Global Material Handling Equipment Market By Product (Bulk Material Handling Equipment, and Other Products), By End-Use (Automotive, Food & Beverages, Semiconductor & Electronics and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 38663

- Number of Pages: 274

- Format:

- keyboard_arrow_up

Material Handling Equipment Market Overview:

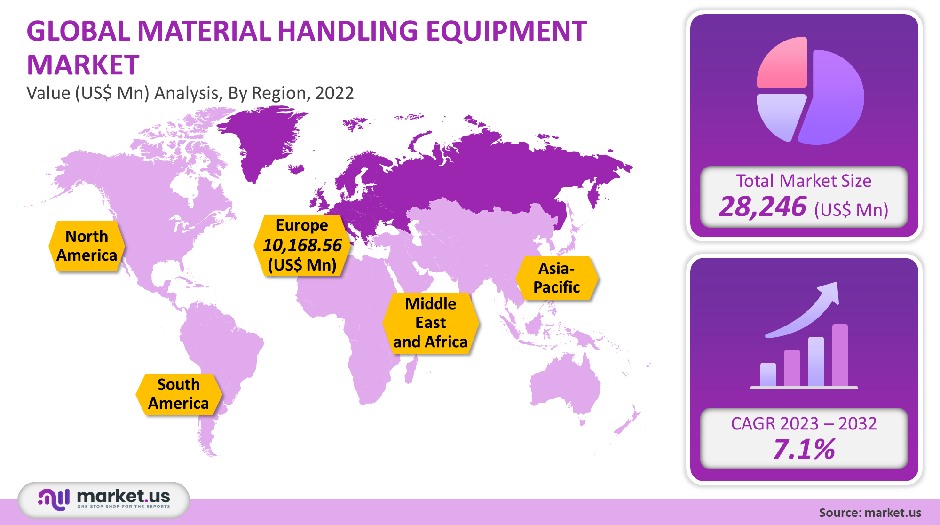

The global market for material handling equipment was valued at USD 28,246 million in 2021. This market is expected to grow at a 7.1% CAGR, between 2023-2032.

Factory owners expect that new projects will be delayed or put on hold by the coronavirus epidemic.

Nearly 32% of factory owners plan to increase their sales revenue by combining ongoing projects. These statistics are not good news for the growth and sustainability of the market unless OEMs plan to digitally transform. Opportunities for market growth are likely to arise from investments in power technology and battery technology.

Global Material Handling Equipment Market Analysis

Product Analysis

The market’s largest segment was industrial trucks. They accounted for over 31% of all revenue in 2021. This segment is forecast to see steady growth during the forecast period. This is why these trucks are preferred because of their broad application in the industrial environment. The use of industrial trucks is a more popular option for transporting crates, and heavy containers to multiple markets.

Over the forecast period, battery-operated trucks will see increased demand as logistic companies shift to sustainable products. The market is expected to register a CAGR exceeding 7.0% during the next seven years.

A significant portion of 2021’s revenue came from the automated storage system and retrieval system segment. This growth can be attributed to warehouses’ enforced social distancing in the COVID-19 epidemic. These systems were preferred because they promoted efficiency and conformed with social distancing norms.

Investments in automated equipment will rise, opening up lucrative markets for material handling equipment. The CAGR for the automated storage-retrieval segment is 7.4%, slightly higher than the global average.

End-Use Analysis

E-commerce was the dominant market for material handling equipment in 2021. The lockdown restrictions created a demand for essential goods and a boom in market growth. Coronavirus won’t have a significant impact on market growth in the short term. It will have a lasting impact on industry demand and create opportunities for suppliers operating in the market of material handling equipment.

Retail has shown enormous opportunities to make huge gains in spite of the pandemic. This trend will continue in the long term. The ease of shopping online has encouraged retailers and distributors to open micro-fulfillment centers that enable quick product deliveries, contributing to the increased demand for material handling gear.

In 2021, the market share for material handling equipment was dominated by the automotive sector. It is predicted that the segment will account for a significant share by 2032. AGVs are preferred by auto vendors due to their autonomy and ability to manage daily operations.

Key Market Segments

By Product

- Bulk Material Handling Equipment

- Storage and Handling Equipment

- Industrial Trucks

- Automated Storage and Retrieval System

- Other Products

By End-use

- Automotive

- Food & Beverages

- Semiconductor & Electronics

- E-commerce

- Other End-Uses

Market Dynamics

Other than the uncertainty created by the coronavirus pandemic, positive government initiatives support new infrastructure worldwide. These initiatives will increase growth opportunities in the market material handling equipment over a forecast period.

Countries such as India and China are attracting foreign investment to promote infrastructure and industrial development. This creates avenues for growth. Development of public infrastructure can include airports, rail networks as well seaports, and power stations. All of these activities will likely encourage the adoption of material handling equipment in the future.

The demand for industrial applications saw a minor dip, however, the unprecedented growth of the eCommerce sector helped to maintain market growth during the pandemic. Market growth saw a resurgence in demand for groceries, which was supported by the lockdown.

Many supply chain firms have begun to research tools to help them make informed decisions about AI implementation and analyze the large amount of data they produce. The combination of hindsight, data-driven insights, and technological advances will create a resilient supply chain.

It is expected that the One Belt One Route initiative by China, also known under the Belt and Road Initiatives, will also be a profitable venture for the materials handling equipment sector. There will be growth opportunities for the project to link a network of railway and road routes connecting China to Europe via the Middle East. Over the next few decades, similar initiatives will benefit the material handling equipment sector.

According to the 2021 Automation Solutions Survey Study report, the COVID-19 epidemic triggered a demand for a fully-automated solution in the manufacturing sector. This led to companies investing more in automated solutions in the coming years.

In the coming two years, companies plan to upgrade their conveyors and sortation systems. Due to the pandemic, many medium-sized businesses have had to change their plans for purchasing or modernizing new equipment.

Regional Analysis

Europe was the leader in the market for material handling devices and held the largest revenue share at 36% in 2021. The region’s industrial presence will benefit from the adoption of high-tech products. This will encourage market growth.

Europe is home to many industries, from electronics manufacturing to food and beverages. This gives them a lot of sales opportunities. E-commerce has been a major contributor to the region’s demand in 2021. This trend will likely continue in the coming years.

The Asia Pacific region’s material handling equipment market will experience a 7.4% CAGR over the forecast period. China and India will offer many opportunities that could help OEMs reach wider end-user markets. The rapid growth of e-commerce in the region was due to the pandemic. This favors equipment sales.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

The market for material handling gear is highly concentrated and subject to intense competition. To maintain competition, vendors are attempting to use both organic and non-organic methods as part of their key growth strategies. Toyota Material Handling launched Mole and Mouse Automated Guided Carts, or AGCs, in April 2021.

The product will allow customers to automate repetitive operations suitable for assembly lines. Distribution centers, warehouses, and manufacturing plants. In order to increase their market reach, vendors look into mergers and acquisitions in order to further enhance their market presence.

Маrkеt Кеу Рlауеrѕ:

- BEUMER Group

- Honeywell International Inc.

- Swisslog Holding AG

- Daifuku Co., Ltd.

- Mecalux, S.A

- Kion Group AG

- SSI Schaefer AG

- Murata Machinery Ltd.

- Other Key Players

For the Material Handling Equipment Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Material Handling Equipment market in 2021?A: The Material Handling Equipment market size is estimated to be US$ 28,246 million in 2021.

Q: What is the projected CAGR at which the Material Handling Equipment market is expected to grow at?A: The Material Handling Equipment market is expected to grow at a CAGR of 7.1% (2023-2032).

Q: List the segments encompassed in this report on the Material Handling Equipment market?A: Market.US has segmented the Material Handling Equipment market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Bulk Material Handling Equipment, Storage and Handling Equipment, Industrial Trucks, Automated Storage and Retrieval System, and Other Products. By End-Use, the market has been further divided into Automotive, Food & Beverages, Semiconductor & Electronics, E-commerce, and Other End-Uses.

Q: List the key industry players of the Material Handling Equipment market?A: BEUMER Group, Honeywell International Inc., Swisslog Holding AG, Daifuku Co. Ltd., Mecalux S.A, Kion Group AG, SSI Schaefer AG, Murata Machinery Ltd., and Other Key Players are engaged in the Material Handling Equipment market.

Q: Which region is more appealing for vendors employed in the Material Handling Equipment market?A: Europe is accounted for the highest revenue share of 36%. Therefore, the Material Handling Equipment industry in Europe is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Material Handling Equipment?A: The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc. are key areas of operation for Material Handling Equipment Market.

Q: Which segment accounts for the greatest market share in the Material Handling Equipment industry?A: With respect to the Material Handling Equipment industry, vendors can expect to leverage greater prospective business opportunities through the industrial trucks Material Handling Equipment segment, as this area of interest accounts for the largest market share.

![Material Handling Equipment Market Material Handling Equipment Market]() Material Handling Equipment MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample

Material Handling Equipment MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample - BEUMER Group

- Honeywell International Inc.

- Swisslog Holding AG

- Daifuku Co., Ltd.

- Mecalux, S.A

- Kion Group AG

- SSI Schaefer AG

- Murata Machinery Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |