Global Enteral Feeding Formulas Market By Product Type (Disease-specific Formulas and Standard Formula), By Flow (Intermittent Feeding Flow and Continuous Feeding Flow), By Stage (Adults and Kids), By End-Use (Homecare and Hospitals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Mar 2022

- Report ID: 32817

- Number of Pages: 248

- Format:

- keyboard_arrow_up

Report Overview

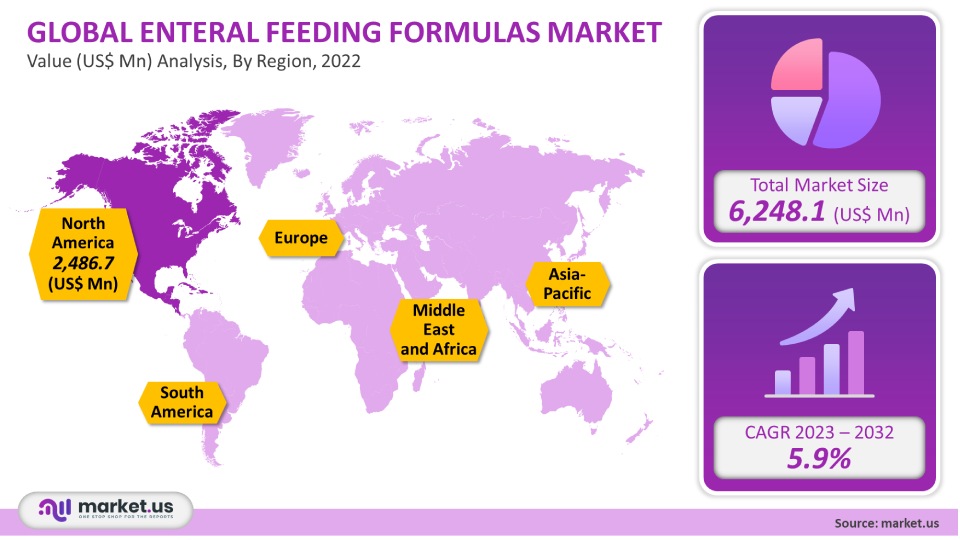

The global market for Enteral Feeding Formulas was worth USD 6,248.1 million in 2021. It is projected to grow at a CAGR of 5.9% between 2023 to 2032. There will be an increase in chronic diseases such as stroke, multiple sclerosis, and dementia. This will drive demand for products that help patients with poor oral intake. Preterm births are another reason for the increasing demand for a formula that provides newborns nutrition.

Global Enteral Feeding Formulas Market Scope:

Product type analysis

Standard formulas dominated the market, accounting for over 55.2% of global revenue in 2021. Various chemical formulations can make Inorganic Enteral Feeding Formulas from inorganic compounds like chromates, metal oxides, and sulfates. You can use inorganic Enteral Feeding Formulas in many applications such as plastics, paints, coatings, or printing inks.

This is due to the availability and increased demand for low-cost nutritional formulations. Patients with fluid restrictions or volume-sensitive patients are also in high demand for standard tube feeds. These conditions include congestive heart disease, renal failure, and Syndrome of Improper Antidiuretic hormone (SIADH). The segment of disease-specific formulas is expected to grow at the fastest pace during the forecast period. Demand for disease-specific formulas is increasing due to the high incidence of chronic diseases such as diabetes, cancer, and liver failure. Recent product innovations to meet the nutritional needs of different diseases will increase the demand over the next few years. NOVASOURCE RENAL from Nestle Health Sciences and SUPLENA (Abbot) are two examples of standard tube feedings used for patients with Chronic Kidney Disease (CKD).

Flow Type Analysis

Based on flow type, the market’s highest revenue share was 93.1% for intermittent feeding flow type in 2021. Because intermittent feeding is more tolerable than bolus, patients are better able to tolerate it. This type of feeding is also easier on the stomach, as it doesn’t require feeding pumps. This will increase its acceptance in hospitals and home care settings, positively impacting the segment’s growth.

In addition, the segment that provides continuous feeding is expected to experience the greatest CAGR over the forecast. The segment’s growth has been driven by the lower feeding rates of continuous feeding flow compared to intermittent. Continuous tube feeding is recommended for critically ill patients with cancer, severe burns, or respiratory failure. These conditions are expected to increase the demand for continuous feeding during the forecast period.

Stage Analysis

Based on stage, the segment of adults accounted for 87.3% of the market’s total revenue in 2021. This segment is expected to see the fastest CAGR during the forecast period. One of the key factors behind the growth is the rising popularity of tube feeds among adults. The large market share is also due to the commercial availability of many tube feeds and products for adults. Abbott Nutrition’s most popular brands for adults include Glucerna and Osmolite.

The adult market is also driven by the growing demand for tube feedings among pregnant women. Additionally, pregnant women often suffer from hyperemesis Gravidarum. This condition causes severe nausea and vomiting and can lead to dehydration and a lack of vital nutrients. Mount Mary University’s research showed that enteral nutrition effectively achieved successful pregnancy outcomes for women with hyperemesis gravidarum. The market is also seeing positive effects from the increasing demand for tube feedings in patients with neurovascular disorders.

Indication Analysis

According to indications, the other segment dominated the market share and accounted for 43.1% of the total revenue in 2021. This segment is closely followed by cancer care which accounted for 25.3% of the total revenue in 2021. This segment is expected to grow due to the increasing cancer incidence and other related conditions.

Cancer can weaken immunity and cause energy loss, leading to malnutrition in 40 to 80 percent of cases. This can affect the patient’s response and increase the risk of developing toxic effects. Tube feeding is used to maintain nutrition and positive nitrate balance. This drives market growth. Abbott Laboratories is a major player that offers liquid formulations that can tube feed cancer patients to maintain their nutrient levels.

End-User

According to end users, the market’s highest revenue share was 55.3% for homecare in 2021. Over the forecast period, the segment is expected to experience the fastest CAGR. One of the main factors driving the segment’s growth is the increasing number of patients receiving home enteral feeds due to increased awareness of complete and balanced nutrition. A recent survey in the U.K. found that 187 of the 257 patients were on home enteral feeding. This indicated that approximately 72% were on home tube feeding. Other factors contributing to segment growth include a growing awareness of enteral nutrition formulas among patients in home care and increased government intervention for educating patients about the use of pumps or enteral feeding systems.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Disease-specific Formulas

- Standard Formula

By Flow

- Intermittent Feeding Flow

- Continuous Feeding Flow

By Stage

- Adults

- Kids

By End-Use

- Homecare

- Hospitals

Market Dynamics:

Furthermore, the rising development of new products is crucial to boosting tube feed growth. For example, Victus, Inc. announced the introduction of ABINTRA Care, a specialized diet that helps strengthen the immune system. This will allow the firm to expand its product offering in the specialist nutrition market. Furthermore, the growing number of home health agencies and nursing care facilities is increasing in demand since these services assist patients post-surgery rehabilitation. Such organizations serve many elderly individuals with swallowing difficulties, which will likely increase the adoption rate of enteral feeding formulas, supporting market expansion.

Due to changes in body composition and muscle mass, frailty and malnutrition are more common among geriatrics with comorbidities such as diabetes, stroke, and dementia. This can lead to a decreased ability to perform Activities of Daily Living (ADLs), thereby increasing the chance of injury or falling. It is therefore important to understand the condition’s pathophysiology, especially nutritional deficiencies. Enteral feeding formulas will be more popular in the future due to the rising prevalence of conditions such as anemia and malnutrition.

The market is also growing due to the increasing number of COVID-19 patients in different geographies and a large geriatric population susceptible to many health conditions. Additionally, COVID-19 severity in the elderly increases with a decrease in immunity or health problems. This will increase the use of enteral nutrition formulas and procedures. According to an article in Europe PMC 2021, enteral nutrition is preferred to parenteral nutrition in COVID-19 patients admitted into the ICUs. It should also be available within 48 hours of admission. These instances indicate the increased use of enteral nutrition formulas during the pandemic.

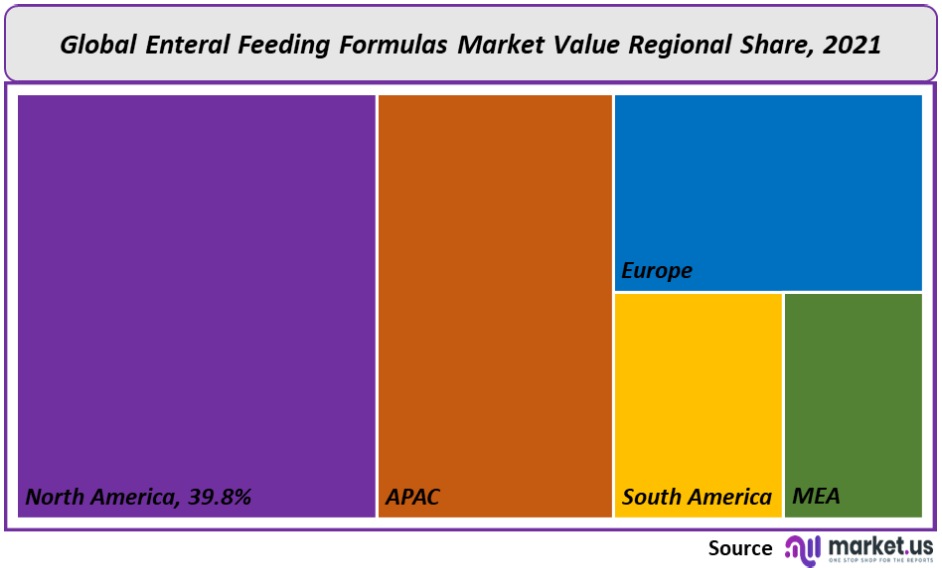

Regional Analysis

The Asia Pacific was the dominant market, accounting for over 39.8% of global revenue in 2021. This is due to the abundance of raw materials and low-cost labor. It has attracted many manufacturers from different industries to establish production plants in the Asia Pacific region to reap greater benefits. The coatings application segment in South Korea is expected to have the largest share of the overall Enteral Feeding Formulas industry growth over the forecast period.

South Korea’s market for Enteral Feeding Formulas is expected to grow due to the increased infrastructure spending and the increasing government spending on public infrastructure. South Korea’s low unemployment rate and high disposable income will also drive the demand for Enteral Feeding Formulas for packaging applications in various end-use industries such as food and beverage and consumer goods.

Germany accounted for the largest share of Europe’s Enteral Feeding Formulas market in terms of revenue and volume. The region’s growth is expected to be aided by the support of many European countries and growing industrial facilities. The region is projected to benefit from the growing popularity of green technology and strict environmental regulations. In the US, the growing number of QSRs and quick-service restaurants (QSRs) is driving the demand for Enteral Feeding Formulas. They use Enteral Feeding Formulas in food packaging and printing ink applications. There are strict guidelines in the USA regarding the types of Enteral Feeding Formulas used in food packaging. Many inorganic pigments can become toxic when they come in contact with foods.

According to the FDA, food coloring agents and printing inks can only be made from materials that the FDA approves. Food packaging cannot use pigments containing polynuclear aroma hydrocarbons or benzopyrene at levels exceeding 0.5 and 5.0, respectively.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

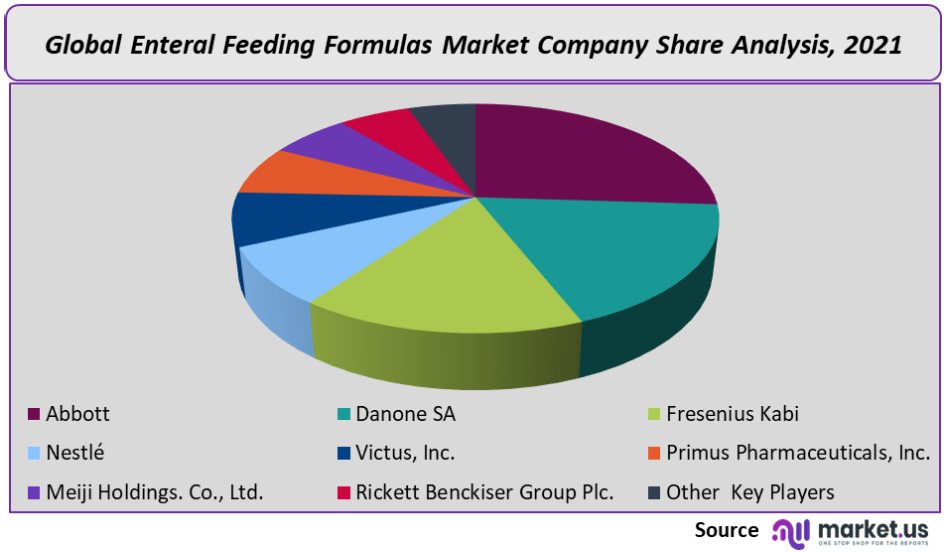

Market Share & Key Players Analysis:

The global Enteral Feeding Formulas market is fragmented. Major players are involved in product development, strategic partnerships, mergers and acquisitions, and joint ventures to vertically incorporate across the value chain. This reduces operational costs and allows for higher profit margins. In March 2019, BASF SE joined forces with Landa Labs to launch its second stir-in pigment, eXpand. Blue (EH 6001) is sold under the Colors & Effects label. Expand Blue (EH 6001) can be used for automotive and outdoor coating applications. Organic Dyes and Pigments also acquired Premier Colors, Inc. in December 2020 to expand its business in Providence and serve the customers of the former. Premier Colors, Inc. is a South Carolina-based company that supplies specialty chemicals and Enteral Feeding Formulas to the paper, textile, paints and coatings, and leather industries. These are the major players in the global Enteral Feeding Formulas industry.

Маrkеt Кеу Рlауеrѕ:

- Abbott

- Danone SA

- Fresenius Kabi

- Nestlé

- Victus, Inc.

- Primus Pharmaceuticals, Inc.

- Meiji Holdings. Co., Ltd.

- Rickett Benckiser Group Plc.

- Other Key Players

For the Enteral Feeding Formulas Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Enteral Feeding Formulas market in 2021?The Enteral Feeding Formulas market size is US$ 6,248.1 million in 2021.

What is the projected CAGR at which the Enteral Feeding Formulas market is expected to grow at?The Enteral Feeding Formulas market is expected to grow at a CAGR of 5.9% (2023-2032).

List the segments encompassed in this report on the Enteral Feeding Formulas market?Market.US has segmented the Enteral Feeding Formulas market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Disease-specific Formulas and Standard Formula. By Flow, the market has been further divided into Intermittent Feeding Flow and Continuous Feeding Flow. By Stage, the market has been further divided into Adults and Kids. By End-Use, the market has been divided into Homecare and Hospitals.

List the key industry players of the Enteral Feeding Formulas market?Abbott, Danone SA, Fresenius Kabi, Nestlé, Victus, Inc., Primus Pharmaceuticals, Inc., Meiji Holdings. Co., Ltd., Rickett Benckiser Group Plc., and Other Key Players are the key vendors in the Enteral Feeding Formulas market engaged in the Enteral Feeding Formulas market.

Which region is more appealing for vendors employed in the Enteral Feeding Formulas market?APAC accounted for the highest revenue share of 39.8%. Therefore, the Enteral Feeding Formulas industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Enteral Feeding Formulas?South Korea, Germany & The US, are key areas of operation for Enteral Feeding Formulas Market.

Which segment accounts for the greatest market share in the Enteral Feeding Formulas industry?With respect to the Enteral Feeding Formulas industry, vendors can expect to leverage greater prospective business opportunities through the intermittent feeding flow type segment, as this area of interest accounts for the largest market share.

![Enteral Feeding Formulas Market Enteral Feeding Formulas Market]() Enteral Feeding Formulas MarketPublished date: Mar 2022add_shopping_cartBuy Now get_appDownload Sample

Enteral Feeding Formulas MarketPublished date: Mar 2022add_shopping_cartBuy Now get_appDownload Sample - Abbott Laboratories

- Danone

- Nestlé S.A Company Profile

- B. Braun Melsungen AG Company Profile

- Victus

- Fresenius Kabi

- Hormel Foods

- Meiji Holdings

- Mead Johnson Nutrition

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |