Global Image-Guided & Robot-Assisted Surgical Procedures Market By Specialty (Gynecologic Surgery, Urologic Surgery, General Surgery), By End-Use (Hospitals, Clinics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 48808

- Number of Pages: 255

- Format:

- keyboard_arrow_up

Image-Guided & Robot-Assisted Surgical Procedures Market Overview

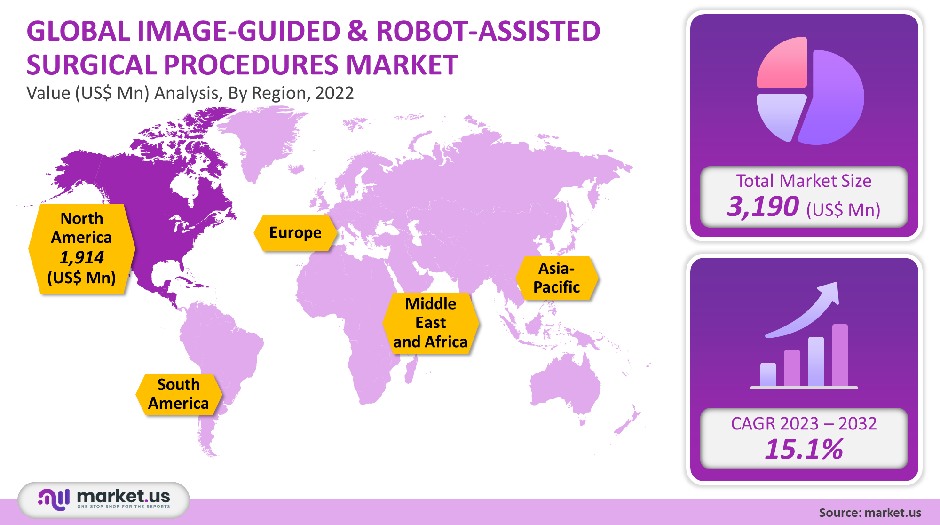

The global Image-Guided & Robot-Assisted Surgical Procedures Market was valued at USD 3.19 Billion in 2021. It is forecast to grow at a CAGR of 15.1% from 2023 to 2032.

The rapid technological advances in medical robotics will lead to the increasing use of robots in surgery. Market growth is expected to be driven by the increasing number of complex surgeries as well as increased trauma incidence. The rise in hospital spending on medical equipment is expected to increase the penetration of image-guided or robot-assisted surgery in emerging economies like Latin America and the Asia Pacific. Over the forecast period, there will be an increase in complex orthopedic, gynecological and urological surgery.

Global Image-Guided & Robot-Assisted Surgical Procedures Market Scope:

Specialty Analysis

The urologic surgery market was the dominant specialty in the global robot-assisted and image-guided surgical procedures market and accounted for a 40% share of the global revenue. Market demand is expected to rise as more people are able to perform complex procedures such as bladder, kidney, prostate, and bladder cancer surgeries. General surgeries are the most common image-guided operations to treat morbid obesity. They account for the second largest market share in terms of revenue.

General surgeons can cater to surgical subspecialties such as colorectal and hernia repair. Cholecystectomy is another option. General surgeons can perform error-free operations by using surgical robots. This will in turn drive adoption of these devices during the forecast period.

End-User Analysis

In 2021, the hospital segment accounted for 70% of total revenue. This segment is seeing an increase in hospital admissions. Market growth is expected to be boosted by the easy access and availability of hospitals, as well as favorable reimbursement policies.

Key Market Segments:

By Specialty

- Gynecologic Surgery

- Urologic Surgery

- General Surgery

- Cardiothoracic Surgery

- Head & Neck Specialties

By End-Use

- Hospitals

- Clinics

- Others

Market Dynamics:

Motion sensors, tiny cameras, and three-dimensional imaging systems are a few examples of recent technology advancements in surgical operations. The Da Vinci Surgical Technology is the most widely used system for intricate operations. Intuitive Surgical Inc. created it. This computer-assisted device is equipped to carry out challenging laparoscopic procedures. This technologically advanced approach improves patient outcomes and lowers surgical errors.

Due to significant expenditures on equipment and medical gadgets, the market for image-guided or robot-assisted surgical procedures will keep expanding. Surgery in a range of disciplines can be performed using the Da Vinci System. Rosa’s spine and Rosa’s brain are robots that can operate on the spine and the nervous system, respectively. Compared to conventional methods, this lowers the possibility of mistakes. The market is anticipated to grow due to an increase in spinal and neurological injuries over the course of the projected period.

Due to the rising use of technologically advanced medical robots and the demand for minimally invasive surgeries, developed economies like North America and Europe now hold a larger market share in terms of revenue. Due to their lower adoption and higher costs, image-guided robotics are less popular in developing economies like Africa, the Middle East, Latin America, and Africa.

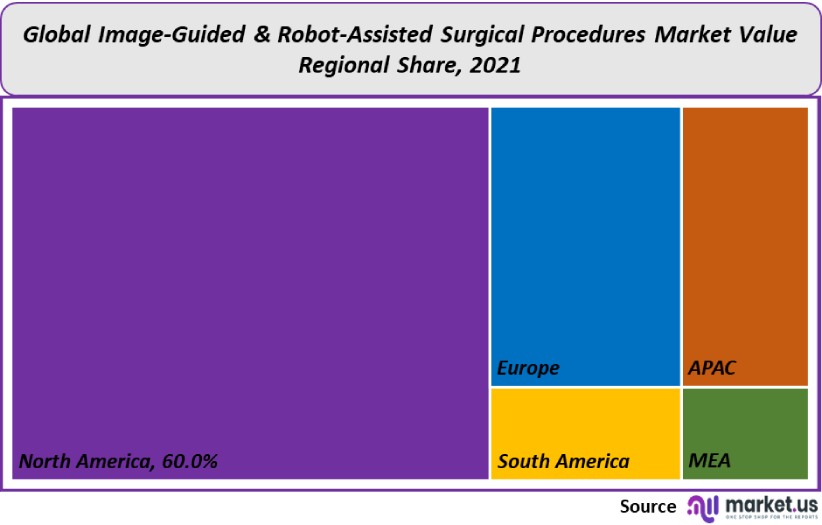

Regional Analysis

North America held the largest market share in 2021 and accounted for a 60% share of the global revenue. The factors expected to drive North American revenue growth include high investment, rising demand, the prevalence and complexity of complex trauma procedures, and the adoption of medical robots. Europe was the second largest region in 2021. Due to their high costs, price-sensitive economies like Latin America and the Middle East, and Africa experience low adoption rates.

Asia Pacific is expected to grow at 16% CAGR over the forecast period, thanks to factors like improved healthcare infrastructure in India and China. Japan has one of the best healthcare systems in the world and is a leader in automation. This has opened up a lot of opportunities for medical robotics companies. These factors will contribute to regional market demand during the forecast period.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

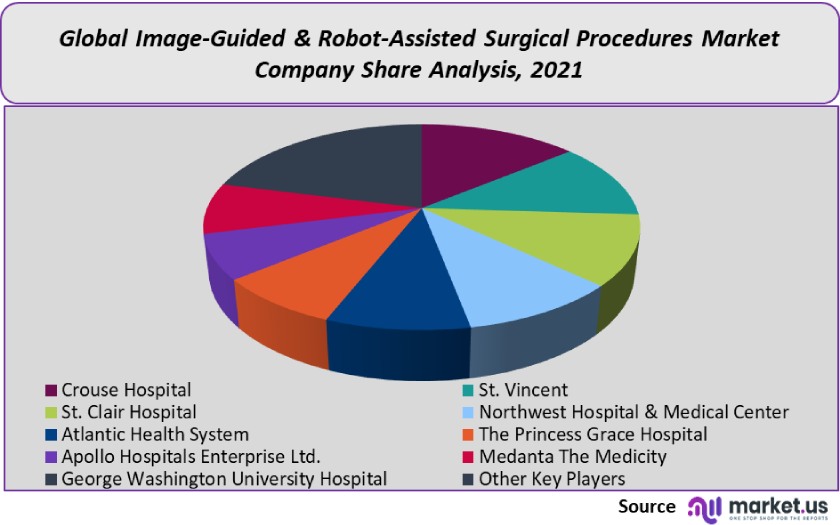

This market will see increased competition over the forecast period due to these market players. Due to the high level of capital investment required and high technical skills, there are not many hospitals that offer robot-assisted surgery. Hospitals dominate the market. Hospitals focus on providing high-quality care and decreasing the incidence of medical errors. In the coming years, hospitals will see a rise in capital investment compared to other healthcare facilities. This is expected to lead to lucrative growth.

Market Key Players:

- Crouse Hospital

- St. Vincent

- St. Clair Hospital

- Northwest Hospital & Medical Center

- Atlantic Health System

- The Princess Grace Hospital

- Apollo Hospitals Enterprise Ltd.

- Medanta The Medicity

- George Washington University Hospital

- Other Key Players

For the Image-Guided & Robot-Assisted Surgical Procedures Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

3.19 Billion

Growth Rate

15.1%

Forecast Value in 2032

14.98 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Image-Guided & Robot-Assisted Surgical Procedures market in 2021?The Image-Guided & Robot-Assisted Surgical Procedures market size is US$ 3,190 million in 2021.

What is the projected CAGR at which the Image-Guided & Robot-Assisted Surgical Procedures market is expected to grow at?The Image-Guided & Robot-Assisted Surgical Procedures market is expected to grow at a CAGR of 15.1% (2023-2032).

List the segments encompassed in this report on the Image-Guided & Robot-Assisted Surgical Procedures market?Market.US has segmented the Image-Guided & Robot-Assisted Surgical Procedures Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Speciality, the market has been segmented into Gynecologic Surgery, Urologic Surgery, General Surgery, Cardiothoracic Surgery, Head & Neck Specialties; and by end-use, the market has been segmented into Hospitals, Clinics, Others.

List the key industry players of the Image-Guided & Robot-Assisted Surgical Procedures market?Crouse Hospital, St. Vincent, St. Clair Hospital, Northwest Hospital & Medical Center, Atlantic Health System, The Princess Grace Hospital, Apollo Hospitals Enterprise Ltd., Medanta The Medicity, George Washington University Hospital, Other Key Players are the key vendors in the Image-Guided & Robot-Assisted Surgical Procedures market.

Which region is more appealing for vendors employed in the Image-Guided & Robot-Assisted Surgical Procedures market?North America accounted for the highest revenue share of 60%. Therefore, the Image-Guided & Robot-Assisted Surgical Procedures industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the Image-Guided & Robot-Assisted Surgical Procedures Market.The US, Canada, Mexico, China, Japan, Germany, France, UK, etc., are leading key areas of operation for Image-Guided & Robot-Assisted Surgical Procedures Market.

Which segment accounts for the greatest market share in the Image-Guided & Robot-Assisted Surgical Procedures industry?With respect to the Image-Guided & Robot-Assisted Surgical Procedures industry, vendors can expect to leverage greater prospective business opportunities through the Urologic Surgery segment, as this area of interest accounts for the largest market share.

![Image-Guided & Robot-Assisted Surgical Procedures Market Image-Guided & Robot-Assisted Surgical Procedures Market]() Image-Guided & Robot-Assisted Surgical Procedures MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Image-Guided & Robot-Assisted Surgical Procedures MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Crouse Hospital

- St. Vincent

- St. Clair Hospital

- Northwest Hospital & Medical Center

- Atlantic Health System

- The Princess Grace Hospital

- Apollo Hospitals Enterprise Ltd.

- Medanta The Medicity

- George Washington University Hospital

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |