Global Orthopaedic Navigation Systems Market By Technology (Optical, Electromagnetic, and Other Technologies), By Application (Hip, Knee, and Spine), By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 35970

- Number of Pages: 352

- Format:

- keyboard_arrow_up

Orthopedic Navigation Systems Market Overview

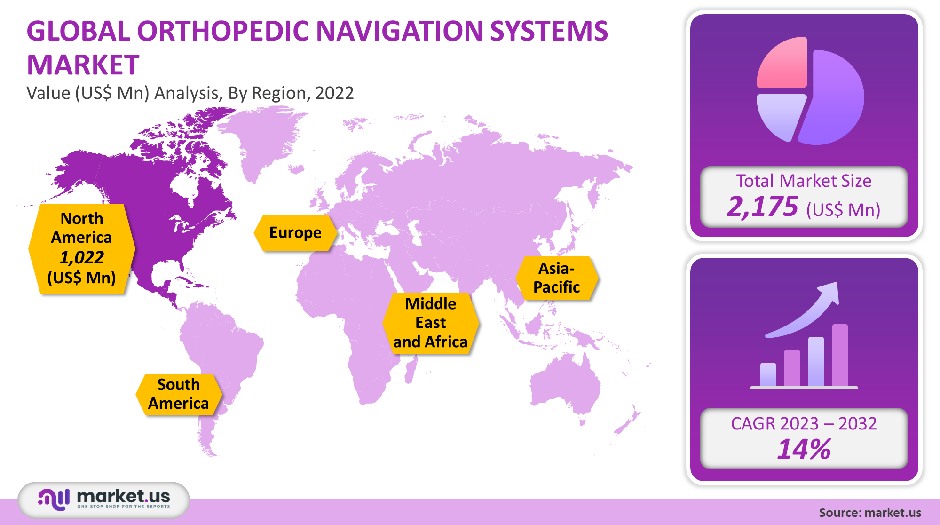

The global market for Orthopedic Navigation Systems was valued at USD 2.17 Billion in 2021. This forecast period will see a CAGR of 14%.

Market growth is expected to be driven by rising geriatrics and joint reconstruction cases, increasing healthcare expenditure, and high awareness levels among patients, and healthcare professionals. There has been an increase in cases of osteoporosis and osteoarthritis. Rheumatoid arthritis is also on the rise. These diseases affect the body’s musculoskeletal system. This includes muscles, bones, joints, and nerves as well as cartilage, ligaments, and tendons. It causes a reduction of range, stiffness, swelling, and pain in the muscles, which can then lead to surgical treatment.

Global Orthopedic Navigation Systems Market Analysis

Technology Analysis

The market was dominated by the optical segment, which had a 60% revenue share in 2021. This dominance is expected to continue throughout the forecast period. This system has improved surgical procedures and opened the door to more complex ones. Optical surgical navigation is much simpler than older-style systems. The system is also built on stereo vision, which allows for high precision. These systems can be used in medical procedures which require extremely high precision and large access routes.

These benefits can be attributed largely to segment growth. An electromagnetic navigation system that uses magnetic fields to produce a live image of the body is called electromagnetic navigation. This navigation system is very important for elderly persons, who are vulnerable to many different physical conditions. This should support segment growth in the coming years.

Application Analysis

The knee segment held a significant revenue share of 49% in 2021. It will continue growing at a steady CAGR for the future years. Its dominance is due to an increase in total knee replacement procedures as well as rising awareness regarding the benefits. Segment growth can also be supported by its wider application in multiple surgical conditions such as total knee joint arthroplasty, and kneecap replacement. Technology advancements such as minimally invasive procedures and improved implant materials will likely boost the volume of knee surgery, which in turn will support the segment’s growth. However, the spine segment will experience the highest CAGR at over 14.1% between 2023-2032.

This is due to an increasing number of spine surgery and an increase in spinal disorders. Because of either weakness or bony spinal injury to the spinal nerves, or the spinal cord, spinal injuries are the leading cause of mortality and morbidity. For a chronic functional disability to be reduced, immediate medical and surgical treatment is essential. Segment growth can also be caused by an increase in sports injuries as well as the rise in road accidents, falls, and other incidents.

End-Use Analysis

The hospital end-use segment contributed heavily to the global revenue, in 2021. Hospitals offer many options in pain management and orthopedic procedures. The growth of this segment is also due to the advancement of medical technology and increased footfall in these facilities.

The segment of Ambulatory Surgical Centers, which is the end-user segment for ASCs, will see the fastest CAGR during the forecast period. The demand for these centers has increased due to factors such as shorter wait times, personalized treatment, and shorter stay lengths. In these centers, innovative surgical techniques allow patients to undergo tests and procedures without having to go to the hospital. This will support segment growth.

Key Market Segments

By Technology

- Optical

- Electromagnetic

- Other Technologies

By Application

- Hip

- Knee

- Spine

By End-Use

- Ambulatory Surgical Centers (ASCs)

- Hospitals

Market Dynamics

This will likely increase demand for orthopedic navigation systems in the future. According to the CDC estimate, 55 million Americans have some form of arthritis. That’s 1 in 4 Americans. The number of people with arthritis is expected to increase to 80 million by 2045. This suggests the future need for navigation systems in orthopedic surgeries. To free up caretakers for COVID-19 victims, many countries decided to stop performing non-emergency surgery procedures. The market was adversely affected by restrictions on non-emergency procedures. This led to delays in several procedures which caused huge revenue losses for the orthopedic firms.

Stryker saw its net revenue decreased by 8.9% compared with last year. Smith & Nephew saw its revenue decline by 11% starting in 2020. But, the market started to recover rapidly after the 3rd quarter. This was due to hospitals gradually resuming elective surgeries. It is predicted that the orthopedic navigation systems market will rebound quickly following the full return to surgical procedures.

Computer-assisted Surgery (CAS) associated advantages, including lower blood loss and shorter hospital stays, as well as easier rehabilitation are expected to drive the industry’s revenue. CAS helps to align implants accurately, provide better functionality, increase quality-adjusted live years, reduce pain & tissue damage, and cause fewer complications. Because of these factors, minimally invasive surgery has been on the rise. The demand will be boosted by technological advancements in orthopedic surgical navigation techniques, rising incidence of osteoarthritis, as well as an increase in R&D funding.

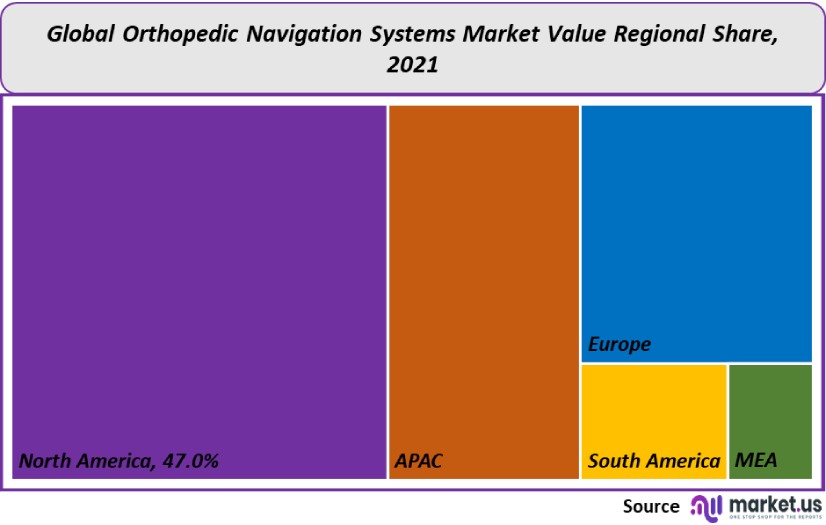

Regional Analysis

North America was the region with the highest revenue share of 47%, in 2021. This is due to better infrastructure, higher awareness levels, and favorable government policies regarding the promotion of orthotic navigation systems. Other factors include the growing geriatric population, the high level of government spending on health care, the well-developed reimbursement structures, and the presence of established companies in the region. These all contribute to regional market growth.

The Asia Pacific is expected to be the fastest-growing regional market from 2023-2032. This is due to a high number of unmet medical needs and increased awareness by the government about minimally invasive options for replacement surgeries. Also, rising investment by manufacturers to produce cost-efficient orthotic navigation systems. The region’s geriatric population is more likely to develop orthopedic disorders. India, China, and Japan are the main regional contributors.

Key Regions and Countries covered in thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

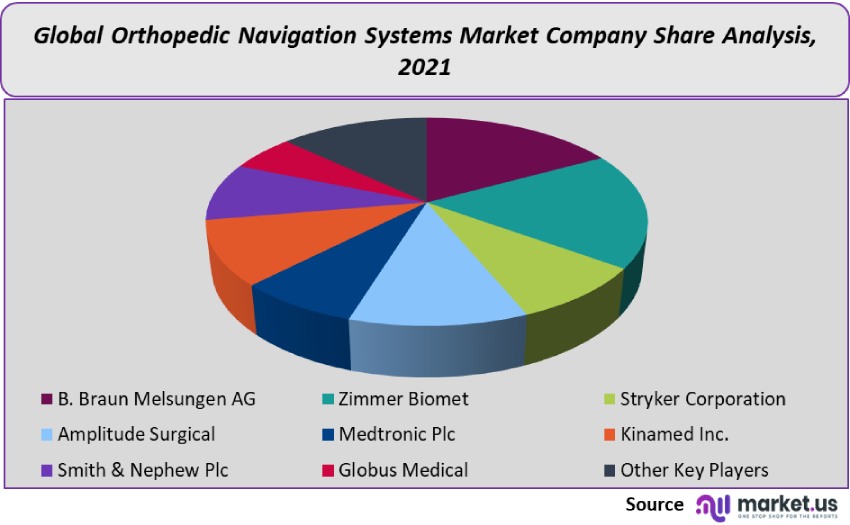

A large product range and global distribution network are key factors in the dominance of a few players. But, mergers & Acquisitions and product development are helping other players gain significant market share. Key players participate in various strategies to increase market penetration. These strategies include new product developments, distribution agreements, expansion strategies, and other strategies. Stryker, for example, acquired Wright Medical to increase its market position in trauma/extremities. This acquisition provides significant opportunities to improve outcomes and advance innovation while increasing patient reach.

Market Key Players:

- B. Braun Melsungen AG

- Zimmer Biomet

- Stryker Corporation

- Amplitude Surgical

- Medtronic Plc

- Kinamed Inc.

- Smith & Nephew Plc

- Globus Medical

- Other Key Players

For the Orthopedic Navigation Systems Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

2.17 Billion

Growth Rate

14%

Forecast Value in 2032

9.17 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Orthopedic Navigation Systems Market in 2021?The Orthopedic Navigation Systems Market size is US$ 2,175 million in 2021.

What is the projected CAGR at which the Orthopedic Navigation Systems Market is expected to grow at?The Orthopedic Navigation Systems Market is expected to grow at a CAGR of 14% (2023-2032).

List the segments encompassed in this report on the Orthopedic Navigation Systems Market?Market.US has segmented the Orthopedic Navigation Systems Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Technology, the market has been further divided into Optical, Electromagnetic, and Other Technologies. By Application, the market has been further divided into Hip, Knee, and Spine. By End-Use, the market has been further divided into Ambulatory Surgical Centers (ASCs) and Hospitals.

List the key industry players of the Orthopedic Navigation Systems Market?B. Braun Melsungen AG, Zimmer Biomet, Stryker Corporation, Amplitude Surgical, Medtronic Plc, Kinamed Inc., Smith & Nephew Plc, Globus Medical, and Other Key Players are engaged in the Orthopedic Navigation Systems market.

Which region is more appealing for vendors employed in the Orthopedic Navigation Systems Market?North America is expected to account for the highest revenue share of 47%. Therefore, the Orthopedic Navigation Systems industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Orthopedic Navigation Systems?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Orthopedic Navigation Systems Market.

Which segment accounts for the greatest market share in the Orthopedic Navigation Systems industry?With respect to the Orthopedic Navigation Systems industry, vendors can expect to leverage greater prospective business opportunities through the optical segment, as this area of interest accounts for the largest market share.

![Orthopedic Navigation Systems Market Orthopedic Navigation Systems Market]() Orthopedic Navigation Systems MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample

Orthopedic Navigation Systems MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample - B. Braun Melsungen AG Company Profile

- Zimmer Biomet

- Stryker Corporation Company Profile

- Amplitude Surgical

- Medtronic Plc

- Kinamed Inc.

- Smith & Nephew Plc

- Globus Medical

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |