Global E-Liquids Market By Type (PG base, and VG base), By Application , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029

- Published date: Jul 2022

- Report ID: 51918

- Number of Pages: 352

- Format:

- keyboard_arrow_up

E-liquid Market Overview

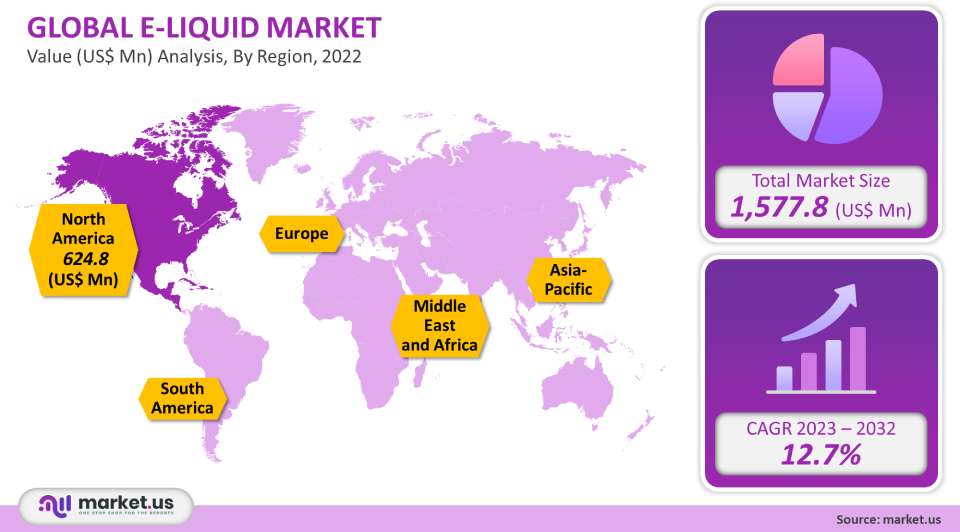

The global e-liquid market is estimated to be worth US$ 1.5778 Billion in 2021. This CAGR will drive the market at 12.7% between 2023-2032. Over the forecast period, e-cigarettes are expected to be more popular due to safer alternatives to smoking. The availability of e-liquids with different flavors like tobacco or menthol, fruit & nuts, chocolate, and cocoa is expected to increase e-liquid usage. Market growth is expected to be driven by a growing awareness of health and the availability of e-liquids containing low levels of toxicants.

Global E-liquid Market Scope:

Flavor Analysis

The market was dominated by the tobacco segment, which accounted for the highest revenue share at over 29.8% in 2021. This is due to the growing demand for tobacco-flavored liquid e-liquid by smokers, which provides the opportunity to smoke real tobacco. In addition, students and women will continue to consume tobacco products. This is expected to fuel the growth of this segment. Based on flavor, the market is divided into menthol, dessert, tobacco, chocolate, fruits and nut, and others.

Vendors have been focusing on new flavors and developing new e-liquids to meet the growing demand. Ploom Tech received two new flavors from Japan Tobacco Inc. in March 2019. Two flavors are available: menthol and a mixed flavor of pineapple, and peach. However, some countries have banned mint and other dessert flavors. This is expected to limit the market’s growth.

Type Analysis

In 2021, the market’s largest revenue share was held by the bottled segment which accounted for over 49.6% of all sales. Pre-filled and bottled are the main segments of the market. E-liquids that are bottled can be used to quickly refill vape tanks. Additionally, bottled liquid can be stored safely and for a longer period of time. This can also allow for DIY e-juices. These factors are expected to contribute to a positive growth rate for the segment over the forecast period.

Over the forecast period, pre-filled will see significant growth. It is easy to dispose of cartridges that have been prefilled with e-liquid. Pre-filled e-liquids are cost-effective and will be a major driver of growth over the forecast period. However, the COVID-19 epidemic has had a negative effect on the market. Lockdowns in many countries have forced the shutdown of non-essential manufacturing facilities, limiting the production of both prefilled and bottled E-liquid products.

Distribution Channel Analysis

In 2021, the retail segment was the dominant market player and earned the highest revenue share at over 64.4%. The fact that many retail stores offer customers the opportunity to sample different e-liquid flavors and e-cigarette products before they purchase can explain this. Based on distribution channels, the market can be segmented into online and retail stores. The market is further divided into convenience stores, specialty shops, and drug stores.

The online segment is forecast to experience significant growth during the forecast period. Over the forecast period, the online market is expected to grow due to improvements in online distribution platforms. These platforms are designed to limit the sale of nicotine products to underage users. JUUL Labs Inc. has implemented an online verification system for age verification to increase the efficiency of its electronic commerce platform. This system relies on third-party verification to prevent underage users from accessing the site.

The new verification system offers four new features: photo upload, public records check, two-factor authentication, protection from fake ID, and protection against false ID. But, governments around the globe have implemented lockdowns in an effort to prevent the spread of COVID-19. The lockdowns have prompted vendors to temporarily cease production and logistic providers to stop transporting goods across borders and within the country. Online shopping has been temporarily suspended by many retailers worldwide due to various levels of lockdowns during the pandemic.

Key Market Segments

Flavors

Menthol

Dessert

Tobacco

Chocolate

Fruits & Nuts

Others

Type

Bottled

Pre-filled

Distribution Channel

Market Dynamics

E-liquids offer a cost advantage over tobacco products. They are also available in different price ranges which makes them more affordable. Vaping can be used to quit smoking and make e-liquid a viable alternative to smoking. E-liquids have seen a rise in demand globally due to the rising cost of traditional cigarettes. This has fueled the market. The market is embracing technologically advanced e-cigarettes, which has increased the demand for different e-liquids to enhance vaping experiences.

The number of vape shops has increased worldwide, with North America being the most prominent. Customers can test the flavors before buying. The market is expected to grow further over the forecast period. JUUL Labs Inc., which is a supplier of e-cigarettes and e-liquid, opened a Toronto, Canada store in June 2019. Customers can then test the flavors before buying. Medical institutes such as the British Medical Association and Royal College of General Practitioners conducted a variety of studies showing that smoking exposes smokers to over 5,000 chemical compounds while e-cigarettes are less harmful. These factors are expected to drive market growth during the forecast period.

Manufacturers of e-cigarettes are offering many device configurations at low prices in order to increase their market share. Modular e-cigarettes have been gaining popularity due to the flexibility of the customization options. This allows users to swap out parts such as battery mods, coils, and atomizers in order to achieve the desired flavor. In the future, the market will continue to grow due to the increasing popularity of Do It Yourself (DIY). This allows users to create their own e-liquids and mix different flavors. There are many e-liquids available with different nicotine strengths. Users can choose from 3 mg, 6mg, and 12 mg.

However, strict regulations regarding e-liquids use by local authorities are likely to hinder the market growth. In September 2019, the U.S. government declared that it would ban flavor e-cigarettes due to a rise in teen vaping. The U.S. government declared a ban on fruit, dessert, and mint-flavored products. In the midst of the ban, U.S. companies stopped selling non-tobacco flavors in the country. JUUL Labs Inc., stopped sales of non-menthol-based flavors and nontobacco products in the U.S., as an example.

Regional Analysis

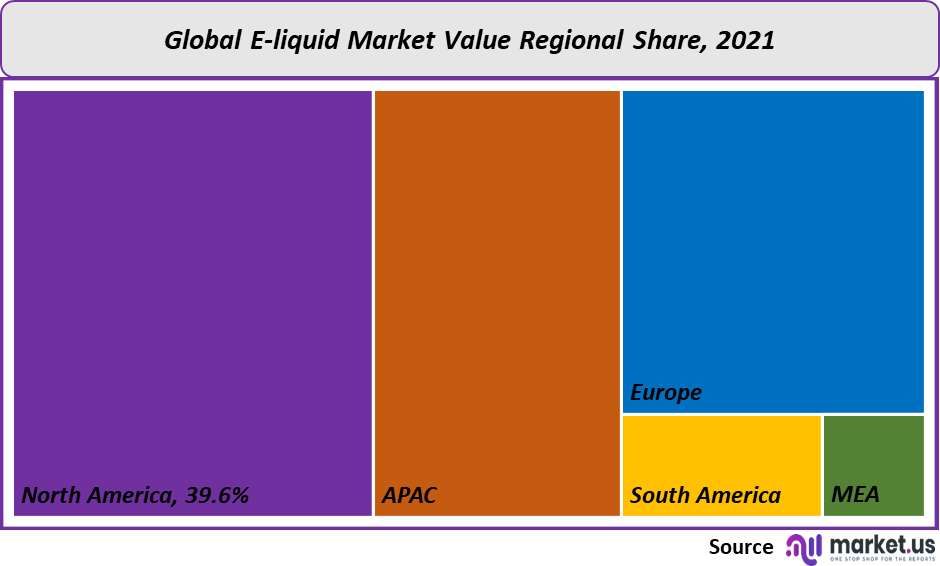

North America dominated the e-liquid market in 2021 and had the highest revenue share at over 39.6%. Key vendors like Philip Morris International Inc., JUULLabs Inc., Turning Point Brands Inc., and Nicquid are responsible for this dominance. Additionally, these vendors are focused on expanding their regional presence through acquisitions and mergers. This trend is expected to further propel North America’s market growth. Turning Points Brands Inc. purchased International Vapor Group LLC in September 2018. Turning Point Brands Inc. could implement a vapor B2C platform into its electronic vapes, and component distribution channel.

It is expected that the Asia Pacific region market will experience significant growth during the forecast period. This is due to the rising number of lung carcinoma cases from tobacco smoking. It’s also because e-cigarettes/e-liquids are perceived as safer than traditional cigarettes. According to Oxford University Press article, China had reported over 690,000. High taxes on Japanese traditional cigarettes will encourage people to smoke e-cigarettes. This is expected to stimulate the market’s growth.

Key Regions and Countries covered іn thе rероrt:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

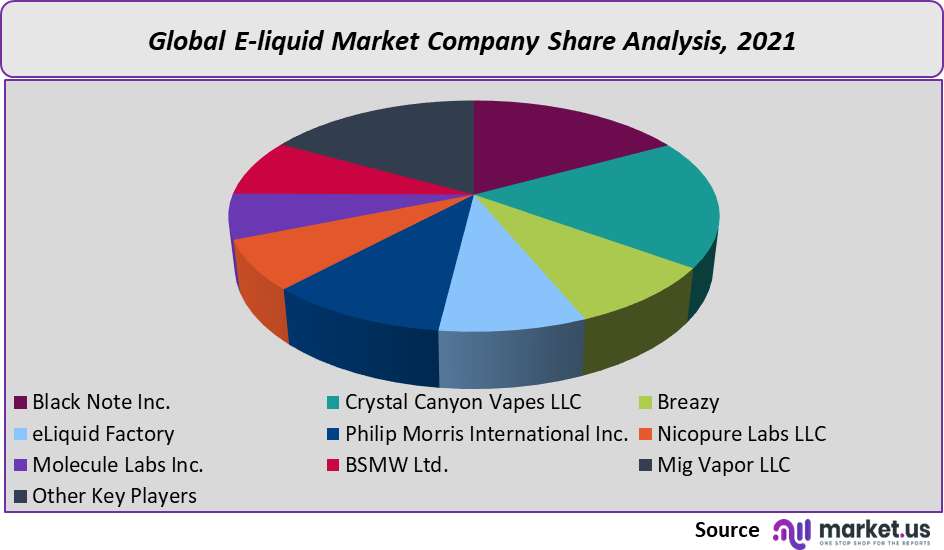

Market Share Analysis

Market leaders are investing in new product development, partnerships, and acquisitions to enhance their position in the market as well as expand their operations around the world. Turning Point Brands, Inc. bought Vapor Supply assets, including VaporSupply.com, and a portion of its affiliates, in April 2018. The former was able to sell e-liquids in America and it also allowed for the expansion of its presence in the vaping market.

Manufacturers depend on a variety of small and medium-sized third-party suppliers. The market growth is expected to be limited by the inability to renew contracts or failure to distribute third-party supplier products through established distribution channels. E-liquids are being developed according to local guidelines. Key players have been investing heavily in this area. Turning Point Brands Inc., which invests US$ 2.5 million in R&D in order to develop high-quality products, was one example.

Key Market Players

The following players are prominent in the e-liquid market.

- Black Note Inc.

Crystal Canyon Vapes LLC

Breazy

E-Liquid Factory

Philip Morris International Inc.

Nicopure Labs LLC

Molecule Labs Inc.

BSMW Ltd.

Mig Vapor LLC

Other Key Players

For the E-Liquids Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

1.577 Billion

Growth Rate

12.7%

Forecast Value in 2032

5.877 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the E-liquid market in 2021?The E-liquid market size was US$ 1,577.8 million in 2021.

What is the projected CAGR at which the E-liquid market is expected to grow at?The E-liquid market is expected to grow at a CAGR of 12.7% (2023-2032).

List the segments encompassed in this report on the E-liquid market?Market.US has segmented the E-liquid market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Flavors, market has been segmented into Menthol, Dessert, Tobacco, Chocolate, Fruits & Nuts, and Others. By Type, the market has been further divided into Bottled and Pre-filled. By Distribution Channel, market has been segmented into Online and Retail Store.

List the key industry players of the E-liquid market?Black Note Inc., Crystal Canyon Vapes LLC, Breazy, eLiquid Factory, Philip Morris International Inc., Nicopure Labs LLC, Molecule Labs Inc., BSMW Ltd., Mig Vapor LLC, and Other Key Players engaged in the E-liquid market.

Which region is more appealing for vendors employed in the E-liquid market?North America is accounted for the highest revenue share of 39.6%. Therefore, the E-liquid industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for E-liquid?The U.S., Canada, U.K., Germany, China, Australia, Japan, Brazil are key areas of operation for E-liquid Market.

Which segment accounts for the greatest market share in the E-liquid industry?With respect to the E-liquid industry, vendors can expect to leverage greater prospective business opportunities through the tobacco segment, as this area of interest accounts for the largest market share.

![E-Liquids Market E-Liquids Market]()

- Black Note Inc.

- Crystal Canyon Vapes LLC

- Breazy

- E-Liquid Factory

- Philip Morris International Inc.

- Nicopure Labs LLC

- Molecule Labs Inc.

- BSMW Ltd.

- Mig Vapor LLC

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |