Global Hernia Repair Devices Market By Product Type (Hernia Mesh and Hernia Fixation Devices), By Procedure Type (Open Surgery and Laparoscopic Surgery), By Surgery Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 36287

- Number of Pages: 257

- Format:

- keyboard_arrow_up

Hernia Repair Devices Market Overview

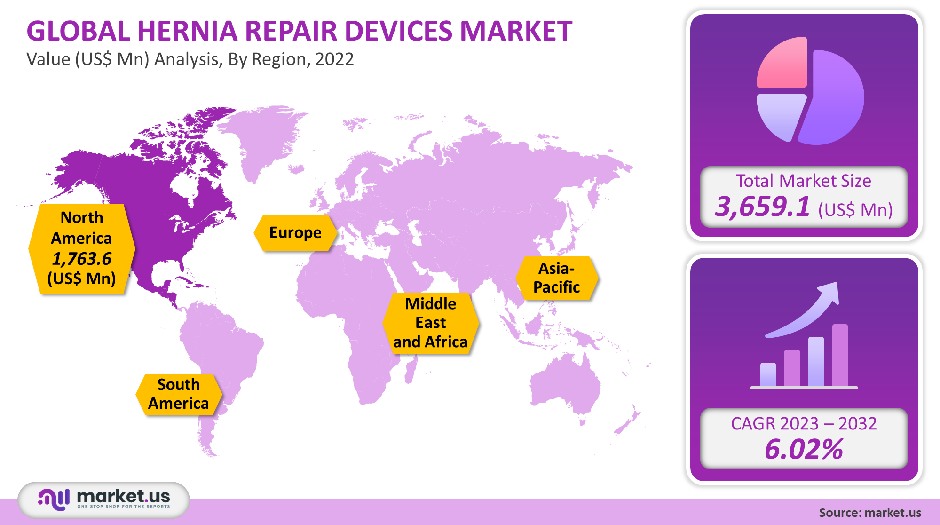

The global hernia repair device market was valued at USD 3.65 Billion in 2021. It is expected to grow at a CAGR of 6.02% between 2023 to 2032.

The market’s growth is attributed to the rising incidence of hernia and favorable reimbursement policies. Market growth is expected to be aided by rising demand for effective repair devices due to the high incidence of hernia. The U.S. FDA estimates that more than a million hernia repairs are performed annually in the United States alone. Market growth is expected to be driven by the demand for a more efficient solution due to high hernia incidence.

In the 13 weeks that the COVID-19 pandemic caused the most disruption, it was estimated that 28 million elective surgeries and operations were canceled. Inguinal hernias were affected by 2.5% and umbilical and incisional hernias respectively.

Global Hernia Repair Devices Market Scope:

Product Type Analysis

Due to their widespread adoption, the hernia mesh segment was the dominant market player with a revenue share of 77% in 2021. This segment’s growth is due to its resistance to infection and ability to provide long-term strength to prevent a repeat. The hernia mesh market can be further divided into synthetic and biological mesh.

Due to its high product availability, easy availability of product material, and cost-effectiveness, synthetic mesh dominated the market for 2021. The fastest growing segment in terms of revenue is the hernia fixation device segment. This segment can be divided into glue applicators, tack applicators, or sutures.

Tack applicators were the most popular market segment in 2021 due to their high price and easy availability. Due to their high use in different surgical applications, sutures held a significant market share in 2021. Due to their advantages such as fewer complications after surgery, the glue applicators market is expected to grow at the fastest pace during the forecast period.

Procedure Type Analysis

With a revenue share of 76.9%, open surgery dominated the market in 2021. It is expected to continue its dominance throughout the forecast period due to its advantages such as its low cost and fewer complications after the procedure. An open hernia procedure involves making a large incision across the abdomen. To strengthen surrounding tissues, the surgical mesh is applied to the hernia. Open surgery has many benefits, including the prevention of hernias recurring, lower cost procedures, and a lower chance of complications afterward.

Open surgery can lead to complications such as blood clot formation and excessive blood loss. Because it is widely accepted as an option for treating hernias, laparoscopic surgery will likely see the highest revenue growth over the forecast period. These minimally invasive procedures are highly recommended due to the fact that they require fewer hospital stays, take less time to recover, and have a lower infection rate.

Surgery Type Analysis

With a market share of more than 65.8%, the inguinal hernia was the dominant segment. This segment is driven by patient feasibility and widespread adoption of these surgical procedures. The FDA estimates that there are over 900,000 inguinal repairs performed each year in the United States.

These procedures are increasing in number, which is driving demand for hernia repair equipment. Incisional hernia is predicted to grow at the fastest revenue CAGR during the forecast period. Incisional hernia can be caused by a previous abdominal wall incision, or incompletely healed surgical wounds. This is the second-most common surgery, after inguinal surgery. According to Medscape, approximately 30.7% of all laparotomies performed in the U.S. each year are incisional hernia operations. Incisional hernias account for 52% of all surgeries within two years. However, 75% occur within four years. This boosts the demand for hernia repair devices.

Key Market Segments

Product Type

- Hernia Mesh

- Biologic Mesh

- Synthetic Mesh

- Hernia Fixation Devices

- Sutures

- Tack Applicators

- Glue Applicators

Procedure Type

- Open Surgery

- Laparoscopic Surgery

Surgery Type

- Inguinal Hernia

- Incisional Hernia

- Umbilical Hernia

- Femoral Hernia

- Other Surgery Types

Market Dynamics

The German government announced in mid-March 2020 that elective surgical procedures would be stopped. Herniated also saw a significant drop in the number of hernia repair cases during March 2021. April 2021 saw the lowest number of hernia repairs. This was approximately 26% less than those performed from February through June 2019. Due to the gradual decline in COVID-19-related cases since May 2021, the restrictions on elective surgery in German hospitals were lifted. This resulted in an increase in elective hernia repair. Despite normalization in Germany’s hospitalization policies, June 2020 saw a significantly lower caseload for hernia repair than June 2019.

The most common type of surgery performed worldwide is hernia repair. Hernia incidence is higher among men than it is among women. Inguinal hernia affects 26% of men and 2.5% of women. Inguinal hernia is linked to obesity, smoking, unhealthy lifestyles, and age. Adults account for 76% of all hernias. This has led to an increase in hernia repair tools. Market growth is expected to be boosted by the high incidence of hernia.

In recent years, technological advances in hernia repair technology have rapidly increased. To overcome problems that can arise during laparoscopic procedures, advancements such as self-fixating meshes and articulating fixation devices have been made. These devices allow surgeons to access weaker areas in the abdominal wall and permit them to secure place the mesh at the desired site. This will increase the market growth.Regional Analysis

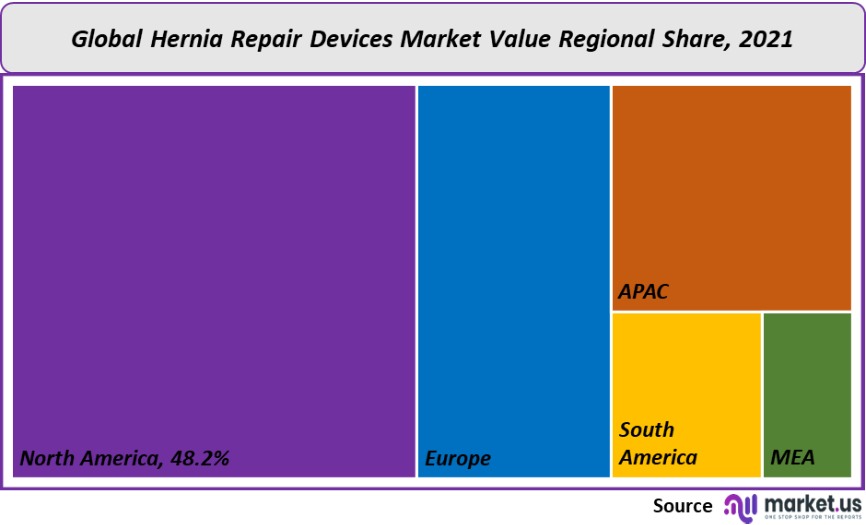

North America was the dominant market, with a revenue share of 48.2% in 2021 due to the presence of major players. Market growth in North America is due to a growing population of elderly people, sedentary lifestyles, and high recurrence rates of hernia. The market is also growing due to rising healthcare spending and quicker FDA approvals. The Asia Pacific experienced the fastest revenue growth over the forecast period. The market is driven by rising medical tourism, affordable treatment, and technological advances, as well as rising healthcare reimbursements. Due to the large patient population, Asian countries are seeing a rise in demand for hernia repair devices. Due to a large number of undiagnosed cases and untreated cases in the region, the market is expected to grow strongly.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis

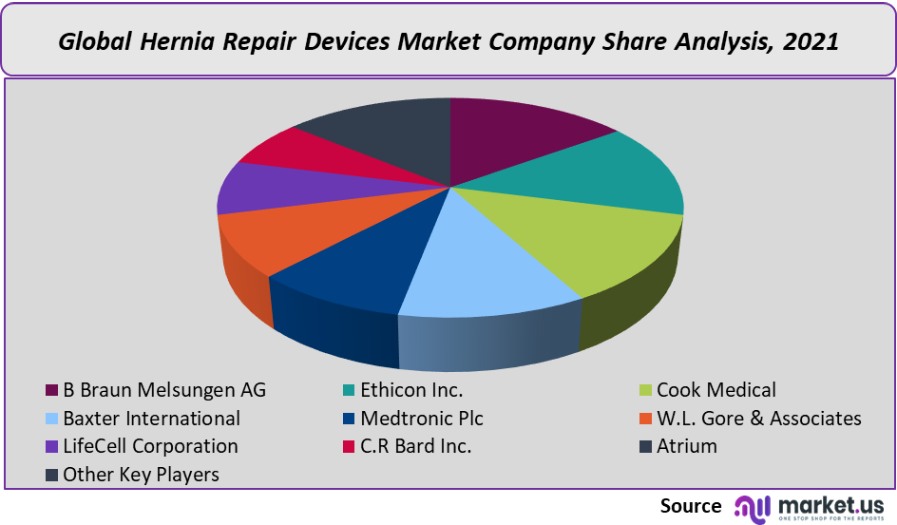

Due to the presence of well-established players in the market, the market has seen high levels of competition. To maintain a larger market share, large companies coexist with smaller companies that specialize in a specific product line to keep their market share.

Key Market Players

- B Braun Melsungen AG

- Ethicon Inc.

- Cook Medical

- Baxter International

- Medtronic Plc

- W.L. Gore & Associates

- LifeCell Corporation

- C.R Bard Inc.

- Atrium

- Other Key Players

For the Hernia Repair Devices Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

3.65 Billion

Growth Rate

6.2%

Forecast Value in 2032

7.7 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Hernia Repair Devices market in 2021?The Hernia Repair Devices market size is US$ 3,659.1 million in 2021.

What is the projected CAGR at which the Hernia Repair Devices market is expected to grow at?The Hernia Repair Devices market is expected to grow at a CAGR of 6.02% (2023-2032).

List the segments encompassed in this report on the Hernia Repair Devices market?Market.US has segmented the Hernia Repair Devices Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into (Hernia Mesh and Hernia Fixation Devices), By Procedure Type, the market has been segmented into (Open Surgery and Laparoscopic Surgery), By Surgery Type, the market has been segmented into (Inguinal Hernia, Incisional Hernia, Umbilical Hernia, Femoral Hernia and Other Surgery Types).

List the key industry players of the Hernia Repair Devices market?B Braun Melsungen AG, Ethicon Inc., Cook Medical, Baxter International, Medtronic Plc, W.L. Gore & Associates, LifeCell Corporation, C.R Bard Inc., Atrium and Other Key Players are the key vendors in the Hernia Repair Devices market.

Which region is more appealing for vendors employed in the Hernia Repair Devices market?North America accounted for the highest revenue share of 48.2%. Therefore, the Hernia Repair Devices industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the Hernia Repair Devices Market.The US, Canada, Spain, Italy, Japan, Germany, France, UK, etc., are leading key areas of operation for Hernia Repair Devices Market.

Which segment accounts for the greatest market share in the Hernia Repair Devices industry?With respect to the Hernia Repair Devices industry, vendors can expect to leverage greater prospective business opportunities through the hernia mesh segment, as this area of interest accounts for the largest market share.

![Hernia Repair Devices Market Hernia Repair Devices Market]() Hernia Repair Devices MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample

Hernia Repair Devices MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample - Hernia Mesh

- B Braun Melsungen AG

- Ethicon Inc.

- Cook Medical

- Baxter International Inc Company Profile

- Medtronic Plc

- W.L. Gore & Associates

- LifeCell Corporation

- C.R Bard Inc.

- Atrium

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |