, Asia Pacific, South America, and Middle East Africa.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

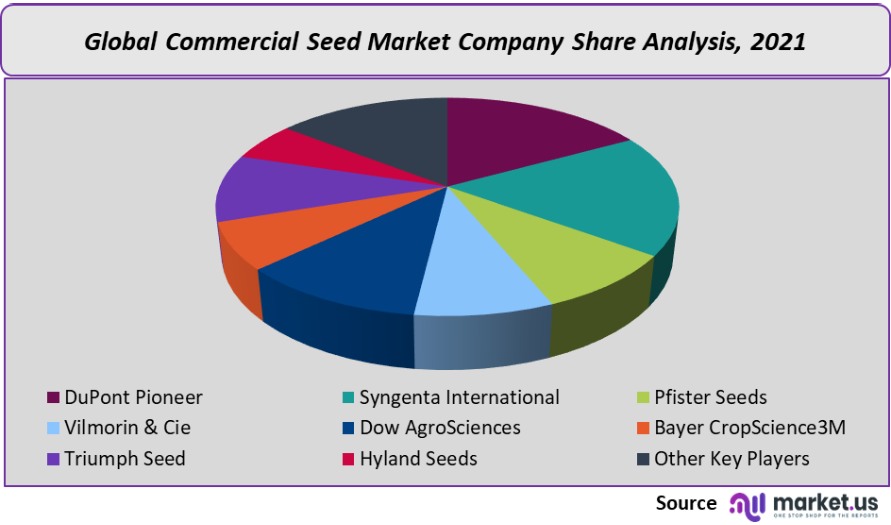

Market Share & Key Players Analysis:

Global market share is high-consolidated, with the top four companies holding over half of it. Syngenta International AG is the dominant player. DuPont Pioneer, Vilmorin & Cie SA are the other major players. The most prominent strategies of industry experts are collaborations and deals to maintain and improve their business performance.

Key companies in this Commercial Seed Industry include DuPont Pioneer, Syngenta International, Sakata Seed Corporation, Pfister Seeds, Vilmorin & Cie, Monsanto Company, Rijk Zwaan Zaadteelt, and other key countries.

Маrkеt Кеу Рlауеrѕ:

- DuPont Pioneer

- Syngenta International

- Pfister Seeds

- Vilmorin & Cie

- Dow AgroSciences

- Bayer CropScience3M

- Triumph Seed

- Hyland Seeds

- Sakata Seed Corporation

- Monsanto Company

- Rijk Zwaan Zaadteelt

- Bayer Crop Science AG

- Other Active Players

For the Global Commercial Seeds Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the Commercial Seed size in 2021?The Commercial Seed size is US$ 67,989 million in 2021.

What is the CAGR for the Commercial Seed?The Commercial Seed is expected to grow at a CAGR of 8.24% during 2023-2032.

What are the segments covered in the Commercial Seed Market report?Market.US has segmented the Global Commercial Seed Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into soybean, rice, maize (corn), canola (rapeseed), cereal crops, vegetable, cotton, and other products. By Type, the market size has been further divided into conventional seeds and genetically modified seeds.

Who are the key players in the Commercial Seed Market share?DuPont Pioneer, Syngenta International, Pfister Seeds, Vilmorin & Cie, Dow AgroSciences, Bayer CropScience3M, Triumph Seed, Hyland Seeds, and Other Key Players.

Which region is more attractive for vendors in the Commercial Seed Market?North America accounted for the highest revenue share of 33.12% among the other regions. Therefore, the Commercial Seed in North America is expected to garner significant business opportunities for the vendors during the forecast period.

What are the key markets for Biodefense?Key markets for Biodefense are US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Which segment has the largest share in the Commercial Seed Market?In the Commercial Seed, vendors should focus on grabbing business opportunities from the maize (corn) product segment as it accounted for the largest market share in the base year.

![Commercial Seed Market Commercial Seed Market]()

- DuPont Pioneer

- Syngenta International

- Pfister Seeds

- Vilmorin & Cie

- Dow AgroSciences

- Bayer CropScience3M

- Triumph Seed

- Hyland Seeds

- Sakata Seed Corporation

- Monsanto Company

- Rijk Zwaan Zaadteelt

- Bayer Crop Science AG

- Other Active Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |