Global Fuel Ethanol Market By Product Type (Starch-based, Sugar-based, and Cellulosic), By Application (Conventional Fuel Vehicles, Flexible Fuel Vehicles, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 59087

- Number of Pages: 299

- Format:

- keyboard_arrow_up

Fuel Ethanol Market Overview:

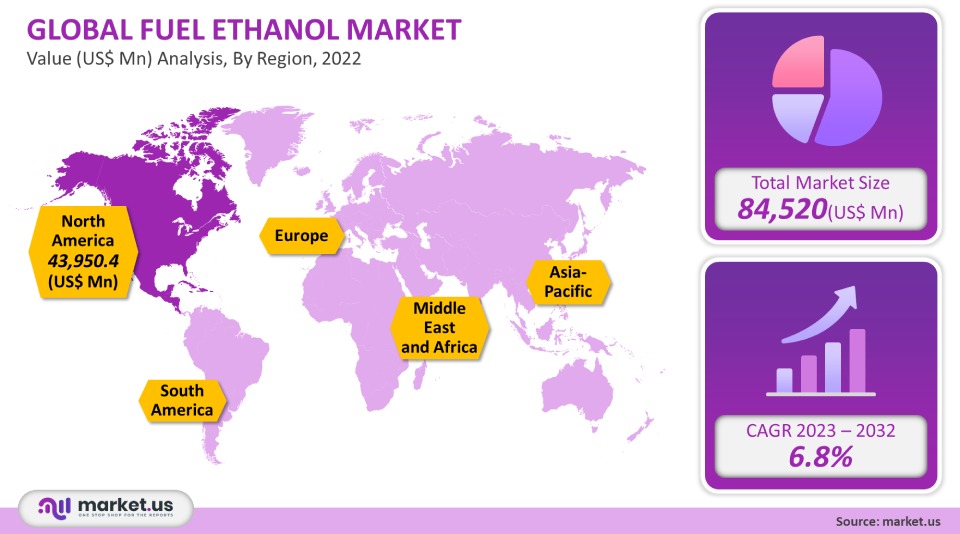

The fuel ethanol market size is expected to be worth around USD 174.24 Billion by 2032 from USD 84.5 Billion in 2021, growing at a CAGR of 6.8% during the forecast period from 2022 to 2032.

In the coming years, ethanol will be more popular as a bio-based additive due to rising carbon emissions from gasoline.

Global Fuel Ethanol Market Scope:

Product Type Analysis

Ethanol can be made from renewable or bio-based feedstock. Depending on the suitable feedstock type, the market can be divided into three segments: starch-based, sugar-based and cellulosic.

In 2021, the starch-based segment held the global market’s largest volume share. It is expected to grow at a 7% CAGR by 2032. Starch-based products are made from starch-rich raw materials like corn, wheat, and barley. This product consumption is high in starch and can reduce greenhouse emissions to a significant extent.

According to The U.S. Department of Energy, corn-based ethyl alcohol has reduced airborne emissions by almost 26%. Cassava is a valuable feedstock, especially in countries like China and Thailand. Its rich starch content, ability to make ethyl alcohol with high octane ratings, and good anti-knocking properties, will all contribute to its growth factor.

The market is expected to see significant growth in cellulosic or cellulose-based ethyl alcohol during the forecast period. This market segment will likely see the most growth due to bio-waste production such as wood chips and corn Stover, wheatgrass, and fruit peels.

Application Analysis

The usage of ethanol fuel is widely used in the automotive and transportation industry. The largest industry application was conventional fuel vehicles in 2021. This segment is expected to grow at a significant CAGR of 7.7% in volume during the forecast period 2023-2032.

The fastest-growing segment in the industry is expected to be flexible fuel vehicles (FFVs). These vehicles are made up of internal combustion engines that can run on gasoline or ethanol-gasoline mixtures beyond E10. Also known as flex-fuel, these vehicles can also be used to transport a variety of ethanol-gasoline fuels. E85 is 51%-83% ethanol mixed with gasoline.

The rapid production of FFVs from Brazil, the U.S., and other European Union countries will help increase fuel ethanol fuel the-market.usage in the coming years. E85 blend has been a key component of the automotive industry, with major manufacturers like Volvo, Toyota Group, and Dacia. The product can also be used for space heating, steam generation, and power generation.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- Sugar-based

- Starch-based

- Cellulosic

By End-Use

- Flexible Fuel Vehicles

- Conventional Fuel Vehicles

- Other Applications

Market Dynamics:

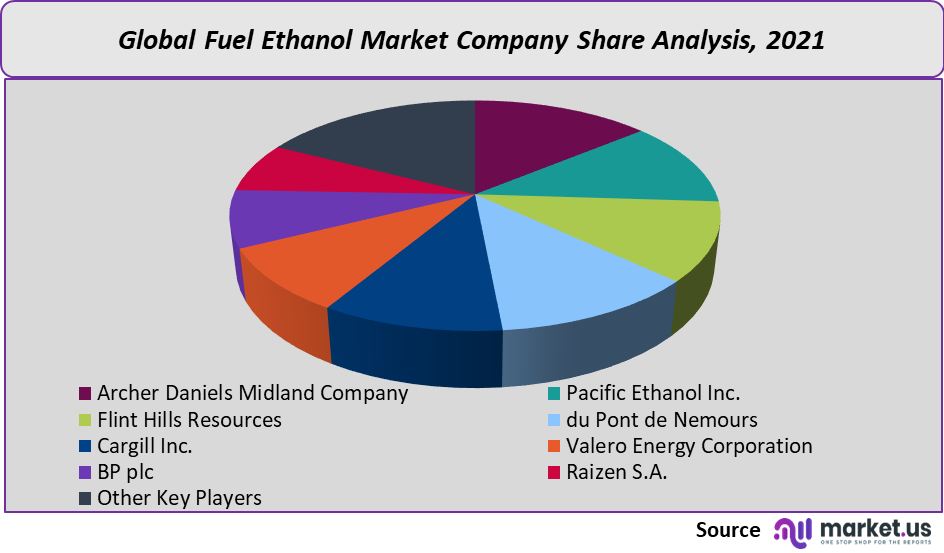

Among the top players in the U.S. are Archer Daniels Midland Company, Pacific Ethanol, Inc., Flint Hills Resources LP, and Pacific Ethanol, Inc. Flint Hills Resources LP bought Southwest Georgia Ethanol, LLC, an ethyl alcohol production facility, in 2015. It is located in Georgia, U.S.A. The company plans to increase its presence and cater to the growing demand for ethanol fuel in the U.S. markets.

Pacific Ethanol, Inc. entered into a technology licensing agreement with Edeniq, Inc., a major ethyl alcohol processing technology developer. The company used Edeniq’s Cellunator and Pathway technologies to manufacture cellulose-based alcohol in Madera, California.

The U.S. is a big consumer of starch-based Ethyl Alcohol as an additive for gasoline. This product is made using dry milling technology and corn kernel feedstock. The country’s auto producers approved using E15 and E85 product mixes regulated by the U.S. E.P.A. in 2015. AUDI and FCA Group are some of the major automotive players that approved the use E15 blend.

Regional Analysis:

This fuel ethanol industry trend is expected to grow rapidly, especially in developing countries. Regulatory policies and mandates will improve the long-term energy supply in India, China, and Mexico regarding the use of crude oil importers in the transportation and automotive sectors.

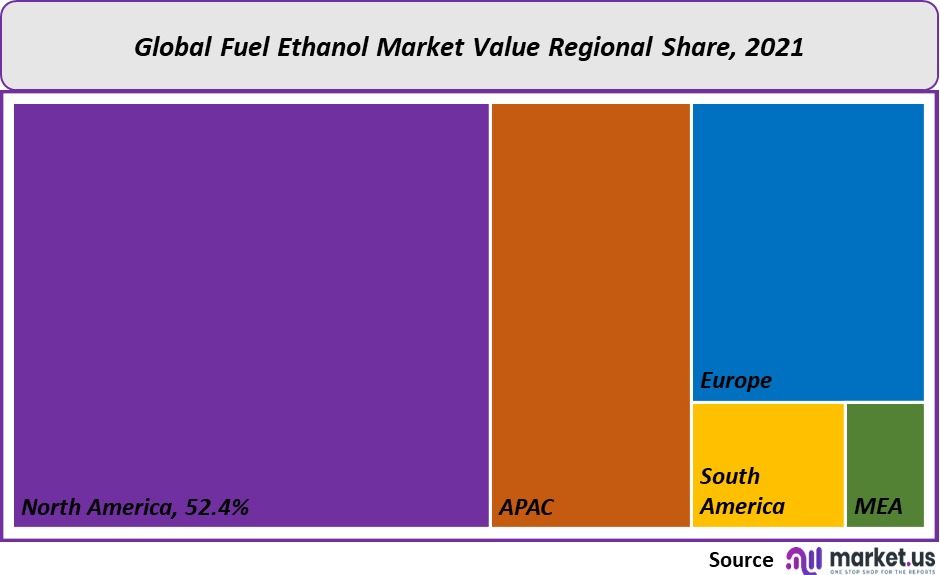

North America held the largest market share, representing 52.4% of 2021’s total volume. Because of its established automotive industry and stringent regulations regarding particulate, this region is expected to be the fastest-growing consumer of the product launch. This is likely to be the case in the U.S.

The Asia Pacific will likely experience the fastest growth over the forecast period. The rise in foreign investment and government initiatives toward sustainable development will likely promote biofuels in the coming years. This will likely happen in Southeast Asia, China, India, and other countries.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

High fragmentation is evident in the market. The industry’s competitiveness is influenced by its product consumption, penetration in regional applications industries, the security and feedstock of raw materials, and the high degree of forwarding integration. The following are some of the major players in the global market for fuel ethanols:

Маrkеt Prominent Player:

- Archer Daniels Midland Company

- Pacific Ethanol Inc.

- Flint Hills Resources

- du Pont de Nemours

- Cargill Inc.

- Valero Energy Corporation

- BP plc

- Raizen S.A.

- Cropenergies ag

- Ford motor company

- Pannonia Bio

- Other Key Players

For the Fuel Ethanol Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the fuel ethanol market in 2021?The Fuel ethanol market growth size will be US$ 84,520 million in 2021.

What is the projected CAGR at which the Fuel ethanol market Share is expected to grow?The Fuel ethanol market is expected to grow at a CAGR of 6.8% (2023-2032).

List the segments encompassed in this report on the Fuel ethanol market?Market.US has segmented the Fuel ethanol market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Product Type, the market has been segmented into Starch-based, Sugar-based, and Cellulosic. By Application, the market has been further divided into, Conventional Fuel Vehicles, Flexible Fuel Vehicles, and other basis of Applications.

List the key industry players of the Fuel ethanol market?Archer Daniels Midland Company, Pacific Ethanol Inc., Flint Hills Resources, e.i. du Pont de Nemours and Company, Cargill Inc., Valero Energy Corporation, BP plc, Raizen S.A., and Other Key Players company overview engaged in the Fuel Ethanol market.

Which region is more appealing for vendors employed in the Fuel ethanol market?North America is expected to account for the highest revenue largest share of 52.4%. Therefore, North America's Fuel Ethanol Technology industry is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Fuel ethanol?The US, Canada, UK, Japan, India, China, & Germany are key areas of operation for the Fuel Ethanol Market.

Which segment accounts for the greatest market share in the Fuel ethanol industry?With respect to the Fuel ethanol industry, vendors can expect to leverage greater prospective business opportunities through the starch based segment, as this area of interest accounts for the largest market share.

![Fuel Ethanol Market Fuel Ethanol Market]()

- Archer Daniels Midland Company

- Pacific Ethanol Inc.

- Flint Hills Resources

- du Pont de Nemours

- Cargill Inc.

- Valero Energy Corporation

- BP plc

- Raizen S.A.

- Cropenergies ag

- Ford motor company

- Pannonia Bio

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Report Library Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |