Global Naphtha Market By Type (Heavy, and Light), By Application (Chemical, Energy and Fuel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 14773

- Number of Pages: 273

- Format:

- keyboard_arrow_up

Naphtha Market Overview:

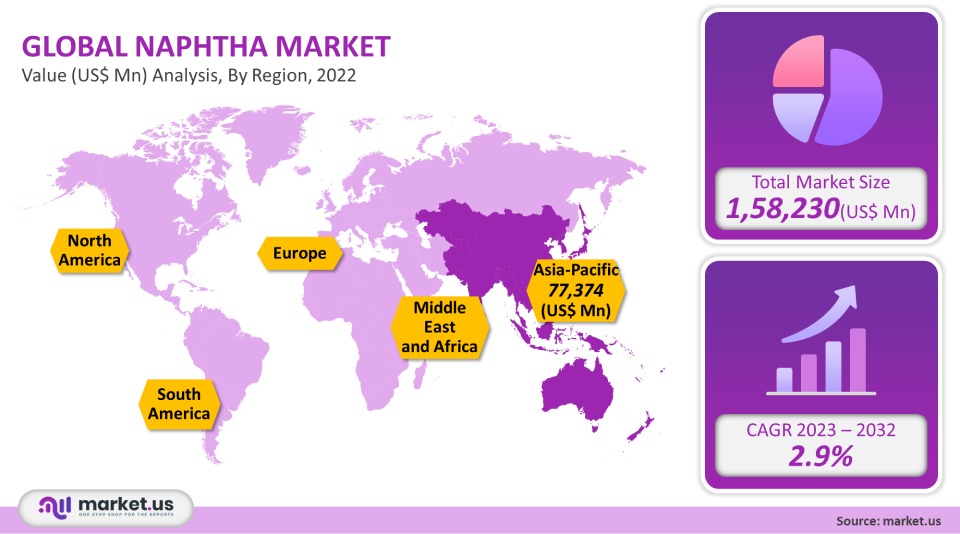

In 2021, the global naphtha market was valued at USD 1,58,230 million. The industry is estimated to experience significant growth in the coming seven years.

This is because of the rising demand for transportation fuel worldwide. The petrochemical sector will see a rise in demand for hydrocarbon cracking products.

Global Naphtha Market Scope:

Type Analysis

The global naphtha market can be divided into two types based on type. This report provides data on trade, demand, supply, and differentiation of light and heavy Naphtha. The Heavy Naphtha analysis includes Naphtha that has high aromatic and naphthenic levels.

This is the proper feed for reforming. Light and heavy naphtha prices and balances are often closely related, even though they have different uses.

Application Analysis

The main application segment for Naphtha was as a chemical feedstock. It accounted for over 63.8% of the total volume share in 2021. It is used to steam crack propylene, ethylene, and gasoline. Catalytic reforming is another application that uses it to extract benzene and toluene.

Naphtha, a mainstream chemical that has many uses, is a key ingredient. Naphtha can be used as an industrial solvent to make household cleaners, vapors of lighters, oil painting, and gasoline production, shoe polish ingredients, stain removal, among many other uses. Light Naphtha plays a crucial role in petrochemical steam crackers. Both aromatics and olefins are produced by cracking. Olefins, which are also used as the primary feedstock in the production of plastics such as polyethylene and propylene, are the main ingredients. Olefins can also be used in other chemical processes such as the production of synthetic rubber and polymers.

Naphtha can also be used to make fuel or as an additive to fuel. Naphtha’s main utility as a fuel is in its Application to industrial and residential heating units, burners, &, power stoves, and cigarette lighters, among other applications. They can also be used to make petrochemicals such as gasoline and butane.

Market growth is expected to be driven by growing plastics demand in construction and packaging. In 2021, more than 32.2% of the total market share for Naphtha was accounted for by energy & fuel. Some niche markets also use Naphtha, such as stoves and camp lanterns. Over the next seven years, growth is expected to be driven by increased demand in the above-mentioned areas.Маrkеt Ѕеgmеntѕ:

By Type

- Heavy

- Light

By Application

- Chemical

- Energy

- Fuel

Market Dynamics:

Refineries, gas, and chemical plants are common sources of production. The production process includes the refinement of crude oil. Highly resilient components are required for hydrocarbon cracking at extreme temperatures and pressure. The material choice is also influenced by regional prices and environmental regulations.

Coal tar and wood are also sources of Naphtha. The type of feedstock used will depend on the process yield and demand for downstream products such as formaldehyde and pigment.

Based on hydrocarbon structure and refinery process, there are two main types of Naphtha: Paraffinic and heavy form. To increase the octane of fuels, heavy is most often used in refinery catalytic transformers.The primary uses include gasoline production and steam cracking aromatic petrochemicals and olefins. These processes have a variety of economic factors that impact their outlook, including the feedstock-to-yield ratio, refinery margins, and existing geopolitics. The production of oils, rubber, and personal-care products is a major use of aromatic forms. Market growth will be affected by regulations on gasoline benzene and crude oil prices over the forecast period.

Regional Analysis:

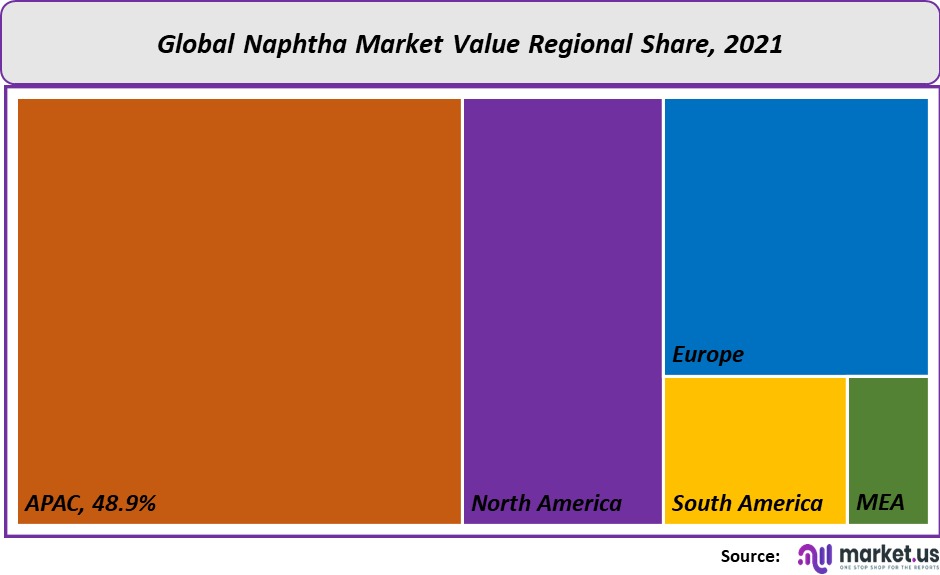

The Asia Pacific naphtha markets dominated global demand in 2021 and accounted for more than 48.9% of the total volume share. The Asia Pacific was the largest exporter of petroleum products in 2021. Over the forecasted period, product demand will be driven by increasing population and increased use of electrical and transport equipment. Market growth is expected to be fueled by a growing demand for plastics in the construction and automotive industries.

Over the forecast period, the demand for Naphtha is expected to rise due to rising production in emerging economies such as China, India, and Japan. Market growth is expected to be slowed by health concerns about exposure to chemicals as well as strict laws in place in the European Union. Due to changing laws regarding chemical trade, Europe’s demand for Naphtha is expected to slow down after 2020. The market is showing some promise, however, with rising demand and production from the Asia Pacific.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

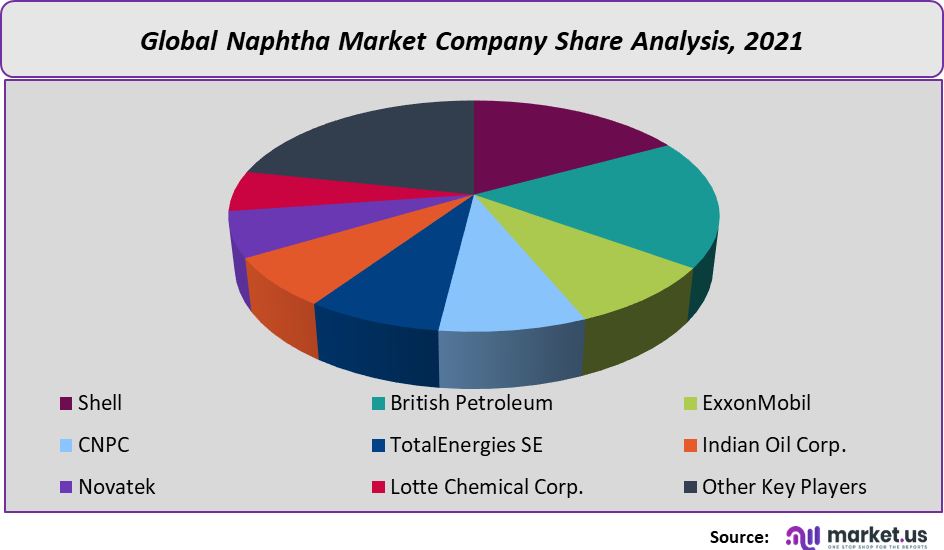

Global naphtha markets are fragmented. The industry’s top five players, which include Shell, British Petroleum, ExxonMobil, and CNPC, accounted for more than half of the industry’s revenue share in 2021. Because of their vast distribution network, these companies can dominate the global market. Their long-term relationships with distributors and the acquisition of petrochemical plants are key to their economic growth.

Due to the high dependency on oil and natural gas, companies have been encouraged to work together across the entire value chain. Reliance Industries, Mitsubishi Chemical, and others have combined their crude oil production with end-product manufacturing to improve economies of scale. Other players in the industry are TotalEnergies SE, Indian Oil Corp., Novatek, and Lotte Chemical Corp. Novachem, SABIC, and Mangalore Refinery & Petrochemicals Limited. These are the top players in global ANPR markets:

Маrkеt Кеу Рlауеrѕ:

- Shell

- British Petroleum

- ExxonMobil

- CNPC

- TotalEnergies SE

- Indian Oil Corp.

- Novatek

- Lotte Chemical Corp.

- Novachem

- SABIC

- Mangalore Refinery & Petrochemicals Limited

- Other Key Players

For the Naphtha Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Naphtha Market size in 2021?The Naphtha Market size is US$ 1,58,230 million in 2021.

Q: What is the CAGR for the Naphtha Market?The Naphtha Market is expected to grow at a CAGR of 2.9% during 2023-2032.

Q: What are the segments covered in the Naphtha Market report?Market.US has segmented the Global Naphtha Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Heavy and Light. By Application, market has been further divided into Chemical, Energy & Fuel.

Q: Who are the key players in the Naphtha Market?Shell, British Petroleum, ExxonMobil, CNPC, TotalEnergies SE, Indian Oil Corp., Novatek , Lotte Chemical Corp., Other Key Players are the key vendors in the Naphtha market.

Q: Which region is more attractive for vendors in the Naphtha Market?APAC accounted for the highest revenue share of 48.9% among the other regions. Therefore, the Naphtha Market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Naphtha?Key markets for Naphtha are the U.S., U.K., China, Japan, Brazil, and South Africa.

Q: Which segment has the largest share in the Naphtha Market?In the Naphtha Market, vendors should focus on grabbing business opportunities from the Chemical segment as it accounted for the largest market share in the base year.

![Naphtha Market Naphtha Market]()

- Shell

- British Petroleum

- ExxonMobil

- CNPC

- TotalEnergies SE

- Indian Oil Corp.

- Novatek

- Lotte Chemical Corp.

- Novachem

- SABIC

- Mangalore Refinery & Petrochemicals Limited

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |