Global Lip Care Products Market By Product (Lip Scrub, Lip Balm, and Other Products), By Distribution Channel (Online, Hypermarkets & Supermarkets, Specialty Store, Pharmacy & Drug Store, and Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 15050

- Number of Pages: 271

- Format:

- keyboard_arrow_up

Lip Care Products Market Overview:

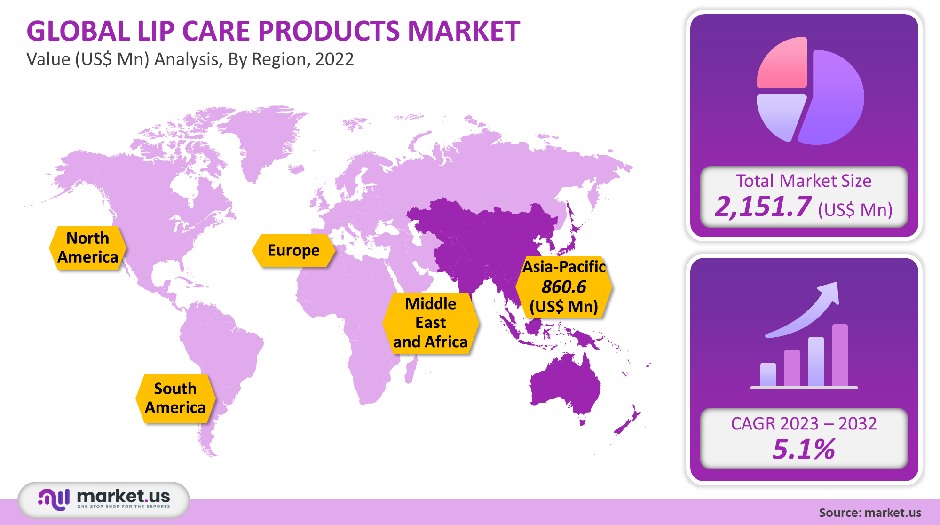

Globally, the market for lip care products was worth USD 2,151.7 million in 2021. It is projected to grow at a CAGR, of 5.1% between 2023-2032.

There is a growing demand for high-quality products due to concerns about sun damage, dryness, and darkening of the lips. As consumers seek safer alternatives to toxic and synthetic chemicals, organic and natural lip balms have been gaining in popularity.

This is due to the increasing popularity of wellness and personal grooming, which has led more men to use these products. Sales of lip care and beauty products via major offline retailers have been greatly affected by the COVID-19 pandemic.

Global Lip Care Products Market Analysis

Product Analysis

In 2021, lip balms accounted for 50% of revenue. This share is expected to continue over the forecast period. Major players have increased the number of product launches to attract a wider customer base. This has contributed to the growth of this segment. Estee Lauder Companies Inc., for instance, launched its lip care range in February. It includes lip balm, potion, and lip gloss.

However, the CAGR for the other segment, which encompasses various types of lip balms, oils, and masks, is expected to grow at the fastest pace during the forecast period. Innovative products are gaining consumers’ attention, which is driving the other segment. Consumers are becoming increasingly fond of collagen and gel-based lip masks. It is predicted that the lip scrub market will grow steadily between 2023 and 2032. Lip scrubs are becoming more popular due to their ability to remove dead cells and exfoliate the skin.

Distribution Channel Analysis

A high revenue share was held by hypermarkets & supermarkets in 2021. It is expected to continue its leadership position for the duration of the forecast period. These stores are a great option for customers because they offer low prices and high visibility of both international and local brands.

The fastest CAGR is expected to be recorded in the specialty stores channel segment during the forecast period. Because of their ease of purchasing, large network, and the availability of a limited range of products at affordable prices, consumers choose specialty stores. These stores can also offer niche items such as organic, cruelty-free, natural, and vegan products.

Online sales are expected to grow at the second-fastest rate between 2023 and 2032. The forecast period will see an increase in online product sales. Anastasia Beverly Hills, Amazon, Kinship Inc., Sephora, and Walmart are among the top online retailers of lip products. The COVID-19 epidemic has led to an increase in sales through eCommerce. This has positively impacted segment growth.

Key Market Segments

By Product

- Lip Scrub

- Lip Balm

- Other Products

By Distribution Channel

- Online

- Hypermarkets & Supermarkets

- Specialty Store

- Pharmacy & Drug Store

- Other Distribution Channels

Market Dynamics

Many mass-market stores, brick and mortar stores, as well as other retailers, reported a drop in sales for the same year. The Boots Company PLC for instance reported a drop in beauty product sales by 2/3 between March 2020 and April 2020. But, DIY and self-care beauty products are a growing trend in the market. This trend is expected to rebound during the forecast period.

Due to increasing demand, these products are rapidly growing in the U.S. because consumers are choosing organic products due to their shifting preference for vegan products. Many lip care companies in the region are now focusing on sustainable production due to growing concerns about plastic reduction and waste disposal. Ethique Inc., for instance, introduced a new line of lip balms to the U.S. in June 2021. The product uses plant-derived ingredients that are 100% biodegradable and plastic-free.

According to the U.S. PIRG article, close to 80% of women use lip-care products and 40% of men do so. American women use lip care products more often than American men. These products are applied on average by American women up to 2.35x per day. This could exceed 15 times per day. These indicators suggest a positive outlook for America’s market in the coming years.

Due to the increased popularity of lip care, self-care, and lip scrubs among women, many international and regional producers are now offering unique lip balms, scrubs, and masks. They are becoming more popular because of the increasing availability of organic, tinted, and natural lip balms at a lower price.

The market leaders are investing in research and development to create premium, skin-friendly products for lip care. Natural and organic lip care treatments that do not contain aluminum or sodium Laureth sulfate are seeing significant growth. Anastasia Beverly Hills launched vegan and cruelty-free lip balms in varieties like mango, strawberry, and coconut. Market growth is expected to be positive if such product offerings are made.

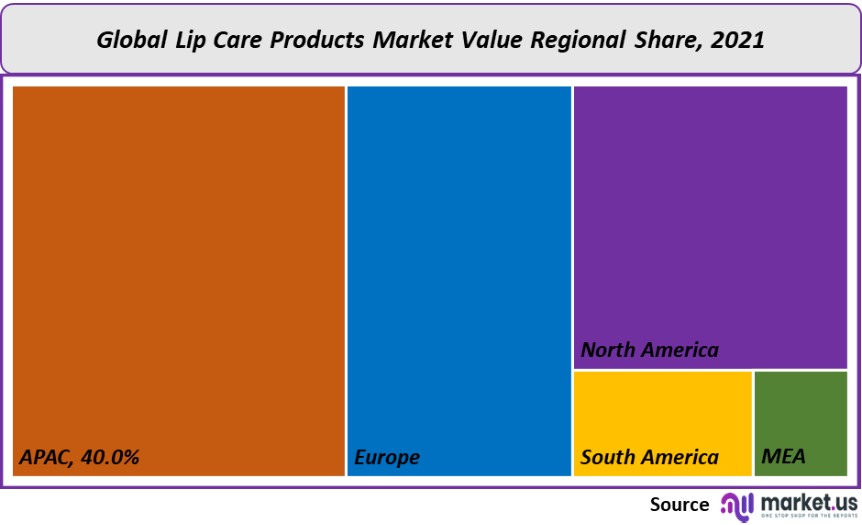

Regional Analysis

The Asia Pacific had a greater revenue share of 40% in 2021. The region is forecast to maintain its leading position and grow at the fastest CAGR for the forecast period. Consumers are becoming more sensitive to the sun, and experiencing issues such as lip coloration and darkening, in particular in India. This is increasing demand for these products. Europe is expected to be the second largest regional market.

Central & South America is projected for the second-fastest CAGR, from 2023-2032. To reach new customer segments, Central & South American manufacturers are working to develop lip care products that include a mix of organic and natural ingredients.

Key Regions and Countries covered in thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

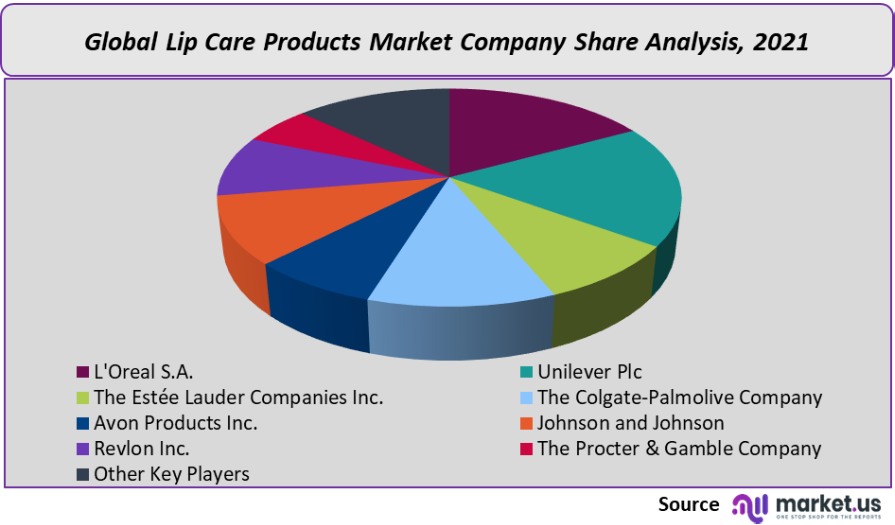

Market Share & Key Players Analysis:

The market is dominated by a few well-established players and new entrants. To increase their product offerings, broaden their consumer base, and gain an edge over other players, market players are focusing on product launches. Summer Fridays launched a new range of lip butter balms in May 2021. They are now available for purchase on retail websites such as Revolve and Sephora.

Маrkеt Кеу Рlауеrѕ:

- L’Oréal S.A.

- Unilever Plc

- The Estée Lauder Companies Inc.

- The Colgate-Palmolive Company

- Avon Products Inc.

- Johnson and Johnson

- Revlon Inc.

- The Procter & Gamble Company

- Other Key Players

For the Lip Care Products Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Lip Care Products Market in 2021?A: The Lip Care Products Market size is US$ 2,151.7 million in 2021.

Q: What is the projected CAGR at which the Lip Care Products Market is expected to grow at?A: The Lip Care Products Market is expected to grow at a CAGR of 5.1% (2023-2032).

Q: List the segments encompassed in this report on the Lip Care Products Market?A: Market.US has segmented the Lip Care Products Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been further divided into Lip Scrub, Lip Balm, and Other Products. By Distribution Channel, the market has been further divided into Online, Hypermarkets & Supermarkets, Specialty Store, Pharmacy & Drug Store, and Other Distribution Channels

Q: List the key industry players of the Lip Care Products Market?A: L’Oréal S.A., Unilever Plc, The Estée Lauder Companies Inc., The Colgate-Palmolive Company, Avon Products Inc., Johnson and Johnson, Revlon Inc., The Procter & Gamble Company, and Other Key Players are engaged in the Lip Care Products market.

Q: Which region is more appealing for vendors employed in the Lip Care Products Market?A: APAC is expected to account for the highest revenue share of 40%. Therefore, the Lip Care Products industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Lip Care Products?A: The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Lip Care Products Market.

Q: Which segment accounts for the greatest market share in the Lip Care Products industry?A: With respect to the Lip Care Products industry, vendors can expect to leverage greater prospective business opportunities through the lip balms segment, as this area of interest accounts for the largest market share.

![Lip Care Products Market Lip Care Products Market]()

- L’Oréal S.A. Company Profile

- Unilever Plc Company Profile

- The Estée Lauder Companies Inc.

- The Colgate-Palmolive Company

- Avon Products Inc.

- Johnson and Johnson

- Revlon Inc.

- The Procter & Gamble Company

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |