Global Nail Polish Market By Product (Gel Nail Polish, Regular Nail Polish), By Distribution Channel (Hypermarkets & Supermarkets, E-commerce, Specialty Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 17935

- Number of Pages: 247

- Format:

- keyboard_arrow_up

Nail Polish Market Overview

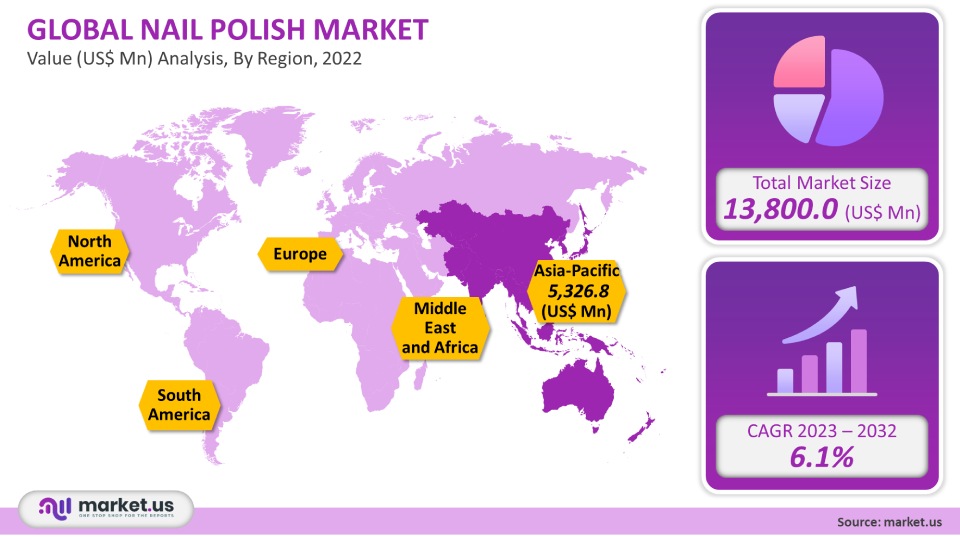

The global nail polish market size will reach USD 13,800.0 million in 2021. This number will increase at a compound annual growth rate of 6.1% between 2023-2032.

Growing demand for nail art and other care product types is a major factor driving market expansion, particularly among millennials. Nail art & extensions are a growing part of grooming among millennials. This will increase the product demand for nail polish over the forecast period. In the future, nail polish will be more popular if it contains natural ingredients that are less toxic and contain fewer chemicals.

For the growth of the market, increasing demand for cosmetics with less harmful chemical content and non-toxic chemical products is responsible. It has attracted major companies’ extra attention to the growth factors driving the non-toxic nail polish market growth.

Global Nail Polish Market

Product Analysis

In 2021, the regular nail polish segment held the largest market share, which accounted for 46% of the global market. Because it is easy to use and available in a wide variety of colors of nail polish, the nail polish market share is significant. Its low cost over other options has fueled its popularity and contributed to market growth.

From 2023 to 2032, the gel nail polish segment is expected to grow at an 8.0% annual growth rate. These products have a higher concentration than regular nail varnish. Gel nail polish is easy to find and has seen a rise in value sales. By product, the other segments include dip powders, acrylic, shellac, and poly-gel nail polish. Due to their many benefits, these products have become increasingly popular. Polygel nail varnish can last for up to 21 consecutive days with minimal maintenance.

Also, dip powder is a trending nail varnish in powdered format. Dip powder can last between 3 and 4 weeks. Dip powder is more durable and lasts longer than any other nail varnish, so it is becoming increasingly popular. Dip powder’s high price will likely limit the market’s growth in value sales.

Distribution Channel Analysis

The largest share of the global market was made by specialty stores in 2021 at 35.5%. These specialty stores are focused on selling natural and chemical-free items. They also offer customers the opportunity to shop from various brands before purchasing. Customers can scan types, colors, and shades in specialty shops per their preference. This segment also benefits from the presence and knowledge of store associates, who help customers choose the right product.

A wide variety of products are available under one roof, making hypermarkets and supermarkets very popular. Placards display the details and prices of each product on shelves. Hypermarkets and supermarkets generally have large displays and can display many products under one roof. These stores are often located close to residential areas for convenience and easy access.

Between 2023 and 2032, the channel is expected to grow by 9.0%. The segment will grow because of the increasing penetration of the internet among consumers and targeted marketing by companies that reaches all customer touchpoints. The market adoption of nail polish is boosted by its easy accessibility and the large discounts & offers offered by online platforms. The overall market will see a rise in sales during the forecast period due to the increased accessibility of the product via the online platform.

Key Market Segments

Product

- Gel Nail Polish

- Regular Nail Polish

- Others

Distribution Channel

- Hypermarkets & Supermarkets

- E-commerce

- Specialty Stores

- Others

Market Dynamics

The recent COVID-19 pandemic has adversely affected the growth and development of the nail polish industry. The outbreak has affected the production of nail polish products and the supply chain for raw material suppliers. Due to social distancing and stay-at-home policies, nail polish sales fell through offline and online channels. The trade restrictions placed by many countries around the world have also had an impact on the logistics and transportation infrastructures all over the globe. This, in turn, hinders overall market expansion.

Nail polish is used for the decoration of the fingers and toes. There are many domestic brands and colors available in the market. This has helped drive the value market for nail polish. This growing number of women in work will also provide immense opportunities for market growth over the forecast period.

Manufacturers have been encouraged to introduce new products by increasing research and development investments. OPI, an industry leader in this market, launched its non-GMO and vegan nail polish in August 2021. According to Facebook ads targeting data, 52 million people showed interest in nail varnish in 2021. Most of them are in the 25 -34 age range. Next came the age category of 18-24 years. And 35 to 44 yrs.

The popularity of sustainable beauty and personal care products will continue to grow with celebrity endorsements, such as nail polish. Trending online articles, celebrity endorsements, and product launches are all popular choices for millennials. This is expected to create huge opportunities for nail polish market growth over the forecast period.

Increasing awareness among customers about the harmful effects of chemicals on the human body and increasing preference for beauty-enhancing products. Harmful chemicals in nail polish show a bad impact on the skin and even during food intake.

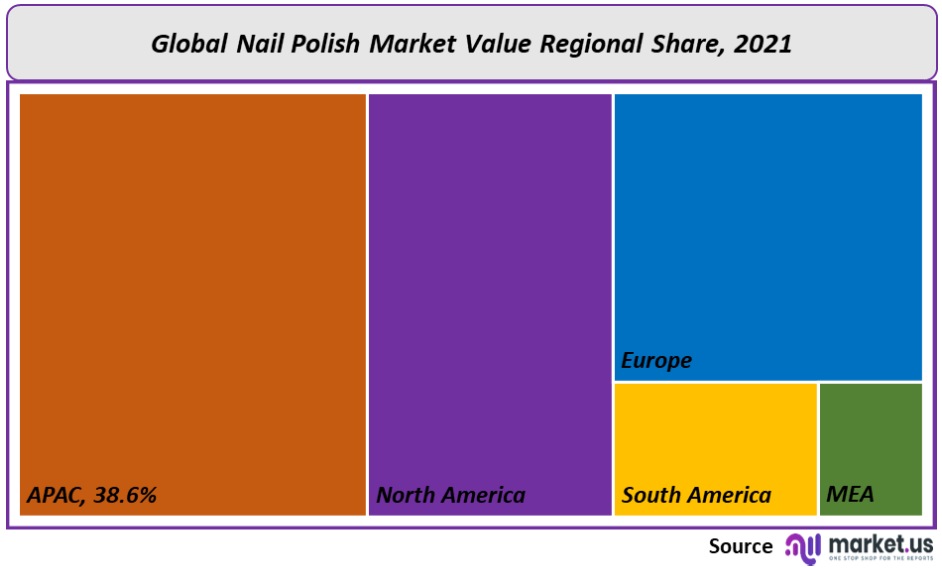

Regional Analysis

The Asia Pacific contributed more to the global market, 38.6%, in 2021. This region is expected to grow the fastest during the forecast period. This is partly due to the increasing number of working women in countries like China and India and their growing interest in and acceptance of nail care fashion trends. For example, India has huge growth opportunities due to the country’s rising women population.

Europe is predicted to experience a 5.4% annual growth rate between 2023-2032. The demand for nail polish products is expected to rise due to consumers’ growing preference for naturally manufactured products, particularly in the UK and Germany. It is also expected that the increasing demand for vegan products in this region, particularly in the UK, will provide lucrative opportunities to grow vegan products over the forecast period. North America is projected to experience a 6.7% annual growth rate between 2023-2032. The attractiveness of a country like Canada and the U.S. is something that consumer desire to pay for. This, in turn, is driving the market growth in this region.

The Middle East is expected to be the second-fastest-growing regional segment during the forecast period. This is due to the growing number of affluent customers in countries like South Africa, UAE, and other countries willing to spend on cosmetics.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

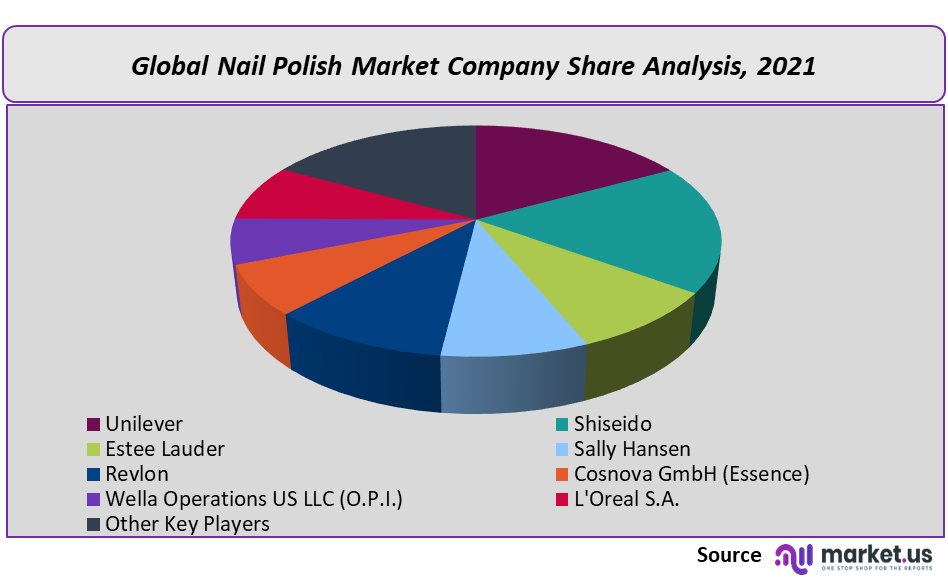

Market Share Analysis

Both domestic and international participants are part of the market. Market leaders focus on strategies like innovation and new cosmetic product launches at retail to increase their market offerings. Sally Hansen (one of the top market manufacturers) introduced its plant-based nail varnishes to the market in September 2020. Hermes, a leading manufacturer of beauty products, launched its first-ever nail polish in September 2021 with 24 shades. Additionally, Colorbar, a beauty brand, recently introduced its vegan nail polish/lacquer in 128 shades.

Key Market Players

These are the major players in the global nail varnish market:

- Unilever

- Shiseido

- Estee Lauder

- Essie Cosmetics, Ltd.

- Wella Operations US LLC

- Coty, Inc.

- Creative Nail Design, Inc.

- Alessandro International

- CNC International

- Orly International Inc

- NARS Cosmetics, Inc.

- NBY London Ltd.

- Sally Hansen

- Soigné nails

- Art of Beauty Co Inc

- Revlon

- Cosnova GmbH (Essence)

- Wella Operations US LLC (O.P.I.)

- L’Oréal S.A.

- Other Key Players

Frequently Asked Questions (FAQ)

What is the size of the Nail Polish market in 2021?The Nail Polish market size was US$ 13,800.0 million in 2021.

What is the projected CAGR at which the Nail Polish market is expected to grow at?The Nail Polish market is expected to grow at a CAGR of 6.1% (2023-2032).

List the segments encompassed in this report on the Nail Polish market?Market.US has segmented the Nail Polish market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Product, the market has been segmented into Gel Nail Polish, Regular Nail Polish, and Others. By Distribution Channel, the market has been further divided into Hypermarkets & Supermarkets, E-commerce, Specialty Stores, and Others.

List the key industry players in the Nail Polish market?Unilever, Shiseido, Estee Lauder, Sally Hansen, Revlon, Cosnova GmbH (Essence), American International Industries, Essie Cosmetics, Ltd., Coty, Inc., Creative Nail Design, Inc., Alessandro International, CNC International, Orly International, NARS Cosmetics, Inc., Wella Operations US LLC (O.P.I.), L’Oréal S.A., and Other Key Players engaged in the Nail Polish market.

Which region is more appealing for vendors employed in the Nail Polish market?The Asia Pacific accounted for the highest revenue share of 38.6%. Therefore, the Nail Polish industry in the Asia Pacific is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Nail Polish?The U.S., Germany, UK, China, India, Brazil, and South Africa are key areas of operation for the Nail Polish Market.

Which segment accounts for the greatest market share in the Nail Polish industry?With respect to the Nail Polish industry, vendors can expect to leverage greater prospective business opportunities through the regular nail polish segment, as this area of interest accounts for the largest market share.

![Nail Polish Market Nail Polish Market]()

- Unilever Plc Company Profile

- Shiseido

- The Estée Lauder Companies, Inc. Company Profile

- Essie Cosmetics, Ltd.

- Wella Operations US LLC

- Coty, Inc.

- Creative Nail Design, Inc.

- Alessandro International

- CNC International

- Orly International Inc

- NARS Cosmetics, Inc.

- NBY London Ltd.

- Sally Hansen

- Soigné nails

- Art of Beauty Co Inc

- Revlon

- Cosnova GmbH (Essence)

- Wella Operations US LLC (O.P.I.)

- L’Oréal S.A. Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |