Global Food Preservatives Market By Type (Natural and Synthetic), By Application (Meat & Poultry, Dairy, Beverages, Bakery, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 16087

- Number of Pages: 398

- Format:

- keyboard_arrow_up

Food Preservatives Market Overview:

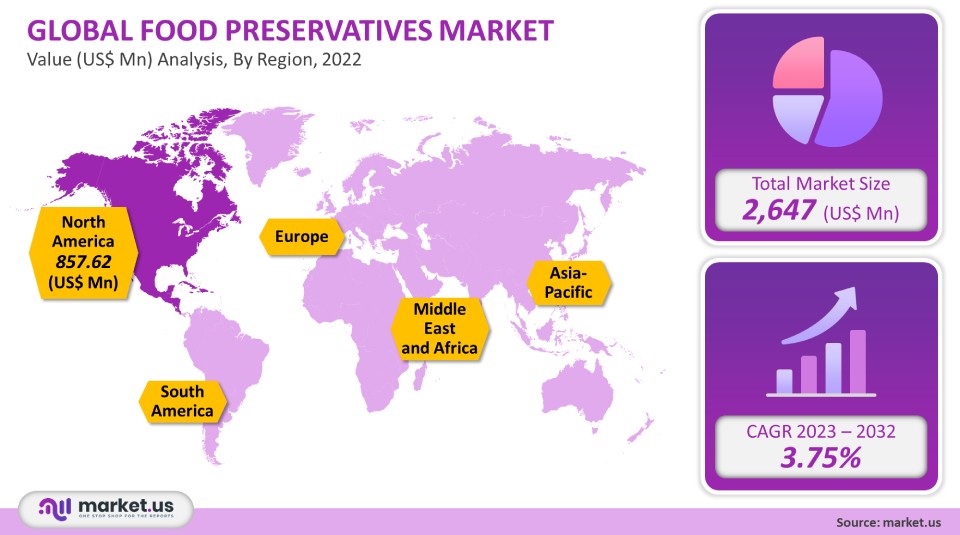

Global food preservation market value was USD 2,647 million in 2021, and it is projected to grow at a CAGR, of 3.75% between 2022-2032.

Food preservatives can be added during food processing to improve its stability and prevent it from spoiling. They are used in small quantities depending on the food’s need. Traditionally, sugar, spices, salt, and cinnamon were used to preserve meats and other food types.

Global Food Preservatives Market Analysis:

Type Analysis

The largest market share, 80% in value, was held by synthetic type in 2021. The synthetic type is popular because it is cost-effective and simple to produce. They can be tailored to suit your needs. The largest value share of all chemical types was held by sorbates due to their widespread use in meat, poultry, and dairy products. Propionates, benzoates, nitrites, and propionates are all widely used synthetic forms. Propionates have a wider acceptance due to their higher limit and more diverse applications. These include preservation at higher pH and baking goods, snacks, and other confectionaries.

Natural preservatives have a greater demand due to their acceptance by regulatory agencies, as well as the growing health consciousness of customers. Because customers prefer clean-label products, the natural products segment will hold a large market share during the forecast period. To meet customer preference for organic products, many manufacturers have adopted new formulation processes to make organic products.

Application Analysis

Products can be used for a variety of purposes, including baking, poultry, meat, and seafood, drinks, confectionery and oils, and fats. The demand is expected to grow over the forecast period as the industry of processed meats, poultry, and seafood continues to expand at a rapid pace globally.

Baking products follow poultry and meat. By 2032, it is expected that the bakery segment will reach US$ 690 million. Due to the expansion in the Asia Pacific, the beverage segment will experience the fastest growth during the forecast period.

Key Market Segments:

By Type

- Natural

- Edible Oil

- Rosemary Extracts

- Natamycin

- Vinegar

- Other Natural Types

- Synthetic

- Propionates

- Sorbates

- Benzoates

- Other Types

By Application

- Meat & Poultry

- Dairy

- Beverages

- Bakery

- Other Applications

Market Dynamics:

Food preservatives are used to stop the growth of microorganisms. They also delay or inhibit food spoilage. They can be classified as either non-toxic or moderately toxic depending on their level of toxicity. Non-toxic preservatives are allowed to be used in the processing. Moderately toxic preservatives are regulated by the relevant regulatory bodies, such as the U.S. Food and Drug Administration and the European Food Safety Authority (EFSA). They are identified using appropriate index numbers (INS and E).

These can be used to preserve foods such as meat, cakes, dairy products, bread, and poultry. The demand for these products is growing globally due to several factors including the change in customer life, rising preference for fresh foods, increased imports and exports, and an increase in consumer willingness to pay premium prices.

North America held the largest market share in 2021, and it is expected to maintain its dominance over the next few years. Convenience foods are becoming more popular due to the increased availability of ready-to-eat food and increased acceptance by Canadian consumers.

The United States was dominated by chemical preservatives such as benzoates and nitrites. The increasing demand for natural preservatives is driving U.S. manufacturers to shift from making synthetic to natural.

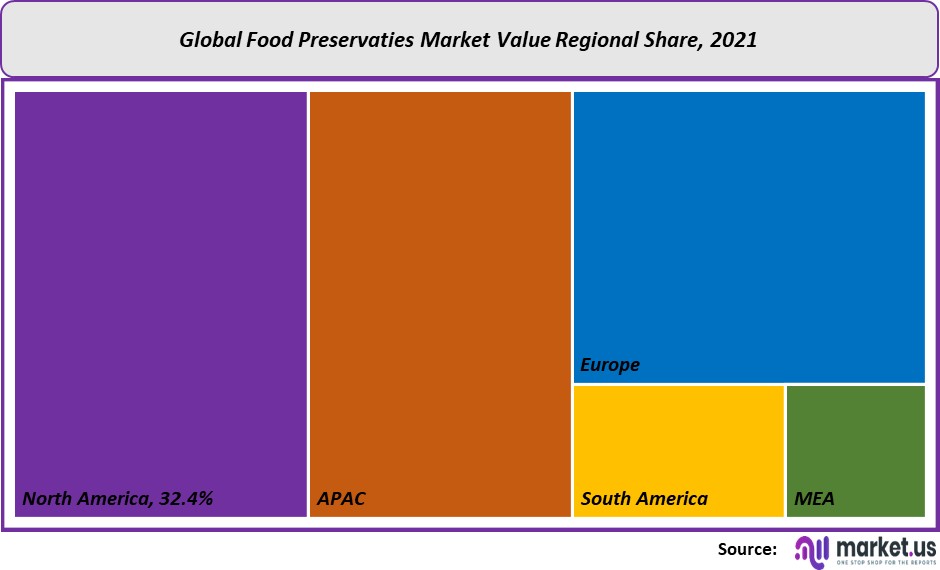

Regional Analysis:

North America was the market leader with a revenue of 32.4%. North America saw a rise in product applications in the U.S., Canada, and Mexico. This market is expected to grow due to the presence of well-established bakeries and an increase in processed meat consumption.

Over the next few decades, Asia Pacific’s market expansion will be helped by a growing working population and a preference for ready-to-eat foods. The Asia Pacific is predicted to be the fastest-growing region. It is expected to grow at a 4.2% CAGR over the forecast period.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Companies & Market share Analysis:

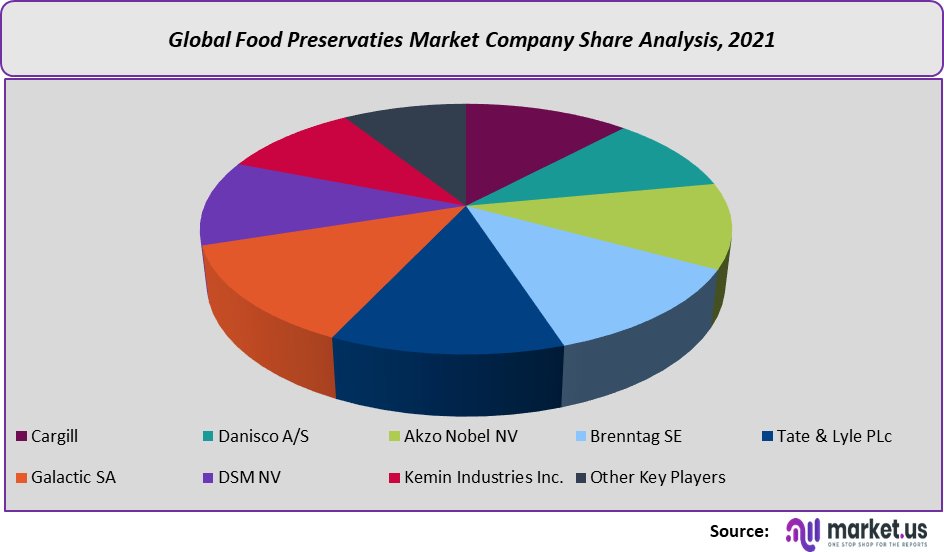

There were many synthetic manufacturers dominating the market. Due to increasing demand for organic preservatives, the market has seen new entrants. Due to increasing consumer awareness regarding health and a willingness to pay more for premium food products, the demand for natural products is slowly rising. A large number of natural food producers have also entered the market, further increasing the competition.

Galactic S.A. and Kemin Industries Inc. have recently entered the market with new products that are derived from natural sources like vinegar and rosemary extracts. To increase their market share and expand their product line, manufacturers use mergers and partnerships.

Key Market Players:

- Саrgіll

- Dаnіѕсо A/S

- Аkzо Nоbеl NV

- Вrеnntаg SE

- Таtе & Lуlе PLc

- Gаlасtіс SA

- DЅМ NV

- Kemin Industries Inc.

- Other Key Players

For the Food Preservatives Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Food Preservatives market size in year 2021?The Food Preservatives market size was US$ 2,647 million in 2021.

Q: What is the CAGR for the Food Preservatives market?The Food Preservatives market is expected to grow at a CAGR of 3.75% during 2023-2032.

Q: What are the segments covered in the Food Preservatives market report?Market.US has segmented the Food Preservatives market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Type, the market has been segmented into Natural and Synthetic. By Application, the market has been further divided into Meat & Poultry, Dairy, Beverages, Bakery, and Other Applications.

Q: Who are the key players in the Food Preservatives market?Саrgіll, Dаnіѕсо A/S, Аkzо Nоbеl NV, Вrеnntаg SE, Таtе & Lуlе PLc, Gаlасtіс SA, DЅМ NV, Kemin Industries Inc., and Other Key Players are engaged in Food Preservatives Market.

Q: Which region is more attractive for vendors in the Food Preservatives market?North America accounted for the largest revenue share of 32.4%, among the other regions. Therefore, North America Food Preservatives market is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Food Preservatives?Key markets for Food Preservatives are the US, Canada, Japan, India, Brazil, Mexico, UK, France, Italy, Spain, etc.

Q: Which segment has the largest share in the Food Preservatives market?In the Food Preservatives market, vendors should focus on grabbing business opportunities from the synthetic type segment as it accounted for the largest market share in the base year.

![Food Preservatives Market Food Preservatives Market]()

- Natural

- Саrgіll

- Dаnіѕсо A/S

- Аkzо Nоbеl NV

- Вrеnntаg SE

- Таtе & Lуlе PLc

- Gаlасtіс SA

- DЅМ NV

- Kemin Industries Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |