Global Gas Turbine Market By Technology (Open Cycle , and Combined Cycle), By Capacity (≤200 MW , and >200 MW), By End-Use (Power & Utility, Industrial) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022–2032

- Published date: May 2021

- Report ID: 22290

- Number of Pages: 271

- Format:

- keyboard_arrow_up

Gas Turbine Market Overview

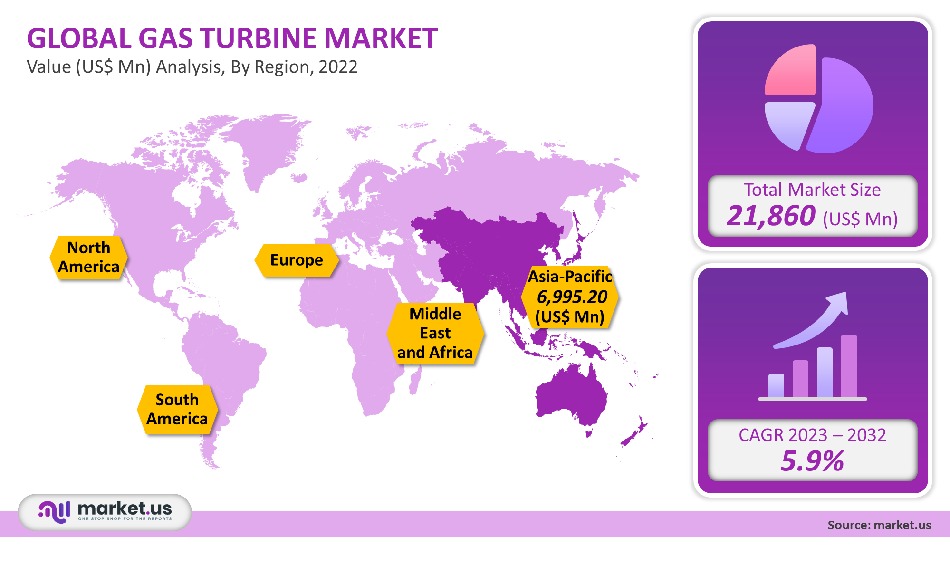

The Gas Turbine Market size is expected to be worth around USD 41,068.20 Million by 2032 from USD 21,860 Million in 2021, growing at a CAGR of 5.9% during the forecast period 2022 to 2032.

A gas turbine, an engine that heats a mixture of fuel and air at very high temperatures to create mechanical energy by spinning the turbine blades, is a type of engine. The generator produces electricity from mechanical energy. Globally, technological innovations in the energy industry and a shift toward distributed power generation technologies are driving the market forward. This market is expected to grow rapidly due to the increased government support for power generation technologies that minimize carbon dioxide emissions.

Global Gas Turbine Market

Capacity Analysis

>200 MW has emerged as one of the most important segments of this market, with a revenue share greater than 65.0% for 2021. It will likely be the fastest-growing segment over the forecast period. This category is being driven by the increasing power generation operations in the world and the transition from coal-based to gas-based plants in some major countries. Because of increasing, power generation needs worldwide, and the growing demand for energy from fast-growing cities and population growth, there is a greater need for power generation. The primary driver of gas turbines is their capacity above 200 MW. The 200 MW turbine’s small size allows for simpler maintenance and operation. This is why it has been so successful. Its smaller size makes the product lighter and ideal for offshore areas where the power-to-weight ratio is important in choosing whether to build a turbine. It is expected that the oil and natural gas industry will restore its energy. Small turbines are used frequently in the oil and natural gas industry due to their compatibility with environmental and operational circumstances.

Technology Analysis

The combined cycle turbines sector was the dominant revenue source with a share greater than 72.0% in 2021. This dominance is expected to continue in the near future. This technology category is expected to increase in popularity at an even faster rate over the next few years. These turbines consume less fuel to produce energy and reduce transmission and distribution losses. Combination turbines are extremely efficient and can reach an efficiency of 60 to 80 percent.

The switch to combined-cycle gas turbine technology is being driven by strict regulations regarding coal plants, low gas prices, as well as the integration of increasing amounts of renewable energy. CCPPs can complement solar and wind power because they can start and stop quickly and allowing them to compensate for changes in renewable power.

The government’s efforts to encourage the use of renewable fuels for electricity generation, and reduce greenhouse gas emissions, will likely increase demand for natural gas-fired energy plants over coal-fired ones. In addition, industry growth is expected to be driven by falling gas prices and the discovery of shale oil reserves over the forecast period.

End-Use Analysis

The largest revenue share was held by the Power and Utility sector, which accounted for around 80.0% in 2021. The growth of population and urbanization in the world is driving increased demand for power. This is increasing the use of gas turbines in the power and utility sectors. A focus on environmentally friendly power generation is another key driver for the gas turbine industry in the power sector.

This industrial segment includes heavy industries, specialty chemicals production, glass, and concrete manufacture, pharmaceutical manufacturing, and sugar mills. Gas turbines are increasingly in demand because of strict pollution regulations. The low prices of natural gas are helping to increase demand for gas turbines in the industrial sector. The rise in industrial activity worldwide over the past is driving this demand.

Key Market Segments

Technology

- Open Cycle

- Combined Cycle

Capacity

- ≤200 MW

- >200 MW

End-Use

- Power & Utility

- Industrial

Market Dynamics

The primary use of gas turbines is power generation. It is costlier to operate a simple turbine power plant to supply electricity to the sector than it is to buy it from elsewhere. Because of their higher efficiency, most people prefer to use combined cycle power plants. CHP plant is one example of a combined-cycle power plant that can be used to produce electricity and also for a mechanical drive.

The market’s growth is largely due to the shift in paradigm from coal-based power generation to gas-based generation. This includes both developed and developing countries, such as the United States, China, India, and Japan. Growing government support of power generation technologies to reduce CO2 emissions is expected to lead to strong growth in the U.S. Market. The key factors driving the shift away from coal-based electricity generation to gas-based energy generation include the availability of suitable economics and supportive policies for building gas-based power plants. In the United States, there is an assured long-term supply of fuel that will support market growth.

Reduce greenhouse gas emissions by using gas turbines. Gas turbines are more efficient than other types of combustion-based electricity generation and produce lower carbon emissions. In the future, gas turbines will see an increase in potential due to the implementation of several climate change initiatives as well as regulations to reduce GHGs emissions.

Major cities and economies in the world have experienced lockdowns that have forced many industries to shut down. This has effectively stopped production. Global demand for oil has dropped as a result. According to the bp statistics analysis of world energy 2021, the global natural gas consumption was 3,822.8 million cubic meters in 2020. This represents a decrease of 81,100 million cubic meters from 2019. In addition, the global pandemic has caused a significant drop in electricity consumption from commercial and industrial end-users. This led to a decrease in gas turbine demand during the pandemic.

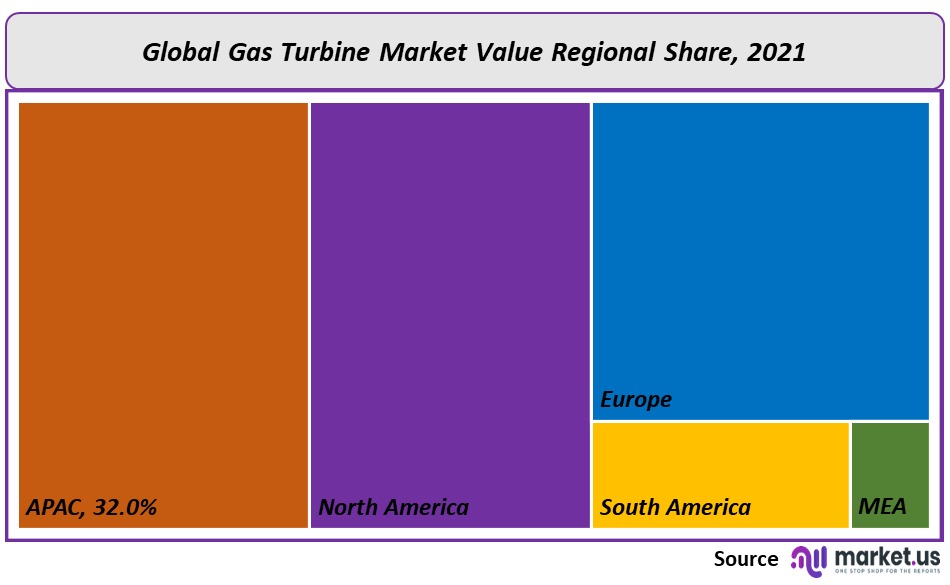

Regional Analysis

The Asia Pacific accounted for more than 32.0% of the global gas turbine market revenue in 2021. The region dominated by India, Japan, and Indonesia is expected to grow the fastest during the forecast period. The rapid urbanization of the region and the growth of the middle-class is driving Asia Pacific’s electricity demand. Multinational companies are tempted to expand in the region because of their access to growing economies like India or China and low-cost raw materials and labor.

North America will see significant growth, with the U.S., Canada, and Mexico leading the charge. The demand is driven primarily by the region’s large shale oil reserves and technological advancements in mining and extraction technology, which have consistently reduced the operational cost of gas extraction. In North America, large-scale gas-based power has been commissioned. Thanks to technological advancements in completion techniques such as multistage hydraulic drilling and horizontal wellbore drilling, oil and gas companies can now produce shale on a commercial scale. Trends predict that the region’s market will be driven by technological advances and commercial shale production over the next few years.

Saudi Arabia is a major Middle East and African gas turbine end, the user. The country has many gas turbine providers, all of which are looking to expand their market share. Major OEMs, such as General Electric, Siemens Energy, and Mitsubishi Power Ltd., supply gas turbines all over the country.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

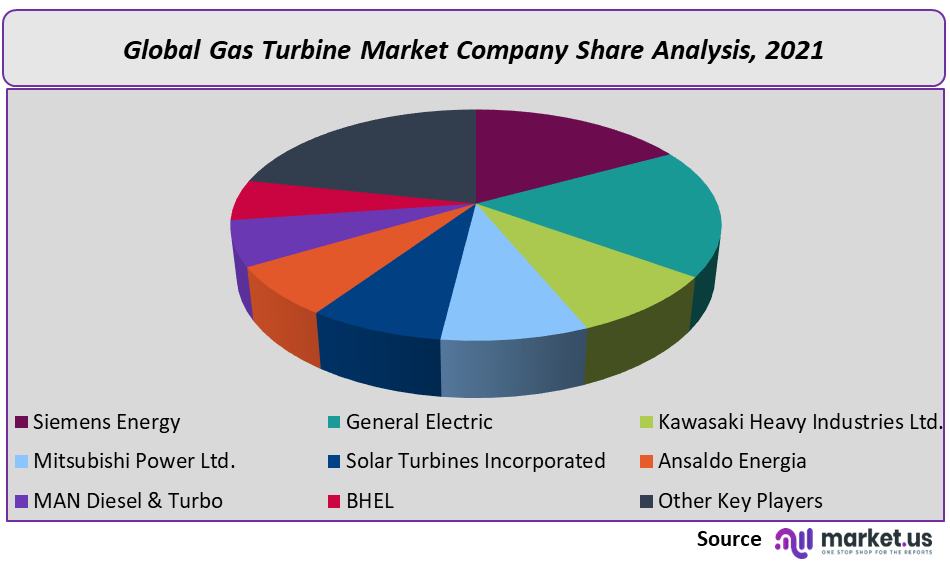

Market Share Analysis

The dominant industry share is held by a handful of large companies that have consolidated the market. To strengthen their position in the market, industry players use various strategic initiatives like joint ventures. Ansaldo Energia’s consortium and Shanghai Electric Group’s signed a deal with North-West Power Generation Company Ltd, a Bangladesh Power Development Board company. According to the terms of this deal, the consortium is expected to design and build an 880MW combined cycle power station in Bangladesh.

Key Market Players

Some of the most prominent players in gas turbine markets include:

- Siemens Energy

- General Electric

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Power Ltd.

- Solar Turbines Incorporated

- Ansaldo Energia

- MAN Diesel & Turbo

- BHEL

- Other Key Players

For the Gas Turbine Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Gas Turbine market in 2021?The Gas Turbine market size was US$ 21,860 million in 2021.

What is the projected CAGR at which the Gas Turbine market is expected to grow at?The Gas Turbine market is expected to grow at a CAGR of 5.9% (2023-2032).

List the segments encompassed in this report on the Gas Turbine market?Market.US has segmented the Gas Turbine market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Technology, market has been segmented into Open Cycle and Combined Cycle. By Capacity, the market has been further divided into ≤200 MW and >200 MW. By End-Use, market has been segmented into Power & Utility and Industrial.

List the key industry players of the Gas Turbine market?Siemens Energy, General Electric, Kawasaki Heavy Industries Ltd., Mitsubishi Power Ltd., Solar Turbines Incorporated, Ansaldo Energia, MAN Diesel & Turbo, BHEL, and Other Key Players engaged in the Gas Turbine market.

Which region is more appealing for vendors employed in the Gas Turbine market?Asia Pacific is accounted for the highest revenue share of 32%. Therefore, the Gas Turbine industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Gas Turbine?The U.S., Russia, China, India, Japan, Saudi Arabia, and Egypt are key areas of operation for Gas Turbine Market.

Which segment accounts for the greatest market share in the Gas Turbine industry?With respect to the Gas Turbine industry, vendors can expect to leverage greater prospective business opportunities through the >200 MW segment, as this area of interest accounts for the largest market share.

![Gas Turbine Market Gas Turbine Market]()

- Siemens Energy

- General Electric

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Power Ltd.

- Solar Turbines Incorporated

- Ansaldo Energia

- MAN Diesel & Turbo

- BHEL

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |